Applying Informer for Option Pricing: A Transformer-Based Approach

Feliks Ba

´

nka

a

and Jarosław A. Chudziak

b

The Faculty of Electronics and Information Technology, Warsaw University of Technology, Poland

Keywords:

Option Pricing, Transformers, Neural Networks, Time Series Forecasting, Deep Learning.

Abstract:

Accurate option pricing is essential for effective trading and risk management in financial markets, yet it

remains challenging due to market volatility and the limitations of traditional models like Black-Scholes.

In this paper, we investigate the application of the Informer neural network for option pricing, leveraging

its ability to capture long-term dependencies and dynamically adjust to market fluctuations. This research

contributes to the field of financial forecasting by introducing Informer’s efficient architecture to enhance

prediction accuracy and provide a more adaptable and resilient framework compared to existing methods.

Our results demonstrate that Informer outperforms traditional approaches in option pricing, advancing the

capabilities of data-driven financial forecasting in this domain.

1 INTRODUCTION

Option pricing is a cornerstone of modern finance, es-

sential for developing trading strategies and managing

risk. Options enable traders and investors to hedge

against potential losses or speculate on price move-

ments. A call (put) option grants the holder the right,

but not the obligation, to buy (sell) an asset at a speci-

fied price before the contract expires. Accurate option

pricing models shape critical decisions in hedging and

risk management, directly affecting trading portfolio

profitability and stability.

Early theoretical frameworks, such as the

Black–Scholes (Black and Scholes, 1973; Merton,

1973) and the Heston (Heston, 1993) models, offered

valuable mathematical foundations but often rely on

simplifying assumptions (e.g., constant volatility).

These assumptions do not always hold in real-world

markets, where sudden shifts in macroeconomic con-

ditions or sentiment can lead to rapid changes in asset

prices (Bollerslev, 1986). Over the past few decades,

machine learning techniques—such as LSTM-based

neural networks (Hochreiter and Schmidhuber, 1997;

Yue Liu, 2023; Bao et al., 2017)—have demonstrated

improved adaptability by capturing non-linearities

and sequential dependencies. Yet, their effective-

ness can be limited when handling very long time

sequences, which demand more efficient and robust

architectures.

Transformer-based models, originally devised for

natural language processing (A. Vaswani and Polo-

a

https://orcid.org/0009-0005-1973-5861

b

https://orcid.org/0000-0003-4534-8652

sukhin, 2017), have shown promise in overcoming

these challenges by leveraging self-attention mecha-

nisms that allow for parallelized long-sequence pro-

cessing. Recent advances, such as the Informer

model (H. Zhou and Zhang, 2021), have introduced

more efficient attention mechanisms geared toward

time-series data. However, their application within

option pricing remains underexplored, motivating the

present study to investigate whether Informer’s long-

horizon capability and computational efficiency can

produce more accurate predictions in option pricing

tasks.

This paper contributes to the field of financial

modeling by evaluating the application of the In-

former architecture for predicting option prices, lever-

aging its efficient attention mechanism and long-

sequence modeling capabilities to enhance predic-

tion accuracy and adaptability to market fluctuations.

Informer’s ability to handle long-term dependencies

makes it an ideal candidate for modeling complex fi-

nancial data, offering a more advanced approach com-

pared to traditional models like Black-Scholes (Black

and Scholes, 1973; Merton, 1973) and Heston (He-

ston, 1993), as well as existing machine learning

models such as LSTM (Hochreiter and Schmidhuber,

1997; Yue Liu, 2023). The contributions of this paper

are as follows:

• We apply the Informer architecture to option pric-

ing, leveraging its long-sequence modeling capa-

bilities and self-attention mechanisms to enhance

prediction accuracy.

• We benchmark the model against traditional and

machine learning-based approaches, evaluating

1270

Ba

´

nka, F. and Chudziak, J. A.

Applying Informer for Option Pricing: A Transformer-Based Approach.

DOI: 10.5220/0013320900003890

In Proceedings of the 17th International Conference on Agents and Artificial Intelligence (ICAART 2025) - Volume 3, pages 1270-1277

ISBN: 978-989-758-737-5; ISSN: 2184-433X

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

its performance in high-volatility scenarios.

• We present an analysis of Informer’s predictive

accuracy and trading profitability on historical

data.

The remainder of this paper is organized as fol-

lows: Section 2 discusses related work, focusing on

traditional and machine learning approaches to option

pricing and the emerging role of Transformers in fi-

nance. Section 3 outlines the Informer-based method-

ology applied to option pricing. Section 4 presents

the experimental setup and results, and Section 5 con-

cludes with a summary and potential directions for

future research.

