Economic Determinants and Oil Shocks: Unravelling the Impact of

Kuala Lumpur Composite Index (KLCI) Performance

Dhia Damia Husni and Abd Hadi Mustaffa

a

Faculty of Business Management and Professional Studies, Management & Science University, University Drive,

Off Persiaran Olahraga, 40100 Shah Alam, Selangor, Malaysia

Keywords: Oil Shocks, Stock Market Performance, ARDL.

Abstract: The Kuala Lumpur Composite Index (KLCI) increase steadily from 1970 to 2023 despite major swings in

important economic indicators such as inflation, exchange rates, GDP, and oil shocks. This divergence

between economic issues and stock market performance emphasises the importance of delving deeper into

the underlying causes. This study examines the impact of economic forces and oil shocks on KLCI

performance using World Bank data from 1970 to 2023. The Auto Regression Distribution Lag (ARDL)

model was used to determine how these variables influence stock market performance in the short and long

run. Two findings are highlighted based on ARDL analysis. First, the short-run findings indicate that Oil Price,

GDP, and Exchange Rate positively impact KLCI. However, inflation delivers a significant and negative

impact on KLCI. Second, the long-run findings indicate that oil prices and GDP deliver significant and

positive impacts towards KLCI. However, inflation and exchange rates have significant and negative impacts

on KLCI. Those findings lead towards further discussion and policy recommendations in the later section,

aligning with SDG 7 (Affordable and clean energy) and 8 (Decent Work and economic growth).

1 INTRODUCTION

Studies on stock market performance have

consistently investigated the impact of various

economic and non-economic factors that determine

market results. These studies frequently concentrate

on components such as value, momentum, and

macroeconomic indicators, examining their impact

on stock returns. Surprisingly, stock markets have

exhibited resilience, occasionally exhibiting positive

returns during economic downturns, highlighting

their ability to survive economic adversities. In

Malaysia, the Kuala Lumpur Stock Exchange,

rebranded as Bursa Malaysia in 2004, is the principal

trading platform. The Kuala Lumpur Composite

Index (KLCI), a significant market performance

indicator, reflects larger economic trends and

provides useful insights into the market's overall

health (Chia et al., 2020).

The KLCI's trading volume trend from 1970 to

2023 shows an overall upward tendency, with notable

drops in individual years such as 1995, 2009, and

2021. These downturns were caused by both global

a

https://orcid.org/0000-0003-1919-2009

and domestic economic shocks, with the ASEAN

financial crisis of the late 1990s having a critical role

(Boonman, 2023). In addition to these crises, oil price

shocks had a substantial impact on KLCI

performance, demonstrating the intricate link

between global oil price changes and the Malaysian

market. This highlights the need to take into account

both macroeconomic forces and external influences,

such as oil price swings, when analyzing KLCI

patterns.

To fill this research gap, the study examines the

impact of both economic forces and oil shocks on the

short run and long run performance of the KLCI using

World Bank data from 1970 to 2023. This paper has

made some contributions. First is methodology

contribution, an econometric analysis, especially an

Auto Regressive Distributed Lag (ARDL) model,

will be used to assess the correlations between these

factors and KLCI performance. This model allows for

the investigation of both short- and long-term impacts

while accounting for any cointegration among the

variables. The study's goal is to investigate how these

parameters influence KLCI performance, both

Husni, D. D. and Mustaffa, A. H.

Economic Determinants and Oil Shocks: Unravelling the Impact of Kuala Lumpur Composite Index (KLCI) Performance.

DOI: 10.5220/0013429700003956

In Proceedings of the 7th International Conference on Finance, Economics, Management and IT Business (FEMIB 2025), pages 243-250

ISBN: 978-989-758-748-1; ISSN: 2184-5891

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

243

separately and in combination, by taking into account

their interactions and correlations. Second, the study

contributes new perspectives by concentrating on

Malaysia's oil shocks and macroeconomic factors,

which have received little attention in rising

Southeast Asian economies (Nguyen & Pham, 2021;

Umar et al., 2023). The third contribution

incorporates SDG 8: Decent Work and Economic

Growth and SDG 7: Affordable and Clean Energy. By

examining the impact of oil shocks and

macroeconomic factors, this research offers policy

recommendations to promote sustainable economic

growth and energy efficiency while fostering resilient

financial systems that support inclusive economic

opportunities in Malaysia.

