COVID-19 and Macro-Financial Forces: Who Drives the

Conventional and Islamic Stock Markets?

Melissa Putritama

1a

, Natanael Christian Adinata

1b

, Nathalie Noviani

1c

and Shinta Amalina Hazrati Havidz

1,2,* d

1

Finance Program, Accounting Department, School of Accounting, Bina Nusantara University, Jl. Kyai H. Syahdan No.9,

Kemanggisan, Kec. Palmerah, Jakarta, Indonesia

2

School of Business, Western Sydney University Indonesia, Surabaya, Indonesia

Keywords: ARDL Panel, Conventional Stocks, COVID-19, Global Pandemic, Islamic Stocks, Vaccine Confidence Index.

Abstract: Although WHO has declared the pandemic end, the underexplored area of study around COVID-19, macro-

financial, conventional, and Islamic stock markets should be conducted. Therefore, this research remains

relevant since a market downturn can happen anytime in the future, and the world will face dynamic changes

in investors' behavior. We aim to investigate the drivers of the Conventional and Islamic stock markets, which

mainly consider the global pandemic COVID-19 and Macro-financial forces. The main methodology applied

panel autoregressive distributed lag (ARDL). This research discovers the following findings: (1) conventional

stocks highly rely on the confidence index of the COVID-19 vaccine, whereas Islamic stocks remain more

resilient; (2) A safe-haven role of Islamic stocks during global market turbulence and outperform their

counterparts; (3) government policies boost the confidence of both stock markets; and (4) conventional stocks

are much more dominant than Islamic stocks. Islamic stocks provide safe-haven attributes during market

turmoil, whereas conventional stocks take time to recover. We offer suggestions to investor decision-making,

regulators, and government policies.

1 INTRODUCTION

Although the global COVID-19 pandemic has come

to an end, as announced by WHO at the beginning of

May 2023, the underexplored area of study around

COVID-19 and stock markets is still crucial to be

investigated. Market uncertainty and economic

conditions greatly affect investment decision-

making, thus determining the future direction of

Islamic and conventional stocks (Albaity et al., 2023).

COVID-19 shocked the world economy—especially

the stock markets—both conventional and Islamic

(Al-Awadhi et al., 2020). Conventional stocks (CS)

experienced incisive declines in the early pandemic

stages. The S&P 500, Nikkei, and Hang Seng indices

fell by 34%, 20%, and 18%, respectively (Al-Awadhi

a

https://orcid.org/0009-0001-2652-1731

b

https://orcid.org/0009-0007-9524-9042

c

https://orcid.org/0009-0009-7219-0521

d

https://orcid.org/0000-0001-9837-7233

*

Corresponding author

et al., 2020; Zhang et al, 2020). COVID-19 also

affects the Islamic Stock (IS) market, but the recovery

outperformed compared with their counterparts, the

CS market (Nomran and Haron, 2021). IS

experienced a smaller decline in its return and

rebounded rapidly (Chowdhury et al., 2022). The

arrival of vaccines resolved the shock due to the

global COVID-19 pandemic. It gave new hope for the

economy and thus the stock markets. It brought

positive stock markets and economic breakthroughs

globally (Rouatbi et al., 2021).

Research about vaccines of COVID-19 and

financial assets (i.e., stocks) have been increasing

recently. A positive stock market reaction was shown

when the COVID-19 vaccines were produced and

distributed (Demir et al., 2021; Rouatbi et al., 2021;

Putritama, M., Adinata, N. C., Noviani, N. and Havidz, S. A. H.

COVID-19 and Macro-Financial Forces: Who Drives the Conventional and Islamic Stock Markets?.

DOI: 10.5220/0013402900003956

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 7th International Conference on Finance, Economics, Management and IT Business (FEMIB 2025), pages 209-216

ISBN: 978-989-758-748-1; ISSN: 2184-5891

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

209

Khalfaoui et al., 2021; Behera et al., 2022).

Furthermore, people are more optimistic about

investing in healthcare stock due to vaccine doses

(Jeremiah et al., 2023). The vaccination rate denoted

an exponential increase and signaled bright news for

investors. Thus, global stock markets remain less

volatile (Rouatbi et al., 2021). Meanwhile, it was

found that vaccination was negatively insignificant to

the return of the IS market in Malaysia (Tee and Kew,

2022).

A novelty research by Havidz et al., (2023),

constructed the vaccine confidence index (VCI),

which was derived from the first and second doses,

creating confidence in individuals and thus promoting

herd immunity. When herd immunity was formed, the

economy would rebound eventually. They further

explored VCI impacts on the cryptocurrencies and

found that VCI positively impacted Bitcoin returns.

This result was confirmed by Havidz et al., (2024).

The impact of VCI on CS and IS markets has been

unexplored; hence, we conducted this study. In

addition to VCI, we utilized additional COVID-19

indices (i.e., the index of global fear (GFI), the index

of stringency (SI), and the panic index of COVID-19

(CPI)).

