Predicting B2B Customer Churn and Measuring the Impact of Machine

Learning-Based Retention Strategies

Vict

´

oria Emanuela Alves Oliveira

2,3 a

, Amanda Cristina da Costa Guimar

˜

aes

3 b

,

Arthur Rodrigues Soares de Quadros

1,3 c

, Reynold Navarro Mazo

3,4 d

,

Rickson Livio de Souza Gaspar

3

, Alessandro Vieira

3 e

and Wladmir Cardoso Brand

˜

ao

1,3 f

1

Department of Computer Science, Pontifical Catholic University of Minas Gerais (PUC Minas), Brazil

2

Center for Exact and Technological Sciences, Federal University of Rec

ˆ

oncavo da Bahia (UFRB), Cruz das Almas, BA,

Brazil

3

Data Science Laboratory (SOLAB), S

´

olides S.A. - Belo Horizonte, MG, Brazil

4

Institute of Mathematical and Computer Sciences (ICMC), University of S

˜

ao Paulo (USP), S

˜

ao Carlos, SP, Brazil

Keywords:

Customer Churn, Churn Prediction, B2B Churn, Support Vector Machines (SVM), Machine Learning,

Feature Selection.

Abstract:

Acquiring new customers often costs five times more than retaining existing ones. Customer churn signifi-

cantly threatens B2B companies, causing revenue loss and reduced market share. Analyzing historical cus-

tomer data, including frequency on product usage, allow us to predict churn and implement timely retention

strategies to prevent this loss. We propose using Support Vector Machines (SVMs) to predict at-risk customers

while retraining it, if necessary. By monitoring its recall over 15-day periods, we retrain the model if its recall

on new data falls below 60%. Our research focuses on feature selection to identify key churn factors. Our ex-

periments show that when constantly retraining the model, we avoid accuracy loss by updating the customer’s

context, providing valuable insights on how to reduce churn rates and increase revenue.

1 INTRODUCTION

In today’s dynamic business environment, compa-

nies often prioritize switching partners over build-

ing strong relationships (Tamaddoni Jahromi et al.,

2014). To avoid revenue loss from customer churn,

B2B companies need predictive methods. Analyzing

past churn data and product usage can help predict

and prevent future churn, protecting revenue.

Churn prediction allows targeted customer strate-

gies. By analyzing recent product usage and com-

paring it to similar companies that experienced churn,

models can identify warning signs and proactively

prevent attrition.

Existing research has explored various automated

customer retention methods. However, a crucial gap

remains in understanding the temporal dynamics of

churn prediction models. As customer needs and

a

https://orcid.org/0009-0000-2777-4581

b

https://orcid.org/0009-0007-0321-3334

c

https://orcid.org/0009-0004-9593-7601

d

https://orcid.org/0009-0003-2011-3715

e

https://orcid.org/0000-0002-9921-3588

f

https://orcid.org/0000-0002-1523-1616

product demands evolve (Li et al., 2023), the under-

lying patterns driving churn may also shift. Conse-

quently, static churn prediction models, trained on

historical data, may lose their effectiveness over time.

Our hypothesis is that, to maintain predictive accu-

racy, churn models must be dynamically updated to

reflect these evolving customer behaviors and prod-

uct requirements.

This paper uses Support Vector Machines (SVMs)

on historical churn data to predict customer churn in

15-day intervals, using strategic feature selection. Ev-

ery two weeks, the predictions are re-evaluated based

and classified as correct or incorrect. This reduces

churn and measures the revenue from strategies for

at-risk customers. The dataset used in this study

comprises over 8,000 Small and Medium Enterprises

(SMEs) in the context of HR services. Although reac-

tive methods allow for some level of customer reten-

tion, the dynamic updates on churn predictors provide

valuable insights to B2B companies, helping busi-

nesses take proactive retention strategies. Namely, we

contribute by:

• Applying SVMs to predict customer churn with

dynamic data and updated models.

572

Oliveira, V. E. A., Guimarães, A. C. C., Soares de Quadros, A. R., Mazo, R. N., Gaspar, R. L. S., Vieira, A. and Brandão, W. C.

Predicting B2B Customer Churn and Measuring the Impact of Machine Lear ning-Based Retention Strategies.

DOI: 10.5220/0013436300003929

In Proceedings of the 27th International Conference on Enterprise Information Systems (ICEIS 2025) - Volume 1, pages 572-581

ISBN: 978-989-758-749-8; ISSN: 2184-4992

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

• Demonstrating the performance degradation of

static churn prediction models over time, high-

lighting the need for dynamic updates.

• Using feature selection to identify key features

for churn prediction, improving customer reten-

tion strategies.

This paper has five sections. Section 2 introduces

customer churn, supervised machine learning, and the

models used: SVM, Logistic Regression, and Sequen-

tial Feature Selection. Section 3 discusses related

work. Section 4 details the methodology: data pre-

processing, feature selection, model architecture, and

evaluation metrics. Section 5 presents and analyzes

the results. Section 6 concludes and suggests future

research.

2 BACKGROUND

This section defines key concepts used in this paper,

including Customer Churn, Machine Learning Algo-

rithms, Support Vector Machines, and Feature Selec-

tion Methods.

2.1 Customer Churn

Customer churn is the probability that a customer

will end their relationship with a company (Kamakura

et al., 2005). Since acquiring new customers is

often more expensive than retaining existing ones

(Athanassopoulos, 2000; Tamaddoni Jahromi et al.,

2014), accurately measuring and predicting churn is

essential for business health.

2.2 Supervised Machine Learning

Supervised machine learning trains a model to predict

a target variable (Y ) from input features (X) (Nasteski,

2017). The model can be a regressor (for continuous

values) or a classifier (for categorical values). Typ-

ically, the data is split into training (e.g., 80%) and

validation (e.g., 20%) sets.

