Randomizing Forger Selection to Improve Decentralization in Proof of

Stake Consensus Protocol

Syed Badruddoja

1

, Sasi Kiran Kanduri

1

and Ram Dantu

2

1

Dept. of Computer Science, California State University, Sacramento, 6000 J Street, Sacramento, California, 95819, U.S.A.

2

Dept. of Computer Science, University of North Texas, 3940 N. Elm Street, Denton, Texas, 76207, U.S.A.

Keywords:

Consensus Protocol, Blockchain, Proof-of-Stake, Decentralization.

Abstract:

In proof-of-stake consensus protocols, the inherent design often favors wealthier participants, perpetuating a

cycle where the rich become richer, thereby consolidating control over validation and block creation. This

dynamic discourages broader participation, as lower-stake nodes are discouraged from contributing to block

creation and transaction processing, undermining the fundamental principle of equitable decentralization. This

research introduces a hash power-based consensus protocol that provides opportunities to low-stakes valida-

tors. We extend an existing work of hash-power-based consensus protocol to increase randomization of val-

idator selection. Moreover, we raise the decentralization factor by extending a ’hash power’ metric, which is

calculated from the minted and native stakes of a participant. The proposed consensus algorithm enhances the

network’s forgers and validators selection mechanism, raising the entropy of the validator selection to 0.80

and fairness to 0.45, which is a significant improvement to coinage-based validator selection.

1 INTRODUCTION

Blockchain (Nakamoto, 2008) is a decentralized and

distributed ledger system that records transactions

across a network with a consensus-based voting

mechanism. The ledger is immutable and distributed

across the network, ensuring that nodes are updated

and the transactions are tamper-proof. Moreover,

blockchain eliminates the need for a single central-

ized entity and validates transactions with the help of

consensus protocols. Proof of Stake (PoS) (Saad and

Radzi, 2020) is one of the popular consensus proto-

cols used by many applications for security and scal-

ability purposes (Swan, 2015). However, decentral-

ization is curbed in PoS protocols due to the nature

of the selection process. Hence, it does not guarantee

true randomness in selecting nodes (Motepalli and Ja-

cobsen, 2024).

Proof of Stake (PoS) (Saad and Radzi, 2020)

emerges as an efficient consensus protocol, select-

ing validators for new blocks based on their cryp-

tocurrency holdings and ”stake.” This method is more

energy-efficient and secures the network through eco-

nomic incentives. However, PoS faces centralization

challenges, with factors showing that stake concen-

tration is encouraged (He et al., 2020). The argument

about centralization has been a pressing one in PoS-

based blockchain systems. PoS protocol inadvertently

leads to a concentration of control among a few par-

ticipants, potentially threatening the decentralized na-

ture of the blockchain.

Not Selected

Due to Low Stake

Selected Validators With High Stake

ForgerValidatorValidatorValidator

Blockchain Consensus Validator

Figure 1: Validator node on the left is not selected due to

low stake. Others with high stakes are selected for the con-

sensus process.

He et al. (He et al., 2020) mentioned that higher-

stakes validators have more probability of being cho-

sen for the block validation process in a PoS consen-

sus protocol. This can create an imbalance in the

validators and make rich participants richer. Inno-

vations like Delegated Proof of Stake (DPoS), uti-

lized by platforms like EOS and TRON, introduce

a delegate system where token holders vote for rep-

resentatives to validate transactions on their behalf,

enhancing scalability and efficiency (Nair and Do-

rai, 2021; Pan et al., 2021). Byzantine Fault Tol-

erance (BFT) algorithms, including Practical Byzan-

260

Badruddoja, S., Kanduri, S. K. and Dantu, R.

Randomizing Forger Selection to Improve Decentralization in Proof of Stake Consensus Protocol.

DOI: 10.5220/0013317200003899

In Proceedings of the 11th Inter national Conference on Information Systems Secur ity and Privacy (ICISSP 2025) - Volume 2, pages 260-267

ISBN: 978-989-758-735-1; ISSN: 2184-4356

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

tine Fault Tolerance (PBFT) and Tendermint, priori-

tize fault tolerance in distributed systems by tolerat-

ing malicious nodes and maintaining consensus even

in faulty nodes. These ideas effectively make the

blockchain network more scalable, but the core prob-

lem of favoring high-staking nodes remains an is-

sue, causing low decentralization. Figure 1 shows an

overview of the decentralization problem.

