Synthetic Data Generation and Federated Learning as Innovative

Solutions for Data Privacy in Finance

Elif

¨

Ozcan

1,2 a

, Rus¸en Akkus¸ Halepmollası

1,2 b

and Yusuf Yaslan

1 c

1

Faculty of Computer and Informatics Engineering, Istanbul Technical University, Turkey

2

T

¨

UB

˙

ITAK Informatics and Information Security Research Center, Kocaeli, Turkey

Keywords:

Finance, Synthetic Data, Federated Learning, Artificial Intelligence.

Abstract:

Financial services generate vast, complex and diverse datasets, yet data privacy issues pose significant chal-

lenges for secure usage and collaborative analysis. Synthetic data generation can offer an innovative solution

while preserving privacy without exposing sensitive information. Also, federated learning enables collabo-

rative model training across clients while maintaining data privacy. In this study, we used Default Credit

Card dataset and employed diffusion based synthetic data generation to evaluate its impact on centralized and

federated learning approaches. To this end, we offer comprehensive benchmarking of synthetic, real, and

hybrid datasets by employing four machine learning classifiers both centrally and federated. Our findings

demonstrate that synthetic data effectively improves results, especially when combined with real data. We

also conduct client specific experiments in federated learning when addressing highly imbalanced or incom-

plete class distributions. Moreover, we evaluate FedF1 aggregation method, which aims to improve global

model performance by optimizing F1-score. To the best of our knowledge, this is the first study to integrate

synthetic data generation and federated learning on a financial dataset to provide valuable insights for secure

and collaborative learning.

1 INTRODUCTION

Artificial Intelligence (AI) has been a transformative

and innovative force in the financial sector, including

banking, insurance, trading, risk management, and

modern FinTech services (Cao, 2022). AI applica-

tions, particularly Machine Learning (ML) and Deep

Learning (DL), are crucial for modeling the complex

linear and nonlinear behaviors of financial variables

to address problems beyond the scope of traditional

models (Ahmed et al., 2022). Meanwhile, ML models

trained on vast amounts of financial data can achieve

higher scores in terms of evaluation metrics and en-

able more robust and efficient data driven decisions.

Financial services generate vast, complex and diverse

dataset; however, the sensitive and personally identi-

fiable features of financial data create significant chal-

lenges and limitations for its usage and sharing (As-

sefa et al., 2020).

One promising solution to handle data privacy and

security issues is synthetic data generation, which

a

https://orcid.org/0009-0002-3423-131X

b

https://orcid.org/0000-0002-9941-2712

c

https://orcid.org/0000-0001-8038-948X

mirrors the statistical properties and patterns of real

data without sharing sensitive data (Lu et al., 2023).

It aims to protect the privacy of customers due to laws

such as General Data Protection Regulation (GDPR)

(Hoofnagle et al., 2019) and Health Insurance Porta-

bility and Accountability Act (HIPAA) (Cohen and

Mello, 2018). Also, sharing realistic synthetic data

between institutions and within research commu-

nity allows training ML models on privacy-compliant

datasets and enables the development of effective so-

lutions to technical challenges. Moreover, synthetic

data can address the lack of historical data for cer-

tain events to provide counterfactual data for testing

strategies, as well as can handle class imbalances in

datasets to improve the performance of ML models,

particularly in cases like fraud detection (Assefa et al.,

2020).

Federated Learning (FL) emerges as another inno-

vative approach to address privacy concerns in finan-

cial data analysis by enabling multiple institutions to

collaboratively train ML models without the need to

share sensitive or raw data (Yang et al., 2019). Data

remains securely within the institutions’ premises,

and only model updates are shared. It ensures that

78

Özcan, E., Halepmollası, R. A. and Yaslan, Y.

Synthetic Data Generation and Federated Learning as Innovative Solutions for Data Privacy in Finance.

DOI: 10.5220/0013440900003956

In Proceedings of the 7th International Conference on Finance, Economics, Management and IT Business (FEMIB 2025), pages 78-89

ISBN: 978-989-758-748-1; ISSN: 2184-5891

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

privacy is maintained, as the underlying financial data

never leaves the organization, thus complying with

regulatory constraints such as GDPR (Truong et al.,

2021). FL also facilitates data collaboration across in-

stitutions and allows them to leverage diverse datasets

to improve model results without violating privacy

policies (Mothukuri et al., 2021).