2.3 Support Vector Machine

A Support Vector Machine (SVM) is a supervised

learning algorithm that separates data points from dif-

ferent classes using a linear or non-linear function

(e.g., a line or hyperplane). See (Mammone et al.,

2009) for more details.

2.4 Feature Selection Methods

Feature selection is crucial in AI modeling, especially

with real-world data (Kumar and Minz, 2014). Ir-

relevant or redundant features can hurt model perfor-

mance. This study uses Sequential Feature Selection

and Logistic Regression for feature selection.

2.4.1 Sequential Feature Selection

Sequential Feature Selection (SFS) selects the n fea-

tures that maximize accuracy, measured across cross-

validated models. The best performing set is kept.

Sequential Forward Floating Selection (SFFS) is

a variation of SFS. SFFS iteratively adds or removes

features based on their contribution to accuracy. The

“floating” search allows the algorithm to remove pre-

viously selected features if they become redundant.

2.4.2 Logistic Regression

Logistic Regression is a supervised learning model

often used for feature selection. It can effectively

measure feature importance and reduce data dimen-

sionality without significant loss of accuracy (Cheng

et al., 2006). In this study, Logistic Regression is used

for feature selection, not classification.

3 RELATED WORKS

Customer churn prediction has gained significant at-

tention in recent years, particularly in industries such

as telecommunications, banking, e-commerce, and

B2B services (Manzoor et al., 2024). Various ma-

chine learning models have been applied to iden-

tify patterns and predict churn, with particular fo-

cus on models such as Support Vector Machines

(SVM), Random Forest, K-Nearest Neighbors, Gradi-

ent Boosting, Logistic Regression, Naive Bayes, De-

cision Trees and Neural Networks (A. and D., 2016).

In the telecommunications sector, multiple stud-

ies emphasize the effectiveness of ensemble methods

and Support Vector Machines (SVMs) for churn pre-

diction. According to (Poudel et al., 2024), which uti-

lizes a telecommunications dataset from Kaggle, Gra-

dient Boosting Machine (GBM) achieved the highest

accuracy at 81%, outperforming models like SVM,

Logistic Regression, Random Forest, and Neural Net-

works. In contrast, (Ullah et al., 2019), analyzing a

South Asian mobile communications service provider

dataset, showed that Random Forest outperformed

Decision Trees, Naive Bayes, Bagging, and Boost-

ing, with an accuracy of 88.63%. However, (Rodan

Predicting B2B Customer Churn and Measuring the Impact of Machine Learning-Based Retention Strategies

573

et al., 2014), which examined customer churn in a Jor-

danian telecommunications company, demonstrated

that SVM achieved an outstanding accuracy of 98.7%,

surpassing other models like Neural Networks, Deci-

sion Trees, and Naive Bayes, highlighting its robust-

ness in handling telecommunications datasets.

In the banking domain, studies such as (Tran et al.,

2023) and (Xiahou and Harada, 2022) highlight the

effectiveness of advanced algorithms, demonstrating

that integrating k-means clustering with SVM can

significantly enhance prediction accuracy. The first

study, based on a Kaggle dataset containing informa-

tion on banking customers, found that Random Forest

consistently outperformed other models, achieving an

accuracy of up to 97.4%. Similarly, in the B2C e-

commerce sector, research by (Xiahou and Harada,

2022), using a dataset from Alibaba Cloud Tianchi,

showed that SVM, after performing customer seg-

mentation, outperformed Logistic Regression with an

accuracy of 91.56%, further highlighting its effective-

ness in predicting customer churn.

In the B2B sector, churn prediction often involves

analyzing complex customer behavioral and transac-

tional patterns. (Tamaddoni Jahromi et al., 2014)

explored models such as Decision Trees and Ad-

aBoost, highlighting the latter’s effectiveness in ad-

dressing class imbalances. Similarly,(Gordini and

Veglio, 2017), using data from an Italian online re-

tail company, demonstrated the superiority of AUC-

optimized SVM over traditional SVM, Neural Net-

works, and Logistic Regression, achieving an ac-

curacy of 89.67%. In subscription-based services,

(Coussement and Van den Poel, 2008), analyzing data

from a Belgian newspaper publisher, highlighted the

utility of SVM, particularly with AUC-based param-

eter tuning. However, Random Forest ultimately de-

livered the highest predictive accuracy. Collectively,

these findings highlight SVM’s adaptability and effec-

tiveness, positioning it as a strong candidate for B2B

churn prediction tasks where precise customer reten-

tion strategies are critical.