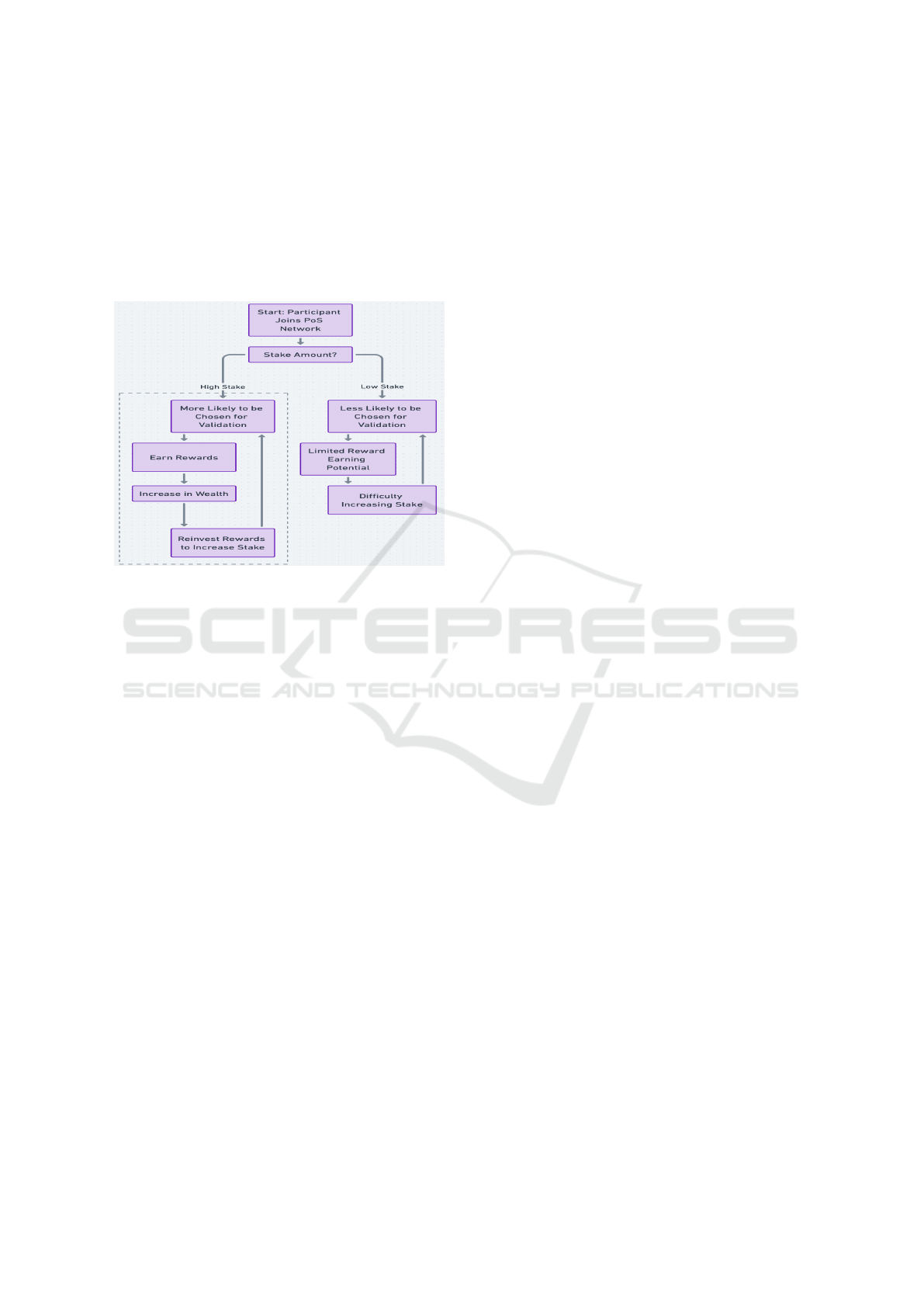

Figure 2: Showing the centralization behavior of the exist-

ing Stake-based consensus protocols.

Figure 2 shows how decentralization could shrink

due to a lack of stake participation. A participant joins

the PoS consensus network and deposits a stake. If the

participant has a high stake, the participant will likely

be selected for being a forger or validator of the block.

However, if the participant has a low stake, there is a

low chance that the participant will be selected.

Liquid staking pool platforms such as Lido (Hord,

2024) help users pool their assets for staking on proof-

of-stake (PoS) networks and incentivize users with

liquid tokens. Moreover, staking pools offer various

advantages for users, such as making participation

more accessible, minimizing technical complexities,

and enabling earning staking rewards even with small

ETH contributions. However, these pools can become

centralized if a few large pools dominate staking, con-

centrating validation power and governance influence

(Hord, 2024). This undermines decentralization by

creating reliance on a small number of entities, in-

creasing risks of collusion or censorship.

2 PROBLEM STATEMENT

Proof of Stake (PoS) originated as an alternative to

the energy-intensive Proof of Work (PoW) consen-

sus mechanism, aiming to address the limitations of

PoW-based blockchain networks like Bitcoin. PoS

was conceived to create a more energy-efficient and

sustainable model for achieving consensus within de-

centralized systems. It operates on the principle

that validators, or participants responsible for validat-

ing transactions and creating new blocks, are chosen

based on the amount of cryptocurrency they hold and

are willing to stake as collateral. Despite the bene-

fits of the Proof of Stake protocol, decentralization

remains a concern, and the algorithm favors nodes

with high stakes. Since incentives come from partic-

ipation in elections for forging/validating blocks, the

wealthier nodes naturally stake more to increase their

chances of participation. This can lead to the concen-

tration of wealth among a few participants with sig-

nificant stakes, centralizing power and influence over

the network.

3 CONTRIBUTION

• Our work builds upon and extends the method-

ologies proposed by Gurram et al. (Gurram et al.,

2023) using a weighted hash power-based selec-

tion.

• We extended the hash power-based consensus

protocol and proposed methodology to develop

a consensus algorithm that can be incorporated

to increase randomization in the validator selec-

tion process while also considering the size of the

stake.

• Our experiment demonstrates an improvement in

the fairness of the consensus protocol, increas-

ing from 0.11 with the coinage validator selection

process to 0.45 using the proposed protocol.

• Our experiment demonstrates an improvement in

the entropy of the consensus protocol, increas-

ing from 0.51 with the coinage validator selection

process to 0.80 using the proposed protocol.