2 LITERATURE REVIEW

2.1 Underpinning Theory

The Efficient Market Hypothesis (EMH), a well-

known hypothesis in financial economics, asserts that

financial markets are informationally efficient, which

means that asset prices quickly reflect all available

information (Fama, 1970). Because price fluctuations

are mostly influenced by fresh information, which is

erratic and unpredictable, EMH contends that it is

practically impossible for investors to outperform the

market regularly. This idea is essential to comprehend

how the stock market behaves and how outside

influences, such as macroeconomic variables and

shocks connected to oil, affect market performance.

One of the primary principles of the EMH is the

idea that markets are efficient, which contradicts

conventional wisdom regarding investors' or fund

managers' capacity to "beat the market" by using

better strategy or analysis. Rather, the theory suggests

that stock values fluctuate in a "random walk,"

meaning it is impossible to forecast future changes

based on historical performance. According to EMH,

the market quickly prices in variables like GDP

growth, inflation, and oil price volatility, eliminating

any opportunity for arbitrage or excess gains

(Samuelson, 1965).

The EMH's critics argue that transaction costs,

market anomalies, and behavioural biases contribute

to inefficiencies that keep markets from operating

optimally. For example, short-term asset mispricing

may result from irrational investor behaviour, as

shown during market booms or collapses (Gupta et

al., 2025). This theory calls into question the fact that

genuine intrinsic values are always reflected in

markets. Furthermore, detractors point out that

regulatory restrictions, reduced liquidity, and

restricted information access may cause emerging

markets like Malaysia to deviate from efficiency

(Ahmad & Wu, 2022). The effect of outside shocks,

such as changes in the price of oil, on market

efficiency is another issue that the EMH framework

calls into question. Critics point out that although the

hypothesis posits that markets react to shocks fast, the

precision and speed of this adjustment might vary

based on the market's depth, maturity, and

information availability (El Ghoul et al., 2022).

2.2 Empirical Review

Empirical research on the effects of oil shocks and

macroeconomic variables on Malaysia's stock market

reveals disparities between short- and long-term

effects. Dutta et al. (2021) found that fluctuations in

oil prices had a considerable impact on stock returns.

The market reacts poorly during crises, such as the

COVID-19 epidemic, but recovers as oil prices rise.

Mokni (2020) also implies that demand-driven oil

shocks tend to stabilize stock returns in the long run,

whereas supply shocks often cause short-term

volatility.

The impact of oil prices on the stock market is

mixed. Aowa et al. (2023) found a negative long-term

impact caused by growing expenses for oil-dependent

enterprises. However, Siow et al. (2023) discovered

that Malaysia, as a significant oil exporter, benefits

from rising oil prices over time. Oil consumption is

also important, as more consumption is associated

with better stock performance. Alamgir and Amin

(2021) claimed that higher oil usage boosts national

GDP and investor confidence over time.

Inflation's effect on the stock market is more

complex. While Kalam (2020) reported a beneficial

influence on Malaysian stock indices, Sumaryoto et

al. (2021) discovered no meaningful short-term

impact. Inflation might reduce purchasing power in

the short term, but it also indicates economic stability

and growth. Meanwhile, GDP consistently correlates

positively with stock performance, with Li et al.

(2022) and Zulkifli et al. (2024) correlating economic

expansion to increased consumer spending and

market confidence. As Liu et al. (2023) point out,

GDP contractions often result in negative stock

returns. Finally, exchange rates have a variable

impact on stock markets across time. While Dang et

al. (2020) reported a long-term positive association

with Malaysia's KLCI, short-term volatility

frequently caused market instability.

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

244

3 METHODOLOGY

3.1 Data Collection and Source

The relationship between Malaysia's stock market

performance, oil shocks, and key Macroeconomic

indicators has been intensively studied. This research

incorporates significant macroeconomic factors that

influence Malaysia's stock market performance. The

explained variable in this study is stock market

performance. Annual data spanning from 1970 to

2023 was collected from publicly available online

sources from the World Bank Development

Indicators (WDI), as presented in Table 1. The data

underwent a log transformation before conducting the

Auto Regression Distribution Lag (ARDL) bound test.

The data were log-transformed before the application

of the ARDL bound test.

3.2 Model Specification

The study employed the auto Regressive Distributed

Lag (ARDL) model initially developed by (Pesaran et

al., 2001) to examine the long-term and short-term

interactions among oil shocks, oil price, oil usage and

key Macroeconomic factors affecting the Malaysian

stock market performance. The methodology is

particularly valuable for analysing connections

among non-stationary time series data, including

variables that exhibit trends or random fluctuations.

