Do ESG Ratings Drive Financial Performance? A Systematic

Analysis of Trends and Challenges

Amelie Heinelt

1a

, Dominic Strube

1b

and Christian Daase

2c

1

Hochschule Wismar, University of Applied Sciences, Technology, Business and Design, Wismar, Germany

2

Institute of Technical and Business Information Systems, Otto-von-Guerick University, Magdeburg, Germany

Keywords: ESG Ratings, Financial Performance, Sustainable Finance, Methodology Analysis, Standardized Ratings.

Abstract: This study examines the relationship between ESG (Environmental, Social, and Governance) ratings and

financial performance through a systematic analysis of studies published between 2019 and 2024. The

findings reveal that a significant correlation between ESG ratings and financial performance was only

demonstrated in a portion of the studies. Regression-based models were the most frequently used methods,

followed by panel data and time series analyses. However, no clear statistical relationship between the choice

of methodology and the results could be established. Variations in findings are attributed to differences in

ESG rating methodologies, data sources, and external factors such as macroeconomic conditions and market

volatility. While ESG investments may involve short-term costs, they can contribute to long-term stability.

The study highlights the need for standardized ESG ratings and consistent analytical approaches to enable

more reliable conclusions.

1 INTRODUCTION

ESG ratings (Environmental, Social, and Governance)

assess a company's performance in these three key

areas, providing financial market participants with

essential non-financial information about the

sustainability of companies. Leading providers

include MSCI, Sustainalytics, Thomson Reuters

(formerly Asset4), Bloomberg, and Vigeo Eiris (now

part of Moody's). Sustainability ratings are gaining

increasing importance, serving as a strategic decision-

making tool for investors and managers as well as a

guide for financial investments worth trillions of

dollars, such as sustainable funds (Dorfleitner et al.,

2014; Hughes et al., 2021; Nazarova and Лаврова,

2022). They are used either to channel financial

resources into sustainable projects out of conviction or

with the expectation of achieving higher returns

compared to conventional investments. According to

Morningstar, global sustainable fund assets amounted

to 7,659 billion USD in the second quarter of 2024.