2 RELATED WORK

The foundational models for option pricing, such as

the Black-Scholes model (Black and Scholes, 1973;

Merton, 1973) and the binomial model (Cox et al.,

1979), have been pivotal in shaping early financial

derivatives pricing. These models introduced critical

concepts such as risk-neutral valuation but often rest

on simplifying assumptions, such as constant volatil-

ity, which do not align with real-world market condi-

tions. The introduction of stochastic volatility mod-

els, such as the Heston model (Heston, 1993), of-

fered more flexibility by allowing volatility to vary

as a stochastic process.

Despite improvements like stochastic volatility

in the Heston model (Heston, 1993), traditional

models remain limited in capturing the rapid shifts

and complex dependencies of modern financial mar-

kets (Jones, 2019; Assaf Eisdorfer and Zhdanov,

2022). This has motivated the exploration of adaptive

machine-learning approaches capable of modeling in-

tricate relationships and dynamic patterns in financial

data (Gatheral, 2006; Christoffersen, 2009).

Recurrent architectures, such as Long Short-

Term Memory (LSTM) networks and Gated Recur-

rent Units (GRU), became popular due to their abil-

ity to capture temporal dependencies in sequential

data (Mintarya et al., 2023; Hochreiter and Schmid-

huber, 1997; Yue Liu, 2023). However, these models

encounter scalability challenges when dealing with

long-term dependencies or high-frequency data, of-

ten leading to computational inefficiencies (Miko-

laj Binkowski and Donnat, 2018; Bryan Lim and

Roberts, 2019). While modular and hybrid neural

networks have been employed to integrate financial

indicators and better capture non-linearities, issues of

scalability and interpretability persist (Amilon, 2003;

N. Gradojevic and Kukolj, 2009).

Input

Sequence

Output

Sequence

Encoder

Multi-head ProbSparse Self-attention

Self-attention distilling

Generative-Style Decoder

Multi-head Attention

Masked Multi-head ProbSparse Self-attention

Figure 1: Informer model - concepcual overview. Based

on (Szydlowski and Chudziak, 2024a).

Transformers, initially developed for natural lan-

guage processing (A. Vaswani and Polosukhin, 2017),

introduced self-attention mechanisms that bypass the

limitations of recurrent models, allowing for the cap-

ture of long-term dependencies without the vanish-

ing gradient problem. Szydlowski (Szydlowski and

Chudziak, 2024b; Wawer et al., 2024) applied the

Hidformer model to stock market prediction, demon-

strating its effectiveness in handling long sequences

and capturing complex market patterns. Informer,

introduced by Zhou et al. (H. Zhou and Zhang,

2021) and illustrated in Figure 2, marked a signif-

icant advancement for time-series analysis with its

ProbSparse self-attention mechanism, reducing the

time and memory complexity of processing long se-

quences to O(L logL) for input length L. Wang

et al. (C. Wang and Zhang, 2022) demonstrated In-

former’s application in predicting stock market in-

dices, showcasing its ability to outperform traditional

deep learning models (e.g., CNN, RNN, LSTM) by

effectively capturing relevant information while filter-

ing out noise—a common challenge in financial time

series. Informer’s robust multi-head attention mecha-

nism allowed for the extraction of key features, lead-

ing to significantly higher prediction accuracy, partic-

ularly in short-term forecasting.

While studies have applied Transformer-based ar-

chitectures to option pricing, including the generic

Transformer model used by Guo and Tian (Guo and

Tian, 2022) and Sagen’s investigation of the Temporal

Applying Informer for Option Pricing: A Transformer-Based Approach

1271

Fusion Transformer (TFT) (Sagen, 2024), the appli-

cation of Informer has not been explored in this do-

main. Given Informer’s strengths in long-sequence

modeling and handling high-dimensional data effi-

ciently, this paper seeks to evaluate its potential for

enhancing predictive accuracy and computational ef-

ficiency in the complex landscape of option pricing.

3 MODEL ARCHITECTURE

In this section, we outline the architecture of the

Informer-based model employed for option pricing.

The Informer model is chosen for its ability to handle

long sequences efficiently and capture dependencies

over varying time scales through its unique attention

mechanisms and architectural optimizations (H. Zhou

and Zhang, 2021; C. Wang and Zhang, 2022). This

is essential in financial applications where complex

temporal relationships can influence outcomes signif-

icantly.

