The Role of Sustainable Loan Products in Managing Sustainability

Risks in German Regional Banks

Dominic Strube

a

Hochschule Wismar, University of Applied Sciences, Technology, Business and Design, Wismar, Germany

Keywords: Sustainable Loans, Regional Bank, Sustainability Risks, Green Loans, Sustainability-Linked Loans.

Abstract: This study examines the role of sustainable loan products, such as Green Loans and Sustainability-Linked

Loans, in managing sustainability risks for regional banks in Germany. Based on a survey of 88 Less

Significant Institutions and 18 Significant Institutions, the findings show that regional banks predominantly

rely on subsidized loans due to their simplicity and low administrative costs. However, these loans lack

flexibility to address specific sustainability risks. In contrast, Green Loans and Sustainability-Linked Loans

offer greater adaptability but require significant resources for implementation, monitoring, and verification.

Challenges such as limited demand, technical constraints, and insufficient sustainability data, particularly

from small businesses, further limit their adoption by regional banks. To overcome these barriers, support

from IT service providers, banking associations, and targeted market education is essential. Despite the

challenges, sustainable loan products present an opportunity for regional banks to enhance resilience,

strengthen local economies, and contribute to a sustainable financial system.

1 INTRODUCTION

The consideration of sustainability risks in banks' risk

management is becoming increasingly important due

to regulatory requirements, as well as growing

weather extremes and societal changes and

expectations related to social and governance factors.

In particular, regional banks, which form the

backbone of the German banking sector, face specific

challenges in managing these risks due to their

regional focus. These risks arise from environmental,

social, or governance (ESG) events and can

negatively impact the creditworthiness of (local)

businesses (Federal Financial Supervisory Authority

Germany [BaFin], 2019). National supervisory

authorities advocate various methods and instruments

to mitigate the impact of sustainability risks on banks.

One approach is the use of sustainability loans, which

are either purpose-tied or linked to specific ESG goals

(Du et al., 2022; Giraudet et al., 2021).

This article examines whether such credit

products are effective tools for reducing sustainability

risks for regional banks, the extent to which they are

already utilized, and the level of demand for them.

The study is based on a survey that provides insights

a

https://orcid.org/0000-0003-3017-5189

into the current application and perception of

sustainable credit products.

This article addresses the following research

questions (RQ):

RQ1: How effective are sustainable credit products

as instruments for reducing sustainability risks in

regional banks?

RQ2: To what extent are sustainable credit products

currently used by regional banks and large banks?

RQ3: How do banks estimate the demand for

sustainable loans?

This article begins with a terminological introduction

to the key concepts of "Sustainable Risk," "Regional

Banks," and "Sustainable Loans." The methodology

of the survey is then explained. The results are

presented in Chapter 4 and discussed in Chapter 5.

The article ends with a conclusion.

Strube, D.

The Role of Sustainable Loan Products in Managing Sustainability Risks in German Regional Banks.

DOI: 10.5220/0013358200003956

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 7th International Conference on Finance, Economics, Management and IT Business (FEMIB 2025), pages 197-202

ISBN: 978-989-758-748-1; ISSN: 2184-5891

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

197

2 CLARIFICATIONS OF

TERMINOLOGY

2.1 Sustainability Risk

Sustainability risk refers to the likelihood of an event

having negative impacts on ESG-factors (BaFin,

2019). These risks are not a standalone type of risk

but instead influence traditional banking risk

categories such as credit risk, liquidity risk and

others. Climate risks are a part of sustainability risks

within the environmental (E) category. They can be

further divided into physical risks and transition

risks.(BaFin, 2019).

Physical risks arise from the direct and indirect

consequences of climate change, such as natural

disasters or extreme weather events. These can lead

to financial losses by impairing the economic

performance of borrowers or reducing the value of

collateral and investments. Transition risks, on the

other hand, stem from financial challenges associated

with transitioning to a low-carbon economy. These

risks are often linked to new regulations aimed at

achieving climate goals (BaFin, 2019). These include,

for example, policy measures to achieve the goals of

the Paris Agreement, such as the European Green

Deal or the EU Action Plan on Sustainable Finance.