The ARDL approach offers a significant advantage in

managing models with mixed-order integration,

accommodating variables that may exhibit varying

orders of integrations. Some variables may be

integrated into order one (I (1)), indicating the

presence of a unit. Root and non-stationery are

present, whereas others may exhibit zero (I (0))

integration, indicating stationery. Consequently, it is

possible to examine relationships among variables

using different statistical properties.

The ARDL approach allows researchers to

estimate the long-term equilibrium relationships

between variables while capturing short-term

dynamics or adjustments towards equilibrium. This

methodology facilitates the assessment of the impact

or changes in one variable on another over time, even

in the presence of non-stationary variables. This

model was constructed to establish the relationship

between the dependent and independent variables.

Where LnKLCI is the Stock market performance

in period t, LnOILRENTS is the

oil rents (% of GDP)

in period t, OILPRI is the oil pump price in period t,

OILUSG is the domestic oil usage in period t, IF is

the inflation rate in period t, GDP is gross domestic

product in period t, and lastly MYR is Malaysian

ringgit exchange rate in period t. In addition, β_0 is a

constant, β_1 to β_6 are the respective regression

coefficients, ε_ denotes stochastic white noise, and t

denotes the period (1970 to 2023).

3.3 Unit Root Test (Test for

Stationarity)

Studies indicate that unit roots may result in

erroneous conclusions in time series analysis

(Granger & Newbold, 1974; Philips, 1987). The

Augmented Dicky-Fuller (ADF) and Philips- Perron

(PP) tests have been established to evaluate the

stationarity of standard unit roots (Dicky & Fuller,

1979; Perron, 1990). Unit root tests are essential for

assessing the integration order variables or series that

are predominantly non-stationary. The specified

model (Equation 3) assumes that the variables exhibit

unit roots at the initial level. These variables can be

converted into stationary via first differencing,

represented as (I (1)). The ADF and PP tests can be

utilised to assess the existence of a unit root in this

scenario. The standard formulation of the ADF test is

expressed in Equation 1:

(1)

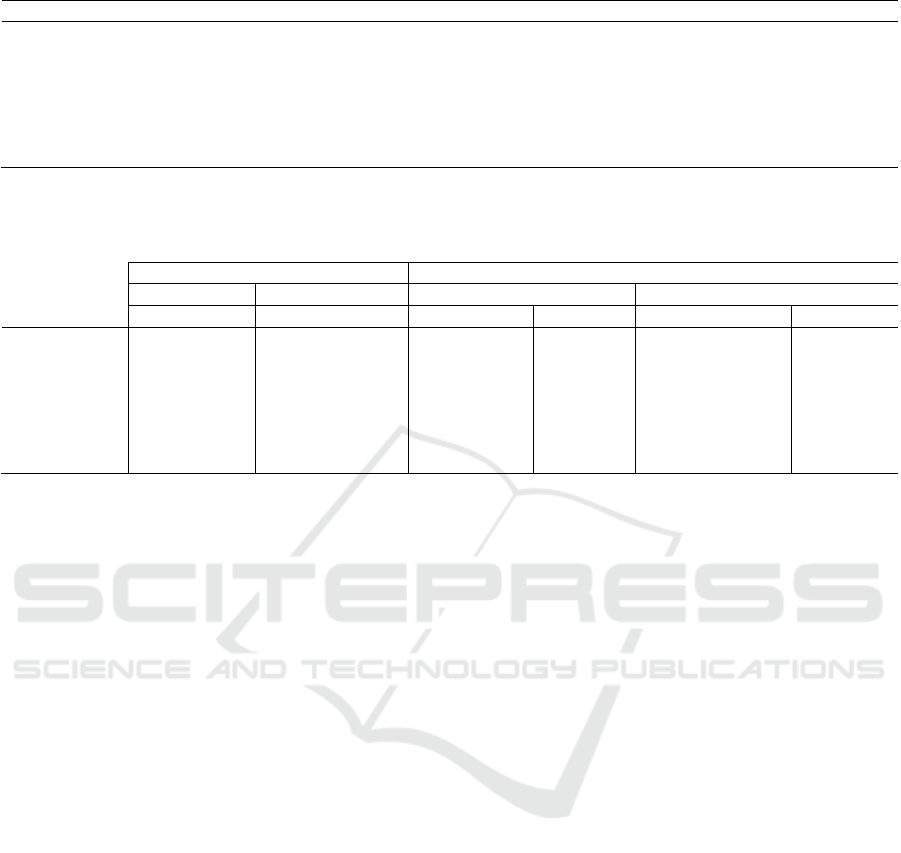

Table 1: Variable description and data source.