4 BACKGROUND

To mitigate the challenges of PoS, ongoing research

and development efforts focus on designing PoS pro-

tocols that promote fair participation, distribute re-

wards equitably, and uphold the principles of decen-

tralization and security. Several iterations and varia-

tions of PoS have emerged, each with its unique ap-

proach to achieving consensus and ensuring network

security. Bonded Proof of Stake (BPoS), one of the

variants of PoS, enhances security by requiring val-

idators to ”bond” or ”lock up” their stake for a certain

Randomizing Forger Selection to Improve Decentralization in Proof of Stake Consensus Protocol

261

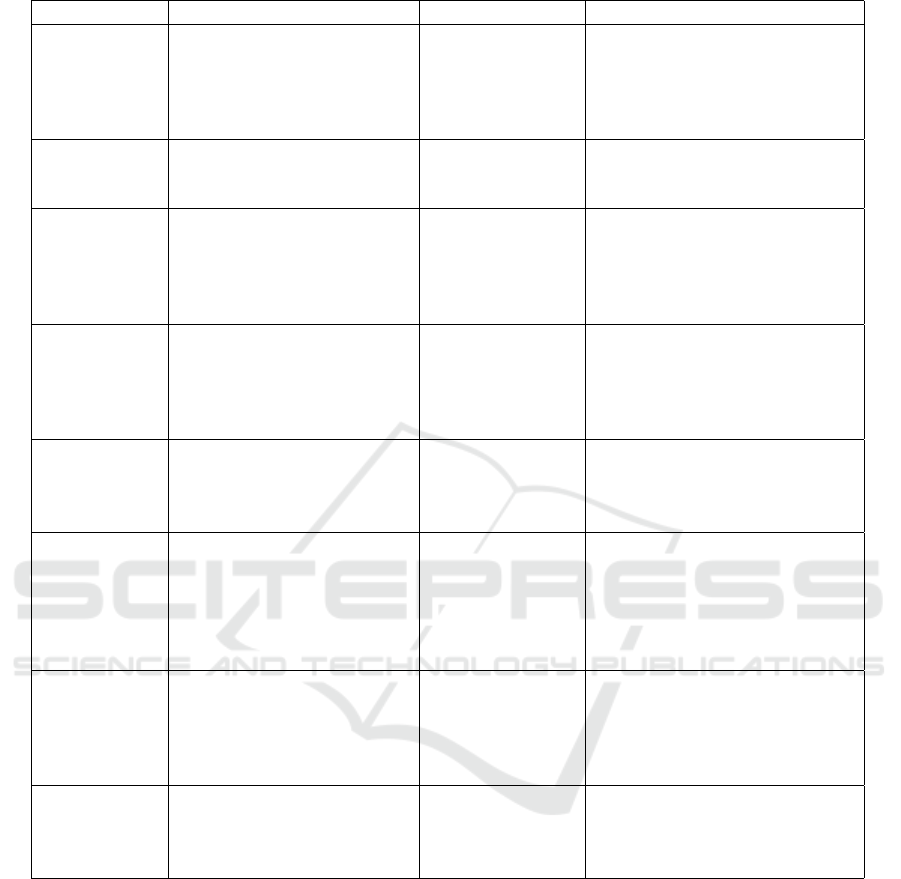

Table 1: Comparison of some of the stake-based consensus protocols that offer decentralization and their limitations.

Consensus Type of Validators Decentralization Limitation

RPoS (Li

et al., 2020)

Uses the number of coins to

select miners and limits the

maximum value of the coin

age to effectively avoid coin

age accumulation attack

Low Does not address decentraliza-

tion problem of the network

DPoS(Pan

et al., 2021)

Validators are elected from a

pre-defined list of block pro-

ducers called delegates

Low Improves scalability but carries

a risk for security and decentral-

ization with fixed delegates

BPoS (Elas-

tos, 2024)

Validators with a certain

amount of stake commit-

ted/locked up in the network

can be selected

Low Minimum stake amounts can in-

crease over time, making the

barrier of entry high, causing

liquidity issues with fewer coins

in circulation

LPoS (Tezos,

2024)

Minimum stake limit (in

coins) is needed to partici-

pate in consensus, can dele-

gate validating rights other-

wise

Medium Increases participation with del-

egation but tends to create a

concentration of few wealthy

validators

PoS (Maung

Maung Thin

et al., 2018)

amount of stake is directly

proportional to opportunities

of participation

Medium Conventional proof of stake

consensus where high staking

participants can centralize over

time

PPoS (Algo-

rand, 2024)

Uses verifiable random

function algorithm (VRF) -

The more algos (cryptocur-

rency) in an account, the

greater chance the account

has of being selected

Medium Promises randomization, but it

is still dependent on coin wealth

EPoS (Saad

et al., 2021)

Executing an immutable

smart contract that imple-

ments the rules of a PoS

auction to support decen-

tralization

Medium Runs a PBFT-based consensus

over the mempool state of PoS,

making it less efficient

This work Based on a ’ hash power’

metric, which is calculated

from the minted and native

stakes of a participant

High -

period. This commitment helps secure the network

by ensuring that validators are vested in maintaining

network integrity, as malicious actions could lead to

losing their bonded stake. In contrast, in LPoS, as op-

posed to DPoS, any user can become a validator with

a certain number of coins. Users can delegate the val-

idation rights if they do not have enough coins. The

idea is to dilute the activity even more and increase

inclusion (Tezos, 2024).

Coinage, another method used in the proof of

stake consensus mechanisms, chooses a validator

based on the product of the tokens staked and the

days they’ve been held, requiring a minimum of 30

days staked to qualify. Winning nodes are excluded

from competition for 30 days, affecting the network’s

scalability. Robust Proof of Stake (RPoS) (Li et al.,

2020) is a proposed consensus algorithm aimed at

improving blockchain sustainability. It elects block

forgers based on coin holdings, limiting the maxi-

mum coinage a node can accumulate to prevent con-

centration. RPoS claims to perform better than tradi-

tional PoW and PoS mechanisms. EPoS (Saad et al.,

2021), another variant of PoS, promises decentral-

ization with random state sharding. Validators with

larger stakes must operate more nodes, maintaining a

balanced control distribution.