Considering the aforementioned data privacy and

security issues, in this study, we employed two inno-

vative approaches: (i)Synthetic data generation and

(ii)FL. We leveraged a diffusion model for synthetic

data generation and explored its impact on both cen-

tralized and FL approaches across several ML al-

gorithms, including Logistic Regression (LR), Sup-

port Vector Classifier (SVC), Stochastic Gradient De-

scent Classifier (SGDC), and Multi Layer Percep-

tron (MLP). We benchmark and evaluate the real,

synthetic and hybrid data in centralized and FL ap-

proaches under six distinct experimental scenarios.

Additionally, we conducted two case studies to an-

alyze specific challenges. Case Study 1 focused on

the impact of FL and synthetic data at client level

and Case Study 2 focused on addressing highly im-

balanced and incomplete class distributions. In this

context, our contributions are as follows:

• We present comprehensive benchmarking of syn-

thetic, real and hybrid data in both centralized

and FL environments. To the best of our knowl-

edge, this is the first study to comprehensively in-

vestigate the integration of synthetic data genera-

tion and FL approach using Default Credit Card

dataset to address critical issues in data privacy,

accessibility, and class imbalance.

• We introduce a client-level analysis in FL to in-

vestigate whether it improves model outputs, par-

ticularly in scenarios with imbalanced or incom-

plete class distributions.

• We evaluate a novel FedF1 aggregation method

(Aktas¸ et al., 2024) to optimize global model per-

formance in FL to explore its ability to handle het-

erogeneity and imbalance clients.

Our contributions provide a robust framework for

integrating synthetic data generation and FL approach

in financial applications to address data privacy, secu-

rity and accessibility issues.

Structure of the Paper. Section 2 summarizes previ-

ous works on synthetic data generation and FL ap-

proaches in finance. In Section 3, we present the

methodology. Section 4 describes the dataset and ex-

perimental setup of case studies. In Section 5, the re-

sults of the study are reported and discussed. Section

6 concludes the paper and offers future work.

2 LITERATURE REVIEW

In this section, we review existing literature on syn-

thetic data generation and FL in the financial domain.

This review is organized into two subsections: the

role of synthetic data in financial applications and ad-

vancements in federated learning for finance.

2.1 Synthetic Data Generation in

Finance

Synthetic data generation plays a crucial role in fi-

nancial applications by addressing various issues such

as data scarcity, class imbalance, and privacy con-

straints. Khaled et al. (Khaled et al., 2024) explored

the use of synthetic data to improve ML models for

credit card fraud detection. Authors employed the

SMOTE technique to address the severe class imbal-

ance in financial datasets, where fraudulent transac-

tions are significantly underrepresented. By train-

ing ML models on the generated synthetic data, they

observed notable improvements in accuracy and re-

call, particularly in detecting minority class detection.

This research underscores the potential of synthetic

data to mitigate data imbalance challenges and im-

prove the performance of fraud detection models in

the financial sector.

Building on the promise of synthetic data,

Jolicoeur-Martineau et al. (Jolicoeur-Martineau et al.,

2023) proposed a novel framework that integrates

score-based diffusion models with conditional flow

matching for tabular data generation and imputation

by using XGBoost. That approach is specifically

designed to handle mixed-type tabular data, includ-

ing both categorical and numerical features, a com-

mon challenge in tabular data modeling. Through ex-

tensive experimentation on 27 datasets from diverse

domains, the method demonstrated superior perfor-

mance in data generation tasks compared to state-of-

the-art DL-based generative models while maintain-

ing competitive results in data imputation scenarios.

Additionally, key advantage of the proposed approach

is its efficiency, as it can leverage parallel CPU train-

ing and bypass the need for computationally expen-

sive GPUs. This work highlights the potential of com-

bining advanced generative modeling techniques with

traditional ML algorithms to effectively address tabu-

lar data challenges.

