Using Transformers for B2B Contractual Churn Prediction Based on

Customer Behavior Data

Jim Ahlstrand

1,2 a

, Anton Borg

1 b

, Håkan Grahn

1 c

and Martin Boldt

1 d

1

Blekinge Institute of Technology, 37179, Karlskrona, Sweden

2

Telenor Sweden AB, Karlskrona, Sweden

Keywords:

Churn Prediction, B2B, Machine Learning, Time-Series Data, Telecommunication, Conformal Prediction.

Abstract:

In the competitive business-to-business (B2B) landscape, retaining clients is critical to sustaining growth,

yet customer churn presents substantial challenges. This paper presents a novel approach to customer churn

prediction using a modified Transformer architecture tailored to multivariate time-series data. We suggest

that analyzing customer behavior patterns over time can indicate potential churn. Our findings suggest that

while uncertainty remains high, the proposed model performs competitively against existing methods. The

Transformer architecture achieves a top decile lift of almost 5 and 0.77 AUC. We assess the model’s confidence

by employing conformal prediction, providing valuable insights for targeted anti-churn campaigns. This work

highlights the potential of Transformers to address churn dynamics, offering a scalable solution to identify

at-risk customers and inform strategic retention efforts in B2B contexts.

1 INTRODUCTION

Retaining clients is essential in the competitive

business-to-business (B2B) landscape. Customers

discontinuing their services or switching to competi-

tors, known as churn or customer attrition, poses sig-

nificant challenges for businesses (Ahn et al., 2020).

Churn can occur for various reasons, such as dissatis-

faction with the service or product, better offers from

competitors, changes in client needs, or stagnation

in added value. Compared to business-to-consumer

(B2C), B2B churn is often more complex and costly,

given the smaller customer base and higher value of

individual contracts (Tamaddoni Jahromi et al., 2014;

Janssens et al., 2022).

This article delves into the intricacies of churn

within the B2B context, highlighting some of the

challenges for predicting churn to maintain business

growth. The hypothesis is that customer churn is pre-

dictable by examining the customers’ changing be-

havior over time (Mena et al., 2019). Furthermore, we

evaluate the hypotheses using real-world telecom data

and conformal prediction, demonstrating that product

a

https://orcid.org/0000-0002-0179-5090

b

https://orcid.org/0000-0002-8929-7220

c

https://orcid.org/0000-0001-9947-1088

d

https://orcid.org/0000-0002-9316-4842

usage does provide a churn signal, although unreli-

able in practice.

With a minor change to the Transformer architec-

ture, we are able to train the model directly on mul-

tivariate time series data, hence reducing the need

for feature engineering. The proposed Transformer

model shows an impressive learning capability. How-

ever, it fails to fully capture the rarity of customer

churn, and the precision drops when evaluated on

a real-world customer base. Implementing churn

prevention targeting in this state is anticipated to

be ineffective in mitigating customer attrition. The

low precision suggests a high likelihood of misalign-

ment with intervention targeting, potentially lead-

ing to unpredictable and costly campaigns (Tamad-

doni Jahromi et al., 2014). We employ conformal

prediction (Shafer and Vovk, 2008) to calibrate the

model and analyze the uncertainty over the validation

dataset, exposing unreliable outcomes. We also in-

vestigate how conformal prediction performs based

on churn risk. Conformal prediction provides un-

certainty estimates for each predicted data point, al-

lowing corporations to focus specifically on the data

points with the highest certainty in the predictions. It

is also easier to perform a risk-reward analysis based

on the cost of incentives. Our results indicate that the

use of conformal prediction could be a valuable addi-

tion to churn prediction in an industrial setting.

562

Ahlstrand, J., Borg, A., Grahn, H. and Boldt, M.

Using Transformers for B2B Contractual Churn Prediction Based on Customer Behavior Data.

DOI: 10.5220/0013432500003929

In Proceedings of the 27th International Conference on Enterprise Information Systems (ICEIS 2025) - Volume 1, pages 562-571

ISBN: 978-989-758-749-8; ISSN: 2184-4992

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

2 BACKGROUND

2.1 Definition of Churn in B2B

Within the context of B2B telecommunication cus-

tomers, churn refers to the phenomenon of not renew-

ing contracts when they expire. Individual subscrip-

tions may be added or terminated (product churn)

within the contract lifetime without necessarily be-

ing considered customer churn. In this study, we ana-

lyze Telecom mobile subscription churn for B2B con-

tracts. This detailed approach also allows for flexibil-

ity in aggregating churn risk across the entire contract

or specific segments.

2.2 Importance of Churn Management

for Business Growth

Predicting and preventing churn is essential for sus-

taining and growing a B2B business (Janssens et al.,

2022). High churn rates can significantly impact rev-

enue, given the substantial acquisition costs and high

contract value of B2B clients (Gattermann-Itschert

and Thonemann, 2022; Chen et al., 2015). Moreover,

losing a client can have a ripple effect, influencing

the perceptions of potential and existing customers.

Understanding the underlying causes of churn can in-

form improvements in product offerings, customer

service, and overall business strategies, fostering a

culture of continuous improvement and growth. Ef-

fectively managing churn can be a vital differentia-

tor in saturated markets (Mena et al., 2019; Wei and

Chiu, 2002). Businesses with a proactive stance can

lead to more robust market positions and increased re-

silience against industry fluctuations.

Acquiring new customers involves significant

costs, such as marketing campaigns, promotions, and

outreach strategies to attract potential clients. In con-

trast, retaining existing customers requires maintain-

ing high-quality service, engaging with loyal cus-

tomers, and building strong relationships that promote

repeat business. While existing customers are already

familiar with your products, consistently exceeding

their expectations can be as challenging and expen-

sive as acquiring new customers.