Constructed by Salisu and Akanni (2020), GFI

negatively impacted the stock market. It was further

agreed by others (Makun, 2021). Furthermore, GFI

was also utilized to find its effect to commodity

(Salisu et al., 2020). SI was also employed because a

high stringency index will cause difficulties in

business activities (Scherf et al., 2022). Nevertheless,

government policy in breaking the chain of COVID-

19 infection could accelerate economic recovery. It

was assumed that when the economy recovers, the

stock market will rebound eventually (Aggarwal et

al., 2021; Chang et al., 2021; Gu et al., 2022). CPI

was utilized to find the impact on the stock market

(Aggarwal et al., 2021), and major fiat and

cryptocurrency volatility (Umar and Gubareva, 2020.

Both GFI and CPI were utilized to find their impact

on cryptocurrency return (Havidz et al., 2023) and

Bitcoin volatility (Tiffani et al., 2023).

Besides COVID-19 factors, macro-financial

factors also determine stock market movement (Pan,

2023). Therefore, we include three macro-financial

factors (i.e., index of financial stress (FSI), rates of

foreign exchange (FOREX), and index of volatility

(VIX)) to avoid biased findings because different

factors could be executed concurrently. Compared

with CS, IS studies during COVID-19 were found to

be very limited. There was a dearth of studies of FSI,

and scant studies of FOREX (Dewi et al., 2022) and

VIX (Francis & Ambilikumar, 2021; Grima et al,

2021).

The literature on comparison studies between CS

and IS grew during the pandemic (Nomran and

Haron, 2021; Widjaja et al., 2024), but this current

research was executed in different ways. Therefore,

we addressed the research gap. We contributed to the

literature threefold. First, this was the first study that

utilized VCI as a determinant of CS and IS. Prior

studies investigated the impact of VCI on the

cryptocurrencies’ return (Havidz et al., 2023, 2024).

Secondly, we scrutinized two main clusters (i.e.,

global COVID-19 pandemic indices and macro-

financial factors) as the determinants, which, as far as

we knew when conducting the study, had not yet been

investigated. Thirdly, instead of executing a one-

sided market, we conducted a comprehensive study

that compared CS and IS markets during market

turbulence and how the range of determinants may

have affected.

2 DEVELOPMENTS OF

HYPOTHESES

2.1 Covid-19 Indices

VCI is a new proxy that was initiated by populations

receiving full vaccination and it drove economic

recovery (Havidz et al., 2023). Once the economy

recovered, it drove stock prices—and their returns—

up (Demir et al., 2021; Rouatbi et al., 2021). When

total vaccination increased, the closing price of CS

also increased (Khalfaoui et al., 2021; Behera et al.,

2022). On the contrary, vaccination was ineffective in

improving IS returns in Malaysia (Tee and Kew,

2022). GFI is an index which composes reported

deaths and cases, and it revealed the higher fear that

was perceived by people prompted a negative

influence on CS (Salisu and Akanni, 2020; Makun,

2021). However, other research revealed insignificant

co-movement between GFI with CS and IS returns in

Pakistan (Ali et al., 2022).

SI is a government policy related to restrictions

including workplace closure and travel bans. Higher

SI impediments business activities and leads to a

stock market downturn (Scherf et al., 2022). This

policy suppresses the infection rate and elevates

people’s confidence, thus ameliorating the

performance of CS (Gu et al., 2022; Chang et al.,

2021). On the contrary, the stringency of government

did not boost IS performance (Hersh et al., 2023).

However, recently, COVID-19 has been considered

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

210

as part of people's lives and treated like other common

diseases. Thus, people and the stock market have

started to adjust. Hence, stock markets start to

recover. CPI is a proxy that refers to panic sentiment

and circulating news. The increase in public panic

invokes a diminution of CS market and affects stock

returns negatively (Aggarwal et al., 2021). COVID-

19 pandemic induced stock market panic and

enhanced volatility in daily returns (Nomran and

Haron, 2021). Meanwhile, IS was less volatile in

response to pandemic news (Ashraf, 2020).

Therefore, we proposed as following hypotheses:

H

1

: Vaccine Confidence Index (VCI) positively

impacted to both stock indices return, conventional

(CSI) vs. Islamic (ISI)

H

2

: Global Fear Index (GFI) negatively/positively

impacted to both stock indices return, conventional

(CSI) vs. Islamic (ISI)

H

3

: Stringency Index (SI) negatively/positively

impacted to both stock indices return, conventional

(CSI) vs. Islamic (ISI)

H

4

: COVID-19 Panic Index (CPI)

negatively/positively impacted to both stock indices

return, conventional (CSI) vs. Islamic (ISI)

2.2 Macro Financial

FSI is a proxy to measure financial markets stress

degree (Kaplanski and Levy, 2010). When the FSI is

higher than the threshold, this denotes the anomalous

market where investment decisions are riskier (Sun et

al., 2023). Stock returns will decrease along with an

increase in FSI (Christopoulos et al., 2011; Ftiti and

Hadhri, 2019). The higher strain level leads to lower

returns, both with CS and IS (Aloui et al., 2021).