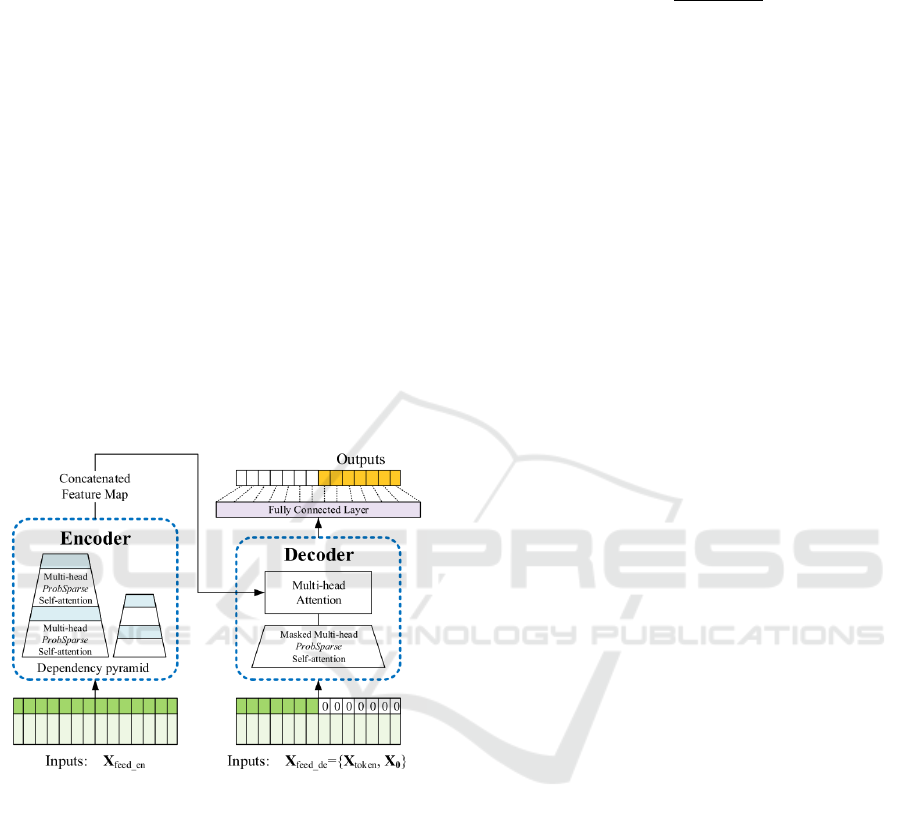

Figure 2: Informer model overview. Copied from(H. Zhou

and Zhang, 2021).

3.1 Data and Feature Engineering

For effective model training, we select input features

known to be crucial for option pricing. These features

include the underlying asset price, implied volatility,

time to maturity, strike price, and an indicator for the

type of option (call or put). Each of these factors

provides valuable insights into how option prices re-

spond to market conditions. Volatility measures indi-

cate market uncertainty (Hull, 2006; Kolm and Ritter,

2019), while time to maturity and strike price are fun-

damental in assessing the intrinsic and extrinsic value

of the option (Jones, 2019; Black and Scholes, 1973;

Merton, 1973). Normalization is applied to standard-

ize the data, ensuring all features are on a comparable

scale:

x

norm

t

=

x

t

−x

min

x

max

−x

min

(1)

where x

norm

t

represents the normalized feature value

at time t, and x

max

and x

min

denote the maximum and

minimum feature values, respectively. This approach

keeps all features within the range [0, 1], aiding in

model stability and faster convergence during train-

ing.

The input data is structured as a time-series se-

quence with a moving window approach, where T

x

past data points are used to predict T

y

future option

prices or metrics. This sequential setup helps cap-

ture dependencies over different time horizons and

enables the model to account for short-term fluctua-

tions as well as long-term trends.

3.2 Proposed Model Architecture

The Informer-based model extends the standard

Transformer architecture by incorporating enhance-

ments tailored to the challenges of time-series fore-

casting in financial applications. It consists of two

main components - the encoder and the decoder,

which exchange information through self-attention

mechanisms and encoder-decoder attention modules,

as we can see in Figure 2. This section details each of

these components and the overall data flow and token

construction procedure.

3.2.1 Encoder

The encoder is responsible for extracting meaningful

temporal dependencies from the input sequence.

It includes an embedding layer, a ProbSparse self-

attention mechanism, a feedforward sub-layer, and a

self-attention distilling step to reduce computational

overhead.

Embedding Layer. Each time step in the raw data

is represented as a token, which is a set of features

(e.g., strike price, time to maturity). The embedding

layer projects these tokens into a dense vector space

of fixed dimension, enabling the network to learn

hidden interactions across features.

ProbSparse Self-Attention Mechanism. This atten-

tion mechanism aims to identify and focus on the

most informative queries in the attention calculation,

as illustrated in Figure 3. Instead of computing at-

tention scores for all L queries and keys, it selects a

subset of queries based on the Kullback-Leibler di-

vergence (KLD) between the query distribution and a

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

1272

predefined sparse distribution. Formally:

Attention(Q, K, V ) = Softmax

Q

⊤

K

√

d

k

V (2)

where Q, K, V are the query, key, and value matri-

ces, and d

k

is the dimension of the keys. By select-

ing only the top-U queries (with U ≪ L), complexity

is reduced from O(L

2

) to approximately O(L log L),

making the model scalable for long sequences.

Figure 3: Illustration of the ProbSparse Attention mecha-

nism. Adapted from(H. Zhou and Zhang, 2021).