Such measures can negatively affect companies in

highly polluting industries, for example, by

increasing costs for CO

2

emissions or requiring

investments in clean technologies.

2.2 Regional Banks

Regional banks are financial institutions primarily

focused on providing financial services and

transactions, such as deposit-taking, lending, and

securities transactions, as well as other banking

activities within a specific regional area (Büschgen,

2014). The loan customers of regional banks are

predominantly small and medium-sized enterprises

(SMEs). However, there is no precise deterministic

distinction between regional banks and large banks.

Within the framework of the Single Supervisory

Mechanism, the European Central Bank classifies

banks into so-called Less Significant Institutions

(LSIs) and Significant Institutions (SIs). The primary

distinguishing criterion is a balance sheet total below

or above €30 billion (European Central Bank, 2024).

Most regional banks report significantly smaller

balance sheets, with approximately 88% of LSIs

having total assets below €5 billion (German Federal

Bank, 2021).

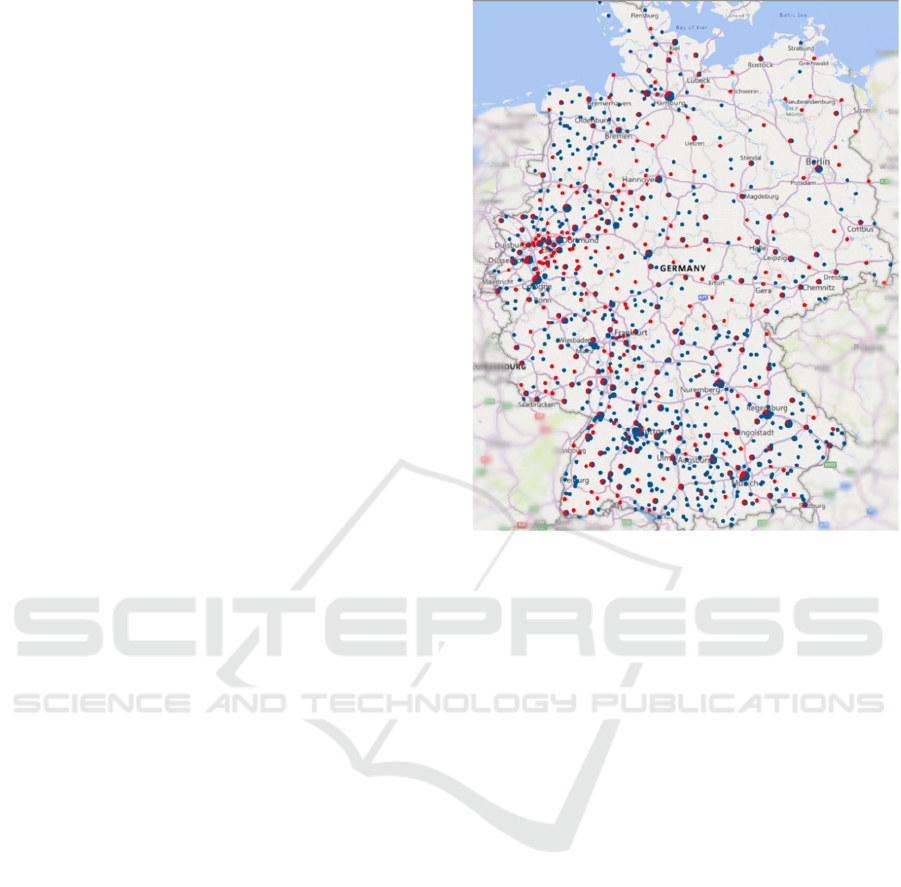

Figure 1: Geographical distribution of cooperative banks

and savings banks in Germany, Status 2022; Adapted from

(Strube et al., 2025).

At the end of 2023, there were around 1,400 banks in

Germany, including approximately 353 savings

banks and 695 cooperative banks (German Federal

Bank, 2024). These two types of banks form a central

part of the German banking landscape and are

distributed across the entire country. Figure 1

illustrates the distribution of German regional banks,

with savings banks shown in red and cooperative

banks in blue. A particularly high density of regional

banks is observed in the southern and western

regions, reflecting smaller and potentially more

climate-sensitive business areas. This vulnerability

arises mainly from their geographic concentration,

which increases their exposure to climate risks - such

as floods, hailstorms, or droughts - that are caused by

climate change. These events can cause significant

damage to borrowers' fixed and current assets or to

regional infrastructure.