Stock value increment would decrease the price of

local currency to the USD (strengthening the value)

and vice versa (Khan, 2019; Qin 2018). The COVID-

19 pandemic debilitated many countries’ economies

resulting in an impairment of those countries’

exchange rates. Therefore, the CS return declines

(Mroua and Trabelsi, 2020; Topcu and Serkan, 2020).

VIX is the fear index in the stock market. Higher

VIX leads to higher uncertainty of CS (Fernandes et

al., 2014; Shu and Chang, 2018), and thus lower the

CS return. The worsen COVID-19 cases led to a

higher perception of risk and reduced the confidence

of stock market investors (Francis & Ambilikumar,

2021; Grima et al., 2021). The fluctuations of VIX are

important predictors of IS (Ftiti and Hadhri, 2019;

Paltrinieri et al., 2019). Yet, IS was more stable and

predictable through the outbreak and proved less

volatile than CS (Ali et al., 2022). Therefore, we

proposed as following hypotheses:

H

5

: Financial Stress Index (FSI) negatively impacted

to both stock indices return, conventional (CSI) vs.

Islamic (ISI)

H

6

: Foreign Exchange (FOREX) negatively impacted

to both stock indices return, conventional (CSI) vs.

Islamic (ISI)

H

7

: Volatility Index (VIX) negatively impacted to

both stock indices return, conventional (CSI) vs.

Islamic (ISI)

3 DATA AND METHODOLOGY

3.1 Data

We selected the countries around the world based on

the availability of vaccine data for them to meet the

criteria of our sample. There were 249 countries with

available data listed by OurWorldInData (2022), but

only 14 countries with complete vaccination data

were selected with additional criteria applied.

South Korea had the most recent vaccination

program, only starting on 26 February 2021, among

our selected countries as the sample. Thus, the

starting period was benchmarked from South Korea.

Since the VCI is our variable of interest and its

computation included the incubation period, 𝑉𝐶𝐼 =

∑

,

∑

(

,

,

𝑥 100; (see Havidz et al., 2023),

we applied a 28-day lag based on the most-used

vaccine in each country of our samples. Employing

daily data in our research, the indices of COVID-19

(i.e., VCI, GFI, CPI and SI) have seven-day daily

data. Hence, we interpolated the five-day data for the

remaining variables to seven days.

Our data spanned from 27 March 2021 to 3

December 2022. We transformed the variables to the

change value ((Pt – Pt-1)/Pt) to allow an apples-to-

apples comparison. Leaving SI and FSI using global

data. We concluded to utilize 13 indicators in this

paper consisting of two dependents (i.e., CSI and ISI),

seven independents (i.e., VCI, GFI, CPI, SI, FSI,

FOREX, VIX), and two control variables for each

type of markets (i.e., CSMC, ISMC, CSVOL and

ISVOL). Table 1 reports the data sources and

summary of descriptive.

3.2 Unit Root Test and Panel ARDL

Levin et al. (2002) proposed a unit root test called the

LLC (Levin, Lin, and Chu) test. Table 2 shows the

LLC's findings, which documented that all variables

were significant at level, except for FSI. Afterward,

COVID-19 and Macro-Financial Forces: Who Drives the Conventional and Islamic Stock Markets?

211

we used the first difference and verified that all

variables were stationary at the first level.

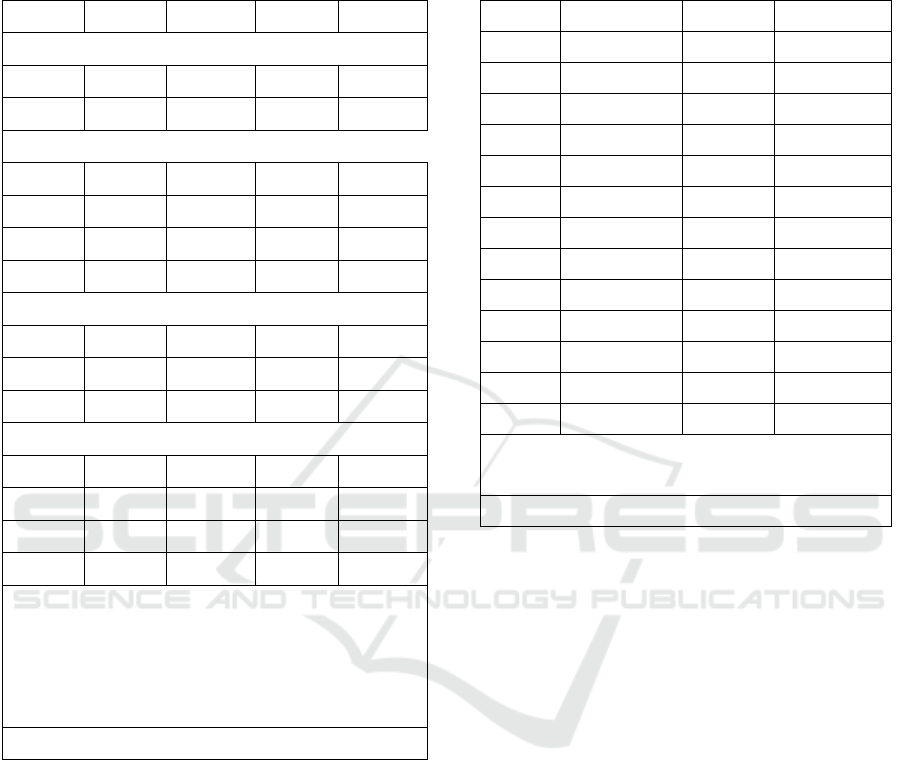

Table 1: Data Sources and Descriptive Summary.