Modeling churn from usage data relies on the

premise that businesses can observe the behaviors

that lead to churn. Usage data may uncover pat-

terns and trends in how customers interact with ser-

vices or products correlated with churn. These predic-

tive models may act as an early warning and identify

at-risk customers before they decide to leave, allow-

ing for targeted interventions. For telecommunication

companies, this often involves tracking mobile sub-

scription metrics, such as the number of calls made

and the amount of data used. This set of features can

be considered a metric for customer health.

2.3 Voluntary vs. Involuntary Churn

Voluntary churn refers to the situation in which a cus-

tomer independently decides to terminate their rela-

tionship with a business (Park and Ahn, 2022). This

decision may be influenced by various factors, in-

cluding dissatisfaction with the product or service,

the availability of more attractive offers from com-

petitors, or evolving needs that the current provider

does not adequately address. Conversely, involuntary

churn occurs when the termination of the relationship

is driven by external factors beyond the customer’s

control (Park and Ahn, 2022). Circumstances such

as payment failures, business closures, policy viola-

tions, or corporate mergers can all lead to involuntary

churn. This churn often arises without prior warning

and can be significantly more challenging to identify

in data compared to voluntary churn. The target for

this study includes both types, i.e., involuntary and

voluntary.

2.4 Contractual vs. Non-Contractual

Churn

A business may include contractual and non-

contractual products, so it’s essential to differen-

tiate between them when defining the churn tar-

get (Gattermann-Itschert and Thonemann, 2022).

Non-contractual churn occurs when customer trans-

actions do not follow a fixed contract or subscription

model. Measuring this type of churn can be chal-

lenging, as the absence of a formal agreement com-

plicates the definition of churn (Reinartz and Kumar,

2003). Regular purchasing patterns that cease after

some determined threshold are often used as an in-

dication of non-contractual churn (Ahn et al., 2020;

Tamaddoni Jahromi et al., 2014). Conversely, con-

tractual churn applies to businesses that operate on a

subscription or contract basis. This form of churn oc-

curs when a customer opts not to renew their contract

upon expiration or chooses to terminate the contract

prematurely (Ahn et al., 2020). This article will ex-

clusively examine contractual churn in the context of

B2B customers.

2.5 Risk vs. Uplift

Both risk and uplift methods are statistical techniques

that help businesses understand and address customer

Using Transformers for B2B Contractual Churn Prediction Based on Customer Behavior Data

563

churn more effectively. Churn risk models are de-

signed to identify customers at risk of leaving. Com-

panies may employ these to improve customer ex-

periences by analyzing patterns and behaviors cor-

related with churn. In contrast, churn uplift models

focus on reducing customer attrition by determining

the most effective treatment and strategy for retaining

customers (Ascarza, 2018; Tamaddoni Jahromi et al.,

2014). However, in this context, we cannot verify the

accuracy of lift metrics as we do not have access to

the outcomes of retention campaigns. Hence, we fo-

cus on churn risk modeling to understand and predict

customer churn.

3 RELATED WORK

Previous work has investigated B2B customer churn

prediction using sequential LSTM and GRU mod-

els on time series data aggregated by customer and

week (Ahlstrand et al., 2024). The results indicated

potential in detecting reliable churn signals. However,

the signals were only significant within one week

ahead. In the present study, we suggest extending this

work by using more granular data. This is done in

two ways: using a daily frequency and without ag-

gregation, i.e., individual subscriptions. These pre-

dictions can then later be aggregated on a customer

level to produce a churn risk scoring for B2B cus-

tomers. Another change is using the Transformer ar-

chitecture to embed the time series sequences. Trans-

formers scale better and have superior attention to sig-

nals over larger context sizes compared to LSTM and

GRU (Islam et al., 2024), which was used in the pre-

vious work.

Usage data has demonstrated promising

results in enhancing customer churn predic-

tions (Sanchez Ramirez et al., 2024; Somosi

et al., 2021; Ascarza and Hardie, 2013; Wei and

Chiu, 2002). Despite this, there has been less

attention on the B2B segment (Tamaddoni Jahromi

et al., 2014) and limited effort to utilize time-series

data directly (Ahmadi and Hasheminejad, 2021; Ahn

et al., 2020). (Ascarza and Hardie, 2013) employs

a hidden Markov model to segment the customer

base and predict paths to death (churn). However,

we find the Markov process problematic because it

only takes into account the current state of affairs,

whereas churn can be the result of long sequences of

events. (Mena et al., 2019) use LSTM to learn churn

risk probabilities and utilize the output as a feature

in their static model. They report Top Decile Lift

(TDL) scores of up to 4.2 and AUC scores of up to

0.78. In a follow-up study, (Mena et al., 2024) shows

that using time-varying features with a recurrent

network improves churn prediction performance and

does work well without static features. This time

they report a TDL of up to 5.5 and AUC of up to

0.84. However, contrary to our findings, they do

not find that Transformers improve the performance

compared to other recurrent networks. It is important

to note that the results cannot be directly compared

due to the absence of any public time-series data sets

available for a fair comparison.

Most related studies have focused on engineered

features derived from usage data. There is also a

divide between papers investigating contractual and

transactional settings; Table 1 shows the literature or-

ganized into sections. Most related works acknowl-

edge customer churn as a rare event but do not thor-

oughly investigate performance under class imbal-

ance and the effects of predicting rare events. (Gür Ali

and Arıtürk, 2014) investigate the issue with rare

event classification in the churn domain and propose

multiple training data (MTD) as a strategy for in-

creasing the positive samples, hence improving the

balance between churn and non-churn and predictive

performance. However, they use logistic regression

and decision trees to model churn; hence, they do not

fully exploit the sequential dependencies in time se-

ries data.