Europe dominates this market significantly with a

share of 73.2% and managed assets of 5,609 billion

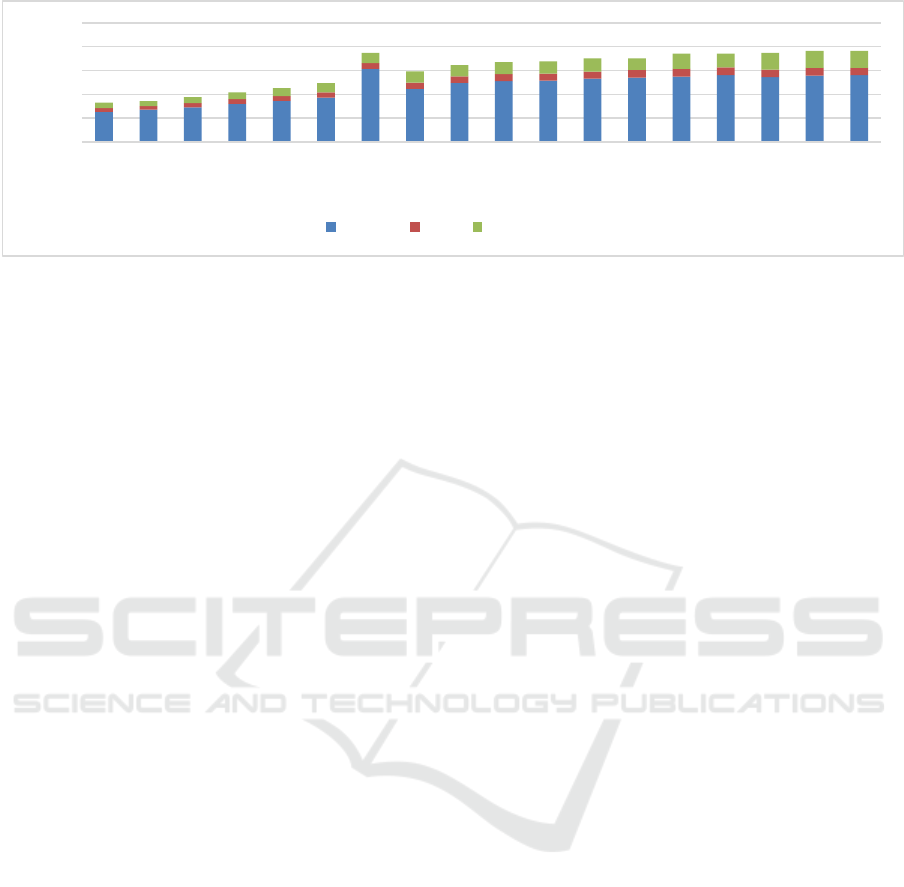

USD. The USA follows with only 8.0%. Figure 1

a

https://orcid.org/0009-0008-3050-1486

b

https://orcid.org/0000-0003-3017-5189

c

https://orcid.org/0000-0003-4662-7055

shows the development of global sustainable fund

assets since the beginning of 2020. These initially

grew steadily but experienced a sharp decline during

the COVID-19 pandemic. Since then, they have

continuously recovered and continue to grow, albeit at

a slower pace. Europe also leads in net fund inflows,

contributing USD 10.3 billion in Q3 2024, while the

United States experienced continuous net outflows

throughout 2024 (Morningstar, 2024). These funds are

fundamentally based on the evaluations of ESG rating

agencies.

Over recent years, numerous studies have

examined the question of whether ESG ratings

correlate with financial performance. This article

aims to investigate whether the correlation between

ESG ratings and financial performance has evolved

over time. In Europe, stricter regulations such as the

EU Taxonomy, the Sustainable Finance Disclosure

Regulation (SFDR), and the Corporate Sustainability

Reporting Directive (CSRD) may have enhanced the

transparency and reliability of ESG data.

Additionally, ESG ratings themselves have likely

improved through the integration of new data sources,

Heinelt, A., Strube, D. and Daase, C.

Do ESG Ratings Drive Financial Performance? A Systematic Analysis of Trends and Challenges.

DOI: 10.5220/0013358400003956

In Proceedings of the 7th International Conference on Finance, Economics, Management and IT Business (FEMIB 2025), pages 203-208

ISBN: 978-989-758-748-1; ISSN: 2184-5891

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

203

Figure 1: Development of Global Sustainable Fund Assets in USD Billion by Region (Q1 2020 – Q2 2024).

advances in methodologies, and technologies like

artificial intelligence.

The study also examines whether specific factors,

such as the choice of ESG rating provider, geographic

focus, or analytical methods, affect study outcomes.

Europe, recognized as a leader in sustainable finance,

may exhibit distinct results due to its strong

regulatory framework and investor demand, which

can drive returns. Analytical and methodological

choices (e.g., linear regression, event studies, or

portfolio construction) are also critical factors

influencing outcomes and are therefore included in

this analysis.

The following research questions arise:

RQ 1: Have the correlation results between ESG

ratings and financial performance changed since

2019?

RQ 2: How do different ESG rating providers,

methodological choices, and geographic differences

influence the financial performance of ESG

investments?

A detailed data table of the evaluated studies is

available upon request, as the full analysis exceeds

the article's space limitations.

2 METHODOLOGY

The purpose of this paper is to analyse the pre-

existing literature on the ESG rating and its impact on

the financial performance of companies.

The focus was on proven correlation by studies that

have already been conducted as well as how the

different ESG rating providers, methodological

choices and geographic differences impact the

financial performance. These were then further

analysed in this article. This analysis was aimed at

identifying any themes and recurring trends in these

studies to understand if these have changed

throughout the years. Furthermore, this can be used

as a basis for further research and identify gaps in the

existing literature.

2.1 Source Selection

For the literature search a systematic approach was

employed. This approach can be used to synthesise

scientific evidence and answer one or more research

questions on a prior established topic. It is supposed

to further academic research by building on already

existing literature and their results. This approach

makes it possible to use empirical methods combined

with a traditional literature review (Lame, 2019).

The search was conducted through the academic

database Scopus. This database was chosen as it is

one of the largest academic research abstract-

databases and should therefore provide the greatest

selection of literature on the topic. The search strings

that were used was “(esg OR "environmental, social,

governance" OR "sustainability" AND "Rating")

AND ("financial performance" OR "stock

performance" OR "stock returns") AND (correlation

OR relationship)”. The main filter that was used was

the timeframe. The search was condensed down to

articles that were published from the year 2019 to

2024. This specific time frame was chosen as there

was a visible increase in studies published on this

topic since 2019.