Pan (Pan et al., 2021) and Lamriji (Lamriji et al.,

2023) published studies that explain the problem of

ICISSP 2025 - 11th International Conference on Information Systems Security and Privacy

262

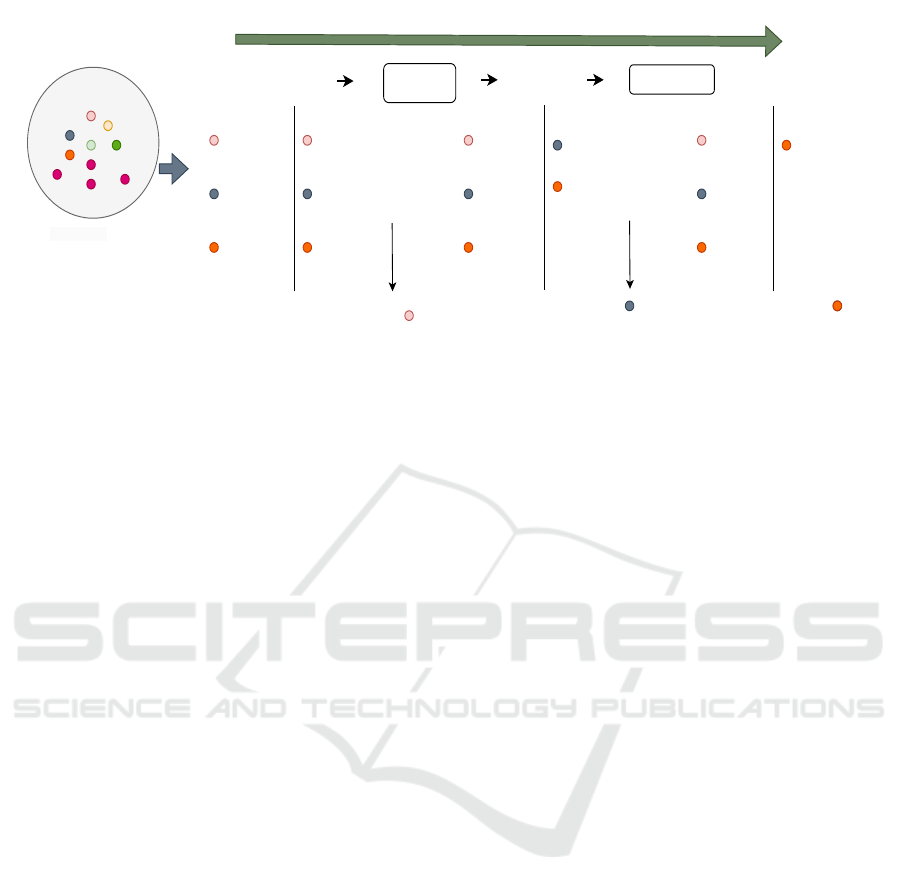

Election

Round 1

(Timestamp t = 0)

Election

Round 2

(Timestamp t = 10)

Election

Round 3

(Timestamp t = 20)

Node 1

Node 2

Node 3

Participants

Probable Winner

Node 1

TIMELINE

NODES

Intiate

Election

Pool of

participants

with hashpowers

hashpower = h(t, S)

hashpower = h(t, S)

hashpower = h(t, S)

Node 1

Node 2

Node 3

Participants Probable Winner

Node 2

hashpower = h(10, S)

hashpower = h((t + 10) / 2, S)

hashpower = h((t + 10) / 2, S)

Node 1

Node 2

Node 3

Participants Probable Winner

Node 3

hashpower = h((20 + 10) / 2, S)

hashpower = h(20, S)

hashpower = h(t(t + 20) / 2, S)

Update

hash powers

Node 2

Node 3

OR

OR

Node 3

OR

Update

hash powers

Node 1Winner =

Node 2Winner = Node 2Winner =

Figure 3: An election process considering three nodes with hash powers. Hashpowers calculated for the nodes at the first

election change over time after every election. In the above figure, the chances of selection for all nodes are equal in election

1, low for node 1, and high for nodes 2 and 3 in election 2. Later, the hash power is high for node 3 in election 3. Hashpowers

are updated based on the assumption that nodes 1, 2, and 3 won elections 1, 2, and 3, respectively.

existing proof-of-stake consensus mechanisms favor-

ing the wealthy, leading to centralization over time.

Extensive analysis indicates that, over a larger scale,

high-staking nodes can easily group together. This

contradicts the purpose of the blockchain as a de-

centralized system (Nair and Dorai, 2021; Pan et al.,

2021). Table 1 shows the comparison of some of the

PoS consensus protocols that indicate the need to im-

prove decentralization.

There have been several approaches to improve

decentralization in blockchain networks. Proof of

Stake and Activity (PoSA) protocol (Kim et al., 2023)

is one such consensus protocol that uses the concept

of Proof of Activity with the traditional Proof of Stake

to reward validators based on both stake capital and

their business contributions, promoting decentraliza-

tion. Khatoon et al. introduce another modified Proof

of Stake mechanism to address the risks of 51% at-

tacks, thus enhancing security and reducing central-

ization by making it more difficult for any single en-

tity to dominate the network validation process (Kha-

toon et al., 2024). Our protocol aims to address the

centralization issue at a lower level, altering the way

block forgers and validators are elected by modifying

the underlying algorithm.

Gurram et al. cite[5] proposed a consensus

methodology that uses stakes with timestamps to cal-

culate what they called hash powers that can be used

to improve randomness in validator selection. How-

ever, their contribution was limited to a mathematical

model and theoretical calculations without practical

implementation or testing of their methodology.