4 METHOD

4.1 Data Collection

Usage data includes several key metrics such as fre-

quency, which tracks how often users engage with

the subscription service, and intensity, which mea-

sures how it was used (Sanchez Ramirez et al., 2024;

Wei and Chiu, 2002). Interactions refer to communi-

cation between customers and companies, e.g., cus-

tomer support. Firmographic data encompasses vari-

ous attributes related to organizations. This may in-

clude contract details, company size, location, rev-

enue, and employee count. Collecting and analyz-

ing firmographic data may help to distinguish cus-

tomers and provide a richer context. Sentiment values

have shown to be beneficial in churn prediction (Wang

et al., 2018; Kumar et al., 2024). In this study,

we therefore included support ticket sentiment val-

ues, which were extracted using the Vader sentiment

framework (Hutto and Gilbert, 2014).

This study used a mixture of usage data, firmo-

graphic data, transactions, and interactions. Table 2

shows the mix of available features used to assem-

ble the subscription time series. The data is based

ICEIS 2025 - 27th International Conference on Enterprise Information Systems

564

Table 1: Related work organized by segment, business model, and use of time series data.

Paper Segment Business model Usage- Time- Balancing Industry

B2B B2C Contr. Trans. data series

Sanchez Ramirez

✓ ✓ ✓ Class weight Software & services

et al., 2024

Mena et al., 2024 — ✓ ✓ Undersample Finance

Gattermann-Itschert

✓ ✓ Class weight Wholesale trade

& Thonemann, 2022

Mena et al., 2019 — ✓ ✓ Undersample Finance

Gür Ali & Arıtürk

✓ ✓ ✓ MTD+SMOTE Private banking

2014

Ascarza & Hardie

✓ ✓ ✓ — —

2013

This paper, 2025 ✓ ✓ ✓ ✓ Undersample Telecom

on mobile subscription usage for B2B customers in

Sweden and the interactions and firmographic data of

each customer. Customer features, e.g., the number of

employees and industry, are applied to all of the cus-

tomers’ subscriptions. The number of ongoing churns

varies over the dataset but is within the interval 1.5%

and 2.5%, making churn a rare event.

We normalized all features independently to the

range 0-1. The upper bound had to be defined for the

non-categorical values such as lifetime. The upper

bound was manually set by inspecting the distribution

and choosing an appropriate cutoff value. Tracking

the exact value doesn’t add much more information

after some point. There were a few missing days in

the dataset. These can be ignored as we have both

day-of-the-week and week numbers, which position

the data in the global context. The revenue was trans-

formed to represent the percentage difference from

the daily mean, which was necessary to make it sta-

tionary and limit the value to the interval -1 to 1. All

values are collected daily. However, not all sources

are updated daily. The firmographic features are up-

dated quarterly or yearly, meaning they are mostly

constant. Finally, all duplicates and training examples

with zero variance were removed.

To ensure the accuracy and privacy of the data

collected, domain experts validated the correctness

of each feature, and all customer identifiers were

anonymized by hashing with a random salt that was

thrown away post-data collection.

4.2 Transformer Architecture

The model is based on a Transformer architecture

with adaptions to fit multivariate time-series data bet-

ter (Vaswani et al., 2017). Specifically, we replaced

the token embedding with one-dimensional depth-

wise convolution, which up-scales the input to the de-

Table 2: Time series subscription features where “Re-

quested term” is the dependent/target variable in the exper-

iments, i.e., churn. Features inherited from the customer

level are marked with a *.

Variable Description

Weekday Day of week

Week Week number

Price Price category

Lifetime Days since activation

Binding Days of binding remaining

Calls Have calls been made?