2.2 Search and Screening Process

From all the articles that could be found through the

search described above, only the 98 most cited

articled were used for analysis. This decision was

made to ensure a wide selection of literature that

represent the foundational research in the topic, as

well as identifies the core concepts and trends. For

this analysis mainly the methodology section and

0

2000

4000

6000

8000

10000

Q1

2020

Q2

2020

Q3

2020

Q4

2020

Q1

2021

Q2

2021

Q3

2021

Q4

2021

Q1

2022

Q2

2022

Q3

2022

Q4

2022

Q1

2023

Q2

2023

Q3

2023

Q4

2023

Q1

2024

Q2

2024

Europe USA RestofWorld

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

204

discussion as well as results were taken into

consideration.

The graphic below is visualizing the research

process for this paper.

Figure 2: Research process.

2.3 Data Analysis

An analysis of the methodology, discussion and

results section was performed. There were

predetermined themes that were used in the analysis

of the data. In this case the themes included:

- The timeframe of the study

- The data sources used for ESG ratings and

financial data

- Geographical and sectoral factors

- The results of the study

- If there was a correlation found or not

An analysis of the data collected from the 98 articles

was used to identify the themes and trends, as well as

see any changes in them throughout the years. The

data was coded in an excel document to visualize the

trends that could be seen in the different themes used

to analyse.

There was also an analysis of the different

statistical methods used in the original studies taken

into consideration for our results.

Finally, a chi-square test was used to investigate

the connection between the methodological

approaches and the correlation results. This test is

also known as the Pearsons chi-square and is most

used to test associations between to categorical

variables such as the existence of a correlation and the

statistical method.

The formula to calculate the chi-square test is also

known as (Onchiri, 2013):

2.4 Limitations

Just as any method there are a few limitations that

must be considered. As the studies that were used

were limited to articles written in English, there might

be relevant findings that were excluded due to studies

in other languages were not investigated for this

analysis.

Another limitation is the fact that only peer revied

journal articles were used, with more in-depth

research and analysis of industry or company reports,

there might have been more, or other insights that

could have been seen.

Lastly, the fact that there is a large variation in

data sources within the articles that have been used

for analysis, it is possible to assume that there are

potential inconsistencies which can result in

difficulties when directly comparing them to one

another.

2.5 Justification

There was a visible increase in studies on this topic,

starting in 2019 and very few before then. This can

indicate that there is either a relevance in this topic or

there have been significant findings in studies which

led to an increase in further studies and research on

the topic. The analysis of a wide variety of articles

with different focus points made sure to ensure

diverse perspectives and the generalizability of the

findings in this analysis. Furthermore, the thematic

analysis provides a structured approach to combine

findings from quantitative and qualitative studies.

Figure 3: Frequency of Different Methodological Research

Approaches.

Methodological Research

approach

Frequency

Regression-Based Technique 41

Panel Data and Time Series

Methods

14

Machine Learning and Predictive

Anal

y

tics

5

Portfolio and Risk Analysis 3

Factor Analysis and Causal

Inference

2

Multivariate and Descriptive

Methods

11

Event and Impact Studies 2

Other 15

3 RESULTS

In total, 98 studies were analysed, with approximately

39% demonstrating a significant correlation between

ESG ratings and financial performance. The most

commonly used ESG ratings include Bloomberg,

MSCI, Thomson/Refinitiv, Compustat, and

Sustainalytics. However, the selection of ratings

Do ESG Ratings Drive Financial Performance? A Systematic Analysis of Trends and Challenges

205

varied widely across studies, with multiple data

providers often used in combination. This variability

makes it difficult to establish a clear pattern or

attribute results to any specific rating source. The use

of different providers reflects the diversity in data

availability and methodological preferences among

researchers.

The analysis of 98 studies reveals that regression-

based techniques, with 41 mentions, are the most

frequently employed method to determine the

relationship between ESG ratings and financial

performance. This popularity may stem from their

suitability for quantifying relationships between

independent variables (e.g., ESG ratings) and

dependent variables (e.g., financial performance), as

well as their ability to control for confounding factors.

Far behind are panel data and time series methods

(14), which are often applied to account for both

temporal trends and firm-specific differences, making

them particularly useful for longitudinal studies.

Multivariate and descriptive methods were

employed 11 times, serving as tools for exploring data

structures and identifying patterns. Less commonly

used are specialized approaches such as machine

learning and predictive analytics (5), portfolio and

risk analysis (3), as well as factor analysis and causal

inference and event and impact studies (each with 2

mentions). The "Other" category (15) reflects

alternative methods.

