Impact of Pinging in Financial Markets: An Agent Based Study

Sriram Bharadwaj Rangarajan

1 a

and Carmine Ventre

2 b

1

UKRI Centre for Doctoral Training in Safe and Trusted AI, Department of Informatics, King’s College London, London,

U.K.

2

Department of Informatics, King’s College London, London, U.K.

Keywords:

Agent Based Modeling, Financial Markets, Dark Pools, Market Impact, Pinging, Market Manipulation,

Empirical Game-Theoretic Analysis.

Abstract:

Institutional traders in the financial markets rely on hidden trading venues to execute significantly large trades

with lower execution costs and reduced information leakage. One such trading venue, known as dark pool,

offers institutional traders better execution costs through hidden order books and delayed trade reporting.

Despite their advantages, dark pools are susceptible to market manipulation practices such as ’pinging’. Due to

low transparency in dark pools, the incentives of pinging agents and their impact on market participants has not

been studied in detail. In this paper, we present an agent-based model of the financial markets to study market

impact of trading strategies and the dynamics of pinging in dark pools. We identify the scenarios and market

conditions under which pinging is a profitable manipulation strategy and compute its impact on execution

costs of informed institutional trading agents. Further, we consider agent incentives and use empirical game

theory to compute the equilibrium state of the market and quantify the additional costs imposed by pinging

agents on informed traders. This study aims to bridge the existing research gap by providing a framework for

analyzing market manipulation in dark pools and is a foundational step towards designing safer dark pools.

1 INTRODUCTION

The financial markets operate as highly sophisticated

ecosystems and are shaped by the diverse interactions

of market participants including retail investors, liq-

uidity providers and institutional traders. Institutional

traders, such as investment banks, frequently need to

acquire or liquidate large quantities of securities to

implement their investment mandates. However, ex-

ecuting large orders in the financial markets can sig-

nificantly impact market prices and lead to higher ex-

ecution costs. Market impact (also known as price

impact) refers to the difference in market price trajec-

tories when a trade is executed compared to the coun-

terfactual price trajectory that would have occurred

had the trade not been executed (Said, 2022). A strat-

egy used by institutional traders to reduce market im-

pact is to distribute their trading activity across ’lit’

markets (financial markets with transparent order re-

porting) and dark pools (financial markets with hid-

den trading activity).

Dark pools are private trading venues that allow

a

https://orcid.org/0009-0006-4310-4004

b

https://orcid.org/0000-0003-1464-1215

participants to execute trades without disclosing their

intention to the wider market. These venues help in-

formed traders to reduce market impact and provide

them with anonymity with regards to their trading ac-

tivity (Brogaard and Pan, 2021; MacKenzie, 2019).

The ability of dark pools to trade in a hidden manner

helps their participants to prevent information leakage

(Buti et al., 2017; Bayona et al., 2023). Dark pools

have evolved significantly since their inception in the

late 20th century. Modern day dark pools such as

Crossfinder are predominantly established and oper-

ated by investment banks. However, the lack of trans-

parency and public data on orders presents challenges

for modeling and understanding the nuances of dark

pool dynamics (MacKenzie, 2019). Controversies

surrounding dark pools have underscored their sys-

temic implications. Numerous lawsuits against dark

pools operators and fines levied by regulators in the

recent past highlight the insufficient policing within

these venues

1

. Unlike ’lit’ markets, where market in-

formation is publicly available, the opaque structure

1

See https://www.tradersmagazine.com/departments/

brokerage/ubs-pays-record-14-million-fine-for-dark-pool-

violations/.

172

Rangarajan, S. B. and Ventre, C.

Impact of Pinging in Financial Markets: An Agent Based Study.

DOI: 10.5220/0013312900003890

In Proceedings of the 17th International Conference on Agents and Artificial Intelligence (ICAART 2025) - Volume 1, pages 172-183

ISBN: 978-989-758-737-5; ISSN: 2184-433X

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

of dark pools limits the ability of researchers and reg-

ulators to study their operations (Buti et al., 2022).

Besides the lack of transparency and inability to

study these markets, market manipulation is a sig-

nificant concern in dark pools, since it disrupts the

’lit’ market efficiency and increases execution costs

for genuine participants. While market manipulation

(Lin, 2017) in ’lit’ markets has been well studied (Liu

et al., 2022), detection of manipulation in dark pools

is much harder due to its low transparency. This opens

up dark pools to market manipulators, who may mis-

use these venues for profiting at the expense of legit-

imate market players (Aquilina et al., 2024). An ex-

ample of a dark pool manipulation strategy is ’ping-

ing’, where the manipulation agent places small quan-

tity orders in the dark pools to detect the presence

of large hidden institutional trading orders (Mart

´

ınez-

Miranda et al., 2016). Once a large order is detected,

the manipulation agent would front-run the institu-

tional agent by placing orders in the ’lit’ market and

profiting from the impending market moves. Ping-

ing undermines the purpose of dark pool trading, re-

duces market confidence, leads to information leak-

age and increases execution costs (Stenfors and Susai,

2021). Despite the negative effects of pinging in dark

pools, it remains relatively unexplored in literature.

Our paper aims to address this research gap by using

agent based modeling (ABM) to study the dynamics

of pinging in dark pools and its impact on institutional

trader’s execution costs.

This paper aims to integrate computational multi-

agent system design with financial market manipula-

tion analysis by presenting a novel incentive-aware

ABM of the financial markets with an associated dark

pool. By presenting a novel pinging agent definition,

we aim to enhance our understanding of how ping-

ing impacts the financial markets and its participants

(like institutional traders). To our knowledge, this is

the first study that analyzes pinging based market ma-

nipulation in dark pools, and quantifies the impact of

pinging on market impact and execution costs of in-

formed traders. The main contributions of our work

are:

• We propose a novel incentive aware ABM of the

financial markets with a dark pool for studying the

market price impact of institutional trading strate-

gies. Our ABM is able to replicate price impact

characteristics in classical literature (Obizhaeva

and Wang, 2013; Almgren and Chriss, 2001) as

well as model the impact of trading in dark pools.

• We define a novel pinging market manipulation

agent (in Section 3.6) that probes the dark pool

markets for hidden orders and profits by trading

ahead of large institutional trades.

• Using our ABM and pinging agent, we are able to

ascertain the market scenarios under which ping-

ing is a profitable manipulative activity, and we

show the impact of pinging on execution costs.

• We use empirical game-theoretic analysis (EGTA)

(Wellman, 2006) to compute the market strat-

egy equilibrium of the institutional and pinging

trader’s actions and compute the impact of ping-

ing in the market equilibrium.

2 RELATED WORK

2.1 Agent Based Modeling

The study of financial markets using computational

agent based models has grown significantly in re-

cent times, leveraging advancements in ABM (Liu

et al., 2022; Wah et al., 2015; Brinkman and Wellman,

2017). ABM allows researchers to study the complex-

ities of the financial markets and observe the emer-

gent market dynamics. Some of the earliest research

works in this field (Chiarella, 1992; Gode and Sun-

der, 1993) consider market participants like funda-

mentalists and zero-intelligence agents to study emer-

gent market phenomenon. Subsequent research (Ma-

jewski et al., 2018) further improves on the Chiarella

model by enhancing the fundamental price to include

a drift component and thereby modeling diverse mar-

ket regimes. ABM has further been used in conjunc-

tion with the ABIDES framework (Byrd et al., 2020)

to estimate market impact of an institutional trader.