Data Data consumption

ARPU Revenue

Employees* Number of employees

Industry* Main industry

Discount* Customer with discount offer

Contract lifetime* Days since contract activation

Contract lifespan* Days until contract expires

Total cases* Number of support tickets

Sentiment* Sentiment value of tickets

Requested termination Subscription termination

sired number of channels, similar to the implementa-

tion by Informer (Zhou et al., 2021). Because most

inputs are a real number between 0 − 1, a simple em-

bedding lookup table won’t work. This change suc-

cessfully embedded the sequential multivariate input

features, which allowed the multi-headed attention

blocks to produce sequence embeddings. Finally, the

attention output is averaged into a linear layer with

sigmoid activation to predict whether the subscription

will churn in the next step. Hence, the network is an

encoder-only Transformer with a binary classifier, as

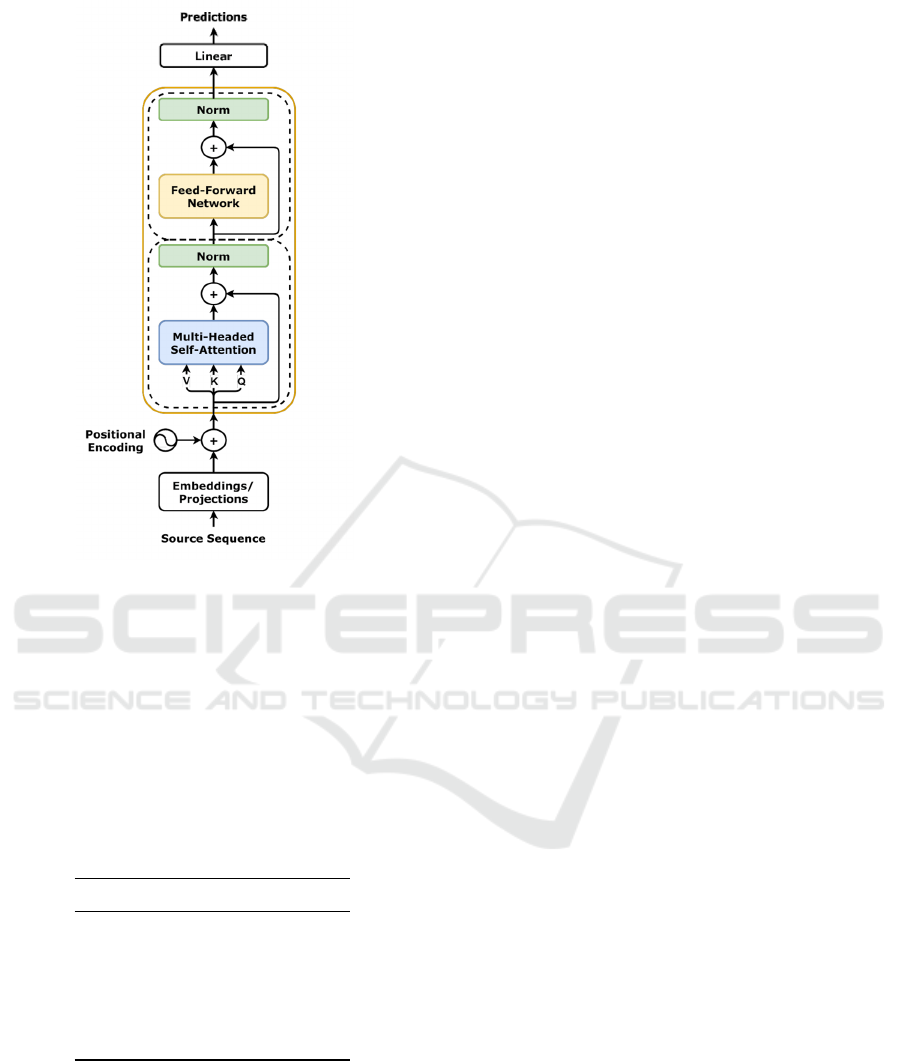

illustrated by figure 1.

4.3 Training

We used PyTorch to build the architecture, optimizer,

loss, and training loops (Paszke et al., 2019). As

Using Transformers for B2B Contractual Churn Prediction Based on Customer Behavior Data

565

Figure 1: Transformer model architecture. Image source

https://github.com/dvgodoy/dl-visuals

the target is a binary variable, we selected the binary

cross-entropy loss with an Adam optimizer. Table 3

shows the hyperparameters and their values; all other

hyperparameters use the default settings defined by

PyTorch. The resulting model only consists of 840k

parameters. The hyperparameters were chosen with

efficiency in mind, as larger networks did not seem

to improve performance. Keeping the network small

allowed for faster training and inference times.

Table 3: Hyperparameters and their values.

Parameter Value

Hidden size 128

Number of heads 16

Number of layers 8

Embedding dimension 128

Sequence length 120

Dropout 0.15

The customers were divided into the following

three groups using a random sampling strategy: train-

ing (75%), calibration (10%), and validation (15%).

The subscriptions of each customer were extracted

from the time-series data and processed using a slid-

ing window of 120 days and a stride of 5 days to cre-

ate the datasets. The dataset used for training was also

class-balanced by selecting all examples of churners

(the minority class) and an equally large uniform ran-

dom sample of non-churners, which removes many of

the negative samples. We experimented with a dy-

namic undersampling, which samples a new set of

non-churners for each training epoch and a higher ra-

tio of negative samples using a class-weight approach.

However, neither had any significant effect on the fi-

nal results. We limited the validation dataset to con-

tain only the same subscription once and selected only

the last 120 days before termination from each sub-

scriber. The calibration data is used post-training to

fit the conformal prediction system and, therefore, is

never seen by the model.

To prevent excessive sampling of the same cus-

tomer, we established two constraints. First, we used

a stride of 5 days between windows. Secondly, we

limited the maximum days after a churn is registered

to half the size of the sequence length, as we want

the model to learn behaviors leading up to termina-

tion. The dataset contains 215 days of recorded data,

resulting in 1, 100, 000 examples for training (where

≈ 16, 000 are churns), 250, 000 examples for valida-

tion, and 150, 000 for calibration.

4.4 Calibration

Conformal prediction is a calibration method in ma-

chine learning that ensures the predicted probabilities

are statistically valid and align closely with the actual

outcomes. This process uses a dedicated calibration

dataset, a subset specifically reserved for refining the

model’s predictions. A conformal classifier generates

prediction regions guaranteed to contain the true la-

bel by a user-specified probability (Shafer and Vovk,

2008; Angelopoulos and Bates, 2021). To calibrate

the model, we used the Crepes framework (Boström,

2022). Specifically, we calibrate a Conformal Predic-

tive System using the Wrap Regressor method. To

normalize the model and make the coverage adaptive,

we used a difficult estimator (i.e., a heuristic score for

the difficulty of a given example). An adaptive cover-

age provides a prediction interval conditioned on the

input, which provides more information on the true

model uncertainty. Two difficulty estimators were in-

vestigated. First, using the Monte-Carlo dropout vari-

ance, which has been shown to produce estimations of

uncertainty (Gal and Ghahramani, 2016), and second,

using the Euclidean distance to the k-nearest neigh-

bors (Pedregosa et al., 2011), where k = 5, using the

sequence embeddings produced by the model.

During calibration, the non-conformity scores are

computed for each point in the calibration set us-

ing the model. The calibrated model can then pro-

vide more accurate and well-calibrated confidence

ICEIS 2025 - 27th International Conference on Enterprise Information Systems

566

estimates for future predictions, thereby improving

decision-making processes based on these predic-

tions. Overall, model calibration using the Confor-

mal Prediction enhances the performance and instills

greater trust in the outputs by ensuring that the pre-

dicted probabilities accurately reflect the likelihood

of various outcomes. These properties are essential

for decision-making and for efficiently targeting in-

terventions in the context of churn.