Feedforward Sub-Layer. The output of the attention

sub-layer is passed through a fully connected feedfor-

ward network with a hidden dimensionality D

FF

:

FeedForward(x) = ReLU(W

1

x + b

1

)W

2

+ b

2

, (3)

where W

1

, W

2

are weight matrices, and b

1

, b

2

are

biases. A larger dimension D

FF

allows the model to

capture intricate patterns.

Self-Attention Distilling. To improve efficiency, the

Informer applies a distilling mechanism at the end of

each layer, pooling or downsampling the sequence to

retain only the most critical tokens. Mathematically,

Z

l

= Pooling(X

l

), X

l+1

= SelfAttention(Z

l

),

where X

l

is the layer-l input. This process concen-

trates the model’s capacity on dominant features,

enhancing performance while mitigating overfitting.

Encoder Output. The final encoder output, denoted

by E

t

, is a contextually enriched representation of the

input tokens and will be passed to the decoder for gen-

erating forecasts.

3.2.2 Decoder

The decoder produces the target sequence by lever-

aging both the encoder output and partially known

future labels. It features a self-attention sub-layer,

encoder-decoder attention, and a feedforward

network. Unlike the traditional approach, which

decodes one step at a time, the Informer employs a

generative-style approach to predict all future steps

simultaneously.

Decoder Input Preparation. To provide the de-

coder with partial knowledge of the future horizon,

the model concatenates the most recent T

label

observed

values with placeholder zeros for the T

y

unknown time

steps. This can be expressed as:

D

t

= [y

t−T

label

+1

, . . . , y

t

, 0, . . . , 0 ].

During training, the first portion corresponds to

known labels or ground truth values, while zeros

mark positions to be predicted.

Attention Modules and Feedforward Sub-Layer.

In the decoder, self-attention accounts for dependen-

cies among known and future positions in D

t

, while

encoder-decoder attention utilizes E

t

(the encoder

output) as keys and values to incorporate previously

extracted temporal structure. It also applies a feedfor-

ward sub-layer similar to that in the encoder.

Generative-Style Decoding. Finally, the decoder

produces the entire predicted sequence in one forward

pass:

ˆ

Y

t

= Decoder(E

t

, D

t

).

This approach improves inference speed compared to

autoregressive decoding, which is advantageous for

time-sensitive financial applications.

Decoder Output. The vector

ˆ

Y

t

constitutes the

model’s forecast for the T

y

future time steps.

3.3 Model Workflow

The overall workflow begins by converting each time

step into a token that bundles relevant features. These

tokens are then passed to the embedding layer, which

maps them into a continuous space of dimension

d

model

. The encoder applies ProbSparse self-attention,

feedforward transformations, and self-attention dis-

tilling to capture critical dependencies with reduced

computational overhead. Its final output E

t

, enriched

with temporal context, is transferred to the decoder.

In parallel, the decoder constructs its input D

t

by

combining partially known labels from the predic-

tion window with placeholder zeros. Self-attention

in the decoder identifies dependencies among these

elements, while encoder-decoder attention integrates

signals from E

t

. The generative-style decoding step

then yields a full multi-step forecast in a single

pass, producing

ˆ

Y

t

. This hierarchical design is es-

pecially suited to financial time-series forecasting,

where long-range dependencies and efficient compu-

tation are both critical.

Applying Informer for Option Pricing: A Transformer-Based Approach

1273

4 EXPERIMENTS

The experiments conducted aim to evaluate the

robustness and predictive power of the proposed

Informer-based model in the context of option pric-

ing. A thorough comparison is established using

baseline models that encompass traditional and ma-

chine learning-based methods.

4.1 Dataset and Data Preparation

We use a dataset comprising eight years of histori-

cal option contracts for Apple Inc. (AAPL), sourced

from publicly available financial databases, covering

the period from January 4, 2016, to March 31, 2023.

The dataset includes both call and put options with

varying strike prices, expiration dates, and moneyness

levels, providing a diverse and comprehensive foun-

dation for analysis.

To improve data quality and ensure relevance, the

preprocessing stage included the application of strict

selection criteria. Options with a time-to-maturity

(TTM) below 30 days were excluded, as such short-

term contracts are typically highly volatile and specu-

lative (Heston, 1993). Furthermore, only options with

a moneyness ratio (the ratio of the underlying asset’s

price to the strike price) between 0.6 and 1.3 were

included, as near-the-money options are more liquid

and exhibit more reliable pricing (Bakshi et al., 2000).

Contracts with insufficient data points or low trading

volume were also removed to maintain robustness and

integrity. The dataset is split into training, validation,

and test sets, with 70% of the data allocated for train-

ing, 15% for validation, and the remaining 15% for

testing (Matsunaga and Suzumura, 2019). This split

ensures that the model is evaluated on unseen data,

simulating real-world conditions where future predic-

tions depend on past training.

4.2 Model Configuration and Training

Strategy

The Informer model is configured to handle complex

time-series data with the following parameters: the

input sequence length is set to 30 days (T

x

= 30), and

predictions are made over a 30-day horizon (T

y

= 30).