Var(s) Mean Std dev Min Max

Stock Indices

CSI -0.015 1.147 -7.222 9.391

ISI -0.008 1.386 -8.356 12.006

COVID-19 indices

VCI 0.008 0.008 -0.429 0.105

GFI -0.002 0.002 -0.053 0.059

SI 39.359 20.438 5.56 84.72

CPI 0.733 3.764 -0.991 151.361

Macro-financial Factors

FSI -0.966 2.427 -4.219 3.32

FOREX 0.018 0.453 -6.876 4.018

VOX 0.171 5.819 -19.463 27.018

Control Variables

CSMC -0.013 1.182 -6.835 11.139

ISMC 0.038 2.208 -33.246 79.807

CSVOL 6.646 85.201 -99.047 4535.741

ISVOL 85.02 2087.093 -99.906 164893.7

Note(s): Data for CSI, ISI, FOREX, VIX, CSMC,

CSVOL, ISMC, and ISVOL were obtained from

www.bloomberg.com; VCI, GFI, and SI were sourced

from ourworldindata.org; CPI and FSI were from

www.ravenpack.com and www.financialresearch.gov,

respectively.

Source(s): by authors.

Mixed stationarity at the level and the first level

exists hence the most appropriate method is panel

autoregressive distributed lag (ARDL) (Pesaran et al.,

1999). A similar approach was also utilized by prior

works (Havidz et al., 2023, 2024). By using the

Hausman test (1978) to choose the most suitable

model, three estimators were applied (i.e., dynamic

fixed effects (DFE), mean group (MG), and pooled

mean group (PMG) and). The model of the ARDL

panel can be explained as follows:

𝑌

=α

+

∑

𝑌

,

+

∑

β

,

+𝜇

(1)

The dependent denotes as Yi,t , while the

independent variables is Xi,t , the parametric

coefficients were αit and βit. 𝜇 it marked as the

residual term, t and i were the time-series and cross-

section, and the ideal lag length was depicted by k and

q, explaining the number of predictors.

Table 2: Unit root test result.

Variables LLC I(0) Variables LLC I(1)

CSI -63.1149*** ΔCSI -120***

ISI -64.2405*** ΔISI -120***

VCI -24.2758*** ΔVCI -90.1856***

GFI -17.6710*** ΔGFI -130***

SI -1.6975** ΔSI -68.6120***

CPI -80.5758*** ΔCPI -140***

FSI -1.0006 ΔFSI -60.3651***

FOREX -65.7013*** ΔFOREX -120***

VIX -73.5749*** ΔVIX -120***

CSMC -63.2171*** ΔCSMC -120***

ISMC -68.8239*** ΔISMC -130***

CSVOL -81.9031*** ΔCSVOL -130***

ISVOL -76.2618*** ΔISVOL -130***

Note(s): ** and *** denotes a significant level at 5%

and 1%, respectively.

Source(s): by authors.

4 RESULTS AND DISCUSSIONS

As suggested by the Hausman test, the long-run

results should refer to the MG estimator for CSI,

while the PMG estimator should be referred to ISI

(see Table 3).

Our results support the entire hypotheses (H

1

, H

2

,

H

3

, H

4

, H

6

, and H

7

), except H

5

. It is revealed that VCI

positively impacted CSI significantly, while it was

insignificant for ISI. Our results support prior works

(Khalfaoui et al., 2021; Behera et al., 2022; Tee and

Kew, 2022). It indicates that fully vaccinated people

increase confidence in the economy (Havidz et al.,

2023), hence the stock returns bounced back. The

conventional and Islamic stocks rebounded, and the

behavior of investors tended to re-buy the stocks.

Conventional stock is highly reliant on the

vaccination rate which leads to a much more stable

market (Khalfaoui et al., 2021; Behera et al., 2022).

However, Islamic stocks applied Shariah law which

prohibited excess risk and emphasized ethical-

oriented trade in doing business (Jawadi et al., 2014).

Hence, Islamic stocks are much more resilient during

market turbulence.

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

212

Table 3: Panel ARDL results for Conventional and Islamic

Stocks.