4.5 Evaluation Metrics

Precision, Recall, and F

1

-score are standard metrics

to measure and evaluate the performance of machine

learning models (Witten et al., 2016). Both precision

and recall are informative metrics, especially when

dealing with rare event predictions such as customer

churn. Precision, or the positive predictive value, tells

us the number of true positives over the total number

of predicted positives. Recall, or the true positive rate,

tells us the probability of detecting a positive value,

i.e., the number of true positives over the entire pop-

ulation of positives. All three metrics are commonly

employed to evaluate machine learning models.

In the context of customer churn prediction, it is

perhaps more likely to encounter the Area Under the

Receiver Operating Characteristic (AUROC) curve

and Top Decile Lift (TDL) metrics (Mena et al., 2019;

Mena et al., 2024; Gattermann-Itschert and Thone-

mann, 2022; Sanchez Ramirez et al., 2024; Gür Ali

and Arıtürk, 2014; Devriendt et al., 2021; Neslin

et al., 2006). The Receiver Operating Characteristic

(ROC) is a plot of the relation between the true pos-

itive rate (sensitivity) and the false positive rate (1-

specificity) (Fawcett, 2006). ROC curve is indepen-

dent of thresholds, which is important when higher

costs are associated with either outcome. The area un-

der the ROC curve gives an overall metric where 0.5

equals a random guesser, and 1.0 is a perfect model.

Lift is the relative segmentation performance of a

model compared to the population baseline. The TDL

metric refers to the model lift in the top 10% segment

based on some targeting strategy. In the context of

churn prediction, the targeting strategy is commonly

based on the models’ estimated churn risk. We ar-

gue that TDL can be misleading in the context of rare

events as it does not take false positives or interven-

tion costs into account. Consider the case where you

have 1000 samples with 50 true positives (5% base-

line, B). If the top decile (100 samples) contains 20

true positives (target response, T ) and 80 false pos-

itives, the lift would be 4 (1), i.e., the top decile is

4 times more likely to contain true positives than the

population baseline. However, the 80 false positives

are disregarded. TDL also makes no assertions about

model certainty, which is crucial for targeting. De-

pending on the application and the cost of false pos-

itives, targeting customers based on risk alone may

be unproductive as risk does not infer that the cus-

tomer is responding to treatments and hence cannot

be retained (Ascarza, 2018; Devriendt et al., 2021).

However, we include TDL in this study to facilitate

the comparison with related work.

li f t =

P(T |B)

P(T )

=

20

100

50

1000

= 4 (1)

5 RESULTS

The model was trained for 15 epochs with a learn-

ing rate of 0.001, which takes less than an hour. Ta-

ble 4 shows the evaluation metrics during training and

evaluation. The training dataset is class-balanced us-

ing a simple uniform undersampling, while the vali-

dation dataset is left unbalanced to represent a real-

world scenario. There is a significant difference in

performance when the model is exposed to the vali-

dation dataset where ≈ 1.3% are churners. Note that

the evaluation is based on a strict definition of true

positive, i.e., only when the termination request has

been made and the model predicts a churn rate above

0.5 will count as a true positive.

Table 4: Performance evaluation on training (balanced) and

validation dataset with a strict TP definition.

Metric Training Validation

F

1

-score 0.935 0.286

Precision 0.923 0.217

Recall 0.964 0.419

AUROC 0.982 0.766

5.1 Conformal Prediction Evaluation

The size of the calibration dataset was reduced to

10240 examples. All positive churn examples were

included (≈ 2000 examples), the rest consisted of

negative samples. The calibration set was then used

as input to the Conformal Predictive System to con-

struct the calibrated model. The calibrated model was

evaluated using a confidence level of 0.9 (α = 0.1).

Table 5 shows the error and efficiency of the confor-

mal prediction with different difficulty estimations.

Efficiency in the crepes framework is based on the

mean size of the prediction interval for regression

tasks, i.e., less is better in this case. We see a dif-

ference depending on the choice of difficulty estima-

Using Transformers for B2B Contractual Churn Prediction Based on Customer Behavior Data

567

tion, where dropout is the most efficient, but the em-

bedding method has the least errors. However, the

evaluation shows that all intervals, with a 90% confi-

dence, are very large, mostly covering the entire pos-

sible range of 0-1.

Table 5: Conformal prediction evaluation using a confi-

dence level of 0.9 with different difficulty estimators. The

best values are in bold.