While there is extensive research on the use of ABMs

for modeling market impact, the modeling of market

impact of execution strategies using an ABM while

replicating temporary and permanent impact compo-

nents remains unexplored.

2.2 Dark Pools and Market

Manipulation

Dark pools are market venues that allow their par-

ticipants to trade in an anonymized manner. Classi-

cal finance literature contains theoretical models on

the dynamics of dark pools. Buti et al. (Buti et al.,

2017) investigate the impact of the dark pool market

on the ’lit’ market and identify the conditions under

which dark pool participation is higher. Kratz and

Schoeneborn (Kratz and Sch

¨

oneborn, 2014) propose

a mathematical equilibrium market model for optimal

liquidation of portfolios in the lit and dark pool mar-

kets. Different kinds of dark pools have been studied

in literature by Zhu (Zhu, 2013). The most prevalent

Impact of Pinging in Financial Markets: An Agent Based Study

173

type is known as crossing networks, which enables

trading at the midpoint of the lit market. One prior

research work (Mo et al., 2013) has used ABM for

modeling the benefits of dark pool trading and high-

light the risk of lower order fills in dark pools.

Market manipulation and predatory strategies in

the financial markets have been studied with a focus

on spoofing and pinging strategies. Liu et al. (Liu

et al., 2022) study the impact of spoofing on the lit

market using ABM and EGTA, and show the resis-

tance of an alternative market design called frequent

call markets. Martınez-Miranda et al. (Mart

´

ınez-

Miranda et al., 2016) study pinging strategies using

a reinforcement learning framework to study the trad-

ing dynamics of these agents. While there is extensive

research on market manipulation in the lit markets,

the impact of market manipulation in dark pools re-

mains unexplored. Furthermore, an analysis of ping-

ing based market manipulation using agent incentives

and using ABM is an unexplored area too.

3 EXPERIMENTAL SETUP

Our study employs an agent-based financial market

model that is inspired by frameworks utilized in prior

research (Liu et al., 2022). All trading is permitted

on a single security only. Our model allows trading

agents to submit orders in two parallel market mecha-

nisms namely the Continuous Double Auction (CDA)

and the Dark Pool (DP) market, enabling a versatile

analysis of market phenomenon. In our market setup,

orders are submitted at discrete intervals of time (t =

0,1,....,N, where N is the total length of simulation)

with order prices being restricted to integer multiples

of the market tick size (set to 1 in this instance). We

leverage ABM to analyze market dynamics and ap-

ply EGTA to compute the equilibrium behavior of the

pinging agent and the institutional trading agent. The

computational ABM market model was implemented

in Python using the mesa library (Kazil et al., 2020)

with separate Python modules built for each trading

agent type and market matching mechanisms. Addi-

tionally equilibrium analysis using EGTA (Wellman,

2006) was performed using the open source egtaon-

line and quiesce libraries.

3.1 Market Environment

Our study uses a market environment that builds on

frameworks commonly used in financial market ABM

studies (Liu et al., 2022; Brinkman and Wellman,

2017). It features a population of N background

agents, whose market arrival times are governed by a

Poisson process with an arrival rate parameter λ. On

arrival, agents may either cancel existing outstanding

orders and/or submit new orders to either the CDA or

dark pool markets. A fundamental price time series,

representing the consensus value of the traded secu-

rity, is expected to be present and known to all the

agents in the environment. At each time step t, the

fundamental price f is governed by a mean-reverting

stochastic process described as below:

f

t

= r

¯

f + (1 − r) f

t−1

+ s

t

s

t

∼ N(0,σ

2

s

) (1)

Here, f

t

represents the fundamental price time series,

r ∈ (0,1) is the mean reversion rate, s

t

is a noise

term sampled from a normal distribution and

¯

f is the

mean of the fundamental value. The parameters r

and σ

2

s

can be adjusted to produce fundamental price

time series with different levels of mean reversion and

volatility. The initial value of the fundamental series

f

0

=

¯

f .

3.2 Valuation Models

At each time step t, when the fundamental value

changes, agents in the market update their security

valuations based on their private and common com-

ponents consistent with the approach in prior re-

search (Brinkman and Wellman, 2017; Liu et al.,

2022). The common component of an agent’s val-

uation is a noisy estimate of the true fundamental

value. This estimate is modeled as a combination

of the true fundamental and an agent-specific valua-

tion bias b

i,t

, which is sampled from a normal dis-

tribution N(0,σ

2

bias

). The agent’s private component,

denoted as θ

i

, reflects the agent’s marginal utility of

acquiring an additional unit of the security. It is repre-

sented as a vector of length 2Q (where Q is the max-

imum permitted agent inventory) and is expressed as

(θ

i,−Q

,θ

i,−Q+1

,....,θ

i,0

,....,θ

i,Q−2

,θ

i,Q−1

). Each ele-

ment θ

i,q

corresponds to the marginal utility of one

additional security for agent i, when its current inven-

tory is q. This vector θ

i

is generated by sampling 2Q

values from a normal distribution N(0,σ

2

pv

) and sort-

ing them in descending order. The total valuation of

agent i at time t with an inventory q is calculated as:

v

i,t,q

=

(

f

t

+ b

i,t

+ θ

i,q

, if buying

f

t

+ b

i,t

− θ

i,q−1

, if selling

(2)

3.3 Market Mechanisms

In this study, we explore two distinct market mecha-

nisms - Continuous Double Auction (CDA) and dark

pool market, which co-exist in the overall market en-

vironment. We would like to examine the market

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

174

dynamics when an institutional trading agent inter-

acts with the CDA and dark pool markets through

different strategies. The CDA is a widely employed

mechanism where agents place buy (sell) limit or-

ders with an associated price at which they would like

to trade at. All orders are stored in the limit order

book (LOB) and trades occurs when a new incom-

ing order matches with an existing one in the LOB.

We implement an ABM functioning as per the CDA

market framework, similar to those presented in prior

research (Liu et al., 2022; Brinkman and Wellman,

2017). The dark pool market, in contrast, is a less

prevalent market design more popular in certain ge-

ographies (MacKenzie, 2019). While the dark pool

market also allows participants to submit buy or sell

orders in continuous time like the CDA, the order

book is hidden from the participants thereby allow-

ing them to hide their trading intentions (Buti et al.,

2017; Bayona et al., 2023). In this study, we imple-

ment a dark pool market that acts as a crossing mech-

anism between buyers and sellers with trades occur-

ring at the midpoint of the best bid and offer prices in

the CDA market. Our dark pool market model is in-

spired by prior research work (Mo et al., 2013), how-

ever we use a more heterogeneous background agent

strategy set. The market model in our study allows

trading agents to trade either in the CDA or the dark

pool market or adopt a mixed trading strategy.

3.4 Background Agents

We use three kinds of background agents in our mar-

ket simulations to study the market dynamics in the

presence of an institutional trading agent and a ping-

ing market manipulation agent. The three agent types

we use are - zero intelligence (ZI) strategy, fundamen-

tal traders (FT) and market makers (MM). Further, we

also employ noise trading agents to enhance the order

book depth at various levels.