5 METHODOLOGY

The primary goal of this work is to improve the con-

sensus algorithm to make it fairer and address the cen-

tralization problem. In conventional Proof of Stake

(PoS) protocols, validators deposit native tokens as

stake, and the protocol selects a validator pseudo-

randomly based on the amount staked, as seen in the

coinage protocol. Building upon the methodology

proposed by Gurram et al. (Gurram et al., 2023),

which introduced the concept of staking minted to-

kens backed by native tokens for participation in

the election process, we extended their approach by

adding a behavior rating (W ) to consider reliability

and conduct in achieving consensus. We developed

a practical algorithm based on their work, breaking

it down into steps that the protocol follows to gov-

ern validator elections and block addition throughout

the blockchain’s operation. This approach ensures a

structured mechanism to improve fairness and valid-

ity in the consensus process. We used hash powers

(hP) for all members during the election process and

followed the proposed algorithm to achieve consen-

sus.

hP = S.(|e − m|) (1)

In equation 1, e is the timestamp of the election,

m is the timestamp minted on a token when it was

deposited. S is a node’s valid (unexpired) stake in the

blockchain. Considering that all staked tokens will

not have the same timestamp,

hP =

x

∑

i=1

S

i

· (e − m

i

) (2)

In equation 2, x is the number of records of staked

Randomizing Forger Selection to Improve Decentralization in Proof of Stake Consensus Protocol

263

tokens, and m

i

is the timestamp minted on a token

when it was deposited. The stake tokens are only

valid for x days from the minted date. The limited va-

lidity prevents wealthy nodes from accumulating very

high hash powers and influencing the protocol. If the

minted tokens remain unused, they’re returned to the

node. The value of ’x’ should be adjusted according

to the scale of the network. The calculated hash power

is then adjusted based on behavior rating W .

hP = hP ·W (3)

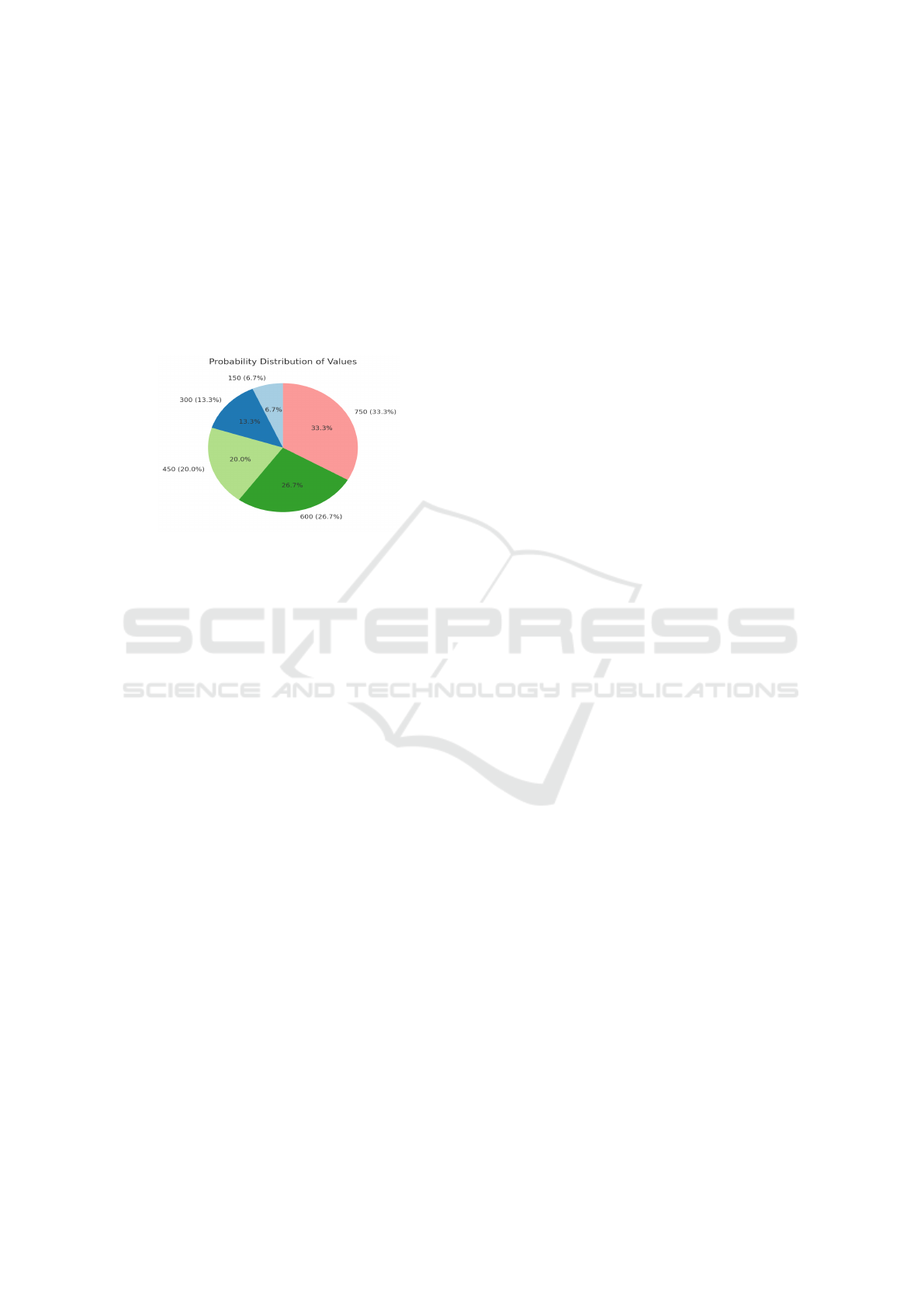

Figure 4: This pie chart represents the probability distri-

bution for being selected as a forger or validator among five

nodes with hash powers assumed as 150, 300, 450, 600, and

750 using Equation 2.

Below is a step-by-step description of the algorithm:

1. Nodes wanting to be a forger/validator can stake

tokens with minted timestamps.