Difficulty estimator Error Efficiency

None 0.055 0.974

Dropout 0.053 0.496

Embedding 0.049 0.795

5.2 ROC & TDL

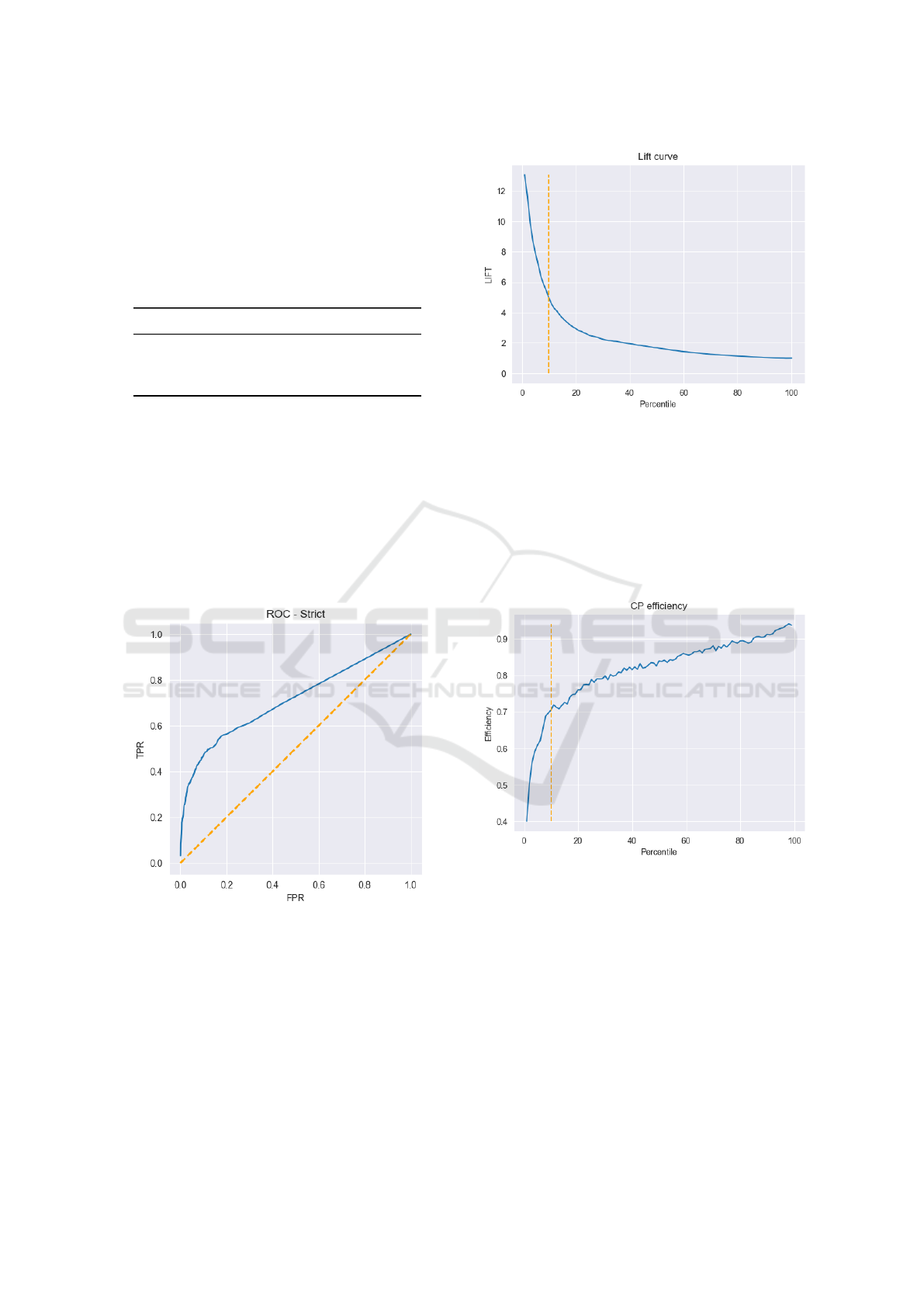

Plotting the ROC curve, illustrated in Figure 2, shows

that the model is able to separate the rare positive

events from the negative events. The ROC is evalu-

ated using the unbalanced validation dataset, the same

as the previous metrics. A business may use the ROC

curve to determine the threshold that balances sensi-

tivity and specificity according to the specific appli-

cation.

Figure 2: The solid line shows the receiver operating char-

acteristic curve for the Transformer model. A random

guesser is shown using a dashed line.

The model achieves a TDL of 4.943 on the valida-

tion dataset, i.e., the model finds almost 5 times more

churners than the baseline when targeting the top 10%

based on churn risk. In Section 4.5, we discussed the

potential risks associated with its use for targeting.

The lift curve is illustrated in Figure 3, which also

marks the top decile.

We also analyzed the efficiency of the confor-

Figure 3: Lift curve based on the percentile of the popula-

tion targeted. The top decile (10%) is marked with a dashed

line.

mal prediction system by percentile. Efficiency is

the average prediction interval size, i.e., lower is bet-

ter. Figure 4 shows that the efficiency is better at the

top decile compared to larger segments. This indi-

cates that the model is more certain of the outcome in

higher churn rankings.

Figure 4: Conformal prediction efficiency by percentile of

the top-ranked churners. Evaluated using 90% confidence.

The top 10% decile is marked with a dashed line.

6 DISCUSSION

Our findings suggest that while uncertainty remains

high, the proposed model performs competitively

against existing methods. The Transformer architec-

ture achieves a TDL of almost 5 and 0.77 AUC. This

can be compared to reported TDL between 4.2 − 5.5

and AUC between 0.78 − 0.82 (Mena et al., 2019;

Mena et al., 2024).

ICEIS 2025 - 27th International Conference on Enterprise Information Systems

568

The results from both the model and conformal

prediction evaluation show that the uncertainty is gen-

erally high, i.e., there are not enough signals in the

data to exclusively identify churning behavior. There

are useful segments in the top percentiles that include

many of the true positives. However, the same seg-

ments also include many false positives. The more

training epochs the model undergoes, the more over-

fitted it becomes toward the obvious churn risks,

which can be problematic as these customers may be

resistant to all anti-churn treatments available. The

additional layer of confidence provided by confor-

mal prediction aids in better decision-making and

may reduce the risk of targeting lost causes. Fig-

ure 4 shows the efficiency of the top-ranked churn-

ers. Although it is still unclear whether these partic-

ular high-risk and high-certainty targets are respon-

sive to anti-churn campaigns, the prediction interval

indicates the certainty of the churn prediction. While

high-risk churn customers can be identified, the ap-

propriate anti-churn treatment is not given, and these

might be different between customers. A root cause

analysis of churn factors could provide more insight

but was not investigated in this paper.

Behaviors such as reduced usage or engagement,

complaints, or changes in client communications may

be indications that a customer is about to churn. How-

ever, it is unlikely that a single definitive event will

cause customers to change their opinions and decide

to churn. The underlying cause is likely a series

of events where the company did not meet the cus-

tomers’ expectations over time. In a B2B setting, con-

tracts typically last for several years, which makes it

difficult to pinpoint exactly when customers decide

not to renew. As a result, there may be several months

between when a customer decides to leave and when

this decision appears in the data.