Dependent

variables

CSI ISI

Model MG PMG

Long-run coefficients

VCI 2.468**(1.234) 0.241(1.171)

GFI -1.307(3.253) 11.512*(5.898)

SI 0.001**(0.003) 0.001**(0.001)

CPI 0.004(0.003) -0.001(0.004)

FSI 0.004(0.003) 0.011***(0.004)

FOREX -0.211***(0.061) -0.032(0.020)

VIX -0.000008 -0.004(0.002)

CSMC 0.856***(0.036) 0.85***(0.007)

CSVOL -0.000001 -0.002(0.003)

Short-run coefficients

ΔVCI -6.272**(2.850) 2.715(3.014)

ΔGFI 3.600(6.119) -6.862(8.876)

ΔSI 0.007(0.009) -0.005(0.01)

ΔCPI -0.002(0.002) 0.001(0.003)

ΔFSI -0.284***(0.074) 0.036(0.063)

ΔFOREX 0.064*(0.037) -0.069(0.068)

ΔVIX 0.002(0.002) -0.001(0.001)

ΔCSMC 0.041(0.045) -0.024(0.028)

ΔCSVOL 0.003(0.002) -0.007(0.001)

Speed of convergence

ECT -0.964***(0.041) -0.772***(0.087)

Constant -0.020(0.013) -0.056***(0.006)

Number of Obs

(N)

8,638 8,638

Note(s): *, **, *** denotes a significant level at 10%,

5%, and 1%, respectively.

Source(s): by authors.

GFI implied a negative insignificant relationship

with CSI. People are getting used to the COVID-19

outbreak, and the level of fear has started to decrease,

driving stock prices up and, therefore, the returns.

These findings are in line with prior works (Salisu and

Akanni, 2020; Makun, 2021). However, a positive

significant impact of GFI on ISI was documented.

Islamic stocks serve as safe-haven assets (SHA),

similar to gold, because of their ability to remain

stable during global crises (Hasan et al., 2021).

Further, investors highly consider Islamic stocks in

the inclusion of the portfolio during the crisis as it

remains as defensive sector (Jeremiah et al., 2023). SI

impacted positively and significantly on both CSI and

ISI. The government's policy in managing COVID-19

increased public confidence in the stock market. This

is also in line with previous findings (Chang et al.,

2021; Gu et al., 2022). Moreover, people’s fear is

lessening regarding COVID-19 as they have adapted

to the notion that COVID-19 can be seen as part of

daily existence. Therefore, they are no longer

panicked by the situation. These results contradicted

prior works (Aggarwal et al., 2021).

FSI impacts positively on both, but is significant

to ISI, while insignificant to CSI. Our results

contradicted previous studies (Christopoulos et al.,

2011; Ftiti and Hadhri, 2019). As COVID-19 had

been underway for a year, thus facing financial

difficulties, the stock markets started to understand

and adjust the conditions. Therefore, stock markets

start to rebound during the stress. Investors’ behavior

certainly does not stop looking for the best stocks

when the market goes down. Prior studies showed

that ISI outperformed CSI (Nomran & Haron, 2021).

Therefore, investors are more interested in Islamic

stocks as it serves as a safe haven.

The exchange rate negatively impacted both

markets but is significant for CSI, while it is

insignificant for ISI. Most indices used around the

world are dominated by conventional indices.

Therefore, the volume of exchange rates for the

conventional stock is greater than the counterpart,

Islamic indices. Our findings are in line with prior

work (Khan, 2019). Moreover, the tendency of

people’s stock consumption leads to the exchange

rate movement (Mroua and Trabelsi, 2020). VIX

shows a negative relationship with both CSI and ISI.

It proves that the less volatile the market, the more

people will invest. This result was supported by

Francis and Ambilikumar (2021) and Grima et al.,

(2021). VIX is determined by the movement of the

S&P 500 which is considered as conventional stocks.

Therefore, CS is more likely to be impacted than IS.

Furthermore, both market caps have a positively

significant impact on CSI and ISI. Indeed, the

growing market cap implied the growth of stock

markets as it gained more investors, thus affecting the

returns. Meanwhile, the volume of both markets

remains a weak determinant of returns compared with

the market caps.

Overall, the short-run results of CSI supported

several significant variables. Although the number of

fully vaccinated people keeps increasing, investors

still question how quickly it will stabilize the

conventional market as recovery takes time.

COVID-19 and Macro-Financial Forces: Who Drives the Conventional and Islamic Stock Markets?

213

Moreover, the outbreak keeps the market stressed

which leads to investors’ anxiety; they will not invest

in the conventional market when turbulence occurs.

The money supply is affected by hot money inflow

and leads to greater stock returns. COVID-19 has

been going on for a brief period but will recede in

time. Therefore, most of the factors were revealed to

be insignificant in the short run. Likewise, Islamic

stocks remained stable and resilient compared with

their counterpart, conventional stocks.

5 CONCLUSIONS

Islamic stocks were found to be more resilient during

high turbulence compared to its counterpart,

conventional stocks. Our findings benefit investors

and suggest the inclusion of Islamic stocks in their

investment portfolio to mitigate the risks. Islamic

stocks are suggested to investors who aim for long-

term behavior investments because they are more

resilient no matter how bad the economy. Meanwhile,

investors who aim for a quicker, higher return may

consider conventional stocks, yet they should be able

to bear higher losses when high uncertain times occur.

Governments should be able to control and encourage

society to be fully vaccinated as well as get booster

doses to keep the economy stable. The COVID-19

vaccine should be an annual vaccine program

provided by the government. This research is limited

to stock indices and could be further examined in a

company's level data to have a better suggestion for

the stock pick. Further, it is interesting to include

emerging countries and compare them with

developed countries to assess the navigation during

uncertain times of these countries.