Zero Intelligence Strategy. Zero intelligence (ZI)

traders place limit orders with prices determined

based on the market fundamental value and private

valuations only, without considering the state of the

order book. The ZI strategy used in our paper is

inspired by prior research (Brinkman and Wellman,

2017) and this agent determines their order prices by

shifting their agent valuation using an offset drawn

from a uniform distribution U ∼ [R

min

,R

max

]. ZI

agents usually carry low inventory and therefore the

inventory limit for our study is set as Q = 3. On en-

tering the market, the ZI agent samples an expected

surplus from the uniform distribution and adjust their

valuation by this surplus to calculate their order price.

The order price submitted by agent i with current in-

ventory q at time t is calculated as below:

p

i,t,q

=

(

v

i,t,q

−U [R

max

,R

min

], if buying

v

i,t,q

+U [R

min

,R

max

], if selling

(3)

Fundamental Trader Strategy. Fundamental traders

(FT) are those who seek long-term value and base

their trading decisions on the dislocations between the

market quote-mid and their security valuations, aim-

ing to capture significant deviations between the two.

In comparison to ZI agents, FT agents are more risk-

averse and require a substantial surplus to be moti-

vated to trade. Drawing from the hypothesis and find-

ings from prior research (Majewski et al., 2018), we

model the FT agent demand as a polynomial function

of the market price’s deviation from the agent valua-

tions. The aggregate demand for all FT agents at time

t is given by:

D

i,t

= β

1

(v

i,t

− P

t

) + β

2

(v

i,t

− P

t

)

3

(4)

where P

t

represents the market mid price at time t,

β

1

and β

2

are the coefficients for the linear and cu-

bic terms respectively, v

i,t

is the agent valuation. FT

agents enter the market following the Poisson process

presented in Section 3.1, place orders near the market

mid price to adjust their inventory to align with their

computed demand function value.

Market Maker Strategy. Market making (MM)

refers to a category of trading strategies aimed at

providing liquidity to the market and profiting from

the bid-offer spread (Chakraborty and Kearns, 2011).

Our MM strategy agent is inspired by Karvik et al.

(Karvik et al., 2018) and has been streamlined to re-

duce computational complexity. The MM agent con-

sidered in our model enters the market and adjusts its

buy and sell orders (Bid

k

, Ask

k

) at each time t ∈ (0,T ).

Our MM agent monitors the volume of arriving buy

and sell orders, constructs indicators of market im-

balance and modifies its orders as described in prior

research (Ho and Stoll, 1981). On observing a higher

demand to buy (sell), the MM infers the market senti-

ment and adjusts its prices upward (downward). They

also effectively manage inventory risk by adjusting

prices upward (downward) to effectively manage de-

creases (increases) in holding inventory. At each time

t, the MM calculates its mid-price mmp

i,t

and series

of quotes (Bid

k

, Ask

k

) as expressed below:

mmp

i,t

= mmp

i,t−1

+ α

demand

.DI + α

inv

.IC (5)

DI = (N

aggbids,t−1−>t

− N

aggasks,t−1−>t

) (6)

IC = (q

i,t

− q

i,t−1

) (7)

Bid

k

= mmp

i,t

−

MMSpr

i

2

− (k − 1)ticksize (8)

Impact of Pinging in Financial Markets: An Agent Based Study

175

Ask

k

= mmp

i,t

+

MMSpr

i

2

+ (k − 1)ticksize (9)

where k = 1,2,3,....MMLvls

i

, mmp

i,0

= f

0

(funda-

mental mean), N

aggbids,t−1−>t

and N

aggasks,t−1−>t

are

the total quantity of aggressive bids and asks respec-

tively between t − 1 and t, q

i,t

is the MM agent in-

ventory at time t, DI represents demand imbalance,

IC represents inventory change, α

demand

is the market

demand adjustment factor, and α

inv

is the agent in-

ventory adjustment factor, MMSpr

i

is the fixed MM

agent spread, MMLvls

i

is the number of quote levels

on both the buy and sell sides.

Noise Trader. Noise traders are uninformed mar-

ket participants who lack intrinsic valuations of the

traded security and typically trade near the market

mid price. These types of agents are frequently em-

ployed in financial market simulations (Ponomareva

and Calinescu, 2014; Farmer et al., 2003) due to the

ability to account for upto 96% of the variance ob-

served in market spreads. In this study, noise trader

agents submit buy or sell orders shifted from the mar-

ket mid price by a value sampled from a uniform dis-

tribution U ∼ [R

min

,R

max

]. The submitted price by

noise trader i at time t is given by:

p

i,t

=

(

P

t

−U [R

max

,R

min

], if buying

P

t

+U [R

min

,R

max

], if selling

(10)

where P

t

is the market mid price at time t

3.5 Institutional Trading Agent

In our study, we use an institutional trader agent im-

plementing a time-weighted average price (TWAP)

strategy for our analysis of market impact in CDA and

dark pool markets. The TWAP strategy entails execut-

ing the total order volume at a consistent rate over the

entire execution period, aiming to match the market’s

time-weighted average price. To achieve this, the

strategy splits the total execution volume into equal

portions, executing one portion per time interval. The

order quantity executed by the TWAP agent during

the k-th interval is given by n

k

= X/N

TWAP

(where

N

TWAP

if the number of intervals for the strategy).

To analyze the impact of executing orders in the dark

pool market mechanism, we extend the vanilla TWAP

strategy to create multiple TWAP strategy variants,

each of which differ in the proportion of the trade

volume executed in the CDA vs dark pool. In this

study, we analyze four different TWAP strategy vari-

ants, as presented in Table 1. For example the strategy

S

0%DP

executes the entire trade volume in the main

CDA market while the S

10%DP

executes 10% of the

trade volume in the dark pool and 90% in the CDA

market.

Table 1: TWAP Strategy Variants - Each of these strategies

differ by the fraction of the overall trade executed in the

dark pool vs CDA markets.

Strategy DP Fraction CDA Fraction

S

0%DP

0% 100%

S

10%DP

10% 90%

S

20%DP

20% 80%

S

30%DP

30% 70%

3.6 Pinging Agent

Pinging (Mart

´

ınez-Miranda et al., 2016) refers to a

market manipulation strategy (Budish et al., 2015)

where the agent submits small orders (typically near

the best bid or offer price of the market) to detect the

presence of large hidden institutional orders. In this

paper, our main focus will be on pinging based market

manipulation in dark pool (DP) markets. As discussed

in classical finance research (Kratz and Sch

¨

oneborn,

2014), pinging agents in dark pool markets aim to

probe the presence of large orders in dark pool mar-

kets and subsequently place orders in the main CDA

markets with the aim of profiting from future market

moves. Pinging can often be harmful to market par-

ticipants since the market price is no longer indicative

of the true security value and this increases execution

costs for institutional trading agents.

For our experiments, we employ a simplistic ping-

ing agent that performs two activities in parallel.

First, the pinging agent places small buy or sell trades

(buy or sell direction chosen at random) of quantity

1 unit in the dark pool market in regular intervals

(in this case at t = 0, 10, 20...., T − 10, T ) to detect

the presence of large dark pool orders. The pinging

agent uses the information gained from the previous

10 pings (on a rolling basis) to ascertain whether there

is hidden buy or sell side demand in dark pool mar-

ket. Second, the pinging agent executes aggressive

buy or sell trades in the CDA market to achieve its tar-

get inventory, which is determined based on the infor-

mation acquired from the dark pool pinging process.