Additionally, these banks are highly dependent on

the dominant economic sectors in their respective

regions, such as tourism, agriculture, mechanical

engineering, or coal mining. Their lending activities

are closely tied to the specific economic needs and

structures of their regions. Regulatory changes, such

as the introduction or increase of CO₂ pricing,

structural changes within the region, or shifting

market conditions, can therefore have a dispropor-

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

198

tionately strong impact on regional banks. Due to their

strong regional focus and limited diversification, such

changes can significantly affect their credit risks and

financial stability (Strube et al., 2025).

2.3 Sustainable Loans

Sustainable loans are credit structures designed to

provide a clear ecological benefit. The focus is

primarily on the environmental sector, such as

renewable energy, pollution prevention and control,

green technologies, and other environmentally

friendly projects. The goal of sustainable loans

includes reducing sustainability risks (Carrizosa and

Ghosh, 2022). These loans can be divided into Green

Loans and SLL, with the primary distinction lying in

their purpose.

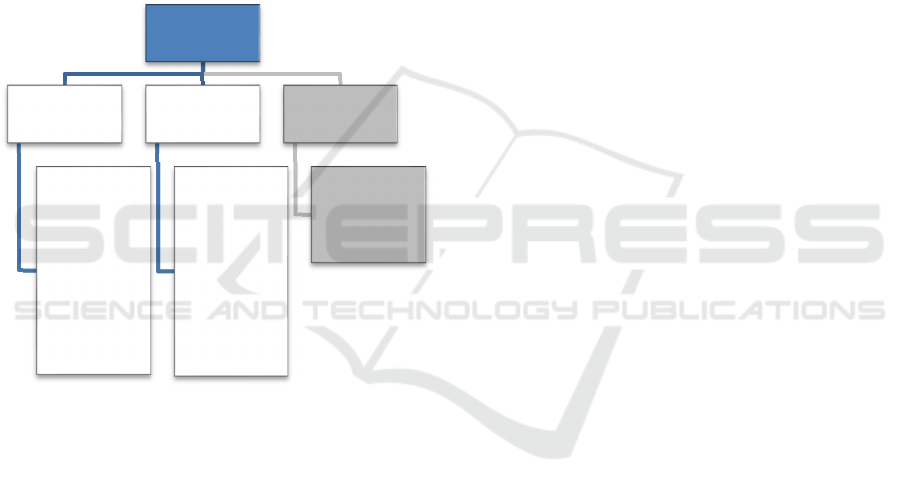

Figure 2: Sustainable Loans.

Green Loans are purpose-specific and exclusively

finance or refinance environmental projects.

Sustainability-Linked Loans

(SLL), on the other hand,

are available for general corporate purposes but are

tied to predefined sustainability targets and

performance indicators, typically monitored by the

lender or external rating agencies. Sustainable loans

may offer preferential interest rates. For SLLs,

interest rates vary based on the achievement of

predefined sustainability goals, functioning similarly

to covenants in loan agreements. Depending on

whether a company meets or fails to meet its

sustainability objectives during the loan term, loan

conditions can improve or worsen, respectively. For

instance, achieving set sustainability targets can lead

to more favorable credit terms for the borrower, and

vice versa. Studies show that the average reduction in

the interest rate for SLLs is between 5 and 10 basis

points, with higher spreads generally observed for

companies with increased ESG and credit risks

(Carrizosa and Ghosh, 2022; Pohl, 2022). Green

loans typically also offer lower interest rates, which

can be up to 8 basis points (Caramichael and Rapp,

2024).

Currently, there are no legal standards for

sustainable loans. Banks rely on the principles of the

Loan Market Association (LMA) as guidelines for

structuring such loans. In the future, an EU standard

similar to the one already developed for Sustainability

Linked Bonds (Regulation (EU) 2023/2631) is

anticipated. This standard is expected to come into

effect by the end of 2024.