ACKNOWLEDGEMENTS

This work is supported by Bina Nusantara University

as a part of Bina Nusantara University's BINUS

International Research - Basic with contract number:

069B/VRRTT/III/2024 and contract date: March 18,

2024.

AUTHOR CONTRIBUTIONS

Melissa Putritama, Natanael Christian Adinata, and

Nathalie Noviani – data collection, methodology, original

draft, analysis, and interpretation. Shinta Amalina Hazrati

Havidz – conception, project administration, original draft,

methodology, review, revision, validation, and supervision.

DATA STATEMENT

The data used in this study cannot be made available due to

commercial reason.

REFERENCES

Aggarwal, S., Nawn, S. and Dugar, A. (2021) ‘What caused

global stock market meltdown during the COVID

pandemic–Lockdown stringency or investor panic?’,

Finance Research Letters, 38(November 2020), p.

101827. Available at:

https://doi.org/10.1016/j.frl.2020.101827.

Al-Awadhi, A.M., Alsaifi, K., Al-Awadhi, A. and

Alhammadi,S. (2020) ‘Death and contagious infectious

diseases: Impact of the COVID-19 virus on stock

market returns’, Journal of Behavioral and

Experimental Finance, 27. Available at:

https://doi.org/10.1016/j.jbef.2020.100326.

Albaity, M., Saadaoui Mallek, R. and Mustafa, H. (2023),

‘Heterogeneity of investor sentiment, geopolitical risk

and economic policy uncertainty: do Islamic banks

differ during COVID-19 pandemic?’, International

Journal of Emerging Markets, Vol. ahead-of-print No.

ahead-of-print. https://doi.org/10.1108/IJOEM-11-

2021-1679

Ali, S., Naveed, M., Saleem, A. and Nasir. M.W. (2022)

‘TIME-FREQUENCY CO-MOVEMENT BETWEEN

COVID-19 AND PAKISTAN’S STOCK MARKET:

EMPIRICAL EVIDENCE FROM WAVELET

COHERENCE ANALYSIS’, Annals of Financial

Economics, 17 No 4. Available at:

https://doi.org/10.1142/S2010495222500269.

Aloui, C., Shahzad, S.J.H., Hkiri, B., Hela, B.H. and Khan,

M.A. (2021) ‘On the investors ’ sentiments and the

Islamic stock-bond interplay across investments ’

horizons’, Pacific-Basin Finance Journal,

65(November 2020), p. 101491. Available at:

https://doi.org/10.1016/j.pacfin.2020.101491.

Ashraf, B.N. (2020) ‘Stock markets’ reaction to COVID-

19: Cases or fatalities?’, Research in International

Business and Finance,54(May),p.101249. Available at:

https://doi.org/10.1016/j.ribaf.2020.101249.

Behera, J., Pasayat, A.K. and Behera, H. (2022) ‘COVID-

19 Vaccination Effect on Stock Market and Death Rate

in India’, Asia-Pacific Financial Markets, 29(4), pp.

651–673. Available at: https://doi.org/10.1007/s10690-

022-09364-w.

Chang, C., Feng, G. and Zheng, M. (2021) ‘Government

Fighting Pandemic , Stock Market Return , and

COVID-19 Virus Outbreak’, Emerging Markets

Finance and Trade, 00(00), pp. 1–18. Available at:

https://doi.org/10.1080/1540496X.2021.1873129.

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

214

Chowdhury, M.I.H., Balli, F. and Bruin, A. de (2022)

‘Islamic equity markets versus their conventional

counterparts in the COVID-19 age: Reaction,

resilience, and recovery’, International Review of

Finance, 22(2), pp. 315–324. Available at:

https://doi.org/https://doi.org/10.1111/irfi.12349.

Christopoulos, A.G., Mylonakis, J. and Koromilas, C.

(2011) ‘Measuring the impact of financial crisis on

international markets: An application of the Financial

Stress Index’, Review of European Studies, 3(1), pp.

22–34. Available at:

https://doi.org/10.5539/res.v3n1p22.

Demir, E., Kizys, R., Rouatbi, W. and Zaremba, A. (2021)

‘COVID-19 Vaccinations and the Volatility of Energy

Companies in International Markets’, Journal of Risk

and Financial Management, 14(12), p. 611. Available

at: https://doi.org/10.3390/jrfm14120611.

Dewi, S.Y., Maesya’bani and Mutmainah, L. (2022) ‘The

Effect of Exchange Rates and Interest Rates on Sharia

Stock Index in Indonesia: Before and During the Covid-

19 Pandemic’, ITQAN: Journal of Islamic Economics,

Management, and Finance, 1(2), pp. 43–52. Available

at: https://doi.org/10.57053/itqan.v1i2.8.

Fernandes, M., Medeiros, M.C. and Scharth, M. (2014)

‘Modeling and predicting the CBOE market volatility

index’, Journal of Banking and Finance, 40(1), pp. 1–

10. Available at:

https://doi.org/10.1016/j.jbankfin.2013.11.004.