4 METHODOLOGY

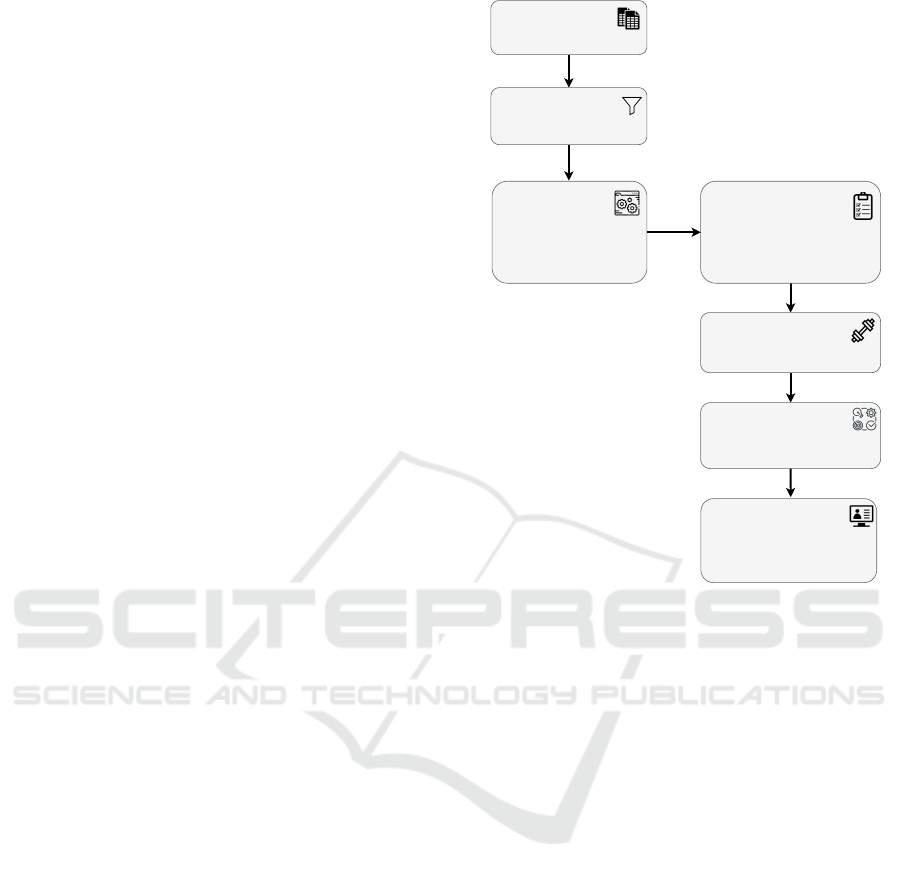

This section presents the proposed customer churn

prediction model, as illustrated in Figure 1.

This diagram outlines the methodology for a cus-

tomer churn prediction project within an HR com-

pany. The process begins with gathering datasets re-

lated to churn prediction and customer usability. A

sampling process focuses on active customers rele-

vant to churn prediction. Feature engineering fol-

lows, involving calculating differences in months

Feature Selection

Logistic Regression

Sequential Forward Floating Selection

5 Fold Cross-validation

Datasets

Churn Prediction

Customer Usability

Sampling Process

Active Customers

Churn Prediction

Feature Engineering

Interval Features

Difference in Months and Days

Product Remapping

One-Hot Encoding

Handling Missing Values

Training Models

Support Vector Machine (SVM)

Evaluation

Accuracy, Precision, Recall, F1-score

Explainer Models

Tabular data

Fast API

Streamlit

Figure 1: An illustration of the data processing, model train-

ing, evaluation and explainer models on the customer churn

data.

and days, creating interval features, remapping prod-

uct categories, applying one-hot encoding, and han-

dling missing values. Feature selection utilizes logis-

tic regression, Sequential Forward Floating Selection

(SFFS), and 5-fold cross-validation. A Support Vec-

tor Machine (SVM) model is then trained on the se-

lected features. The model is evaluated using met-

rics such as accuracy, precision, recall, and F1-score.

Finally, explainer models, including, Fast API, and

Streamlit, are used to interpret the model’s predictions

and understand the key drivers of churn.

4.1 Data Preprocessing

4.1.1 Dataset

The dataset used in this study comes from an Human

Resources Technologies (HR Tech) company and in-

cludes 8,878 business customers, all categorized as

Small and Medium Enterprises (SMEs). These cus-

tomers span various sectors, including commerce, re-

tail, technology, consultancy, marketing, and services.

They are classified within the company’s portfolio

based on the number of employees registered on the

platform. The Customer Relation Manager (CRM)

ICEIS 2025 - 27th International Conference on Enterprise Information Systems

574

database was used during the period from March 2024

to November 2024.

Additionally, all available data from canceled cus-

tomers were used, while for active customers, a strat-

ified sample was used. The combination of these two

datasets forms the final dataset used to train the SVM

model. Including canceled customers is crucial for

the model to learn to identify the factors that lead

to churn and, consequently, predict the probability of

churn for new customers.

4.1.2 Sampling Process

Active user data is divided into groups based on the

unique products. For each product category, a sample

size is calculated proportionally to the representation

of that stratum in the original dataset. Equation 1 dis-

plays how we calculate this.

¯

S = c

S

N

(1)

where c is the multiplication factor defined as 1.5

times the size of the canceled users dataset. This en-

sures that the final dataset has a higher proportion of

users who canceled. S is the number of active users

belonging to the specific product category, and N is

the total number of active users. If

¯

S ≤ 0,

¯

S is set to

1, ensuring that all products are present in the train-

ing dataset, regardless of length. For each group, we

randomly select

¯

S samples, and combine each random

sample, generating a final stratified sample containing

all groups.

4.1.3 Feature Engineering

Feature engineering is performed in several stages

to prepare raw data for training the churn prediction

model. The primary transformations include:

• Difference in Months: Calculates the number of

months between a customer’s subscription date

and the current date.

• Difference in Days: Calculates the number of

days between various event dates (last login, last

job post created, etc.) and the current date. The

generated features are named as “days without the

event”.

• Interval Features: Creates interval features (bins)

for numerical features calculated in the previous

steps. The values of each feature are divided into

intervals based on quartiles, generating features

such as “interval months subscriber” (from 0 to

12), “interval days without logging” (from 0 to 7),

and so on.

• Product Remapping: Groups similar product cat-

egories into more general categories.

• One-Hot Encoding: Converts categorical features

into dummy variables (0 or 1).

• Missing Value Treatment: Replaces missing val-

ues with 0.