The target inventory for the pinging agent is set to the

maximum positive (negative) inventory if a large hid-

den buyer (seller) was detected in the pinging process.

The target inventory for pinging agent is set as:

T I

Ping

=

+Q

Ping

, if buyer in 70%+ pings

−Q

Ping

, if seller in 70%+ pings

0, otherwise

(11)

where T I

Ping

is target inventory of the pinging agent

and Q

Ping

is the maximum inventory for the pinging

agent (Q

Ping

= 10 in our study).

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

176

Table 2: Environment Parameters.

Parameter Value Parameter Value

f 500 N 110

r 0.2 N

noise−agents

20

σ

2

s

10 λ

ZI

0.01

σ

2

bias

10 λ

FT

0.005

T 2000 (α

inv

,α

demand

) (1,-1)

R

min

0 R

max

5

MMSpr

i

4 MMLvls

i

5

σ

2

pv

5 β

1

-5

β

2

-6.4e-3

3.7 Environment Parameters

During the course of experiments and analysis in this

paper, the general market parameters remain fixed. To

estimate the market impact of different strategies, we

vary the execution strategy under consideration (as

described in Section 3.5) and the total order quan-

tity executed (as described in Table 3). The secu-

rity price is allowed to fluctuate between 0 and 1000

with a market tick size of 1. The market consists

of N = 110 (N = N

ZI−CDA

+ N

FT −CDA

+ N

MM−CDA

+

N

ZI−DP

) background agents, which are split between

the CDA and dark pool markets. As per the findings

in prior research (Ye, 2024) that dark pool markets

attract informed speculatory agents and uninformed

trading agents, we will assume our market model to

contain 50 FT agents (N

FT −CDA

= 50), 25 ZI agents

(N

ZI−CDA

= 25) and 10 MM agents (N

MM−CDA

= 10)

in the CDA market while the dark pool market will

contain 25 ZI agents alone (N

ZI−DP

= 25). We do

not include any MM agents in the dark pool as per

the findings in prior research (Zhu, 2013). ZI and FT

agents arrive at the market following a Poisson pro-

cess with respective arrival rates λ

ZI

and λ

FT

, while

the MM agent is present at every time step. To ac-

count for market variance, we maintain a fixed num-

ber of noise trader agents N

noise−agents

in the CDA

market. The demand function factors for FT agents

are specified in Table 2. These parameter choices are

motivated by the findings in prior research (Majewski

et al., 2018). The simulation length is set to T = 2000

time steps. The summary of environment and back-

ground agent parameters discussed in this section is

shown in Table 2, with each of these parameters cho-

sen to be in line with prior research (Liu et al., 2022;

Brinkman and Wellman, 2017; Karvik et al., 2018).

3.8 Execution Scenarios and Metrics

We outline certain execution scenarios to analyze

market impact of various execution strategies. These

Table 3: Execution Scenario Definitions.

Scenario Execution Order Volume

Scen

100

Agent buys 100 units of security

Scen

150

Agent buys 150 units of security

Scen

200

Agent buys 200 units of security

Scen

250

Agent buys 250 units of security

scenarios differ based on the total order volume exe-

cuted in each scenario. For each scenario, an institu-

tional trader agent trades a total order volume as de-

fined by the respective scenario beginning at t = 0 and

completing execution at t = 1000. The scenarios un-

der which we will be evaluating market impact are

specified in Table 3. These execution scenarios were

chosen with the order quantities aligned with 10%,

15%, 20% and 25% of the typical trading volume in

one simulated trading day of T = 2000 time steps. To

evaluate market impact in a CDA-dark pool market

model, we focus mainly on temporary/permanent im-

pact and execution costs as defined in prior research

(Said et al., 2017). The list of market metrics we will

use are temporary impact, permanent impact, imple-

mentation shortfall and agent surplus. These are de-

fined as follows:

• Temporary Impact - Temporary impact is defined

as the peak change in market price observed dur-

ing the execution period relative to the execution

strategy’s arrival price.

• Permanent Impact - Permanent impact refers to

the new equilibrium price level post execution

completion relative to the execution strategy’s ar-

rival price.

• Implementation Shortfall - Implementation Short-

fall (also known as execution cost) is the effective

cost incurred by the execution agent, i.e., the aver-

age cost incurred by the agent per unit of security

purchased.

• Agent Surplus/Profits - The terminal surplus of an

agent is the sum of cash and value of terminal se-

curity holdings (Brinkman and Wellman, 2017).

3.9 Agent Strategy Space and EGTA

Our ABM simulation is formulated as a financial

profit maximization game between an institutional

trader and a pinging agent. Also as defined in Sec-

tion 3.4, the market model consists of N = 110 back-

ground agents who act as per their fixed strategies and

do not adapt their strategies as per the market sce-

nario. We assume that the time period of the institu-

tional agent activity and pinging agent activity is too

short for the background agents to detect and adapt to

and therefore each of the background agents (ZI, MM

Impact of Pinging in Financial Markets: An Agent Based Study

177

and FT) follow fixed strategy profiles.

On the other hand, the two players in our financial

market game with dynamic strategies are the institu-

tional trader agent (described in Section 3.5) and the

pinging agent (described in Section 3.6). While we

do analyze all combinations of these strategies in Sec-

tions 4.1 and 4.2, we model the market simulation as a

2-player game in Section 4.3 to compute the equilib-

rium state. The institutional trader chooses its strat-

egy from the strategy set {S

0%DP

, S

10%DP

, S

20%DP

,

S

30%DP

} (described in Table 1). The pinging agent

chooses between 2 strategies - ’Idle’ (dormant) or

’Active’ (agent acts per Section 3.6). Both of these

agents pick their strategy in the market equilibrium to

maximize their profits. Since we are unable to apply

theoretic Nash equilibrium models to a financial mar-

ket ABM, we use EGTA (Wellman, 2006) for analyz-

ing our market game. First, we consider all strategy

combinations for the institutional trader agent (4 pos-

sible strategies) and pinging agent (2 possible strate-

gies) and run 100 simulations for each strategy pro-

file. Next, we analyze and calculate the agent surplus

for each simulation. Finally, we compile these strat-

egy profiles with their payoffs, construct the payoff

matrix and perform EGTA.

4 EXPERIMENTS AND ANALYSIS

4.1 Market Impact in Hybrid

CDA-Dark Pool Strategies

In this section, we show the ability of our financial

market ABM to model market impact of an institu-

tional trader agent under various execution scenarios

while following different strategies.

Figure 1: Market Price Trajectory under different execution

scenarios for Strategy S

10%DP

.

4.1.1 Experimental Procedure

First, we use an ABM based on the financial market

model described in Sections 3.1-3.3 and the parame-

ters in Table 2. Second, we introduce an institutional

trader agent (as defined in Section 3.5) into the mar-

ket model in different market scenarios. The institu-

tional trader agent is simulated under each of the ex-

ecution scenarios defined in Table 3 while following

each of the TWAP strategy variants defined in Table 1.

The purpose of these scenario and strategy variants is

to understand the relationship between the total order

execution volume and the market impact metrics, as

well as the relationship between the CDA-dark pool

execution volume splits and market impact metrics.

Finally, under each of these scenarios and strategies,

we observe the emergent system dynamics and com-

pute the market impact metrics defined in Section 3.8.