Furthermore, Sattarov et al. (Sattarov et al., 2023)

introduced FinDiff, a novel diffusion-based model

specifically designed to generate synthetic tabular

data in the financial domain. The model addresses

the challenges associated with mixed-type data, such

as the coexistence of numerical and categorical fea-

Synthetic Data Generation and Federated Learning as Innovative Solutions for Data Privacy in Finance

79

tures. FinDiff was rigorously evaluated on three real-

world financial datasets and focused on regulatory

tasks including economic scenario modeling, stress

testing, and fraud detection—key applications in fi-

nance where data availability and privacy are critical

concerns. Their experimental results demostrated that

FinDiff can preserve the statistical properties of the

original dataset and generate high-fidelity synthetic

data while ensuring utility and privacy. Thus, the

model offers a robust solution to data-sharing chal-

lenges in the financial industry. Moreover, authors

highlighted the versatility of FinDiff in supporting

downstream ML tasks and showing competitive per-

formance compared to traditional methods. FinDiff

not only enhances data accessibility but also aligns

with the regulatory requirements of the financial sec-

tor. Therefore, it can be a valuable tool for FL appli-

cations.

2.2 Federated Learning in Finance

FL has received significant attention from researchers

and practitioners as it enables collaborative model

training without sharing sensitive data (

¨

Ulver et al.,

2023)(Zhang et al., 2021)(Yurto

˘

glu et al., 2024).

Wang et al. (Wang et al., 2024) proposed Feder-

ated Knowledge Transfer (FedKT), a FL approach de-

veloped for credit scoring while preserving data pri-

vacy. The approach enables collaboration among fi-

nancial institutions without sharing raw data to ad-

dress privacy concerns in credit scoring. A key chal-

lenge in FL is the heterogeneity of data distribu-

tions across participants, which can hinder the learn-

ing capacity of the global model. For this purpose,

FedKT combines fine-tuning and knowledge distilla-

tion techniques to effectively extract general knowl-

edge from the global model’s early layers and task-

specific knowledge from its outputs. Experimental

evaluations on four distinct credit datasets demon-

strated that FedKT outperforms existing FL algo-

rithms in terms of predictive performance and robust-

ness. Its ability to balance privacy preservation with

high model performance makes it particularly valu-

able in the financial sector, where data sensitivity and

regulatory compliance are critical.

In addition to privacy concerns, data imbalance

poses a significant challenge in FL environments.

Zhang et al. (Zhang et al., 2024) explored the chal-

lenges posed by data imbalance in FL for credit

risk forecasting, a critical task in financial decision-

making. They analyzed the performance of three ML

models—Multilayer Perceptron (MLP), Long Short-

Term Memory (LSTM), and eXtreme Gradient Boost-

ing (XGBoost)—across multiple datasets with vary-

ing client numbers and data distribution patterns.

They achieved an average performance improvement

of 17.92% and their findings revealed that FL mod-

els significantly outperformed local models for non-

dominant clients with smaller, highly imbalanced

datasets. However, for dominant clients with larger

datasets, FL models offered no clear advantage over

local models, thus, authors highlighted potential dis-

incentives for their participation. The study empha-

sized the need for strategies to mitigate the effects of

data imbalance and ensure equitable benefits for all

participants in FL environments.

Trust and interpretability are also critical for

the adoption of FL in finance. Awosika et al.

(Awosika et al., 2023) introduced a novel approach

that combines FL and eXplainable Artificial Intelli-

gence (XAI) to enhance financial fraud detection sys-

tems. FL enables multiple financial institutions to

collaboratively train a shared fraud detection model

without exchanging sensitive customer data, thereby

upholding data privacy and confidentiality. The in-

tegration of XAI ensures that the model’s predic-

tions are interpretable by human experts and fosters

transparency and trust in the system. Authors con-

ducted experiments on realistic transaction datasets

and demonstrated that the FL-based fraud detection

system consistently achieved high performance met-

rics. They underscored FL’s potential as an effec-

tive and privacy-preserving tool in combating finan-

cial fraud.

3 METHODOLOGY

In this section, we provide our methodology that in-

volves synthetic data generation, FL approach and

ML algorithms.

3.1 Synthetic Data Generation

In this study, we follow synthetic data production pro-

cedure presented in FinDiff: Diffusion Models for

Financial Tabular Data Production (Sattarov et al.,

2023). For this purpose, we used Gaussian Diffu-

sion Models to generate synthetic data customized to

mixed-type tabular datasets, which are common in fi-

nancial applications. The methodology is intended to

overcome the issues of working with heterogeneous

data that contains both numerical and category vari-

ables.

Gaussian Diffusion Models operate by gradually

transforming data distributions through a two-step

process. In the forward diffusion phase, Gaussian

noise is incrementally added to the original data,

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

80

effectively smoothing its complex structure into a

noise-dominated state. Thus, the learning of high-

dimensional relationships within the data is facili-

tated. In the reverse diffusion phase, noise is sys-

tematically removed and reconstructed synthetic sam-

ples that approximate the original data distribution. A

learned score function guides the reverse process to

ensure that the generated data aligns closely with the

original dataset’s statistical and structural properties

(Ho et al., 2020)(Sohl-Dickstein et al., 2015).