Variables Descriptions Measurement units Source

KLCI Mala

y

sian stoc

k

market

p

erformance Stoc

k

traded, total value

(

%ofGDP

)

WDI

OILRENTS Oil shocks Oil rents (% of GDP) WDI

OILPRI Oil

p

rice Pum

p

p

rice fo

r

g

asoline

(

US$

p

e

r

litre

)

WDI

OILUSG Oil usage Energy use (kg of oil equivalent

p

e

r

capita) WDI

IF Inflation Inflation, consume

r

p

rices

(

annual %

)

WDI

GDP Gross Domestic Product GDP growth (annual %) WDI

MYR Exchan

g

e Rate Official exchan

g

erate

(

LCU

p

e

r

US$,

p

erio

d

avera

g

e

)

WDI

Economic Determinants and Oil Shocks: Unravelling the Impact of Kuala Lumpur Composite Index (KLCI) Performance

245

Exogeneity test was not judged necessary in this

study because it used the Auto Regressive Distributed

Lag (ARDL) model. The ARDL model is resistant to

endogeneity problems, particularly when variables of

order I(0) or I(1), as in the case of the selected

independent variables. Furthermore, the factors

chosen—such as oil price shocks, GDP, inflation, and

currency rates—are predominantly impacted by

broader macroeconomic dynamics and are unlikely to

be considerably affected by KLCI performance,

particularly in the short run. As a result, exogeneity

problems are negligible in this setting, and rigorous

testing was not necessary. However, if any

endogeneity is discovered throughout the analysis,

suitable corrective steps will be implemented.

3.4 ARDL Model

The variables identified by the ARDL bounds test

exhibit a common stochastic trend and will increase

proportionally over time. Engle and Granger (1987)

propose that an error correction model (ECM) is

warranted when a long-term relationship exists

between the variables. The vector autoregression

model (VAR) is generally favoured when the

variables demonstrate a short-term relationship. In the

context of cointegration, an ECM representation can

be articulated through equations 3.

Where

represents the Malaysia stock

market performance,

denotes the residual

series from the long-run regression error correction

term, is the parameter for the speed of adjustment,

is the difference operator,

is the constant to

represent the regression coefficients, n represents the

optimal lag orders, and I represent the number of

variables in the model, which could be from 1 to k.

The dependent variable is a function of its lagged

values

, which becomes an exogenous

variable among the legged values of the regressors in

the model.

The ARDL form for the long-run relationship

model in the context of cointegration is specified in

equation (2):

The short-run model, estimated with ECM, is

formulated as in equation (3):

4 RESULTS AND DISCUSSIONS

4.1 Descriptive Results

Table 2 contains descriptive statistics on oil shocks,

oil prices, oil usage, and major economic factors that

influenced Malaysia's stock market performance

from 1970 to 2023. The KLCI has a mean of 5.4018

and a standard deviation of 6.1850, indicating high

market volatility caused by macroeconomic

conditions, financial crises, and fluctuations in

investor opinion.

Oil-related variables fluctuate at different rates.

Oil shocks (OILRENTS) have a mean of 4.758 and a

standard deviation of 3.087, suggesting Malaysia's

vulnerability to geopolitical risks and global supply-

demand imbalances. In contrast, oil prices (OILPRI)

showed less variability (mean: 0.442, SD: 0.0851),

indicating that global pricing systems have partially

stabilized excessive volatility. However, given

Malaysia's reliance on oil, even small price

fluctuations can have an impact on the stock market.

Aside from oil, other economic indices show

noticeable movements. Oil usage (OILUSG) has a

mean of 2514.932 and a standard deviation of

777.841, indicating that it responds to industrial

activity and economic cycles. Inflation (IF) is very

variable (mean: 3.358, SD: 2.793), influenced by both

domestic and global economic influences.

Meanwhile, GDP growth has been reasonably

consistent (mean: 6.617, SD: 2.657), demonstrating

Malaysia's resilience in the face of global and local

economic shifts. The currency rate (MYR), with a

mean of 3.128 and a standard deviation of 0.693,

shows moderate volatility, which is critical for

investor confidence and trade competitiveness.

Aside from oil, other economic indices show

noticeable movements. Oil usage (OILUSG) has a

mean of 2514.932 and a standard deviation of

777.841, indicating that it responds to industrial

activity and economic cycles. Inflation (IF) is very

variable (mean: 3.358, SD: 2.793), influenced by both

domestic and global economic influences.

Meanwhile,

GDP growth has been reasonably

(2)

(3)

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

246

Table 2: Descriptive Statistics.