To investigate whether there is a connection

between the methodological approach and the

correlation results, a chi-square Test was performed.

The test yielded a Chi-Square value of 0.59 and a p-

value of 0.999, suggesting no statistically significant

relationship between the methods used and the

likelihood of observing a correlation. This indicates

that the choice of methodology does not seem to

influence whether a study identifies a significant

relationship between ESG ratings and financial

performance.

An analysis of the correlation between the study

period and correlation results also showed no

significant findings. Interestingly, a slight negative

correlation of -0.216 was observed, suggesting that

more recent studies tend to report fewer correlations.

However, the p-value of 0.219 is well above the

significance threshold of 0.05, meaning no

statistically significant relationship can be

established. This result might reflect evolving

methodologies or changing perceptions of the

relationship over time but requires further

exploration.

Many of the studies with a demonstrated

correlation focus on global markets or multi-sectoral

analyses, such as oil and gas or real estate. These

broad approaches aim to capture general trends and

cross-industry insights. Few studies specifically

examine individual countries or regions, such as

China or BRICS nations, making it challenging to

establish a clear geographic preference or draw

region-specific conclusions. Similarly, no clear

relationship was observed between the choice of ESG

ratings and the results. The data show a wide

distribution of sources, with no single ESG data

provider dominating the studies with demonstrated

correlations. This diversity underscores the

complexity of the topic and the importance of

considering multiple perspectives in ESG research.

4 DISCUSSION

Our results show that there is no statistically

significant relationship between the study period, the

choice of methodology, and the correlation results of

the studies. Due to the challenges, no statistical

relationship can be mathematically proven in relation

to region or rating provider in our case. However, it

appears that neither of these aspects serves as a main

driver for positive results.

The reasons for this are manifold and are most

likely rooted in the design of the rating methodologies

themselves. Numerous studies demonstrate that the

breadth and diversity of ESG factors, the subjectivity

of their evaluation, and differing assessment methods

result in vastly divergent ratings for the same

company. This means that ESG ratings exhibit high

inconsistency due to low correlations among them,

which can be attributed to the lack of standardized

methods for measuring ESG performance (Berg et al.,

2019; Chatterji et al., 2016; Dimson et al., 2020;

Zumente and Lāce, 2021). The clear relationship

between a high ESG rating and a higher level of

sustainability remains ambiguous. Some studies

suggest that the mere volume of available data

positively correlates with ESG ratings, indicating that

insufficient sustainability data could lead to a

downgraded rating (Drempetic et al., 2020). Although

approximately 39% of the analysed articles indicate a

positive correlation, the lack of standardized criteria

makes it difficult to compare results across studies or

draw reliable conclusions. Furthermore, a correlation

does not necessarily imply causation, which is

challenging to establish given the mentioned

limitation. Nonetheless, a correlation can be used to

detect existing relationships between variables and

can be of use to guide further studies in the are of

study. It is also valuable for predictions, when a clear

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

206

underlying cause cannot be identified. Lastly, these

correlations can be used to generate further

hypothesis which can be proven by causal research.

Only through the establishment of standardized

definitions of sustainability and uniform

measurement methods will it be possible in the future

to conduct more reliable and robust investigations.

Another significant factor is that many studies use

capital market indicators as their dependent variable.

In particular, the stock market is influenced by a

multitude of complex factors, such as macroeconomic

developments, geopolitical events, and speculative

behaviour. Crises like the COVID-19 pandemic have

significantly increased the volatility of capital

markets in industrialized nations (Baek et al., 2020;

Ozkan, 2021). Similarly, the Russia-Ukraine conflict

had a substantial impact on stock returns and market

volatility, leading to high inflation and rising interest

rates (Ahmed et al., 2023; Wu et al., 2023). Against

this backdrop, the effect of ESG ratings may be

overshadowed by these broader influences, making

both temporal and geographic comparisons difficult,

as macroeconomic and geopolitical factors vary

significantly between countries.

Furthermore, it remains questionable whether

sustainability leads to a short-term improvement in

financial performance. Investments in social and

governance aspects may result in companies

incurring higher short-term costs, for instance,

through stricter compliance regulations, improved

working conditions, or more comprehensive

reporting. While these measures contribute to long-

term stability and the company's reputation, they can

reduce returns in the initial phase. Thus, sustainability

may not always provide immediate financial benefits

but rather represents a strategic decision aimed at

long-term stability and corporate responsibility.