In some cases, subsidized loans are also

subsumed under sustainable loans. These loans are

similar in concept to Green Loans and are generally

tied to a specific purpose. However, these are not

standalone credit products provided by the banks

themselves. Instead, the banks typically act as

intermediaries for government-subsidized loan

programs, such as those offered by the Kreditanstalt

für Wiederaufbau (KfW) or regional development

banks. These programs often target the financing of

projects in areas such as energy efficiency, renewable

energy, or sustainable construction. The role of the

banks is primarily limited to advising on and

facilitating the loan process. House banks often

receive a service fee or a small interest margin for

their role as intermediaries (KfW, 2024).

3 METHODOLOGY

The methodology is based on an exploratory survey,

the results of which form the foundation of this study.

The survey was developed in collaboration with the

Sustainability Transformation Monitor (STM), a

longitudinal study examining the progress of

transformation in companies within the real economy

and financial sector (Sustainability Transformation

Monitor, 2023). The survey period began on

September 11, 2024. As of the preliminary evaluation

on November 16, 2024, 88 banks with total assets

below €30 billion (the primary threshold for LSIs)

and 18 banks with total assets exceeding €30 billion

(SI) participated. The findings represent a preliminary

analysis, as the survey period concluded on

December 1, 2024.

The questionnaire was developed through multi-

step process and was tested for errors and practicality

in a pretest. The survey was conducted online, with

participants' email addresses collected to prevent

duplicate submissions. The questionnaire consisted of

Sustainble Loans

Green Loans

Purpose: Specific

Use of Proceeds

Control

Guideline: Green Loan

Priciples

Flexibilty: Low

Interest Rate: Fixed,

Based on Purpose

Sustainability-Linked

Loans

Purpose: Not-Specific

ESG Target

Achievement

-Guideline:

Sustainability-Linked

Loans Principles

Flexibility: High

Interest Rate: Varies,

Tied to ESG Target

(Subsidized Loans)

Goverment-Supprted

Loans, No Separate

Credit Product

The Role of Sustainable Loan Products in Managing Sustainability Risks in German Regional Banks

199

multiple-choice questions, as well as open and closed

questions, and covered various dimensions of

sustainability transformation.

The data were analyzed using SPSS software,

employing both descriptive and inferential statistical

methods. Differences between LSI and SI were

examined during the analysis.

The results of this survey are compared to a

similar, independently conducted study from 2022,

which also investigated the sustainability

transformation of regional banks. For more detailed

information on the methodology and findings of the

2022 study, readers are referred to the respective

publication (Strube et al., 2023). Only LSI banks were

questioned in this survey.

The methodology was carefully designed;

however, potential limitations, such as possible biases

due to self-selection of participants, should be taken

into account.

4 RESULTS

In the survey, participating banks were initially asked

about transformation financing through lending.

Specifically, the question addressed whether the

organization offers financial products whose issuance

and/or interest rates are tied to specific sustainability

criteria. Among the LSI banks (n=71), 35.2% stated

that they already have such products in their portfolio.

For 23.2%, the introduction of these products is in the

planning stage, while around one-fifth of regional

banks (22.9%) currently do not offer this type of loan.

Compared to the results of larger banks, it

becomes clear that they are more advanced in

implementing such products. Of the 17 larger banks

participating, 94.1% already offer this type of loan,

while only one bank (5.9%) indicated that it is still in

the planning phase.