4.1.2 Results and Analysis

The resulting price trajectory for one of the TWAP

strategies S

10%DP

under each of the execution scenar-

ios is as shown in Figure 1. Based on the emergent

market dynamics observed in Figure 1, we observe

that the market price impact peaks around t = 1000

for all of the execution scenarios, which is when the

institutional trader agent concludes its execution. The

market price then swiftly converges to a new price

equilibrium by the end of the simulation day around

t = 2000. Across the execution scenarios, a larger

volume executed corresponds to a higher price im-

pact. The initial peak in market price impact is mea-

sured as temporary impact and this peak is due to the

temporary demand-supply mismatch. The subsequent

convergence to a new price equilibrium is due to the

subsequent arrival of FT agents, who in turn absorb

most of the demand from the institutional trader. This

price dynamics is as expected by classical finance lit-

erature (Obizhaeva and Wang, 2013). We also notice

that the price impact trajectory in Figure 1 shows a

concave shape in line with theoretical finance models

(J. Doyne Farmer and Waelbroeck, 2013).

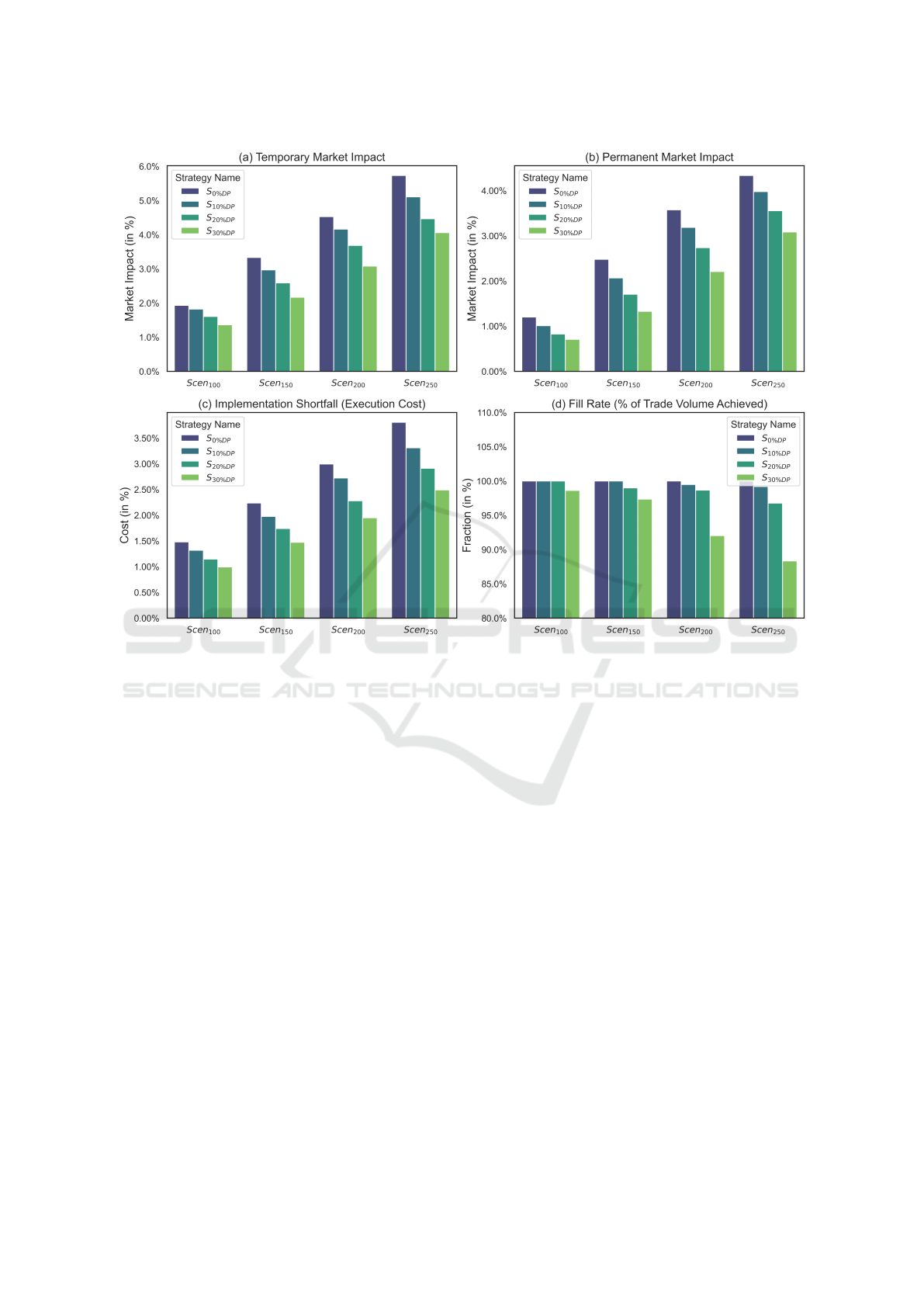

The market impact metrics for each of the exe-

cution scenarios and strategies is as shown in Fig-

ure 2. As the fraction of the trade volume executed

in the dark pool increases, we observe a decrease in

temporary impact, permanent impact and execution

cost. For example in Figure 2(a)-(c), temporary im-

pact, permanent impact and execution cost decreases

as we move from S

0%DP

to S

30%DP

(left to right in Fig-

ure) for a given scenario. On investigating our ABM

simulations, we find that this is due to the dark pool

market trades being hidden from other participants

and thereby the anonymity leads to lower price impact

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

178

Figure 2: Market Impact Metrics under different execution scenarios and TWAP strategies. The X-axis for each of these

subplots contains the execution scenario under analysis (as per Table 3). (a) Temporary Market Impact, (b) Permanent Market

Impact, (c) Implementation Shortfall (a.k.a Execution Cost), (d) Fill Rate (% of Trade Volume Achieved).

of the dark pool trades. We also notice a larger reduc-

tion in temporary impact, permanent impact and exe-

cution cost from more dark pool trading for the larger

volume scenarios (such as Scen

250

). This can be at-

tributed to two factors. First, as the execution scenario

volume increases, a larger quantity is being executed

in the dark pool market and thereby higher cost sav-

ings. Second factor is the un-executed trades in the

larger volume execution scenarios such as Scen

250

.

As can be seen from Figure 2(d), there is a reduc-

tion in the trade fill rate as we move from Scen

100

to

Scen

250

, especially while employing strategy S

30%DP

.

This shows that there is limited liquidity available in

the dark pool market and thereby attempting to exe-

cute large volumes would lead to non-executed trades

and thereby a lower agent surplus. Thereby insti-

tutional traders need to balance the benefits of cost-

efficient execution in dark pools with the higher risk

of un-executed trades in dark pools.

4.1.3 Key Outcomes

• We show the ability of our ABM to estimate mar-

ket impact of an institutional trader strategy under

different TWAP strategy variants.

• We also show that as the TWAP strategy executes

a larger portion of the trade in dark pool, it bene-

fits from lower market impact and execution costs

due to hidden nature of activity in the dark pool.

• We observe that the benefits of executing higher

volumes in the dark pool plateau based on the ex-

ecution scenario and leads to un-executed trades

due to limited dark pool liquidity.