Based on the transformations performed, the fea-

tures were classified into two main types: numeri-

cal and categorical. These types were organized into

functional groups to facilitate analysis, including Us-

ability, Engagement, Performance, Interval Usability,

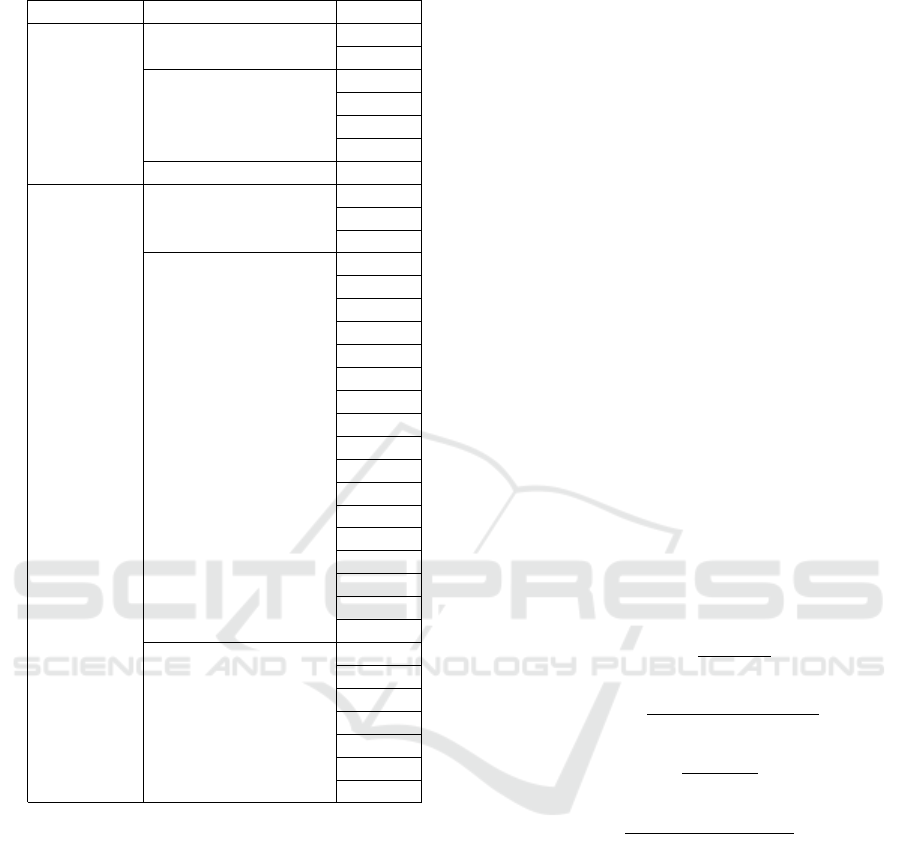

and Interval Performance, as described in Table 1.

The Engagement group includes numerical features

that capture users’ direct interaction with the plat-

form, while the Usability group contains both numer-

ical and interval features that monitor behaviors and

usage patterns. The Performance group evaluates the

outcomes generated by user actions and also includes

both numerical and interval features. The Product

group includes information about the service terms

contracted by the customer. This classification was

designed to preserve the confidentiality of the orga-

nization’s operational details while ensuring that the

data provides relevant insights for churn analysis.

4.1.4 Feature Selection

To select features, we employed a Logistic Regression

model and selected the most significant features by

removing those that did not contribute to the model’s

accuracy (Ververidis and Kotropoulos, 2005). After

that, we applied SFFS for feature selection. The se-

lected features were chosen based on the 5-fold cross-

validation results of the trained model.

The accuracy metric, reflecting the proportion

of correct classifications, was used to evaluate the

model’s performance. To reduce dimensionality with-

out sacrificing crucial information, only the top 34

most relevant features were selected, as shown in Ta-

ble 1.

4.2 Model Architecture

After selecting the most significant features, the

dataset was divided into subsets of training and test-

ing, with 75% and 25% of the data being allocated for

training and testing, respectively.

To address the class imbalance in the dataset,

weights were assigned to the classes, with the no-

churn class given a higher weight (2) and the churn

class a lower weight (1). This exploratory approach

aimed to balance the influence of both classes dur-

ing model training, ensuring the no-churn class had

Predicting B2B Customer Churn and Measuring the Impact of Machine Learning-Based Retention Strategies

575

Table 1: Features analyzed in the model.

Type Group Feature

Numerical

Engagement

F1

F2

Usability

F3

F4

F5

F6

Performance F7

Categorical

Product

F8

F9

F10

Interval Usability

F11

F12

F13

F14

F15

F16

F17

F18

F19

F20

F21

F22

F23

F24

F25

F26

F27

Interval Performance

F28

F29

F30

F31

F32

F33

F34

greater significance in shaping the model’s learning

process.

However, this balancing approach is not equiva-

lent to the more well-known techniques in the litera-

ture, such as oversampling or undersampling (Drum-

mond and Holte, 2003). Unlike these techniques,

which alter the quantity of data in each class, this ap-

proach adjusts the importance of each class, allow-

ing the model to account for the disproportionate im-

pact of imbalanced classes without altering the origi-

nal data structure. This helps improve the model’s ac-

curacy by mitigating potential biases toward the ma-

jority class and balancing learning and prediction be-

tween the two classes.

The model used to predict customer non-churn

was the Support Vector Machine (SVM), which

proved to be suitable for binary classification prob-

lems with high-dimensional data (Mammone et al.,

2009). In the model construction process, the Lin-

ear kernel was chosen, which tries to separate the

classes through a linear hyperplane in the original

data space. The choice of this kernel is due to its

computational simplicity and suitability for problems

where the classes are approximately linearly separa-

ble (Cortes and Vapnik, 1995).

The performance of the SVM with the Linear ker-

nel strongly depends on the regularization parame-

ter C, which controls the trade-off between maximiz-

ing the margin separating the classes and minimizing

classification errors. When the value of C is high,

the model tries to minimize classification errors dur-

ing training at all costs, which can lead to overfit-

ting. On the other hand, when the value of C is low,

the model accepts more errors, prioritizing the sepa-

ration between classes, which can result in underfit-

ting (Coussement and Van den Poel, 2008). Based on

this, the chosen value was 1.0, as it provided a good

balance between maximizing the margin of separation

and minimizing classification errors.