The architecture includes one encoder layer and two

decoder layers with a label length of 5 days, each

featuring three attention heads. The embedding di-

mension (D

MODEL

) is set to 32, balancing computa-

tional efficiency and model expressiveness. The feed-

forward network dimension is set to 8, with a dropout

rate of 0.06 to prevent overfitting. The model employs

full attention with a factor of 3, suitable for capturing

temporal patterns effectively in financial time-series

data. The training process employs a batch size of

64 and utilizes the Adam optimizer (Kingma and Ba,

2014) with an initial learning rate of 0.0001. Train-

ing proceeds over 300 epochs, with early stopping ap-

plied based on validation loss, using a patience of 30

epochs. A weighted mean squared error (MSE) loss

function is used, prioritizing accuracy across the en-

tire 30-day prediction horizon. Hyperparameters, in-

cluding the number of layers, attention heads, embed-

ding dimension, learning rate, and dropout rate, were

fine-tuned via random search.

4.3 Evaluation Metrics

The performance of the Informer model is evaluated

using a comprehensive set of metrics to ensure a ro-

bust evaluation (Ruf and Wang, 2020):

Prediction Accuracy: The model’s outputs are

compared with the ground truth on the validation set

to evaluate the prediction accuracy. Two commonly

used indicators are employed: Mean Absolute Er-

ror (MAE), which measures the average magnitude

of prediction errors, and Root Mean Squared Error

(RMSE), which emphasizes larger errors to capture

prediction variance. Lower values of both metrics in-

dicate better model performance.

Final-Day Evaluation: We focus on final-day

evaluation because it highlights the model’s ability to

make accurate long-term predictions, which is crucial

for strategic financial decision-making (Kristoufek,

2012). To measure this, we use Direction Accuracy

(DA), which measures the percentage of sequences

where the predicted and actual price changes have

the same direction, and Final-Day MAE, which cal-

culates the MAE between predicted and actual prices

specifically on the last day.

Return Calculation: The trading effectiveness of

the model is evaluated using a simple strategy based

on the predicted price at the end of each sequence.

For a given sequence, if the predicted price ( ˆy

t+30

)

is higher than the starting price (y

t

), a long position

is taken; otherwise, a short position is assumed. The

return for the sequence is calculated as:

R = ln

y

t+30

y

t

×sign( ˆy

t+30

−y

t

) (4)

where y

t+30

is the true price at the prediction horizon,

y

t

is the starting price, and ˆy

t+30

is the predicted price.

The cumulative net value (NV) aggregates returns

across all sequences in the dataset, starting from an

initial value of 1:

NV = 1 +

N

∑

i=1

R

i

(5)

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

1274

where N is the total number of sequences.

By combining predictive accuracy metrics (MAE

and RMSE) with trading performance (NV), this eval-

uation framework captures both the statistical preci-

sion and the practical utility of the model in financial

applications.

To benchmark the performance of the Informer-

based model, we compare it against several estab-

lished baseline models, including the Black-Scholes

model, the Heston model, and the simple LSTM-

based model. These models, ranging from traditional

finance to advanced machine learning, help evaluate

how the Informer performs in option pricing, high-

lighting its strengths and areas for improvement.

4.4 Results and Analysis

The results of the experiments demonstrate that the

Informer model consistently outperforms all other

models, both in terms of prediction accuracy and

final-day evaluation metrics.

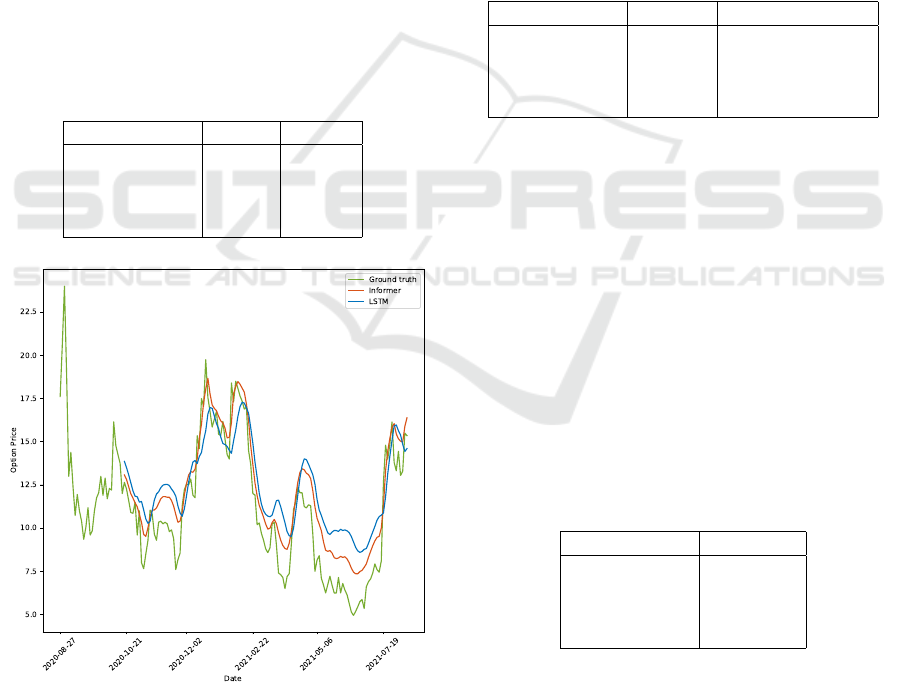

Table 1: Overall prediction metrics for all models.