4.2 Impact of Pinging Agent

Manipulation

In this section, we show the impact of pinging based

market manipulation on market impact and execution

costs incurred by institutional trading agents. We ana-

lyze the scenarios and conditions under which pinging

is a profitable strategy.

Impact of Pinging in Financial Markets: An Agent Based Study

179

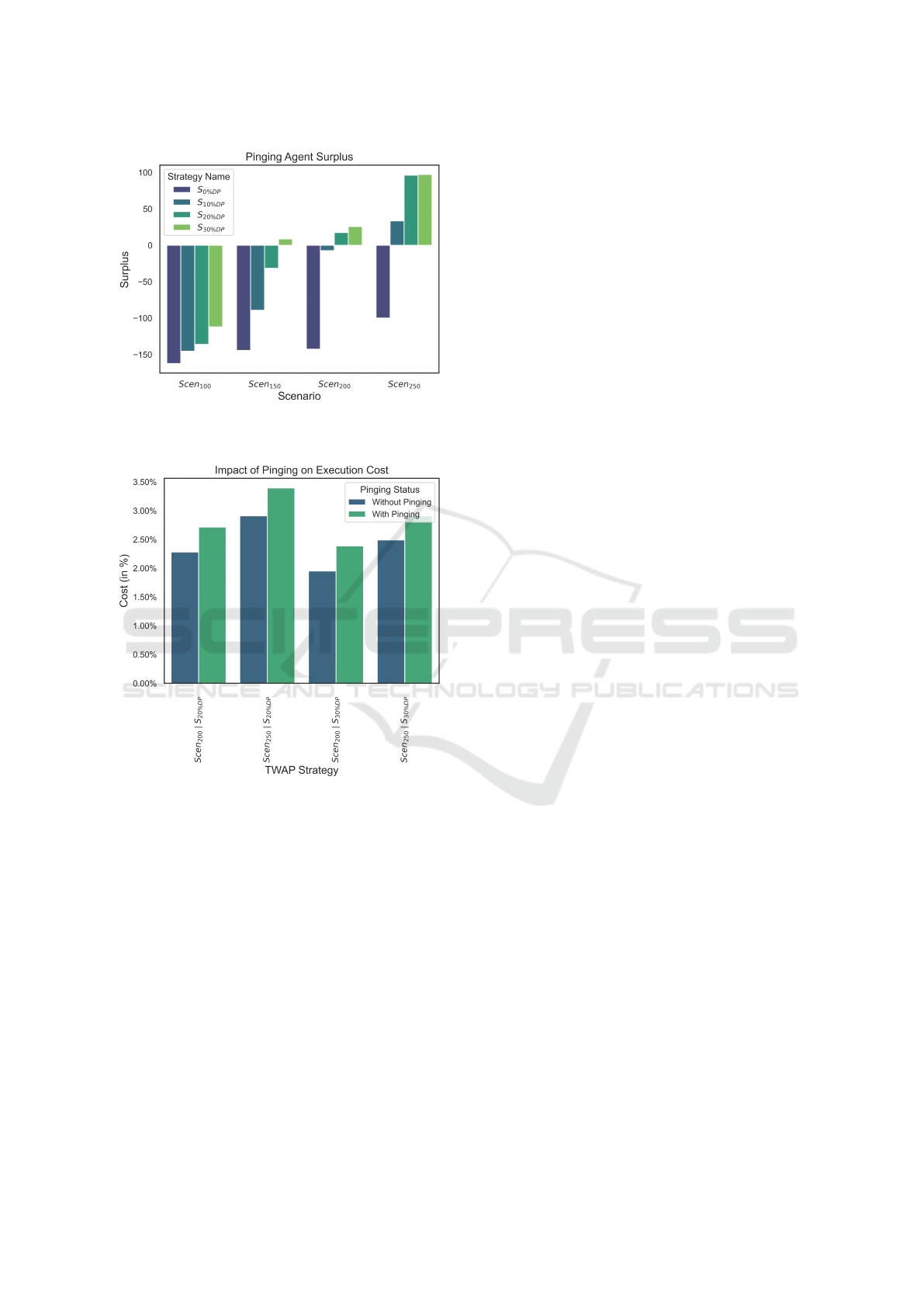

Figure 3: Pinging agent surplus under different execution

scenarios and different TWAP strategies.

Figure 4: Execution cost impact caused by pinging agent

when institutional trader adopts strategies S

20%DP

and

S

30%DP

, in the Scen

200

and Scen

250

execution scenarios.

4.2.1 Experimental Procedure

First, we use the same ABM setup as described in

Sections 3.1-3.3. Second, we introduce an institu-

tional trader agent into the market model under the

same scenarios and TWAP strategy variants as used

in Section 4.1. We also introduce a pinging agent

(as described in Section 3.6) into the market envi-

ronment. Finally, under each of these scenarios and

strategies, we observe the emergent system dynam-

ics, analyze the conditions under which the pinging

agent is profitable and also understand its impact on

execution costs.

4.2.2 Results and Analysis

First we analyze the conditions under which pinging

based market manipulation is profitable by looking at

the pinging agent profits (surplus) as shown in Fig-

ure 3. We can see that the profits accumulated by the

pinging agent increases as the fraction of volume ex-

ecuted in the dark pool market increases, i.e., as we

move from strategy S

0%DP

to S

30%DP

for a given sce-

nario. We find that a larger volume executed in the

dark pool corresponds to larger supply demand mis-

matches in the dark pool, thereby allowing the ping-

ing trader to reliably detect the presence of a hidden

large institutional order. The pinging agent is then

able to use this reliable signal of dark pool buy or-

ders to execute manipulative trades in the CDA mar-

ket and profit from the subsequent upward market

move. Based on the profit numbers show in Figure 3,

we observe that the pinging agent is only able to stay

profitable (surplus > 0) under certain market condi-

tions. For example, under market scenario Scen

200

,

the pinging agent is only profitable when the insti-

tutional trading strategies S

20%DP

or S

30%DP

are de-

ployed. This is because these scenario/strategy com-

binations with large volumes executed in dark pools

provide the pinging agent a reliable hidden order sig-

nal.

Next, we analyze the impact of pinging activity on

the execution costs of institutional traders. The execu-

tion costs for an institutional trader agent under some

of the impacted scenario/strategy combinations is as

shown in Figure 4. We can see that pinging causes

a significant increase in execution costs for the insti-

tutional trader agent in scenarios Scen

200

and Scen

250

when the strategies S

20%DP

and S

30%DP

are deployed.

For example, when S

30%DP

strategy is deployed in

Scen

250

scenario, there is an increase in execution cost

from 2.49% to 2.90%. In some other scenario/strategy

combinations such as under the Scen

100

scenario, the

impact of pinging on execution costs is much smaller

or negligible due to the pinging agent being unable to

reliably detect hidden dark pool orders.

4.2.3 Key Outcomes

• We show that pinging is profitable mainly under

significant supply demand imbalances in the dark

pool. This is because of the higher reliability of

hidden order signals.

• We also show that pinging based market manip-

ulation is harmful to institutional traders since it

leads to an increase in market impact and a subse-

quent increase in execution costs.