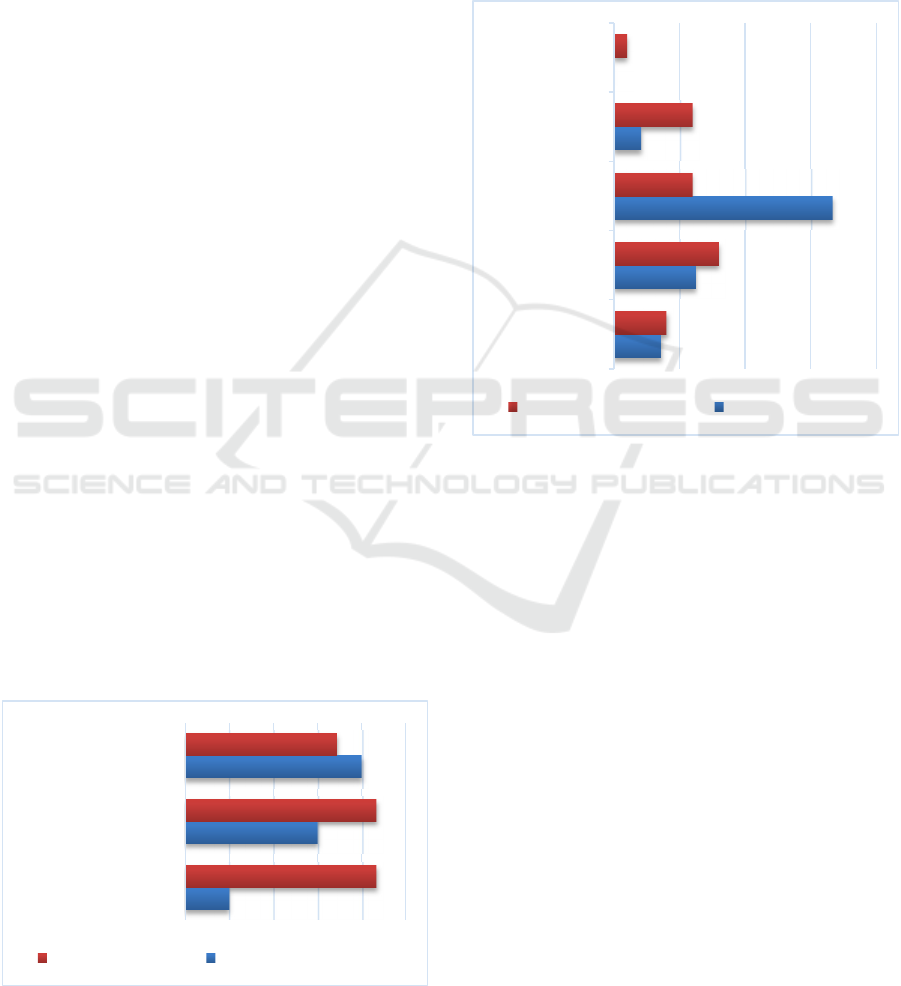

Figure 3: Share of Sustainable Loan Types in the Offer

Portfolio of SI and LSI.

With regard to the question of which specific forms

of sustainable loans are offered, LSIs show a clear

focus on subsidized loans, as illustrated in Figure 3.

Classic Sustainable credit (Green Loans and SSL)

products are significantly more prevalent among

large banks. While some LSIs also offer Green Loans

and SSL, their usage is considerably lower. Only 15

of the 71 LSI-banks surveyed (17.04%) utilize Green

Loans, just 10 banks (11.37%) offering SSL.

Figure 4: Assessment of Demand for Sustainable Loans by

Significant and Less Significant Institutions.

Figure 4 illustrates the intensity of demand for

sustainable loans from the perspective of banks.

Among large banks, demand is predominantly

perceived as moderate. In contrast, LSIs show a

distribution across the entire rating scale. The average

rating for both bank groups, at 3.6 and 3.8

respectively, falls within the range of "rather low" to

"moderate." This suggests that customers of large

banks do not exhibit significantly higher demand for

these loan products compared to customers of smaller

banks.

In the 2022 study, 21.1 % of respondents stated

that they offer SSL, which is in line with the results

of the current study. As shown in Table 1, participants

in 2022 were also specifically asked about the

perceived demand for SSL. With an average score of

2.2, the result fell into the 'low' category and was

significantly below the overall average for

Sustainable Loans as a whole. However, the surveyed

banks generally believe that this type of loan provides

a promising incentive for financing sustainable

investments, with an average score of 3.5.

20.00%

60.00%

80.00%

86.67%

86.67%

68.75%

Sustainability Linked

Loans

Purpose-Tied Loans

Subsidized Loans

Significant Intitutes Less Significant Intitutes

14.29%

25.00%

66.67%

8.33%

0.00%

16.00%

32.00%

24.00%

24.00%

4.00%

none / very low

rather low

moderate

rather large

very large

Less Significant Intitutes Significant Intitutes

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

200

Table 1: Results Survey Sustainability Loans.