Model MAE RMSE

Informer 2.7145 3.6766

LSTM 3.9343 5.0373

Black-Scholes 4.1765 5.3840

Heston 4.1282 5.3565

Figure 4: Comparison of Informer and LSTM predictions

on a longer period for an option contract.

Table 1 highlights the overall prediction metrics,

Mean Absolute Error (MAE) and Root Mean Squared

Error (RMSE). The Informer model achieves the low-

est MAE (2.7145) and RMSE (3.6766) among all

models, demonstrating its superior ability to pre-

dict option prices with high accuracy. The LSTM

model, while a competitive machine-learning ap-

proach, exhibits a significantly higher MAE (3.9343)

and RMSE (5.0373). Traditional models like Black-

Scholes and Heston, despite their widespread use in

finance, perform worse than the machine-learning-

based methods. The Black-Scholes model has a

slightly lower MAE (4.1765) compared to the Hes-

ton model (4.1282), but both models fail to capture

complex market dynamics as effectively as the In-

former. Figure 4 further illustrates the comparative

performance of the Informer and LSTM models on a

longer prediction period, highlighting the Informer’s

ability to track trends more closely.

Table 2: Final-day evaluation metrics for all models.

Model DA (%) Final-Day MAE

Informer 54.43 2.9709

LSTM 52.19 4.0900

Black-Scholes 52.53 4.6880

Heston 51.74 4.6861

Table 2 presents the final-day evaluation met-

rics, including Direction Accuracy (DA) and Final-

Day MAE. The Informer achieves the highest DA

(54.43%) and the lowest Final-Day MAE (2.9709),

showcasing its ability to predict both the direction

and final value of option prices with superior preci-

sion. The LSTM model, while demonstrating a rea-

sonable DA (52.19%), exhibits a higher Final-Day

MAE (4.0900), indicating less reliability in final price

predictions. Among the traditional models, Black-

Scholes performs slightly better than Heston, achiev-

ing a DA of 52.53% compared to 51.74%, but both

models have significantly higher Final-Day MAE val-

ues, exceeding 4.68.

Table 3: Performance of the trading strategy for Apple op-

tions based on final cumulative net value.