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

180

4.3 Strategic Response and Market

Equilibrium

4.3.1 Experimental Procedure

First, we use the same ABM setup as described in

Sections 3.1-3.3. Second, we compute the Nash equi-

librium strategy adopted by institutional trader agent

under each of the execution scenarios in Table 3 in

the absence of pinging agents. Third, we compute the

Nash equilibrium strategy adopted by both the institu-

tional trading agent and the pinging agent (per Section

3.9). Finally, we compare the Nash equilibrium with

and without the pinging agent to quantify the impact

of pinging on execution cost of institutional traders.

4.3.2 Results and Analysis

First, we analyze the equilibrium market strategies

played by the institutional trader agent in the absence

of the pinging agent as displayed in Table 4. We see

that in the scenarios Scen

100

and Scen

150

, the institu-

tional trader adopts the S

30%DP

strategy which is the

most cost effective strategy (as seen in Section 4.1).

However, for scenarios with larger execution volumes

Scen

200

and Scen

250

, the trader adopts the S

20%DP

and

S

10%DP

strategies respectively. This is because the

S

30%DP

strategy despite being the most cost-effective

can lead to un-executed trades (as seen in Section 4.1).

Next, we analyze the equilibrium market strategies

played by the institutional trader agent and the ping-

ing agent when they are both present in the market.

As shown in Table 4, the pinging agent chooses to

be inactive (’Idle’) in scenarios Scen

100

and Scen

150

while its active in the other two scenarios. This is be-

cause the pinging agent makes negative surplus in the

former two scenarios as a result of constantly pinging

the market and not receiving any reliable signals. On

the other hand, pinging agent makes positive surplus

in scenarios Scen

200

and Scen

250

and stays active due

to reliable hidden order signals.

The institutional trader has two main ways to re-

spond to the actions of a pinging agent. It may either

reduce its dark pool volume (by following a differ-

ent strategy) and thereby stay under the radar of the

pinging agent or it may choose to accept the negative

cost impact of the pinging agent since reducing dark

pool trading volume may increase costs even more.

From Table 4, we see that the institutional trader plays

the same strategies as in the market scenario with-

out pinging, except when its in scenario Scen

150

. In

this scenario, the institutional trading agent switches

from the most cost-effective strategy S

30%DP

to the

second most effective strategy S

20%DP

to stay under

the radar and avoid being manipulated by the pinging

agent. The increased costs by switching to the second

best strategy is overshadowed by the costs saved by

evading the effects of pinging. Meanwhile, the in-

stitutional trader agent is unable to evade the pres-

ence of the pinging agent in scenarios Scen

200

and

Scen

250

since the increased cost from pinging based

manipulation is lesser than the cost of switching to

a trading strategy with lower dark pool volume. Fi-

nally, we can see from Table 4, that pinging creates

an increase in execution cost of 0.27%-0.48% of the

overall trade value depending on the scenario. The

only scenario that is unaffected by pinging is Scen

100

,

since the low execution volume is not conducive for

the pinging agent.

4.3.3 Key Outcomes

• We show that the presence of pinging agents in the

market can incentivize some institutional traders

to reduce their volume executed in the dark pool

market, thereby increasing their costs and market

volatility, due the higher visibility of their trades.

• We also show that pinging agents do co-exist with

institutional traders in the equilibrium state of

market scenarios with high dark pool execution

volume. Pinging agents profit at the expense of

institutional traders by front-running their trades

and leading to an increase in execution costs.

4.4 Market Implications and Regulation

The existence of dark pool pinging strategies has neg-

ative implications for market integrity. Since dark

pools are mainly used by informed trading agents to

hide their orders from the general market, pinging

strategies that uncover these hidden dark pool orders

undermine the purpose of dark pools. Dark pools with

pinging activity no longer enable informed traders to

execute their trades in a cost effective way and lead

to information leakage (Mittal, 2008; Zhu, 2013).

This could potentially lead to an erosion of trust and

thereby reduced participation in dark pools. A reduc-

tion in dark pool participation could lead to reduced

information acquisition, lower market price discovery

and higher volatility (Ye et al., 2012).

Financial regulators have recognized the chal-

lenges caused by market manipulation activities like

pinging and acknowledged the need for regulation in

dark pools

2

. Improving transparency in dark pools

while maintaining the hidden nature of trade execu-

tion could prove to be a crucial step towards combat-

2

See https://www.forbes.com/sites/jonathanponciano/

2021/08/04/sec-looking-closely-at-dark-pools-heres-

what-they-are-and-why-reddit-traders-are-rallying/.

Impact of Pinging in Financial Markets: An Agent Based Study

181

Table 4: Table shows the market equilibrium strategies played by Institutional trader agent with and without the presence of

a pinging agent and the equilibrium pinging agent strategy when its present. The execution cost impact of introduction of a

Pinging agent in different execution scenarios is displayed. The cost and impact are in % of the overall executed trade value.

Pinging Strategy Institutional Trader Strategy Pinging Cost & Impact

Pinging Scenario Idle Active S

0%DP

S

10%DP

S

20%DP

S

30%DP

Cost (in%) Impact (in%)

Without Scen

100

0 0 0 1 0.99%

Scen

150

0 0 0 1 1.47%

Scen

200

0 0 1 0 2.28%

Scen

250

0 1 0 0 3.30%

With Scen

100

1 0 0 0 0 1 0.99% 0%

Scen

150

1 0 0 0 1 0 1.74% 0.27%

Scen

200

0 1 0 0 1 0 2.71% 0.43%

Scen

250

0 1 0 1 0 0 3.78% 0.48%

ing market manipulation. Besides transparency, there

are concrete regulations that can be put in place to

combat pinging. Imposing minimum dark pool order

sizes could make it operationally expensive for ping-

ing traders, thereby de-incentivizing them (Buti et al.,

2017). Dark pool operators could also consider more

robust market design options such as implementing

randomized clearing with non-deterministic delays in

the dark pool clearing process (Aquilina et al., 2021).

5 CONCLUSION

In this paper, we have proposed a novel incentive

aware ABM of the financial markets with a dark pool,

for investigating the impact of pinging on execution

costs incurred by institutional traders. The key out-

comes from our study are as follows:

• We show that our ABM can replicate market im-

pact dynamics under various institutional strate-

gies that split their trades between the CDA and

dark pool. The market impact dynamics are in line

with classical finance literature and we show that

executing in dark pools is associated with lower

execution costs and higher risk of non-execution.

• We propose a novel pinging agent for understand-

ing the profitability of pinging under different

market scenarios. We show that pinging is mainly

profitable when there is significant supply demand

mismatch in the dark pool. This is when the ping-

ing agent can extract reliable signals of hidden

large orders and profit from it.

• We show that the potential impact of pinging

can incentivize institutional traders to reduce their

dark pool activity to avoid being detected in some

scenarios. Meanwhile, in other scenarios pinging

agents can co-exist in the equilibrium with insti-

tutional traders leading to higher execution costs

for the latter and poorer market price discovery.

There is plenty of scope for future work in the area

of market manipulation analysis in dark pool markets

using ABM. First, there is a need to model the incen-

tives of background trader agents to understand which

type of agents prefer dark pools and how this varies

across market conditions. Second, there is a need to

identify and test the potential of regulatory policies

such as minimum order sizes and randomized clear-

ing on combating market manipulation like pinging

in dark pools. Third, there is need to identify more

sophisticated pinging agent policies using reinforce-

ment learning that may be more efficient at identify-

ing large hidden orders. Finally, there is a need to

ground ABM design with real world empirical data to

produce more actionable insights.