5 CONLUSIONS

Ultimately this study demonstrates that there is no

statistical relationship between the study period,

methodological choices, or the geographical focus, as

initially suspected. The variety in different ESG

rating providers and methodological approaches

added to the complexity of this analysis. This issue

highlights the need for more standardized ESG rating

to be able to definitively draw conclusions from these

ratings and their impact on different factors such as

the financial performance of a company. These

findings further suggest that the variability in ESG

ratings can be a contributing factor to the inconsistent

results across studies. This is further driven by the

differing methodologies, as well as subject

evaluations. Approximately 39% of the studies that

were observed showed a positive correlation between

the ESG ratings and financial performances. It is

crucial to note, that correlation does not imply

causation. Variability in ESG ratings, mainly driven

by the different methodologies used as well as

differences in the factors considered, have a

significant impact on the inconsistent results across

the different studies. There were approximately 39%

of studies that showed a correlation between the ESG

rating and financial performance, it must be

mentioned, that a correlation does not imply an

automatic causation between these factors. There is a

variety of external factors which can manipulate the

impact of ESG ratings on financial performance.

Some examples for these factors can be

macroeconomic conditions as well as the market

volatility. There are definite higher short-term costs

due to investments into the ESG aspects which have

to be considered. These can lead to more ling-term

stability however there is no certainty, that it causes

financial improvements. There should be a clear

understanding of the relationship between the ESG

ratings, and the financial performance achieved. This

can be supported by standardized ratings and

methodologies as well as analysis which account for

internal as well as external factors.

REFERENCES

Ahmed, S., Hasan, M. M., & Kamal, M. R. (2023). Russia–

Ukraine crisis: The effects on the European stock

market. European Financial Management, 29(4),

1078–1118.

Baek, S., Mohanty, S. K., & Glambosky, M. (2020). Covid-

19 and stock market volatility: An industry level

analysis. Finance Research Letters, 37, 101748.

Berg, F., Kö, lbel, J., & Rigobon, R. (2019).

Aggregate Confusion: The Divergence of ESG Ratings.

SSRN Electronic Journal. Advance online publication.

Chatterji, A. K., Durand, R., Levine, D. I., & Touboul, S.

(2016). Do ratings of firms converge? Implications for

managers, investors and strategy researchers. Strategic

Management Journal, 37(8), 1597–1614.

Dimson, E., Marsh, P., & Staunton, M. (2020). Divergent

ESG Ratings. The Journal of Portfolio Management,

47(1), 75–87.

Dorfleitner, G., Halbritter, G., & Nguyen, M. (2014).

Measuring the Level and Risk of Corporate

Responsibility - An Empirical Comparison of Different

ESG Rating Approaches. SSRN Electronic Journal.

Advance online publication.

Drempetic, S., Klein, C., & Zwergel, B. (2020). The

Influence of Firm Size on the ESG Score: Corporate

Do ESG Ratings Drive Financial Performance? A Systematic Analysis of Trends and Challenges

207

Sustainability Ratings Under Review. Journal of

Business Ethics, 167(2), 333–360.

Hughes, A., Urban, M. A., & Wójcik, D. (2021).

Alternative ESG Ratings: How Technological

Innovation Is Reshaping Sustainable Investment.

Sustainability, 13(6), 3551.

Lame, G. (2019). Systematic Literature Reviews: An

Introduction. Proceedings of the Design Society:

International Conference on Engineering Design, 1(1),

1633–1642.

Morningstar. (2024). Global Sustainable Fund Flows: Q3

2024 in Review.

https://www.morningstar.com/lp/global-esg-flows

Nazarova, V., & Лаврова, В. (2022). Do ESG Factors

Influence Investment Attractiveness of the Public

Companies? Journal of Corporate Finance Research /

Корпоративные Финансы | ISSN: 2073-0438, 16(1),

38–64.

Onchiri, S. (2013). Conceptual model on application of chi-

square test in education and social sciences.

Educational Research and Reviews, 2013, 1231–1240.

Ozkan, O. (2021). Impact of COVID-19 on stock market

efficiency: Evidence from developed countries.

Research in International Business and Finance, 58,

101445.

Wu, F., Zhan, X., Zhou, J., & Wang, M. (2023). Stock

market volatility and Russia–Ukraine conflict. Finance

Research Letters, 55, 103919.

Zumente, I., & Lāce, N. (2021). ESG Rating—Necessity for

the Investor or the Company? Sustainability, 13(16),

8940.

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

208