4.3 Evaluation Metrics

For the model’s quality assessment, the metrics of ac-

curacy (Equation 3), recall (Equation 4), and f1-score

(Equation 5) were applied.

precision =

T P

T P + FP

(2)

accuracy =

T P + T N

T P + FN + T N + FP

(3)

recall =

T P

T P + FN

(4)

F1 =

2 × precision × recall

precision + recall

(5)

In equations 2, 3, 4, and 5, T P, FP, T N, and FN

represent true positive, false positive, true negative,

and false negative, respectively. In our context, for a

given observation, the model:

• Correctly predicts a non-churned customer, for

T P.

• Incorrectly predicts a non-churned customer as

churned, for FP.

• Correctly predicts a churned customer, for T N.

• Incorrectly predicts a churned customer as non-

churned, for FN.

More specifically, Equation 3 measures the overall

proportion of correct predictions. Equation 4 quanti-

fies the proportion of true positive instances among

ICEIS 2025 - 27th International Conference on Enterprise Information Systems

576

all actual positive instances. Equation 5 calculates the

harmonic mean of precision and recall, providing a

balanced measure of the model’s performance. Ide-

ally, all values should approach 1, indicating optimal

performance.

Recall was specifically used for determining if the

model needed to be retrained or not. On a threshold

of 60% recall, we defined the need for retraining if

a trained model achieved a recall of less than 60%.

The use for recall instead of any other metric is that

there is a need to update the true model’s capacity for

avoiding churns, and the recall measures exactly this,

while others do not.

5 RESULTS

5.1 Experiments

The analysis of predictions for all customers over a 6-

month period, using a single train/test split, revealed

distinct results for the SVM model. In this scenario,

the model achieved an accuracy of 0.79, precision of

0.44, recall of 1.00, and an F1-Score of 0.62, as shown

in Table 2.

Table 2: Overall confusion matrix.

– Non-churners Churners

Non-churners 5459 1901

Churners 582 936

Comparing these results with the biweekly analy-

sis, we identified significant differences. These varia-

tions are detailed in tables 5 to 8, highlighting poten-

tial implications for retention strategies and necessary

adjustments to the model for different time windows.

Table 3: Confusion matrix for the first biweekly period.

– Non-churners Churners

Non-churners 5514 1665

Churners 56 112

Table 4: Confusion matrix for the second biweekly period.

– Non-churners Churners

Non-churners 5735 1695

Churners 58 152

Table 5: Confusion matrix for the third biweekly period.

– Non-churners Churners

Non-churners 4886 1531

Churners 37 75

Table 6: Confusion matrix for the fourth biweekly period.

– Non-churners Churners

Non-churners 5171 1546

Churners 34 49

Table 7: Confusion matrix for the fifth biweekly period.

– Non-churners Churners

Non-churners 5453 1900

Churners 40 84

Table 8: Confusion matrix for the sixth biweekly period.

– Non-churners Churners

Non-churners 5514 1665

Churners 56 112

5.2 Metrics Analysis

The biweekly analysis accuracy (0.74 to 0.77) was

similar to the previous analysis (0.79), showing con-

sistent overall classification performance. However,

accuracy can be misleading with imbalanced classes

or unequal error costs (false positives/negatives)

(Coussement and Van den Poel, 2008). A model pre-

dicting all customers as “non-churn” can have high

accuracy but be useless (Coussement and Van den

Poel, 2008). Precision is important in churn predic-

tion because false positives lead to unnecessary reten-

tion costs (Coussement and Van den Poel, 2008).

The biweekly analysis precision (0.03 to 0.08)

was much lower than the previous precision (0.44),

indicating a significant increase in false positives.

While the earlier analysis balanced precision and re-

call, the biweekly analysis prioritized recall at the

cost of precision. This low precision suggests a per-

sistent problem with false positives (Coussement and

Van den Poel, 2008). The drop in precision suggests

the traditional approach overestimated the model’s

generalization ability. (Tamaddoni Jahromi et al.,

2014) and (Coussement and Van den Poel, 2008)

emphasize the importance of considering the time-

varying nature of churn data, as customer behavior

changes. The biweekly analysis captures this varia-

tion for a more realistic performance assessment.

The biweekly analysis recall (0.59 to 0.72) was

lower than the previous perfect recall (1.00). This in-

dicates the model missed more churning customers in

the biweekly analysis.

The biweekly analysis F1-score (0.06 to 0.15) was

also much lower than the previous F1-score (0.62),

reflecting the poor precision.

The main difference between the results is the

lower precision in the biweekly analysis. This sug-

Predicting B2B Customer Churn and Measuring the Impact of Machine Learning-Based Retention Strategies

577

gests the single train/test split overestimated the

model’s generalization. The biweekly analysis re-

veals a tendency for more false positives, negatively

impacting precision. Comparing the biweekly re-

sults with the single train/test split results (accuracy

0.79, precision 0.44, recall 1.00, F1-score 0.62) is

crucial. The precision drop suggests the traditional

approach overestimated generalization. (Tamaddoni

Jahromi et al., 2014) and (Coussement and Van den

Poel, 2008) highlight the importance of considering

temporal data variation in churn modeling. The bi-

weekly analysis captures this and provides a more re-

alistic performance view.

The decreased recall in the biweekly analysis is

also important, showing a reduced ability to iden-

tify at-risk customers. However, the precision drop is

the main contributor to the lower F1-score. (Tamad-

doni Jahromi et al., 2014) address B2B churn, propos-

ing an approach that considers customer heterogene-

ity and profit. While not discussing biweekly analysis

directly, their emphasis on temporal variation and ro-

bust models supports the idea that these metrics are

affected by the time frame used (Tamaddoni Jahromi

et al., 2014).