In line with the methodology presented in (Sat-

tarov et al., 2023), we also evaluated the quality

and utility of the generated synthetic data using sev-

eral metrics, including fidelity, utility, synthesis, and

privacy. Fidelity measures how well the synthetic

data replicated the statistical properties of the orig-

inal data, both at the column level (individual fea-

tures) and row level (holistic data structures). Util-

ity evaluates the ability of synthetic data to support

downstream ML tasks such as fraud detection and

credit scoring. Synthesis ensures that the generated

data maintained structural alignment with the original

dataset. Privacy assesses resistance to privacy attacks

such as membership inference.

3.2 Federated Learning

FL is a decentralized ML approach designed for train-

ing models collaboratively across multiple clients

while preserving data privacy. Unlike traditional cen-

tralized approaches, where data is collected and pro-

cessed on a central server, FL ensures that data re-

mains on the clients. Only model updates, such

as gradients and weights, are shared with a central

server, in which the model parameters are aggregated

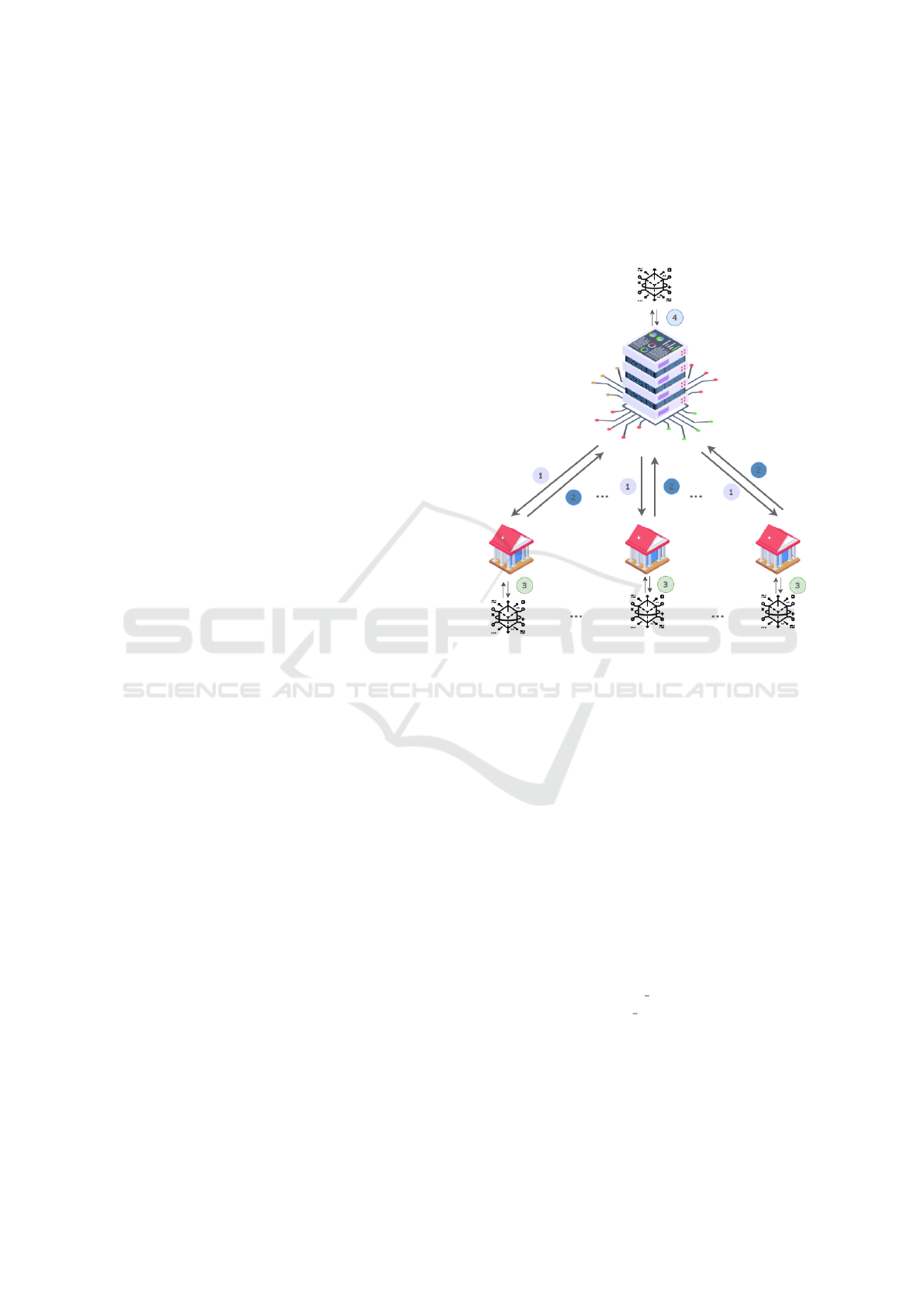

to create a global model. As shown in the Figure 1,

each client trains the model locally on its own dataset

to create a global model without sharing the data and

ensure that sensitive data never leaves the clients’ en-

vironment. After local training, each client sends only

the model parameters to the server that aggregates the

weights from all clients to update the global model.

The updated global model is shared with all clients,

and the process is repeated for several iterations until

the model converges.

In this study, we employed two aggregation meth-

ods. The first method, namely FedAvg, computes a

weighted average of model updates from participat-

ing clients based on their dataset sizes to ensure pro-

portional contribution to the global model (McMahan

et al., 2017). The second method, namely FedF1, ag-

gregates model updates by assigning weights based

on the clients’ F1-scores (Aktas¸ et al., 2024). FedF1

prioritizes contributions from clients with higher F1-

scores to reflect more stable and accurate local mod-

els. In other words, by using F1-scores as a weighting

factor, it aims to improve the overall performance and

reliability of the global model, particularly in scenar-

ios with imbalanced datasets or heterogeneous client

performance.

Figure 1: Synthetic Data Generation.

3.3 Machine Learning Algorithms

When comparing the both synthetic−real data and

central−decentral approaches, we examined the fea-