Model Net Value

Informer 1.30

LSTM 1.21

Heston 1.15

Black-Scholes 1.14

In trading performance, the Informer achieved the

highest cumulative net value (NV), outperforming all

models, as shown in Table 3. With a final NV of

1.30, the Informer model demonstrates its superior

ability to generate profitable trading strategies by ac-

curately predicting directional movements over a 30-

day horizon. The LSTM model follows with an NV of

Applying Informer for Option Pricing: A Transformer-Based Approach

1275

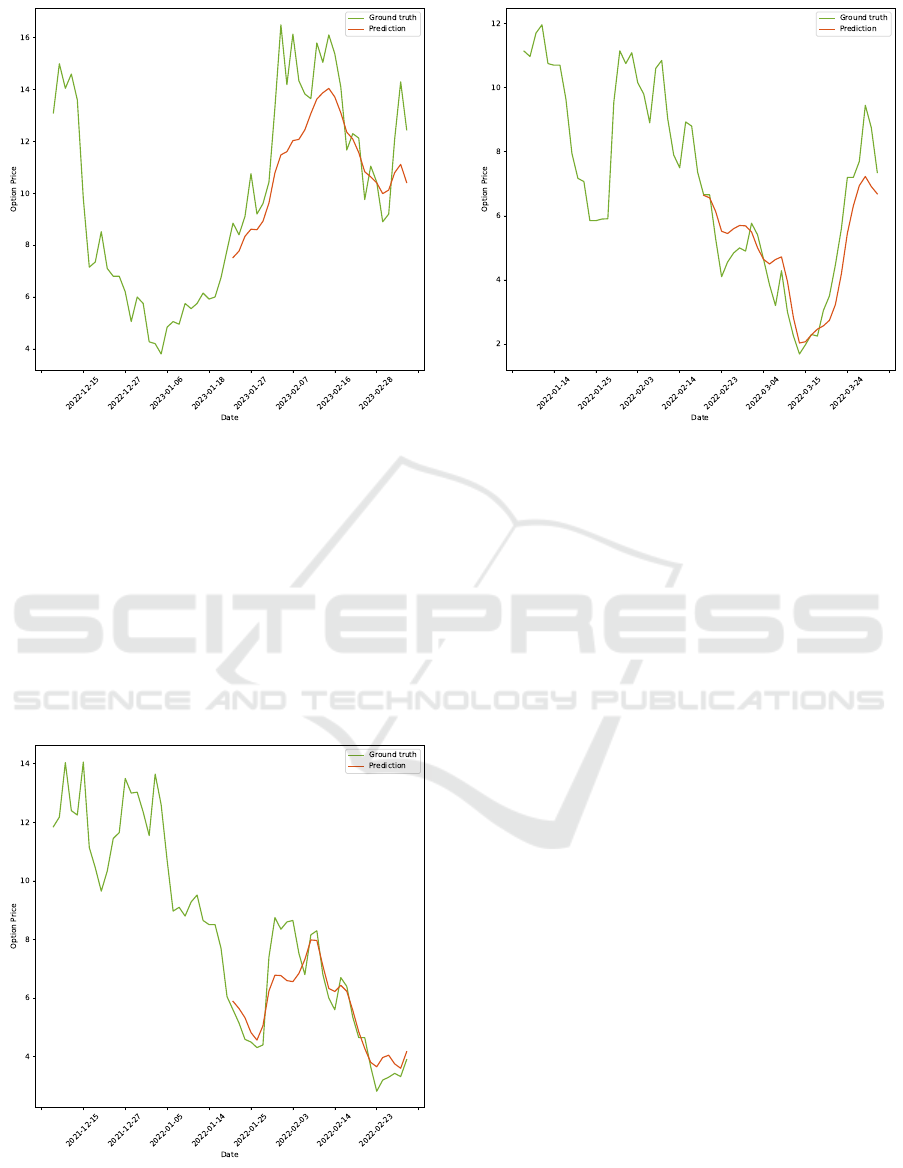

Figure 5: Example of upward trend Informer prediction for

one option contract.

1.21, while the traditional models, Heston and Black-

Scholes, lag slightly behind with NVs of 1.15 and

1.14, respectively.

As we can see on Figures 5 to 7 the In-

former’s predictions remain stable across different

trend types—upward, downward, and mixed. This

stability highlights the potential of the Informer

model as a valuable tool for investors, providing re-

liable insights to navigate diverse market conditions

effectively.

Figure 6: Example of downward trend Informer prediction

for one option contract.

Figure 7: Example of mixed trend Informer prediction for

one option contract.

5 CONCLUSION AND FUTURE

WORK

Our research demonstrates that the Informer model,

with its specialized attention mechanisms and

generative-style decoder, outperforms traditional

models like Black-Scholes and Heston, as well as re-

current neural networks such as LSTM, in predicting

option prices and capturing long-term dependencies

in financial data. The Informer not only achieved

the lowest MAE and RMSE across all tested models

but also generated the highest cumulative net value

in trading evaluations, outperforming all other mod-

els and demonstrating its practical value in optimizing

trading strategies.

This paper contributes to the field of option pric-

ing by implementing the Informer model for option

trading and evaluating its performance against other

established models.

This study demonstrates the potential of the In-

former model in enhancing option pricing predic-

tions, yet there are several avenues for further ex-

ploration. Future work could involve incorporat-

ing reinforcement learning (RL) strategies to dynami-

cally adjust trading decisions based on model predic-

tions (Szydlowski and Chudziak, 2024a), improving

adaptability in real-time trading environments. Ad-

ditionally, applying the Informer architecture within

a broader portfolio management framework could re-

veal insights into its effectiveness in balancing risk

and return across diverse financial instruments. An-

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

1276

other promising direction would be to test and refine

trading strategies based on model outputs, such as

mean-reversion or momentum-based approaches, to

assess the practical profitability and robustness of In-

former in real-world trading applications (Chudziak

and Wawer, 2024).

REFERENCES

A. Vaswani, N. Shazeer, N. P. J. U. L. J. A. G. L. K. and

Polosukhin, I. (2017). Attention is all you need. Ad-

vances in Neural Information Processing Systems, 30.

Amilon, H. (2003). A neural network versus black-scholes:

A comparison of pricing and hedging performances.

Journal of Forecasting, 22(4):317–335.

Assaf Eisdorfer, R. S. and Zhdanov, A. (2022). Maturity

driven mispricing of options. Journal of Financial and

Quantitative Analysis, 57(2):514–542.

Bakshi, G., Cao, C., and Chen, Z. (2000). Pricing and

hedging long-term options. Journal of Econometrics,

94(1):277–318.

Bao, W., Yue, J., and Rao, Y. (2017). A deep learning

framework for financial time series using stacked au-

toencoders and long-short term memory. PLOS ONE,

12(7):1–24.