ACKNOWLEDGEMENTS

This work was supported by the UKRI Centre for

Doctoral Training in Safe and Trusted Artificial In-

telligence [EP/S0233356/1].

REFERENCES

Almgren, R. and Chriss, N. (2001). Optimal execution of

portfolio transactions. Journal of Risk, 3(2):5–39.

Aquilina, M., Budish, E., and O’Neill, P. (2021). Quanti-

fying the high-frequency trading “arms race”*. The

Quarterly Journal of Economics, 137(1):493–564.

Aquilina, M., Foley, S., O’Neill, P., and Ruf, T. (2024).

Sharks in the dark: Quantifying hft dark pool latency

arbitrage. Journal of Economic Dynamics and Con-

trol, 158:104786.

Bayona, A., Dumitrescu, A., and Manzano, C. (2023). In-

formation and optimal trading strategies with dark

pools. Economic Modelling, 126:106376.

Brinkman, E. and Wellman, M. P. (2017). Empirical mech-

anism design for optimizing clearing interval in fre-

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

182

quent call markets. In Proceedings of the 2017 ACM

Conference on Economics and Computation, EC ’17,

page 205–221, New York, NY, USA. Association for

Computing Machinery.

Brogaard, J. and Pan, J. (2021). Dark pool trading and infor-

mation acquisition. The Review of Financial Studies,

35(5):2625–2666.

Budish, E., Cramton, P., and Shim, J. (2015). The High-

Frequency Trading Arms Race: Frequent Batch Auc-

tions as a Market Design Response *. The Quarterly

Journal of Economics, 130(4):1547–1621.

Buti, S., Rindi, B., and Werner, I. M. (2017). Dark pool

trading strategies, market quality and welfare. Journal

of Financial Economics, 124(2):244–265.

Buti, S., Rindi, B., and Werner, I. M. (2022). Diving into

dark pools. Financial Management, 51(4):961–994.

Byrd, D., Hybinette, M., and Balch, T. H. (2020). Abides:

Towards high-fidelity multi-agent market simulation.

In Proceedings of the 2020 ACM SIGSIM Confer-

ence on Principles of Advanced Discrete Simulation,

SIGSIM-PADS ’20, page 11–22, New York, NY,

USA. Association for Computing Machinery.

Chakraborty, T. and Kearns, M. (2011). Market making

and mean reversion. In Proceedings of the 12th ACM

Conference on Electronic Commerce, EC ’11, page

307–314, New York, NY, USA. Association for Com-

puting Machinery.

Chiarella, C. (1992). The dynamics of speculative be-

haviour. Working Paper Series 13, Finance Discipline

Group, UTS Business School, University of Technol-

ogy, Sydney.

Farmer, J. D., Patelli, P., and Zovko, I. I. (2003). The Predic-

tive Power of Zero Intelligence in Financial Markets.

Papers cond-mat/0309233, arXiv.org.

Gode, D. K. and Sunder, S. (1993). Allocative efficiency

of markets with zero-intelligence traders: Market as a

partial substitute for individual rationality. Journal of

Political Economy, 101(1):119–137.

Ho, T. and Stoll, H. (1981). Optimal dealer pricing under

transactions and return uncertainty. Journal of Finan-

cial Economics, 9(1):47–73.

J. Doyne Farmer, Austin Gerig, F. L. and Waelbroeck, H.

(2013). How efficiency shapes market impact. Quan-

titative Finance, 13(11):1743–1758.

Karvik, G.-A., Noss, J., Worlidge, J., and Beale, D. (2018).

The deeds of speed: an agent-based model of market

liquidity and flash episodes. Bank of England working

papers 743, Bank of England.

Kazil, J., Masad, D., and Crooks, A. (2020). Utilizing

python for agent-based modeling: The mesa frame-

work. In Social, Cultural, and Behavioral Modeling,

pages 308–317, Cham. Springer International Pub-

lishing.

Kratz, P. and Sch

¨

oneborn, T. (2014). Optimal liquidation in

dark pools. Quantitative Finance, 14(9):1519–1539.

Lin, T. C. W. (2017). The new market manipulation. Emory

Law Journal, 66:1253. Temple University Legal Stud-

ies Research Paper No. 2017-20.

Liu, B., Polukarov, M., Ventre, C., Li, L., Kanthan, L.,

Wu, F., and Basios, M. (2022). The spoofing resis-

tance of frequent call markets. In Proceedings of the

21st International Conference on Autonomous Agents

and Multiagent Systems, AAMAS ’22, page 825–832,

Richland, SC.

MacKenzie, D. (2019). Market devices and structural

dependency: The origins and development of ‘dark

pools’. Finance and Society, 5(1):1–19.

Majewski, A., Ciliberti, S., and Bouchaud, J.-P. (2018).

Co-existence of Trend and Value in Financial Mar-

kets: Estimating an Extended Chiarella Model. Papers

1807.11751, arXiv.org.

Mart

´

ınez-Miranda, E., McBurney, P., and Howard, M. J. W.

(2016). Learning unfair trading: A market manipu-

lation analysis from the reinforcement learning per-

spective. In 2016 IEEE Conference on Evolving and

Adaptive Intelligent Systems (EAIS), pages 103–109.

Mittal, H. (2008). Are you playing in a toxic dark pool? In

The Journal of Trading.

Mo, S. Y. K., Paddrik, M., and Yang, S. Y. (2013). A study

of dark pool trading using an agent-based model. In

2013 IEEE Conference on Computational Intelligence

for Financial Engineering & Economics (CIFEr),

pages 19–26.

Obizhaeva, A. A. and Wang, J. (2013). Optimal trading

strategy and supply/demand dynamics. Journal of Fi-

nancial Markets, 16(1):1–32.

Ponomareva, N. and Calinescu, A. (2014). Revisiting

Agent-Based Models of Algorithmic Trading Strate-

gies, pages 92–121. Springer Berlin Heidelberg,

Berlin, Heidelberg.

Said, E. (2022). Market Impact: Empirical Evidence,

Theory and Practice. Working Papers hal-03668669,

HAL.

Said, E., Ayed, A. B. H., Husson, A., and Abergel,

F. (2017). Market impact: A systematic study of

limit orders. Market Microstructure and Liquidity,

03(03n04):1850008.

Stenfors, A. and Susai, M. (2021). Spoofing and ping-

ing in foreign exchange markets. Journal of Inter-

national Financial Markets, Institutions and Money,

70:101278.

Wah, E., Hurd, D., and Wellman, M. (2015). Strategic mar-

ket choice: Frequent call markets vs. continuous dou-

ble auctions for fast and slow traders. EAI Endorsed

Transactions on Serious Games, 3(10).

Wellman, M. P. (2006). Methods for empirical game-

theoretic analysis. In Proceedings of the 21st Na-

tional Conference on Artificial Intelligence - Volume

2, AAAI’06, page 1552–1555. AAAI Press.

Ye, L. (2024). Understanding the impacts of dark pools

on price discovery. Journal of Financial Markets,

68:100882.

Ye, M., Yao, C., and Gai, J. (2012). The externalities of

high frequency trading. SSRN Electronic Journal.

Zhu, H. (2013). Do dark pools harm price discovery? The

Review of Financial Studies, 27(3):747–789.

Impact of Pinging in Financial Markets: An Agent Based Study

183