sibility of using four classifiers, namely LR, SVC,

SGDC and MLP. The employed classifiers are, in

short, described below:

Logistic Regression. (Hosmer et al., 2013) models

the probability of a binary class label using the sig-

moid function by transforming a linear combination

of input features into a probability score. It is a para-

metric and discriminative method and focuses on the

direct mapping between features (independent vari-

ables) and class labels (dependent variables). In this

study, we conducted hyperparameter tuning using the

training and validation datasets, resulting in the best

parameters: C = 0.01, max iter = 5000, penalty = l1,

solver = saga, and class weight = balanced.

Support Vector Classifier. (Cortes and Vapnik,

1995) constructs a hyperplane that separates classes

in the feature space with maximum margin. In this

study, we employed a linear kernel to model linearly

Synthetic Data Generation and Federated Learning as Innovative Solutions for Data Privacy in Finance

81

separable data. Hyperparameter tuning focused on

improving the model’s handling of class imbalances

and convergence properties, with the optimal param-

eters identified as C = 0.1, max iter = 1000, and

class weight = balanced.

Stochastic Gradient Descent Classifier. (Bottou,

2010) is a linear classifier that leverages Stochastic

Gradient Descent for optimization. It iteratively up-

dates the model parameters by computing the gra-

dient of the loss function with respect to a single

training example to make it highly efficient for large-

scale and sparse datasets. In this study, we fine-

tuned the hyperparameters, and determined the op-

timal configuration as al pha = 0.1 (regularization

term), max iter = 5000 (maximum number of itera-

tions), penalty = elasticnet (combination of L1 and

L2 regularization), and l1 ratio = 0.5 (balance be-

tween L1 and L2 regularization).

Multi-Layer Perceptron. (Goodfellow et al.,

2016) is a feedforward neural network that cap-

tures non-linear relationships between input fea-

tures and target labels using multiple layers of

neurons. Training is performed using backprop-

agation to optimize the weights of the network.

The hyperparameter tuning process determined

the best configuration as activation = relu,

al pha = 0.001, hidden layer sizes = (50, ),

learning rate = adaptive, max iter = 200, and

solver = adam.

4 EXPERIMENTAL SETUP

In this section, we present the details of the dataset we

utilized and the experiments we conducted, including

the training configuration, evaluation scenarios, case

studies, and evaluation metrics. The overall flow of

the experimental setup is shown in Figure 2.