Do you think purpose-tied loans are a good incentive for companies to finance sustainable investments?

no rather no

to some extent rather yes yes

Location paramete

Quantity 3 19

43 37 7

⌀ = 3.5

Percent 2.8% 17.4%

39.5% 33.9% 6.4% Median: 3

How do you estimate your customers' demand for such loans?

very low low

moderate high

very

high

Location paramete

Quantity 18 56

28 3 1 ⌀: 2.2

Percent 17.0% 52.8%

26.4% 2.8% 0.9% Median: 2

The main reasons for not offering SLL were primarily

technical and operational challenges. For instance,

the banking software used by most smaller banks is

often unable to adequately handle the additional

conditions. Furthermore, there is a lack of expertise,

experience, and personnel capacity to monitor the

defined targets. Additionally, the limited availability

of sustainability data from borrowers (typically

smaller companies) makes evaluation and target

setting challenging. Some banks also prefer to utilize

alternative incentives, such as subsidized loans, rather

than developing their own sustainable products

(Strube et al., 2025).

5 DISCUSSION

Subsidized loans are the preferred instrument for

smaller banks to promote sustainable investments by

borrowers. This is not surprising. Due to their low

administrative effort, reduced risk, and legal

certainty, they are particularly easy for regional banks

to implement. However, the disadvantages lie in their

lack of flexibility, as subsidized loans are often

limited to specific projects. As a result, certain

sustainable projects demanded by companies cannot

be financed if they are not part of the subsidy

programs. Additionally, there are no options to use

these loans specifically to address in-house

sustainability risks, making it more challenging to

manage risks outside the scope of subsidized areas.

To overcome these disadvantages, Green Loans

are particularly suitable. By developing their own

sustainable loan products, banks can account for

internal specificities and risk concentrations, enabling

a more effective management of sustainability risks.

Nevertheless, compared to large banks, only a few

regional banks currently offer this type of loan. This

is primarily due to moderate overall demand and the

higher administrative effort compared to subsidized

loans. The traditional default risk remains entirely

with the bank, as the loan stays on its balance sheet.

Additionally, the responsibility for monitoring the

proper use of funds lies solely with the bank.

The cost-benefit ratio plays a crucial role,

particularly for SLLs, for both borrowers and lenders.

In addition to relatively low demand, technical and

resource-related constraints in target monitoring led

to relatively high implementation costs (compared to

large banks). For borrowers, the additional

information requirements are only worthwhile if they

are offset by lower financing costs. Similarly, for the

lending bank, the increased administrative effort and

often lower interest rates must be compensated by

significantly reduced risk costs (expected loss) to

ensure the profitability of such loans.

This issue represents a Principal-Agent Problem

(PAT) caused by information asymmetries between

borrowers and banks (for PAT see Braun and Guston,

2003). The bank requires the borrower to provide

credible certificates and reports for target monitoring

to prevent moral hazard. Banks, on the other hand,

incur significant costs for verifying and monitoring

compliance with sustainability criteria and these

assessments. If the costs of monitoring and

verification exceed a reasonable risk premium, or if

the overall information effort outweighs the interest

savings, SLLs and Green Loans become

uneconomical for both parties.

The relative effort is particularly high for small

borrowers, who are typically financed by regional

banks. In contrast to large corporations, small

borrowers often lack the necessary resources and are

not obligated to publish sustainability information.

This also makes the audit particularly challenging for

small banks. Large banks, on the other hand, have

dedicated sustainability departments, customized IT

systems, and significantly larger personnel resources

The Role of Sustainable Loan Products in Managing Sustainability Risks in German Regional Banks

201

than smaller banks. It is therefore unsurprising that

large banks are able to include SLLs and Green Loans

in their product offerings. For regional banks, SLLs

currently appear less suitable due to the high

implementation and monitoring effort as well as the

limited demand. Nevertheless, Green Loans and

SLLs offer significant potential to reduce

sustainability risks specifically at the company level,

despite these challenges.

In the future, IT service providers and banking

associations will need to play a key role in supporting

regional banks with the design and implementation of

these loan products. In addition, targeted training

programs and knowledge platforms could help

strengthen know-how and personnel resources within

regional banks. This support will be essential to

establish regional banks as active players in

sustainable finance and to secure their long-term

competitiveness.