Variables Observ Mean St. Dev Minimum Maximum

Stoc

k

market

p

erformance

(

KLCI

)

54 5.402 6.185 1.172 2.491

Oil shocks (OILRENTS) 54 4.758 3.087 0.017 13.334

Oil

p

rice

(

OILPRI

)

54 0.442 0.085 0.280 0.680

Oil usage (OILUSG) 54 2514.932 777.841 1029.126 3500.000

Inflation

(

IF

)

54 3.358 2.793 0.290 17.3289

Gross domestic

p

roduct (GDP) 54 6.6172 2.6574 0.5177 11.7011

Exchan

g

e rate

(

MYR

)

54 3.1284 0.6928 2.1769 4.4011

Note: The results are taken before using an algorithm. KLCI, OILRENTS, OILPRI, OILUSG, IF, GDP and MYR represent Stock Market

Performance, Oil shocks, Oil Prices, Oil Usage, Inflation, Gross domestic product and Exchange Rate.

Table 3: Unit root test via Augmented Dicky-fuller (ADF) and Philips-Perron (PP).

ADF Philli

p

s-Perron

T-STAT At level First difference

Variables At level First difference Z(

p

) Z(t) Z(

p

) Z(t)

KLCI -2.12 -11.48*** 0.08* -3.29 0.0000*** -11.48

OILRENTS -6.53 -4.66*** 0.00*** -7.69 0.0001*** -5.66

OILPRI -2.59 -4.50*** 0.65 -1.88 0.0355** -3.65

OILUSG -1.48 -6.28*** 0.93 -1.06 0.0000*** -10.65

IF -4.51 -9.23*** 0.003*** -4.51 0.0000*** -10.23

GDP -6.34 -11.02*** 0.00*** -6.33 0.0001*** -37.44

MYR -3.62 -5.59*** 0.15 -2.95 0.0002*** -5.48

consistent (mean: 6.617, SD: 2.657), demonstrating

Malaysia's resilience in the face of global and local

economic shifts. The currency rate (MYR), with a

mean of 3.128 and a standard deviation of 0.693,

shows moderate volatility, which is critical for

investor confidence and trade competitiveness.

4.2 Unit Root Test Results (Test for

Stationery)

Before implementing the ARDL test, confirm that

each variable's unit root is stationary at I(0), I(1), or

both for the bound F-statistical test. The integration

order of the variables was determined using the

augmented Dicky-Fuller (ADF) and Philips-Perron

(PP) unit root tests (Dicky & Fuller, 1979; Perron,

1990), and the results were compared to Mackinnon's

(1996) critical values. The null hypothesis implies the

existence of a unit root, and a test statistic less than

the critical value demonstrates stationarity. As shown

in Table 3, the ADF and PP tests show that all

variables (KLCI, OILRENTS, OILPRI, OILUSG, IF,

GDP, and MYR) are stationary at I(1) with a 0.05

significant level. This implies that there is no unit

root, showing that the variables follow a stable or

predictable pattern, and that they have the same order

of stationarity, implying a possible long-run link.

4.3 Short Run Estimation

Engle & Granger (1987) assert that an Error

Correction Model (ECM) should be developed when

a long-run relationship exists between variables. As a

result, ECM was created to estimate the error term.

The estimated coefficient of ARDL-ECM indicates

the existence of cointegration among variables and

exhibits a positive sign. It means the adjustment rate

to long-run equilibrium after experiencing short-run

disturbances. The estimated ECM coefficient in this

study is - 0.02, which is statistically significant at the

5% level. This finding indicates that any divergence

from short-run equilibrium among variables and

Stock Market performance can be corrected and

reinstated annually at 0.02% in the long run, as

demonstrated in Table 4. Following the verification

of long and short-run associations between variables

through the ARDL test, the study identifies the

parameters for these variables in both time frames.

The short-run ARDL model finds numerous

significant drivers of Malaysia's stock market

performance (DLnKLCI). Oil price (DLnOILPRI),

lagged by one and two periods, has a substantial

negative impact on KLCI, with a coefficient of

3.6202 (p = 0.0380), showing that higher oil prices in

the past have harmed stock market performance.

Lagged inflation (DLnIF) spanning four periods

likewise demonstrates a negative association, with a

coefficient of -0.1940 (p = 0.0323), implying that

higher historical inflation damages the market by

Economic Determinants and Oil Shocks: Unravelling the Impact of Kuala Lumpur Composite Index (KLCI) Performance

247

Table 4: Estimated Short-run coefficient from ARDL (54 observations from 1970 to 2023).