The proposed changes to the Transformer archi-

tecture have not been subject to thorough scrutiny be-

yond that it works well in this particular case. Ex-

actly how large an impact the depthwise convolutions

have on the final performance is unclear; this could

be determined by, e.g., conducting an ablation study.

Subscriptions are not entirely independent of the B2B

customer, as a contract covers multiple subscriptions

and determines the final churn timing. We tried to in-

clude this feature by adding the contract lifetime and

lifespan for each subscription. However, the impor-

tance of the included features is unknown.

To summarize, while the proposed model per-

forms competitively in predicting churn, it faces chal-

lenges due to the uncertainty inherent in rare events

like customer attrition. Incorporating diverse data

sources, such as contractual changes, customer sup-

port interactions, or product lifecycle data, could po-

tentially enhance the predictive capabilities of the

model. In addition, combining Transformer-based ap-

proaches with causal inference could provide deeper

insights into the root causes of churn, enabling more

effective and personalized interventions. This study

also emphasizes the importance of ethical AI, advo-

cating for fairness, transparency, and the safeguard-

ing of customer privacy. Broadening the scope of

this research to other industries holds the potential

to strengthen our understanding of customer retention

and develop robust strategies for mitigating churn on

a larger scale.

7 CONCLUSION AND FUTURE

WORK

The results demonstrate that we can effectively clas-

sify complex multivariate time-series patterns with a

single simple change to the Transformer architecture.

Even under unfavorable conditions, the model is able

to perform in line with previous research results (see

Section 3). While the metrics are not directly compa-

rable due to the lack of a common data set, the evalu-

ation methods are the same. Additionally, we demon-

strate how conformal prediction can be used to evalu-

ate model certainty and should prove valuable in deci-

sions regarding anti-churn campaign targeting. To our

knowledge, conformal prediction for churn prediction

has not been investigated previously. Thus, one of the

contributions of this study is the novel application of

conformal prediction in the context of churn predic-

tion, offering a fresh perspective on model uncertainty

and its role in anti-churn strategies.

If customer behavior does change before churn,

it is not unambiguously observable in the usage data

available to us, and the model does not produce pre-

cise predictions. We cannot rule out that the behav-

ioral changes are caused by the decision to churn and

not vice versa. Another plausible explanation is con-

founding variables, e.g., external factors or a reduc-

tion in demand, which may cause both changes in us-

age behavior and an increase in churn.

Some features that remained mostly time-

invariant could have been excluded from the time se-

ries window and instead intertwined with the Trans-

former in a multi-modal fashion. Hence, future work

could design a slightly simpler architecture and still

include all the information that might improve perfor-

mance. This work is limited by the specific use case

we studied, and the empirical results may not transfer

or be generalized well to other domains or industries.

Future work could explore the performance of the

Using Transformers for B2B Contractual Churn Prediction Based on Customer Behavior Data

569

proposed Transformer architecture on generic time

series classification tasks. Additionally, creating a

public time series dataset for customer churn would

facilitate direct comparisons between models.

ACKNOWLEDGEMENTS

This work was partially funded by Telenor Sverige

AB.

REFERENCES

Ahlstrand, J., Boldt, M., Borg, A., and Grahn, H. (2024).

Predicting B2B customer churn using a time series ap-

proach. In 2024 Fifth International Conference on In-

telligent Data Science Technologies and Applications

(IDSTA), pages 44–51.

Ahmadi, H. and Hasheminejad, S. M. H. (2021). A new

time series approach in churn prediction with discrim-

inatory intervals. In 2021 11th International Confer-

ence on Computer Engineering and Knowledge (IC-

CKE), pages 508–513.

Ahn, J., Hwang, J., Kim, D., Choi, H., and Kang, S. (2020).

A survey on churn analysis in various business do-

mains. IEEE Access, 8:220816–220839.

Angelopoulos, A. N. and Bates, S. (2021). A gen-

tle introduction to conformal prediction and

distribution-free uncertainty quantification.

https://arxiv.org/abs/2107.07511v6.

Ascarza, E. (2018). Retention futility: Targeting high-risk

customers might be ineffective. Journal of Marketing

Research, 55(1):80–98.

Ascarza, E. and Hardie, B. G. S. (2013). A joint model

of usage and churn in contractual settings. Marketing

Science, 32(4):570–590.

Boström, H. (2022). crepes: a python package for gener-

ating conformal regressors and predictive systems. In

Johansson, U., Boström, H., An Nguyen, K., Luo, Z.,

and Carlsson, L., editors, Proceedings of the Eleventh

Symposium on Conformal and Probabilistic Predic-

tion and Applications, volume 179 of Proceedings of

Machine Learning Research. PMLR.

Chen, K., Hu, Y.-H., and Hsieh, Y.-C. (2015). Predicting

customer churn from valuable b2b customers in the

logistics industry: a case study. Information Systems

and e-Business Management, 13(3):475–494.

Devriendt, F., Berrevoets, J., and Verbeke, W. (2021). Why

you should stop predicting customer churn and start

using uplift models. Information Sciences, 548:497–

515.

Fawcett, T. (2006). An introduction to ROC analysis. Pat-

tern Recognition Letters, 27(8):861–874.

Gal, Y. and Ghahramani, Z. (2016). Dropout as a bayesian

approximation: Representing model uncertainty in

deep learning. In Balcan, M. F. and Weinberger,

K. Q., editors, Proceedings of The 33rd International

Conference on Machine Learning, volume 48 of Pro-

ceedings of Machine Learning Research, pages 1050–

1059, New York, New York, USA. PMLR.

Gattermann-Itschert, T. and Thonemann, U. W. (2022).