6 CONCLUSION

This study highlights the opportunities and challenges

regional banks face in utilizing sustainable loan

products to address sustainability risks. While

subsidized loans are widely used due to their

simplicity and legal certainty, they lack the flexibility

to address specific risks or diverse customer needs.

Green Loans and SLL offer greater adaptability but

require additional resources and effort.

Larger banks are more advanced in implementing

these products, whereas regional banks often rely on

subsidized loans. The reasons for this lie primarily in

technical feasibility, a lack of know-how, and

incomplete sustainability data, particularly from

small businesses. Many banks continue to perceive

the demand for sustainable loans as moderate to low,

highlighting the need for greater market education

and additional incentives. However, the introduction

of sustainability loans is only economically viable for

regional banks if the costs of gathering information

on the borrower’s side and verifying that information

on the bank’s side do not outweigh the financial

benefits of reduced interest rates.

Investments in these products, along with support

from banking associations and IT service providers,

can help overcome technical and resource-related

hurdles. Fundamentally, both Green Loans and SLL

serve as strong incentives to support local economies

and contribute to the transformation toward a

sustainable financial system.

REFERENCES

Braun, D., & Guston, D. H. (2003). principal-agent theory

and research policy: an introduction. Science and Public

Policy, 30(5), 302–308.

Büschgen, H. E. (2014). Bankbetriebslehre (5., vollst.

überarb. Aufl., Nachdruck). Gabler.

Caramichael, J., & Rapp, A. C. (2024). The green corporate

bond issuance premium. Journal of Banking & Finance,

162, 107126.

Carrizosa, R., & Ghosh, A. (2022). Sustainability-Linked

Loan Contracting. SSRN Electronic Journal. Advance

online publication.

Du, K., Harford, J., & Shin, D. (2022). Who Benefits from

Sustainability-linked Loans? SSRN Electronic Journal.

Advance online publication.

European Central Bank. (2024). Organisation of supervision

and oversight for less significant institutions. ECB.

https://www.bankingsupervision. europa.eu/framework/

lsi/organisation/html/index.en.html

Federal Financial Supervisory Authority Germany. (2019).

Fact Sheet on Dealing with Sustainability Risks

[Merkblatt zum Umgang mit Nachhaltigkeitsrisiken].

https://www.bafin.de/SharedDocs/Downloads/DE/Mer

kblatt/dl_mb_Nachhaltigkeitsrisiken.html

German Federal Bank. (2021). Supervision creates relief for

smaller institutions [Aufsicht schafft Erleichterungen

für kleinere Institute]. https://www.bundesbank.de/de/

presse/pressenotizen/aufsicht-schafft-erleichterungen-

fuer-kleinere-institute-868812

German Federal Bank. (2024). Bank Branch Statistics

Germany 2023. German Federal Bank.

https://www.bundesbank.de/de/presse/pressenotizen/ba

nkstellenentwicklung-im-jahr-2023-932222

Giraudet, L.‑G., Petronevich, A., & Faucheux, L. (2021).

Differentiated green loans. Energy Policy, 149, 111861.

KfW. (2024). Funding for companies [Förderung für

Unternehmen].

https://www.kfw.de/inlandsfoerderung/Unternehmen/

Pohl, C. (2022). (Design characteristics of sustainability-

linked loans) Ausgestaltungscharakteristiken von

Sustainability-Linked Loans. Corporate Finance, 2022,

313–318.

Strube, D., Mayer-Fiedrich, D., & Streuer, O. (2023).

Bewertung, Umsetzung und Perpektiven der Integration

von Evaluation, implementation and perspectives of the

integration of sustainability risk aspects in the

management practice of regional banks

[Nachhaltigkeitsrisikoaspekten in der

Managementpraxis von Regionalbanken]. Corporate

Finance(11-12), 270–277.

Strube, D., Mayer-Fiedrich, D., & Streuer, O. (2025). The

challenges of integrating sustainability risks into the

credit risk management of German regional banks [Die

Herausforderungen bei der Integration von

Nachhaltigkeitsrisiken in das Kreditrisikomanagement

deutscher Regionalbanken]. Corporate Finance, 2025.

Sustainability Transformation Monitor.

(2023).

https://www.sustainabilitytransformation.org/

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

202