Black, F. and Scholes, M. (1973). The pricing of options

and corporate liabilities. In Journal of Political Econ-

omy. Journal of Political Economy.

Bollerslev, T. (1986). Generalized autoregressive condi-

tional heteroscedasticity. Journal of Econometrics,

31(3):307–327.

Bryan Lim, S. Z. and Roberts, S. (2019). Enhancing

time-series momentum strategies using deep neural

networks. The Journal of Financial Data Science,

1(4):19–38.

C. Wang, Y. Chen, S. Z. and Zhang, Q. (2022). Stock market

index prediction using deep transformer model. Ex-

pert Systems with Applications, 208:118128.

Christoffersen, P. F. (2009). Elements of Financial Risk

Management. Academic Press, San Diego, CA.

Chudziak, J. A. and Wawer, M. (2024). Elliottagents: A

natural language-driven multi-agent system for stock

market analysis and prediction. In Proceedings of the

38th Pacific Asia Conference on Language, Informa-

tion and Computation, Tokyo, Japan, (in press).

Cox, J. C., Ross, S. A., and Rubinstein, M. (1979). Option

pricing: A simplified approach. Journal of Financial

Economics, 7:229–263.

Gatheral, J. (2006). The Volatility Surface: A Practitioner’s

Guide. Wiley, Hoboken, NJ.

Guo, T. and Tian, B. (2022). The study of option pricing

problems based on transformer model. In Proceedings

of the IEEE Conference. IEEE.

H. Zhou, S. Zhang, J. P. S. Z. J. L. H. X. and Zhang, W.

(2021). Informer: Beyond efficient transformer for

long sequence time-series forecasting. In Proceedings

of the AAAI Conference on Artificial Intelligence, vol-

ume 35, pages 11106–11115.

Heston, S. L. (1993). A closed-form solution for options

with stochastic volatility with applications to bond and

currency options. The Review of Financial Studies,

6(2):327–343.

Hochreiter, S. and Schmidhuber, J. (1997). Long short-term

memory. Neural Computation, 9:1735–1780.

Hull, J. C. (2006). Options, Futures, and Other Derivatives.

Pearson Prentice Hall.

Jones, C. M. (2019). Volatility estimation and financial mar-

kets. Journal of Financial Markets, 42:12–36.

Kingma, D. P. and Ba, J. (2014). Adam: A method for

stochastic optimization. arXiv, 1412.6980.

Kolm, P. N. and Ritter, G. (2019). Dynamic replication

and hedging: A reinforcement learning approach. The

Journal of Financial Data Science, 1(1):159–171.

Kristoufek, L. (2012). Fractal markets hypothesis and

the global financial crisis: Scaling, investment hori-

zons and liquidity. Advances in Complex Systems,

15(06):1250065.

Matsunaga, D. and Suzumura, T. (2019). Long-term rolling

window for stock market predictions. arXiv preprint,

1911.05009.

Merton, R. C. (1973). Theory of rational option pricing. The

Bell Journal of Economics and Management Science,

4(1):141–183.

Mikolaj Binkowski, G. M. and Donnat, P. (2018). Au-

toregressive convolutional neural networks for asyn-

chronous time series. In International Conference on

Machine Learning, pages 580–589. PMLR.

Mintarya, L. N., Halim, J. N., Angie, C., Achmad, S., and

Kurniawan, A. (2023). Machine learning approaches

in stock market prediction: A systematic literature re-

view. Procedia Computer Science, 216:96–102. 7th

International Conference on Computer Science and

Computational Intelligence 2022.

N. Gradojevic, B. G. and Kukolj, S. (2009). Option pric-

ing with modular neural networks. Neural Networks,

22(5):716–723.

Ruf, J. and Wang, W. (2020). Neural networks for option

pricing and hedging: a literature review.

Sagen, L. K. (2024). Applied option pricing using trans-

formers. Master’s thesis, Norwegian University of

Science and Technology (NTNU).

Szydlowski, K. L. and Chudziak, J. A. (2024a). Toward

predictive stock trading with hidformer integrated into

reinforcement learning strategy. In Proceedings of the

36th International Conference on Tools for Artificial

Intelligence (ICTAI 2024), Herndon, VA, USA.

Szydlowski, K. L. and Chudziak, J. A. (2024b).

Transformer-style neural network in stock price fore-

casting. In Proceedings of the 21th International Con-

ference on Modeling Decisions for Artificial Intelli-

gence (MDAI 2024), Tokyo, Japan.

Wawer, M., Chudziak, J. A., and Niewiadomska-

Szynkiewicz, E. (2024). Large language models and

the elliott wave principle: A multi-agent deep learn-

ing approach to big data analysis in financial markets.

Applied Sciences, 14(24).

Yue Liu, X. Z. (2023). Option pricing using lstm:

A perspective of realized skewness. Mathematics,

11(2):314.

Applying Informer for Option Pricing: A Transformer-Based Approach

1277