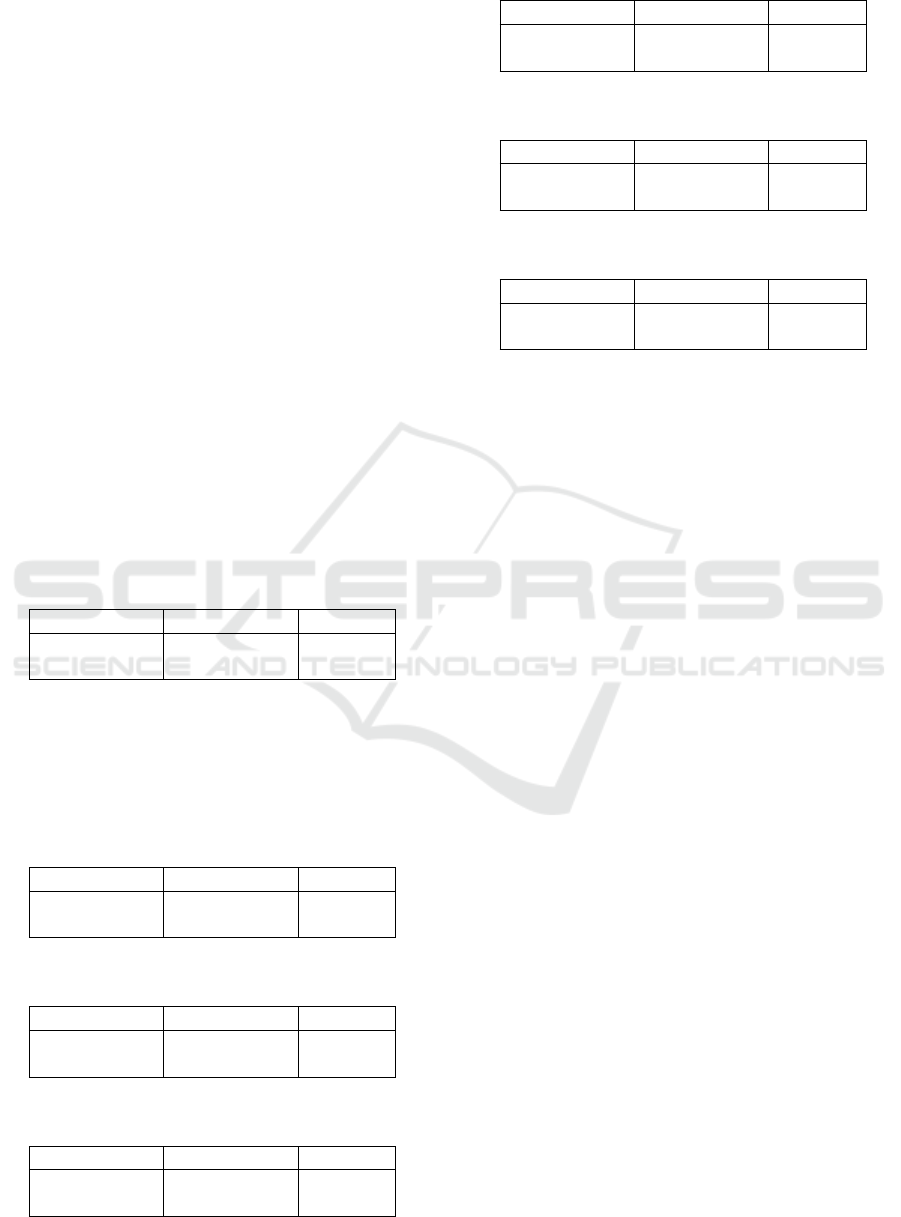

Figure 2 shows our six biweekly intervals and

model updates when recall is below our threshold.

Figure 2: Recall of models leading to retraining.

When recall falls below the threshold, we retrain

the model to keep it above 60%. These values indicate

that changing customer needs often reduce model ca-

pabilities, requiring periodic retraining.

(Coussement and Van den Poel, 2008) compare

SVM parameter selection for churn prediction. While

focusing on modeling, their discussion of model gen-

eralization and performance evaluation across scenar-

ios (including class distributions) supports biweekly

analysis. Their use of a time window for predictive

variables further supports analyzing temporal data

variation (Coussement and Van den Poel, 2008).

5.3 Models Analysis

The feature selection resulted in a subset of 10 fea-

tures deemed most relevant for churn prediction. The

accuracy achieved during cross-validation in the fea-

ture selection process was 0.72. (Tamaddoni Jahromi

et al., 2014) and (Coussement and Van den Poel,

2008) emphasize the importance of considering tem-

poral variation in data when modeling churn, as cus-

tomer behavior and the factors influencing churn can

change over time. Biweekly analysis, by evaluating

the model across different periods, captures this vari-

ation and provides a more realistic assessment of its

performance.

The trained SVM model was then evaluated on a

separate test set, similarly, (Rodan et al., 2014) focus

on using SVM to predict churn in the telecommuni-

cations industry. The authors employ metrics such as

accuracy, hit rate, churn rate, and lift coefficient to

evaluate the SVM model’s performance and compare

it with other approaches, such as neural networks and

decision trees. Although they do not explicitly men-

tion AUC or Gini, their emphasis is on the model’s

ability to correctly identify customers likely to churn

(Rodan et al., 2014).

The high AUC (0.9029) and Gini coefficient

(0.8057) indicate excellent model discrimination, ef-

fectively distinguishing churn customers from non-

churn customers. According to (Coussement and

Van den Poel, 2008), AUC is a crucial metric for eval-

uating churn models, as it is more robust to varying

classification thresholds and class imbalances com-

pared to accuracy. The authors conduct statistical

tests to compare the AUC of different models, includ-

ing SVMs and logistic regression. Additionally, they

emphasize the importance of lift and top-decile lift,

which assess the model’s ability to identify customers

with the highest likelihood of churn.

Similarly, (Poudel et al., 2024) compare various

models, including GBM and neural networks, using

metrics such as accuracy, precision, recall, F1-score,

ROC-AUC, and PR-score (area under the Precision-

Recall curve). They also employ SHAP values to ex-

plain the model’s predictions, providing insights into

the key features influencing the results.