Francis, F., & Ambilikumar, D. (2021) ‘Impact of Covid-

19 cases on Global Stock Market’,The Journal of

Contemporary Issues in Business and Government,

27(3). https://doi.org/10.47750/cibg.2021.27.03.124

Ftiti, Z., & Hadhri, S. (2019) ‘Can economic policy

uncertainty, oil prices, and investor sentiment predict

Islamic stock returns? A multi-scale

perspective’,Pacific-basin Finance Journal, 53, 40–55.

https://doi.org/10.1016/j.pacfin.2018.09.005

Grima, S., Özdemir, L., Özen, E., & Romānova, I. (2021)

‘The Interactions between COVID-19 Cases in the

USA, the VIX Index and Major Stock Markets’,

International Journal of Financial Studies, 9(2), 26.

https://doi.org/10.3390/ijfs9020026

Gu, J., Yue, X.G., Nosheen, S., Hag, N.U. and Shi.L. (2022)

‘Does more stringencies in government policies during

pandemic impact stock returns ? Fresh evidence from

GREF countries , a new emerging green bloc’,

Resources Policy, 76(September 2021), p. 102582.

Available at:

https://doi.org/10.1016/j.resourpol.2022.102582.

Hasan, M.B., Mahi, M., Hassan, M.K. and Bhuiyan, A.B.

(2021) ‘Impact of COVID-19 pandemic on stock

markets: Conventional vs. Islamic indices using

wavelet-based multi-timescales analysis’, North

American Journal of Economics and Finance,

58(June),p.101504.Available at:

https://doi.org/10.1016/j.najef.2021.101504.

Hausman, J. A. (1978). Specification Tests in

Econometrics. Econometrica, 46(6), 1251–1271.

https://doi.org/10.2307/1913827

Havidz, S.A.H., Tiffani., Calvilus, I.C. and Angelita, Z.

(2023) ‘COVID-19 full vaccination and blockchain

size: empirical evidence from the cryptocurrency

market’, EuroMed Journal of Business, 18(2), pp. 229-

247. Available at: https://doi.org/10.1108/EMJB-12-

2021-0200.

Havidz, S. A. H., Anastasia, E. V., Patricia, N. S., Diana, P.

(2024) ‘COVID-19 vaccine confidence index and

economic uncertainty indices: empirical evidence from

the payment-based system cryptocurrency market’,

International Journal of Social Economics. doi:

10.1108/IJSE-05-2023-0392.

Hersh, N.F., Masron, T.A., Pitchat, A.A., Malim, N.A.K.

and Mazlan, P.N.B.M. (2023) ‘Does government

stringency policy reduce the adverse effects of COVID-

19 on Islamic stock?’, Asian Academy of Management

Journal [Preprint]. Available at:

https://ejournal.usm.my/aamj/article/view/3191.

Jawadi, F., Jawadi, N. and Louhichi, W. (2014)

‘Conventional and Islamic stock price performance: An

empirical investigation’, International Economics, 137,

pp. 73–87. Available at:

https://doi.org/10.1016/j.inteco.2013.11.002.

Jeremiah, M., Setiadi, A. and Havidz, S.A.H. (2023)

‘COVID-19 Vaccination and Fear Indices Impacting

the Price of Healthcare Stock Indices in Southeast Asia

during the Vaccination Rollout’, 14(1), pp. 194–213.

Available at: https://doi.org/:

https://doi.org/10.15388/omee.2023.14.88.

Kaplanski, G. and Levy, H. (2010) ‘Sentiment and stock

prices: The case of aviation disasters’, Journal of

Financial Economics, 95(2), pp. 174–201. Available at:

https://doi.org/10.1016/j.jfineco.2009.10.002.

Khan, M.K. (2019) ‘Impact of Exchange Rate on Stock

Returns in Shenzhen Stock Exchange : Analysis

Through ARDL Approach’, International Journal of

Economics and Management, 1(2), pp. 15–

26. Retrieved from

https://dergipark.org.tr/en/pub/jecoman/issue/49682/6

36984

Khalfaoui, R., Nammouri, H., Labidi, O and Jabeur, S.B.

(2021) ‘Is the COVID-19 vaccine effective on the US

financial market ?’, Public Health, 198, pp. 177–179.

Available at:

https://doi.org/10.1016/j.puhe.2021.07.026.

Levin, A., Lin, C.F., and Chu, C.S.J. (2002) ‘Unit Root

Tests in Panel Data: Asymptotic and Finite-Sample

Properties’, Journal of econometrics, 108, 1-24.

Available at: https://doi.org/10.1016/S0304-

4076(01)00098-7

Makun, K. (2021) ‘COVID-19 based global fear index,

economic fundamentals and stock return nexus:

analysis of Asia-Pacific stock markets’, International

Journal of Monetary Economics and Finance, 14 No 6,

pp. 532–550. Available at:

https://doi.org/https://doi.org/10.1504/IJMEF.2021.12

0031.

Mroua, M. and Trabelsi, L. (2020) ‘Causality and dynamic

relationships between exchange rate and stock market

indices in BRICS countries’, Journal of Economics,

COVID-19 and Macro-Financial Forces: Who Drives the Conventional and Islamic Stock Markets?