2. Calculate hash powers with equations (2) and (3)

3. Select a random hash power for all the calcu-

lated unique hash powers. Let us assume a list

of unique hash powers calculated on the network

in step 2. The list can form a probability distri-

bution as shown below in figure 4, representing

the weight of each hash power value. Nodes with

higher hash power will have a higher probabil-

ity of getting selected as a forger/validator - The

largest hash power, say 750, might have a 33%

chance of getting selected, as shown in figure 4.

This can be imagined as spinning a roulette wheel

where larger hash powers have bigger slices but

are not guaranteed to be selected. Upon selecting

a hash power value, a node with that hash power is

chosen randomly from all nodes sharing the same

value.

4. After selecting the forger, the same steps above

are used to form the validator committee, ex-

cluding the chosen forger’s hash power. This

approach aims to increase the chances for low-

staking nodes with fewer hash powers to partic-

ipate, diversifying forger/validator roles and pre-

venting dominance by high-stake nodes, as having

higher hash power can always result in selection

in subsequent elections.

5. When the election is completed and a block has

been forged, the staked tokens are returned to the

participants with updated timestamps. The times-

tamps are updated differently in the two scenarios.

• Win scenario: When a node wins the election,

the staked tokens are returned with their times-

tamps updated as

m

i

= e (4)

where m

i

is the timestamp mentioned in equa-

tion 1 and e is the timestamp of the election.

• Lose scenario: When a node loses the election,

the staked tokens are returned with their times-

tamps updated as

m

i

= (e + m

i

)/2 (5)

where m

i

is the timestamp, e is the election

timestamp that was just completed.

6. After the selected forger proposes the new block,

the block’s validity is determined with the voting

strategy in (4), where votes are aggregated and

weighted based on the behavior ratings of each

participant.

For simplicity, let’s take an example with three

nodes on a sequence of elections. Figure 3 shows

the timeline of 3 elections. Assume that the three

nodes have equal stakes of 10 with a minted times-

tamp value of zero at the first election. The times-

tamps of the stakes will be updated with the elec-

tion times in the win scenario, the mean of election

time, and the previous timestamps on the token in the

lose scenario after every election. This way, the hash

power’s potency, calculated with equation (2), fluctu-

ates over time, leading to a dynamic shift in the prob-

ability distribution of participation chances.

6 EXPERIMENTAL SETUP

The aim is to simulate a private blockchain that can

be distributed and run across a network of nodes. We

used Python programming language and leveraged

its frameworks to simulate a network of 50 nodes

implementing the proposed consensus protocol. The

network setup consists of peer-to-peer discovery us-

ing Python’s ‘p2pnetwork‘ module and Flask-based

web communication for transaction processing.

Each node is assigned a port, facilitating socket

communication. Key blockchain components include

ICISSP 2025 - 11th International Conference on Information Systems Security and Privacy

264

the Block, Transaction, and Blockchain, where each

node maintains a synchronized copy of the chain.

The network implements the proposed proof of stake

protocol across nodes to manage forger/validator

selection and consensus. Additionally, the Account

Model handles participant wallets and nodes, up-

dating wallets post-transaction execution on the

blockchain. Together, these components form a

decentralized and cohesive blockchain network. The

implementation of the abovementioned environment

to simulate a blockchain can be found at the link.

To measure the decentralization of the consensus

protocol, we made some assumptions for a few pa-

rameters in the algorithm.

• The time for the staked token to be valid is as-

sumed to be 5 minutes for the test runs.

• All nodes are assumed to be good nodes with no

malicious behavior so that we can focus on the

randomness in the selection. This means that W is

set to 1 in equation 3.

• Every time a node’s stake expires, the node will

immediately stake the amount it had at that mo-

ment.y

We also measured the decentralization of a

blockchain with Fairness and Entropy metrics. Fair-

ness metrics have been used extensively in resource

allocation in wireless networks. As the objective of a

consensus protocol in blockchain is to be fair among

the miners, we can use the Fairness index to quantify

decentralization (Gochhayat et al., 2020) as shown

below.

F(X) =

∑

N

i=1

p

i

2

N

∑

N

i=1

p

2

i

(6)

pi is the fraction of total blocks mined by a node

i and N is the number of miners. When a system is

completely distributed, when all pis are the same, the

fairness is 1. When it is completely central, the fair-

ness will be N1.

We can then calculate decentrality as normalized

fairness, i.e.,

NF(X ) =

F(X )−

1

N

1 −

1

N

(7)

When a system is completely distributed, the normal-

ized fairness is 1. When it is completely central, the

normalized fairness will be 0.

We used entropy as a metric to measure the ran-

domness in the selection of nodes. The amount of in-

formation from a source is the amount of uncertainty

that existed before the source released the information

(Gochhayat et al., 2020). In Blockchain systems, we

can estimate the probability that a miner will create

the next block based on its ability to add a block in

the past(Gochhayat et al., 2020). With respect to this

model, we can use Shannon’s entropy (Smith, 2011),

H(x), to quantify decentralization as,

H(X) =

N

∑

i=1

−p

i

log(p

i

) (8)

we can calculate normalized entropy as

d(X) =

H(X)

log

2

(N)

(9)

7 PERFORMANCE EVALUATION

We executed the coinage-based and hash power-based

consensus protocol in two scenarios - one where the

stakes are totally random among all the nodes and an-

other where a fixed group of nodes have higher stakes

than all others. The same software setup will be used

to run the blockchain with the coinage algorithm in

the two scenarios with the same set of transactions to

compare the two protocols.