DLnKLCI Coefficient Std. Error T-statistics Prob Results Impact

DLnOILRENTS 0.0211 0.1286 0.1641 0.8707 Not significant -

DLnOILPRI (-1) (-2) 3.6202 1.6706 -2.1669 0.0380 Significant Positive

DLnOILUSG -0.2729 0.5380 -0.5072 0.6155 Not significant -

DLnIF (-1) (-2)(-3)(-4) - 0.1940 0.08657 -2.2415 0.0323 Significant Negative

DLnGDP (-1) (-2) 0.2370 0.1168 2.0288 0.0511 Significant Positive

DLnMYR (-1) 2.1621 0.8074 2.6778 0.0117 Significant Positive

ECM -0.0174 0.0029 -5.9214 0.0000 Significant Positive

*P>|z| values are based on a 5% significant level. The dependent variable is Malaysia's stock market performance (KLCI). ARDL

(3,0,4,2,1,2,0) was selected using Akaike information criteria (Source: Author's Estimation).

Table 5: Estimated Long-run coefficient from ARDL (54 observations from 1970 to 2023).

LnKLCI Coefficient Std. Error T-statistics Prob Results Impact

LnOILRENTS 0.0211 0.1285 0.1641 0.8707 Not significant -

LnOILPRI 2.3587 1.0323 2.2848 0.0293 Si

g

nificant Positive

LnOILUSG -0.2729 0.5380 -0.5073 0.6155 Not significant -

LnIF -0.2966 0.1195 -2.4823 0.0187 Si

g

nificant Ne

g

ative

LnGDP 0.2580 0.1094 2.3589 0.0248 Significant Positive

LnMYR -2.5028 0.8905 -2.8104 0.0085 Si

g

nificant Ne

g

ative

*P>|z| values are based on a 5% significant level. The dependent variable is Malaysia's stock market performance (KLCI). ARDL

(3,0,4,2,1,2,0) selected by Akaike information criteria (Source: Author's Estimation)

reducing consumer spending and purchasing power.

Gross Domestic Product (DLnGDP), which is lagged

by one or two periods, has a positive correlation with

stock market performance, with a coefficient of

0.2370 (p = 0.0511), demonstrating that economic

expansion stimulates the market. The exchange rate

(DLnMYR) also has a positive effect, with a

coefficient of 2.1621 (p = 0.0117), implying that a

stronger Malaysian Ringgit boosts stock market

performance. The ECM coefficient of -0.0174 (p =

0.0000) indicates that short-term deviations from

long-run equilibrium are rectified at a rate of 1.74%

each cycle.

In contrast, oil shocks (OILRENTS) and oil

consumption (DLnOILSUG) had no significant

impact on KLCI performance, with coefficients of

0.0211 (p = 0.8707) and -0.2729 (p = 0.6155),

respectively, indicating that changes in oil prices or

usage do not instantly affect Malaysia's stock market.

4.4 Long Run Estimation

The long-run ARDL estimation results based on

Table 5 indicate several significant relationships

between all variables and Malaysia's stock market

performance from 1970 to 2023. Oil price

(LnOILPRI) exhibits a significant positive effect on

LnKLCI, indicated by the coefficient of 2.3587 (p =

0.0293). A 1% increase in LnOILPRI results in a

2.36% increase in LnKLCI, highlighting the oil

price's significance in influencing the Malaysian

stock market performance. Inflation (LnIF)

significantly and negatively impacts LnKLCI,

indicated by a coefficient of -0.2966 (p = 0.0187).

Gross Domestic Product (LnGDP) exhibit a

significant and positive correlation with LnKLCI,

evidenced by a coefficient of 0.2580 (p = 0.0248),

suggesting an increase in gross domestic product

results in a 0.26% increase in Malaysia stock market

performance. The exchange rate (LnMYR) exhibits a

significant and negative impact on LnKLCI, indicated

by the coefficient of -2.5028 (p = 0.0085), suggesting

that a 1% depreciation in the Malaysian Ringgit

(LnMYR) leads to a 2.50% decline in the Malaysia

stock market performance. This finding underscores

the sensitivity of the stock market to currency

fluctuations, where a weaker exchange rate

negatively impacts investor confidence and stock

market valuations.

Conversely, various variables exhibit no

significant long-term effect on LnKLCI. The oil

shocks (LnOILRENTS) with a coefficient of 0.0211

(p = 0.8707) do not significantly influence the

Malaysia stock market performance, indicating that

fluctuations in the oil shocks do not impact LnKLCI

over a long time. Likewise, Oil Usage (LnOILUSG),

exhibiting a coefficient of -0.2729 (p = 0.6155),

indicates no significant relationship, implying that oil

usage does not directly affect Malaysia's stock market

performance.