In summary, the SVM model, trained with an

optimized subset of 34 features via SFFS, demon-

strated excellent performance in churn prediction, ev-

idenced by high accuracy and AUC. Analysis with co-

efficient values provided actionable insights into the

main drivers of churn, highlighting the importance of

customer engagement, especially regarding frequent

logins, job creation, and the occurrence of positive in-

teractions on the platform.

ICEIS 2025 - 27th International Conference on Enterprise Information Systems

578

Figure 3: Features importance analyzed.

5.4 Features Analysis

Feature F11, with a coefficient of 1.4186, indicates

that customers inactive for 8 to 44 days are signif-

icantly more likely to churn, highlighting the im-

portance of regular engagement. Strategies such as

sending relevant content and personalized notifica-

tions could be effective in mitigating churn. The im-

portance of frequent logins is corroborated by vari-

ous studies on churn in online services. In the paper

by (Poudel et al., 2024) the feature “Tenure Months”

(subscription duration) has a strong impact on churn,

and inactivity for 8-44 days can be an early sign of

disinterest. The suggestion to send relevant content

and personalized notifications aligns with retention

strategies focused on proactive engagement, as dis-

cussed by (Tamaddoni Jahromi et al., 2014).

Feature F15, with a coefficient of 1.2309, also

points to a high churn risk when customers don’t cre-

ate new job postings for 69 to 823 days. Actively

using this feature suggests they are engaged and less

likely to churn. Offering tutorials and support to en-

courage job postings could be helpful (Coussement

and Van den Poel, 2008). Increasing customer en-

gagement with key platform features, like job post-

ings, can effectively reduce churn.

Feature F31, with a coefficient of 1.5098, is the

most significant predictor of churn, highlighting the

critical impact of positive interactions (e.g., feedback,

promotions) on customer retention. A lack of such

interactions for 37 to 55 days is an even stronger in-

dicator of churn than inactivity in logins or job post-

ings. This underscores the importance of continuous

engagement beyond mere platform usage. To miti-

gate churn, companies should proactively foster pos-

itive interactions through strategies like gamification,

rewards, and recognition, ensuring customers feel val-

ued and engaged.

Feature F27, with a coefficient of 0.7588, indi-

cates that not using the engineering feature for 101

to 200 days increases churn risk. Like feature F15,

this highlights the importance of regularly using plat-

form features. While “engineering” may be less criti-

cal than job creation, promoting its use is still impor-

tant for retention.

Feature F30, with a coefficient of 0.9003, is sim-

ilar to F31. It shows that not having positive inter-

actions for 31 to 36 days also increases churn risk,

though slightly less. Both features emphasize the im-

portance of positive occurrences, but the 37-55 day

period (F31) appears more critical.

Features F16 (coefficient 0.1969) and F17 (coeffi-

cient 0.2494) both show that any period of inactivity

without creating profiles increases churn risk. This

suggests that regularly creating profiles is a key sign

of customer engagement, though less impactful than

other features.

Feature F1, with a coefficient of 0.0477, indicates

that a high number of open job postings slightly in-

creases the likelihood of churn. This might mean

users are frustrated with the recruitment process. It’s

worth checking if these jobs are hard to fill or if there

are platform usability issues.

Feature F13, with a coefficient of -0.3513, shows

that short breaks (3 to 7 days) in creating job postings

are linked to a lower churn risk. This could be a nor-

mal pattern, where users post jobs, wait for results,

and then continue.

Feature F22, with a coefficient of -1.1810, reveals

that not having evaluations for 3 to 229 days is tied

to a lower churn risk. This suggests that how often

users evaluate may not directly show their satisfac-

tion. Happy customers may not feel the need to con-

stantly evaluate.

The coefficient analysis of each feature highlights

that keeping customers engaged and consistently us-

ing platform features is crucial for retention. By un-

derstanding these factors, companies can create tar-

geted strategies to reduce churn. Personalized re-

tention strategies should be developed based on the

coefficient analysis of each feature. For example,

those with high coefficient for days without logging

in should receive engagement incentives. Tracking

the evolution of each coefficient analysis can also

help identify changes in customer behavior and adapt

strategies accordingly.

Using coefficient analysis of each feature with

other metrics, such as AUC, precision, and recall, pro-

vides a more complete picture of the model’s perfor-

mance and what drives churn.

5.5 Result Discussions

The SVM model displays overall good performance

regarding recall when it is re-trained periodically. The

Predicting B2B Customer Churn and Measuring the Impact of Machine Learning-Based Retention Strategies

579

results show that with time the pattern changes, thus

reducing the capabilities of the obsolete model to cor-

rectly assess the predictions. This indicates the need

for constant updates on model training to optimize re-

call.

Consistent analysis identifies customer inactivity

as a strong predictor of churn. Long periods without

logins (F11), job postings (F15), or positive interac-

tions (F31) strongly indicate higher churn risk.

Addressing B2B churn in HR Tech is challeng-

ing. To our knowledge, there are few studies specifi-

cally on HR Tech churn, highlighting the novelty and

importance of our work. Our findings offer valuable

insights into HR Tech churn factors, enabling tailored

retention strategies. By focusing on proactive engage-

ment and addressing inactivity, HR Tech companies

can improve customer retention.

6 CONCLUSIONS AND FUTURE

WORKS

This study investigated churn prediction in a B2B

context using biweekly data and a SVM model with a

linear kernel. Feature selection through SFFS, com-

bined with interpretability analysis based on the co-

efficient values of each feature, enabled the identifi-

cation of key churn drivers and the development of

actionable insights for retention strategies.

The model’s accuracy stability across the analyzed

biweekly periods demonstrates its robustness to tem-

poral data variations, a crucial aspect in dynamic envi-

ronments like B2B. Additionally, the consistent mini-

mization of false positives in four out of five biweekly

periods reduces the cost of unnecessary interventions,

optimizing retention resources.