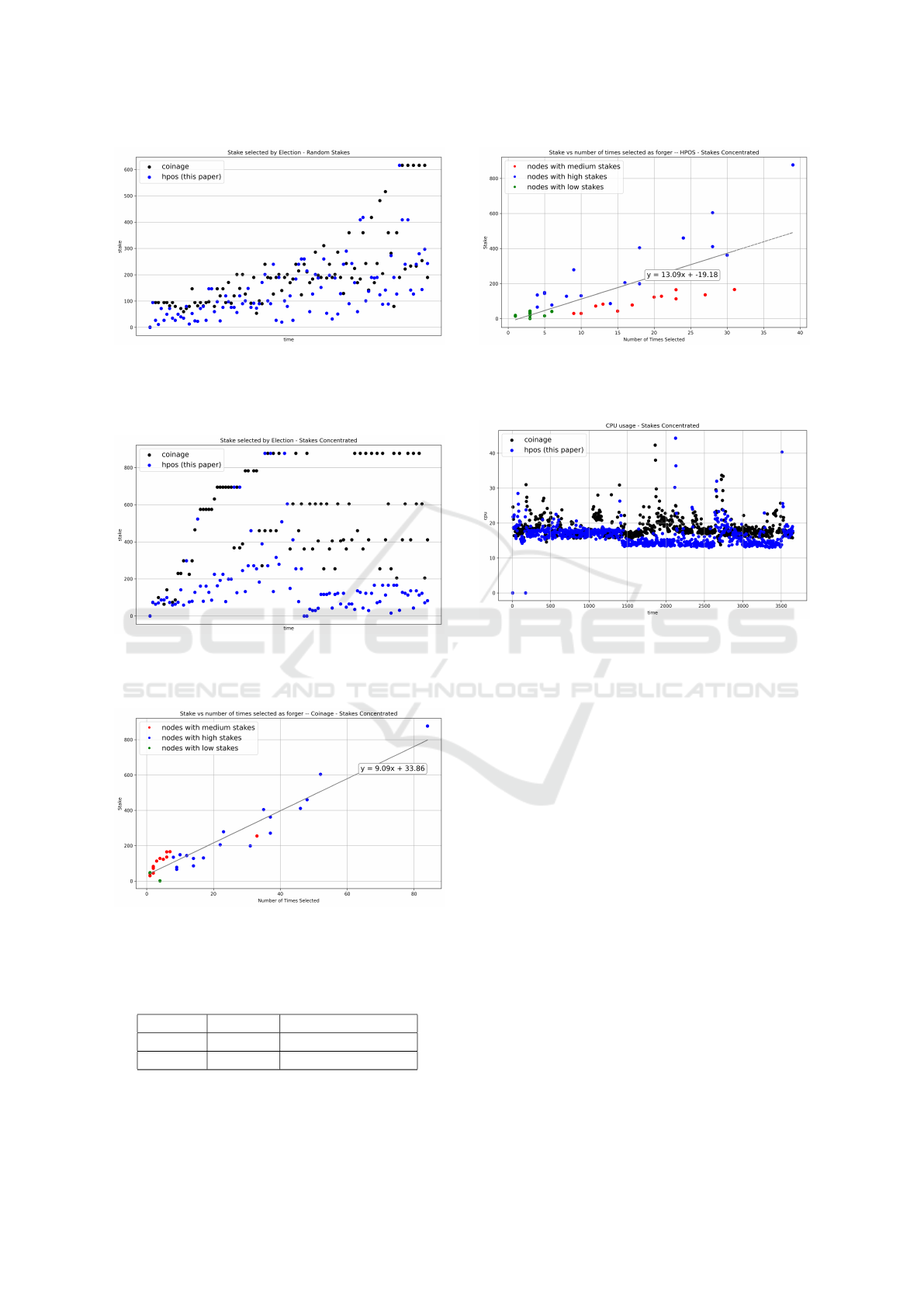

Figure 5 represents a scatter plot of how both the

algorithms behaved in terms of the variable stakes

for node selection. We observed a slight improve-

ment in decentralization with our protocol, but the

overall trend was similar. In a scenario where a

group of nodes has higher stakes than others, our al-

gorithm performed noticeably well, as shown in fig-

ure 6. As the coinage algorithm selected nodes with

higher coinage values in descending order, we see pat-

terns of higher stakes selected across the elections of

the blockchain. Figure 6 also shows that our proto-

col does not have such patterns and is fairly random.

Since the validity of each stake expires after a cer-

tain period of time, the node selection is based on the

stake average over a certain range of stakes, which

increases the randomness of the protocol.

Figures 7, 8 display the selection metrics for all

nodes, showing the frequency with which each node

participated in block forging/validation in the sce-

nario where nodes are grouped by the number of

stakes deposited. The nodes colored in blue have

higher stakes than others, the red-colored nodes have

medium and reasonable amounts of stakes, and the

green-colored nodes have low stakes. Figure 7 shows

the participation opportunities are more equitably dis-

tributed than coinage protocol. However, when nodes

have significantly lower stakes than others in the net-

work, it is natural for any protocol to favor them less.

Figure 9 shows the CPU usage of the coinage-based

and hash power-based consensus protocols; they are

almost at the same level of consumption.

Randomizing Forger Selection to Improve Decentralization in Proof of Stake Consensus Protocol

265

Figure 5: This graph plots the total unexpired stakes of the

nodes selected as forgers at every election. In this scenario,

the transactions and stakes are totally random among all

nodes.

Figure 6: This graph plots the total unexpired stakes of the

nodes selected as forgers at every election. In this scenario,

a few nodes have higher stakes than other nodes.

Figure 7: This graph plots the total number of times a node

with a certain stake was selected as a forger/validator with

the coinage algorithm.

Table 2: Fairness and Entropy metrics for Fig. 6.