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

248

4.5 Residual Diagnostics Check

Table 6 represents the residual diagnostics check

pertinent to the residual analysis of the ARDL model.

The model produced an R-square of 0.973297,

signifying a strong fit, as it accounts for

approximately 97.3% of the variability of the

Malaysian stock market performance (KLCI). The

adjusted R-Square values of 0.9578 indicated a robust

fit, considering the number of predictors in the model,

and demonstrated that approximately 95.8% of the

variations are explained post-adjustment. The

Durbin-Watson of 2.1869 indicates an absence of

significant autocorrelations in the residuals, as it is

approximately the ideal value of 2, signifying that the

errors are not serially correlated.

Table 6: Diagnostic Tests.

R- Square 0.9733

Ad

j

uste

d

R-S

q

uare 0.9578

Durbin-Watson statistics 2.1869

5 CONCLUSION

The study aims to provide insights into how oil

shocks, oil price fluctuations, oil usage, and key

macroeconomic variables influence Malaysia's stock

market performance in the short and long run and

their broader implications for economic stability and

policy formulation. Data for this analysis were

gathered from reliable sources, including the World

Bank and the Central Bank of Malaysia, from 1970 to

2023. The study employs the Auto Regression

Distributed Lag (ARDL) approach to investigate the

dynamic relationships and causality between these

variables and stock market performance, offering

valuable findings for policymakers and investors.

Two findings are highlighted based on ARDL

analysis. First, the short-run findings indicate that Oil

Price, GDP, and Exchange Rate positively impact

KLCI. However, inflation delivers a significant and

negative impact on KLCI. Second, the long-run

findings indicate that oil prices and GDP deliver

significant and positive impacts towards KLCI.

However, inflation and exchange rates have

significant and negative impacts on KLCI. Those

findings lead towards further discussion and policy

recommendations in the later section.

5.1 Policy Recommendation

The findings of this study present crucial policy

recommendations for improving Malaysia's stock

market stability in line with SDG 8, which focuses on

promoting economic growth and decent work. In the

medium term, stabilizing oil prices and lowering

reliance on fossil fuels are crucial for mitigating the

negative consequences of price volatility. Malaysia

should focus on energy diversification by investing in

renewable energy sources including solar, wind, and

hydropower. This will help to achieve SDG 7

(Affordable and Clean Energy) while also protecting

the economy from cyclical changes in oil prices. The

government may encourage energy sector innovation,

provide incentives for green technologies, and drive

private sector involvement in sustainable energy, all

of which would improve the economy's long-term

resilience.

To lessen dependency on global oil price

volatility, Malaysia must prioritize economic

diversification beyond the oil and gas industry in the

long run. Promoting GDP development through

investments in high-value areas like technology,

digital innovation, and green industries will help to

stabilize the stock market and promote SDG 8's aims

of inclusive and sustainable industrialisation.

Furthermore, fostering a business-friendly climate for

new industries, as well as investing in education and

skill development in the green economy, can help

Malaysia create jobs and maintain its global

competitiveness. Regional and global collaborations

are particularly important because they can supply the

resources, knowledge, and money required to

transition to a sustainable economy, which benefits

both SDGs 7 and 8.

5.2 Limitations and Future Research

Directions

Based on the result, this study has weaknesses

whereby two variables that do not have short-run and

long-run effects are oil shocks and oil usage. Hence,

future research directions are to revise the formula to

calculate oil shocks and usage or use a new proxy for

the variable. In addition, scholars can also test other

variables available in world development indicators

that may impact the Malaysian stock market

performance, such as foreign direct investment,

export and import, etc., because they are believed to

be another factor affecting the Malaysian stock

market. One of the limitations of ARDL is that it only

analyses one-way directions. Hence, it is

recommended that future research test analysis using

Economic Determinants and Oil Shocks: Unravelling the Impact of Kuala Lumpur Composite Index (KLCI) Performance

249

NARDL, which can provide two-way directions, or

QARDL, which is based on quantile regression

ARDL. Those analyses might deliver more robust and

reliable results in the future.

ACKNOWLEDGEMENTS

We thank the Research Management Centre (RMC),

Management and Science University (MSU) for

supporting this research work via MSU Conference &

Seminar Grant (MCSG) funding with reference

number MCSG-025-042024.

REFERENCES

Ahmad, M., & Wu, Q. (2022). Does herding behavior

matter in investment management and perceived

market efficiency? Evidence from an emerging market.

Management Decision, 60(8), 2148-2173.