Proactive customer retention management in a non-

contractual b2b setting based on churn prediction with

random forests. Industrial Marketing Management,

107:134–147.

Gür Ali, O. and Arıtürk, U. (2014). Dynamic churn predic-

tion framework with more effective use of rare event

data: The case of private banking. Expert Systems with

Applications, 41(17):7889–7903.

Hutto, C. and Gilbert, E. (2014). VADER: A parsimonious

rule-based model for sentiment analysis of social me-

dia text. In Proceedings of the International AAAI

Conference on Web and Social Media, volume 8,

pages 216–225. Number: 1.

Islam, S., Elmekki, H., Elsebai, A., Bentahar, J., Drawel,

N., Rjoub, G., and Pedrycz, W. (2024). A com-

prehensive survey on applications of transformers for

deep learning tasks. Expert Systems with Applications,

241:122666.

Janssens, B., Bogaert, M., Bagué, A., and Van den Poel,

D. (2022). B2boost: instance-dependent profit-driven

modelling of b2b churn. Annals of Operations Re-

search, 341(1):267–293.

Kumar, S., Mariyasagayam, N., and Nonaka, Y. (2024).

Evaluating the effect of leading indicators in customer

churn prediction. In Borah, M. D., Laiphrakpam,

D. S., Auluck, N., and Balas, V. E., editors, Big Data,

Machine Learning, and Applications, Lecture Notes

in Electrical Engineering, pages 327–340. Springer

Nature.

Mena, C. G., De Caigny, A., Coussement, K., De Bock,

K. W., and Lessmann, S. (2019). Churn pre-

diction with sequential data and deep neural net-

works. a comparative analysis. arXiv:1909.11114,

http://arxiv.org/abs/1909.11114.

Mena, G., Coussement, K., De Bock, K., De Caigny, A.,

and Lessmann, S. (2024). Exploiting time-varying

RFM measures for customer churn prediction with

deep neural networks. Annals of Operations Research,

339(1):765–787.

Neslin, S. A., Gupta, S., Kamakura, W., Lu, J., and Mason,

C. H. (2006). Defection detection: Measuring and un-

derstanding the predictive accuracy of customer churn

models. Journal of Marketing Research, 43(2):204–

211.

Park, W. and Ahn, H. (2022). Not all churn customers are

the same: Investigating the effect of customer churn

heterogeneity on customer value in the financial sec-

tor. Sustainability, 14(19):12328.

Paszke, A., Gross, S., Massa, F., Lerer, A., Bradbury, J.,

Chanan, G., Killeen, T., Lin, Z., Gimelshein, N.,

Antiga, L., Desmaison, A., Kopf, A., Yang, E., De-

Vito, Z., Raison, M., Tejani, A., Chilamkurthy, S.,

Steiner, B., Fang, L., Bai, J., and Chintala, S. (2019).

PyTorch: An imperative style, high-performance deep

learning library. In Advances in Neural Information

Processing Systems, volume 32. Curran Associates,

Inc.

ICEIS 2025 - 27th International Conference on Enterprise Information Systems

570

Pedregosa, F., Varoquaux, G., Gramfort, A., Michel, V.,

Thirion, B., Grisel, O., Blondel, M., Prettenhofer,

P., Weiss, R., Dubourg, V., Vanderplas, J., Passos,

A., Cournapeau, D., Brucher, M., Perrot, M., and

Duchesnay, E. (2011). Scikit-learn: Machine learning

in Python. Journal of Machine Learning Research,

12:2825–2830.

Reinartz, W. J. and Kumar, V. (2003). The impact of cus-

tomer relationship characteristics on profitable life-

time duration. Journal of Marketing, 67(1):77–99.

Sanchez Ramirez, J., Coussement, K., De Caigny, A.,

Benoit, D. F., and Guliyev, E. (2024). Incorporating

usage data for b2b churn prediction modeling. Indus-

trial Marketing Management, 120:191–205.

Shafer, G. and Vovk, V. (2008). A tutorial on conformal

prediction. Journal of Machine Learning Research,

9(12):371–421.

Somosi, A., Stiassny, A., Kolos, K., and Warlop, L. (2021).

Customer defection due to service elimination and

post-elimination customer behavior: An empirical

investigation in telecommunications. International

Journal of Research in Marketing, 38(4):915–934.

Tamaddoni Jahromi, A., Stakhovych, S., and Ewing, M.

(2014). Managing b2b customer churn, retention

and profitability. Industrial Marketing Management,

43(7):1258–1268.

Vaswani, A., Shazeer, N., Parmar, N., Uszkoreit, J., Jones,

L., Gomez, A. N., Kaiser, Ł., and Polosukhin, I.

(2017). Attention is all you need. Advances in Neural

Information Processing Systems, 30.

Wang, Y., Satake, K., Onishi, T., and Masuichi, H. (2018).

Customer churn prediction using sentiment analysis

and text classification of VOC. In Computational Lin-

guistics and Intelligent Text Processing, pages 156–

165. Springer, Cham.

Wei, C.-P. and Chiu, I.-T. (2002). Turning telecommunica-

tions call details to churn prediction: a data mining ap-

proach. Expert Systems with Applications, 23(2):103–

112.

Witten, I., Frank, E., Hall, M., and Pal, C. (2016). Data

Mining: Practical Machine Learning Tools and Tech-

niques. The Morgan Kaufmann Series in Data Man-

agement Systems. Elsevier Science.

Zhou, H., Zhang, S., Peng, J., Zhang, S., Li, J., Xiong, H.,

and Zhang, W. (2021). Informer: Beyond efficient

transformer for long sequence time-series forecasting.

Proceedings of the AAAI Conference on Artificial In-

telligence, 35(12):11106–11115.

Using Transformers for B2B Contractual Churn Prediction Based on Customer Behavior Data

571