215

Finance and Administrative Science, 25(50), pp. 395–

412. Available at: https://doi.org/10.1108/JEFAS-04-

2019-0054.

Nomran, N.M. and Haron, R. (2021) ‘The impact of

COVID-19 pandemic on Islamic versus conventional

stock markets: international evidence from financial

markets’, Future Business Journal, 7(1), pp. 1–16.

Available at: https://doi.org/10.1186/s43093-021-

00078-5.

Paltrinieri, A., Floreani, J., Kappen, J.A., Mitchell, M.C.

and Chawla, K. (2019) ‘Islamic, socially responsible,

and conventional market comovements: Evidence from

stock indices’, Thunderbird International Business

Review, 61(5), pp. 719–733. Available at:

https://doi.org/10.1002/tie.22027.

Pan, B. (2023) ‘The asymmetric dynamics of stock – bond

liquidity correlation in China : The’, Economic

Modelling, 124(August 2022), p. 106295. Available at:

https://doi.org/10.1016/j.econmod.2023.106295.

Pesaran, M. H., Shin, Y., & Smith, R. P. (1999) ‘Pooled

Mean Group Estimation of Dynamic Heterogeneous

Panels’, Journal of the American Statistical

Association, 94(446), 621–634.

https://doi.org/10.2307/2670182

Qin, F., Zhang, J. and Zhang, Z. (2018) ‘RMB exchange

rates and volatility spillover across financial markets in

China and Japan’, Risks, 6(4). Available at:

https://doi.org/10.3390/risks6040120.

Rouatbi, W., Demir, E., Kizys, R. and Zaremba, A. (2021)

‘Immunizing markets against the pandemic: COVID-19

vaccinations and stock volatility around the world’,

International Review of Financial Analysis, 77(June),

p. 101819. Available at:

https://doi.org/10.1016/j.irfa.2021.101819.

Salisu, A.A., Akanni, L. and Raheem, I. (2020) ‘The

COVID-19 global fear index and the predictability of

commodity price returns’, Journal of Behavioral and

Experimental Finance, 27, p. 100383. Available at:

https://doi.org/10.1016/j.jbef.2020.100383.

Salisu, A.A. and Akanni, L.O. (2020) ‘Constructing a

Global Fear Index for the COVID-19 Pandemic’,

Emerging Markets Finance and Trade, 56(10), pp.

2310–2331. Available at:

https://doi.org/10.1080/1540496X.2020.1785424.

Scherf, M., Matschke, X. and Rieger, M.O. (2022) ‘Stock

market reactions to COVID-19 lockdown : A global

analysis’, Finance Research Letters, 45(December

2020), p. 102245. Available at:

https://doi.org/10.1016/j.frl.2021.102245.

Shu, H.-C., & Chang, J.-H. (2018) ‘Spillovers of volatility

index: Evidence from U.S., European, and Asian Stock

Markets’, Applied Economics, 51(19), 2070–2083.

https://doi.org/10.1080/00036846.2018.1540846

Sun, Y., Amanda, C. and Centana, B.C. (2023) ‘The effect

of hashrate, transaction volume, social media and

macroeconomics on Bitcoin before and during the

COVID-19 pandemic’, Asian Journal of Accounting

Research [Preprint]. Available at:

https://doi.org/10.1108/ajar-10-2022-0319.

Tee, L. and Kew, S. (2022) ‘COVID-19 Cases, Deaths,

Vaccinations and Malaysian Islamic Stock Market

Returns’, Journal of International Business, Economics

and Entrepreneurship, 7(1), pp. 12–18. Available at:

https://doi.org/10.24191/jibe.v7i1.18660.

Tiffani, Calvilus, I.C. and Havidz, S.A.H. (2023)

‘Investigation of cointegration and causal linkages on

Bitcoin volatility during COVID-19 pandemic’, Global

Business and Economics Review, 28(2), pp. 195–217.

Available at:

https://doi.org/https://doi.org/10.1504/GBER.2023.128

844.

Topcu, M. and Serkan, O. (2020) ‘The impact of COVID-

19 on emerging stock markets’, Finance Research

Letters, 36(June), p. 101691. Available at:

https://doi.org/10.1016/j.frl.2020.101691.

Umar, Z. and Gubareva, M. (2020) ‘A time–frequency

analysis of the impact of the Covid-19 induced panic on

the volatility of currency and cryptocurrency markets’,

Journal of Behavioral and Experimental Finance, 28, p.

100404. Available at:

https://doi.org/10.1016/j.jbef.2020.100404.

Widjaja, M., Gaby, N., & Havidz, S. A. H. (2023) ‘Are gold

and cryptocurrency a safe haven for stocks and bonds?

Conventional vs Islamic markets during the COVID-19

pandemic’, European Journal of Management and

Business Economics. https://doi.org/10.1108/ejmbe-

05-2022-0135

Zhang, D., Hu, M. and Ji, Q. (2020) ‘Financial markets

under the global pandemic of COVID-19’, Finance

Research Letters, 36(April), p. 101528. Available at:

https://doi.org/10.1016/j.frl.2020.101528.

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

216