Alamgir, F., & Amin, R. (2021). Oil price dynamics and

economic indicators in Malaysia. Energy Economics,

105, 105745.

Awoa, P. A., Efogo, F. O., & Ondoa, H. A. (2023). Oil

dependence and entrepreneurship: Non-linear evidence.

Economic Systems, 47(1), 101059.

Boonman, J. (2023). ASEAN financial crises and stock

market trends in Malaysia. Economic Review Journal,

58(2), 204-225.

Chia, C., et al. (2020). Factors influencing the Kuala

Lumpur Composite Index (KLCI): A Malaysian

perspective. Journal of Economic and Financial

Studies, 12(3), 78-89.

Dang, T. V., et al. (2020). Exchange rate fluctuations and

stock market performance in emerging economies.

International Finance Review, 30(2), 112-130.

Dicky, D. A., & Fuller, W. A. (1979). Distribution of the

estimators for autoregressive time series with a unit

root. Journal of the American statistical association,

74(366), 427-431.

Dutta, A., et al. (2021). Short-term and long-term effects of

oil price shocks on stock market returns: Evidence from

Malaysia. Energy Policy Journal, 45(6), 62-78.

El Ghoul, S., Guedhami, O., Mansi, S. A., & Sy, O. (2022).

Event studies in international finance research. Journal

of International Business Studies, 54(2), 344.

Engle, R. F., & Granger, C. W. (1987). Co-integration and

error correction: representation, estimation, and testing.

Econometrica: journal of the Econometric Society, 251-

276.

Fama, E. F. (1970). Efficient capital markets: A review of

theory and empirical work. The Journal of Finance,

25(2), 383-417.

Granger, C. W., & Newbold, P. (1974). Spurious

regressions in econometrics. Journal of econometrics,

2(2), 111-120.

Gupta, S. K., Nerlekar, V. S., Sane, A., Gadekar, M., &

Waghulkar, S. (2025). The Emotional Rollercoaster of

Market Overreaction: Understanding the Psychological

Drivers of Irrational Market Behaviour. In

Psychological Drivers of Herding and Market

Overreaction (pp. 221-254).

Kalam, A. (2020). Inflation and stock market performance:

Evidence from Malaysia. International Journal of

Finance and Economics, 26(3), 1278-1288.

Li, J., et al. (2022). The relationship between GDP growth

and stock market trends: Insights from Malaysia.

Journal of Development Economics, 56(4), 245-261.

Liu, Y., et al. (2023). Economic cycles and stock market

behavior in emerging economies: The Malaysian

context. Global Economic Perspectives, 14(2), 153-

168.

MacKinnon, J. G. (1996). Numerical distribution functions

for unit root and cointegration tests. Journal of applied

econometrics, 11(6), 601-618.

Mokni, K. (2020). Demand and supply shocks in oil

markets and their impacts on stock returns: A focus on

Malaysia. Energy Journal, 41(3), 125-139.

Nguyen, T., & Pham, H. (2021). Macroeconomic

determinants of financial markets in Southeast Asia.

Emerging Markets Studies, 18(1), 45-67.

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds

testing approaches to the analysis of level relationships.

Journal of applied econometrics, 16(3), 289-326.

Phillips, P. C. (1987). Time series regression with a unit

root. Econometrica: Journal of the Econometric

Society, 277-301.

Perron, P. (1990). Testing for a unit root in a time series

with a changing mean. Journal of Business & Economic

Statistics, 8(2), 153-162.

Samuelson, P. A. (1965). Proof that properly anticipated

prices fluctuate randomly. Industrial Management

Review, 6(2), 41-49.

Siow, I. W., et al. (2023). Impact of exchange rates and oil

prices on Malaysia's stock market. Malaysian Journal

of Finance and Economics, 21(5), 318-329.

Sumaryoto, H., et al. (2021). The role of inflation in

ASEAN financial markets: Comparative evidence.

Journal of Financial Studies in Southeast Asia, 16(2),

208-225.

Umar, Z., Aziz, M. I. A., Zaremba, A., & Tran, D. K.

(2023). Modelling dynamic connectedness between oil

price shocks and exchange rates in ASEAN+ 3

economies. Applied Economics, 55(23), 2676-2693.

Yasmini, N., & Noraini, H. (2019). Long-term impact of oil

prices on stock market returns: Malaysian evidence.

Asian Journal of Financial Research, 8(4), 314-325.

Zulkifli, H., et al. (2024). Exploring the linkage between

GDP and Malaysian stock market performance. Journal

of Developmental Economics, 60(1), 67-82.

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

250