The coefficient analysis of each feature revealed

valuable insights into customer behavior and the

factors influencing churn. Platform inactivity, ex-

tended periods without creating new job postings, and

the absence of positive occurrences emerged as the

strongest predictors of churn. These findings align

with existing literature emphasizing the importance

of customer engagement and positive service experi-

ences for retention. The analysis also highlighted the

influence of other features, such as inactivity in the

engineering functionality and profile creation, point-

ing to the need for further investigation into the rela-

tionship between evaluation frequency and churn.

Despite stable accuracy, our results indicate that

the recall falls over customer necessities. Because

of this, it may be necessary to periodically retrain

the model for more consistent results. The discrep-

ancy suggests potential overfitting in the traditional

approach and underscores the importance of temporal

validation for a more realistic assessment of model

performance.

This study contributes to B2B churn prediction by

identifying key churn drivers, demonstrating the value

of coefficient-based feature analysis for model inter-

pretability, and proposing targeted retention strate-

gies, such as encouraging frequent logins, promoting

key functionalities, and fostering positive platform in-

teractions. For future research, exploring alternative

machine learning models, including ensemble meth-

ods (Random Forest, Gradient Boosting) and Deep

Learning approaches, could provide valuable perfor-

mance comparisons with SVM. Additionally, incor-

porating class balancing techniques, such as Class

Weight adjustments, SMOTE, and Random Over and

Under-Sampling, may improve model effectiveness

by addressing data imbalance. Further investigation

of new predictive features, such as detailed behavioral

metrics, contextual company characteristics, and sea-

sonal factors, could enhance model accuracy and pro-

vide deeper insights into customer retention dynam-

ics.

REFERENCES

A., S. and D., C. (2016). A Survey on Customer Churn Pre-

diction using Machine Learning Techniques. Interna-

tional Journal of Computer Applications, 154:13–16.

Athanassopoulos, A. D. (2000). Customer satisfaction cues

to support market segmentation and explain switching

behavior. Journal of Business Research, 47(3):191–

207.

Cheng, Q., Varshney, P. K., and Arora, M. K. (2006). Lo-

gistic regression for feature selection and soft classifi-

cation of remote sensing data. IEEE Geoscience and

Remote Sensing Letters, 3(4):491–494.

Cortes, C. and Vapnik, V. (1995). Support-vector networks.

Machine Learning, 20(3):273–297.

Coussement, K. and Van den Poel, D. (2008). Churn predic-

tion in subscription services: An application of sup-

port vector machines while comparing two parameter-

selection techniques. Expert Systems with Applica-

tions, 34(1):313–327.

Drummond, C. and Holte, R. (2003). C4.5, class imbalance,

and cost sensitivity: Why under-sampling beats over-

sampling. Proceedings of the ICML’03 Workshop on

Learning from Imbalanced Datasets.

Gordini, N. and Veglio, V. (2017). Customers churn pre-

diction and marketing retention strategies. An appli-

cation of support vector machines based on the AUC

parameter-selection technique in B2B e-commerce in-

dustry. Industrial Marketing Management, 62:100–

107.

Kamakura, W., Mela, C. F., Ansari, A., Bodapati, A., Fader,

P., Iyengar, R., Naik, P., Neslin, S., Sun, B., Verhoef,

ICEIS 2025 - 27th International Conference on Enterprise Information Systems

580

P. C., et al. (2005). Choice models and customer rela-

tionship management. Marketing letters, 16:279–291.

Kumar, V. and Minz, S. (2014). Feature selection. SmartCR,

4(3):211–229.

Li, Y., Cheng, Y., Ni, Y., and Zhang, N. (2023). Assess-

ment of product resilience towards the changing cus-

tomer requirements. Journal of Engineering Design,

34(8):561–590.

Mammone, A., Turchi, M., and Cristianini, N. (2009). Sup-

port vector machines. Wiley Interdisciplinary Re-

views: Computational Statistics, 1(3):283–289.

Manzoor, A., Atif Qureshi, M., Kidney, E., and Longo, L.

(2024). A Review on Machine Learning Methods for

Customer Churn Prediction and Recommendations

for Business Practitioners. IEEE Access, 12:70434–

70463.

Nasteski, V. (2017). An overview of the supervised machine

learning methods. Horizons. b, 4(51-62):56.

Poudel, S. S., Pokharel, S., and Timilsina, M. (2024). Ex-

plaining customer churn prediction in telecom indus-

try using tabular machine learning models. Machine

Learning with Applications, 17:100567.

Rodan, A., Faris, H., Al-sakran, J., and Al-Kadi, O. (2014).

A Support Vector Machine Approach for Churn Pre-

diction in Telecom Industry. International journal on

information, 17.

Tamaddoni Jahromi, A., Stakhovych, S., and Ewing, M.

(2014). Managing b2b customer churn, retention

and profitability. Industrial Marketing Management,

43(7):1258–1268.

Tran, H. D., Le, N., and Nguyen, V.-H. (2023). Customer

Churn Prediction in the Banking Sector Using Ma-

chine Learning-Based Classification Models. Inter-

disciplinary Journal of Information, Knowledge, and

Management, 18:087–105.

Ullah, I., Raza, B., Malik, A. K., Imran, M., Islam, S. U.,

and Kim, S. W. (2019). A Churn Prediction Model

Using Random Forest: Analysis of Machine Learn-

ing Techniques for Churn Prediction and Factor Iden-

tification in Telecom Sector. IEEE Access, 7:60134–

60149.

Ververidis, D. and Kotropoulos, C. (2005). Sequential for-

ward feature selection with low computational cost.

In 2005 13th European Signal Processing Conference,

pages 1–4.

Xiahou, X. and Harada, Y. (2022). B2C E-Commerce Cus-

tomer Churn Prediction Based on K-Means and SVM.

Journal of Theoretical and Applied Electronic Com-

merce Research, 17(2):458–475.

Predicting B2B Customer Churn and Measuring the Impact of Machine Learning-Based Retention Strategies

581