Coinage HPOS(this paper)

Fairness 0.11 0.45

Entropy 0.51 0.80

Table 2 shows the fairness and entropy compari-

son of the hash power-based consensus protocol ver-

Figure 8: This graph plots the total number of times a node

with a certain stake was selected as a forger/validator with

the proposed algorithm.

Figure 9: This graph plots the CPU usage of both algo-

rithms. Since both algorithms have the same underlying

concept of Proof of Stake, there is not much difference in

CPU usage.

sus the Coinage protocol. The fairness factor in-

creased from 0.11 to 0.45, and entropy increased from

0.51 to 0.80 for hash power-based protocol compared

to the Coinage.

8 CONCLUSION

The proposed consensus protocol in this paper im-

proves the decentralization of stake-based consensus

protocols. The hash power-based algorithm discussed

in this paper enhances randomness and makes the pro-

tocol fairer. By considering timestamps and valid-

ity on the staked currencies, the protocol ensures that

wealthy nodes staking high amounts cannot influence

the network over time. However, evaluating the pro-

posed protocol at a larger scale, with more nodes, is

crucial to test the feasibility and requires further in-

vestigation. Moreover, the experiments conducted as-

sumed that all participating nodes were honest. Proof

of stake consensus mechanisms rely on a voting strat-

egy to validate a block’s authenticity to be added to

the blockchain. This makes the protocol susceptible

ICISSP 2025 - 11th International Conference on Information Systems Security and Privacy

266

to malicious or abstaining nodes in the system, as all

nodes are anonymous. Our future work aims to se-

cure the blockchain network from malicious nodes by

assessing node behavior and weighing the nodes ac-

cordingly to protect the validity of consensus.

REFERENCES

Algorand (2024). Pure proof of stake. https://developer.

algorand.org/docs.

Elastos (2024). Bonded proof of stake. https://elastos-wiki.

netlify.app/learn/mainchain/bpos/.

Gochhayat, S. P., Shetty, S., Mukkamala, R., Foytik, P.,

Kamhoua, G. A., and Njilla, L. (2020). Measuring de-

centrality in blockchain based systems. IEEE Access,

8:178372–178390.

Gurram, H. N., Mohamad, H., Sriram, A., and Endurthi, A.

(2023). A strategy to improvise coin-age selection in

the proof of stake consensus algorithm. In 2023 In-

ternational Conference on Software, Telecommunica-

tions and Computer Networks (SoftCOM), pages 1–4.

He, P., Tang, D., and Wang, J. (2020). Staking pool central-

ization in proof-of-stake blockchain network. ERN:

Other Game Theory & Bargaining Theory (Topic).

Hord (2024). Ethereum staking pools: The risks of lido’s

centralization. Accessed: 2024-11-20.

Khatoon, N., Rishu, R., Verma, S., and Pranav, P. (2024).

Proposing a modified proof of stake system to counter

51blockchain. In 2024 2nd International Conference

on Device Intelligence, Computing and Communica-

tion Technologies (DICCT), pages 01–04.

Kim, J., Oh, S., Kim, Y., and Kim, H. (2023). Improving

voting of block producers for delegated proof-of-stake

with quadratic delegate. In 2023 International Confer-

ence on Platform Technology and Service (PlatCon),

pages 13–17.

Lamriji, Y., Kasri, M., Makkaoui, K. E., and Beni-Hssane,

A. (2023). A comparative study of consensus algo-

rithms for blockchain. In 2023 3rd International Con-

ference on Innovative Research in Applied Science,

Engineering and Technology (IRASET), pages 1–8.

Li, A., Wei, X., and He, Z. (2020). Robust proof of stake:

A new consensus protocol for sustainable blockchain

systems. Sustainability, 12(7).

Maung Maung Thin, W. Y., Dong, N., Bai, G., and

Dong, J. S. (2018). Formal analysis of a proof-of-

stake blockchain. In 2018 23rd International Confer-

ence on Engineering of Complex Computer Systems

(ICECCS), pages 197–200.

Motepalli, S. and Jacobsen, H.-A. (2024). How does

stake distribution influence consensus? analyzing

blockchain decentralization. In 2024 IEEE Interna-

tional Conference on Blockchain and Cryptocurrency

(ICBC), pages 343–352. IEEE.

Nair, P. R. and Dorai, D. R. (2021). Evaluation of perfor-

mance and security of proof of work and proof of stake

using blockchain. In 2021 Third International Confer-

ence on Intelligent Communication Technologies and

Virtual Mobile Networks (ICICV), pages 279–283.

Nakamoto, S. (2008). Paper templates. In Bitcoin: A Peer-

to-Peer Electronic Cash System.

Pan, J., Song, Z., and Hao, W. (2021). Development in con-

sensus protocols: From pow to pos to dpos. In 2021

2nd International Conference on Computer Commu-

nication and Network Security (CCNS), pages 59–64.

Saad, M., Qin, Z., Ren, K., Nyang, D., and Mohaisen,

D. (2021). e-pos: Making proof-of-stake decentral-

ized and fair. IEEE Transactions on Parallel and Dis-

tributed Systems, 32(8):1961–1973.

Saad, S. M. S. and Radzi, R. Z. R. M. (2020). Compar-

ative review of the blockchain consensus algorithm

between proof of stake (pos) and delegated proof of

stake (dpos). International Journal of Innovative

Computing, 10(2).

Smith, G. (2011). Quantifying information flow using min-

entropy. In 2011 Eighth International Conference on

Quantitative Evaluation of SysTems, pages 159–167.

Swan, M. (2015). Blockchain: Blueprint for a new econ-

omy. OReilly Media.

Tezos, O. (2024). Liquid proof of stake. https://opentezos.

com/tezos-basics/liquid-proof-of-stake#references.

Randomizing Forger Selection to Improve Decentralization in Proof of Stake Consensus Protocol

267