4.1 Dataset

In this study, we used Default of Credit Card

Clients(DCCC) dataset (Yeh and Lien, 2009), ob-

tained from the UCI Machine Learning Repository.

DCCC dataset includes 30,000 records of credit card

clients in Taiwan and includes both categorical and

numerical features. It provides a comprehensive set of

attributes, including demographic information, pay-

ment history, bill statements, and a default payment

indicator. It is complete, with no missing values, and

the target variable is binary. The dataset has a class

imbalance, with class ratio of 3:1.

4.2 Training Configuration

We randomly split 90% of the data for training and

10% for testing. Random splitting of the dataset can

lead to significant variations in the target variable ra-

tios, which may impact model performance, espe-

cially since our dataset is imbalanced with a small

number of samples in the default class. To address

this issue, we ensured that the data split was per-

formed with stratification. To obtain more reliable

results, we repeated the experiments 10 times, each

with a different random seed to shuffle the order of

the samples, and calculated the average performance

scores across all runs.

We utilized the training data to generate synthetic

data from the training set. For this purpose, we em-

ployed the diffusion model, as detailed in Section 3.

Moreover, we partitioned the training data equally

into five subsets, representing five distinct clients for

FL setup. We built federated models using the real

train set distributed across those clients and evaluated

models’ performance using the real test set. When

exploring the potential of synthetic data in FL, we in-

dependently applied the same diffusion model to each

client to generate client-specific synthetic data. Please

note that we generated synthetic data for each client

using only their local data, as clients in real-world FL

scenarios cannot access to each other’s data. Over-

all, to evaluate the impact of data augmentation on

model performance, we trained federated models on

three data types: real data, synthetic data and hybrid

data which is a combination of real and synthetic data.

Furthermore, to compare the FL approach with the

centralized approach, we used the same train-test con-

figurations when building ML models centrally. Sim-

ilar to the FL approach, we trained centralized models

on three data types: real data, synthetic data and hy-

brid data.

Table 1 provides a detailed summary of the data

distribution across centralized and federated setups to

highlight the class distribution in each subset. In all

scenarios, we used only the test set split from the real

data for evaluation. In other words, model testing

across all configurations was performed on the real

test set. Thus, we ensured consistency and compara-

bility across centralized and federated setups, as well

as across models trained on real, synthetic, and com-

bined datasets.

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

82

Figure 2: Illustration of proposed experimental setup.

Table 1: Data distribution across clients and test set.

# Samples

Class 0

# Samples

Class 1

Class 1

Proportion (%)

Central Data 21023 5977 22.1

Client 1 4229 1171 21.6

Client 2 4209 1191 22.0

Client 3 4218 1182 21.8

Client 4 4187 1213 22.4

Client 5 4180 1220 22.5

Test Data 2341 659 21.9

4.3 Benchmarking: Evaluating

Synthetic Data in Centralized and

FL Approaches

To investigate the impact of synthetic data on FL, we

conducted a comprehensive analysis using four al-

gorithms: Logistic Regression (LR), Support Vector

Classifier (SVC), Stochastic Gradient Descent Clas-

sifier (SGDClassifier) and Multi-Layer Perceptron

(MLP). Our goal is to evaluate the performance of

both centralized and federated models on varying data

types and provide insights into how synthetic data in-

fluences learning outcomes. Also, we designed the

experiments around six distinct scenarios:

• Central+Real Data. In this scenario, centralized

models are trained solely on the real data. The

objective is to assess the baseline performance of

centralized models without the influence of syn-

thetic data.

• Central+Synthetic Data. In this scenario, central-

ized models are trained using only synthetic data

generated from the training set. This allows us to

evaluate the impact of synthetic data in a central-

ized learning environment by comparing perfor-

mance with the real data scenario.

• Central+Hybrid Data. This scenario involves

centralized models trained on a combination of

real and synthetic data. The goal is to assess the

effectiveness of data augmentation.

• FL+Real Data. In this scenario, federated models

are trained using only real data distributed across

clients. This scenario provides a baseline for FL

performance with real data.

• FL+Synthetic Data. In this scenario, federated

models are trained using synthetic data generated

for each client. The purpose is to explore the

potential of synthetic data in a FL environment

and evaluate how it influences model performance

compared to real data.

• FL+Hybrid Data. This scenario involves feder-

ated models trained on a combination of real and

synthetic data. By incorporating both types of

data, the setup evaluates the impact of data aug-

mentation on FL performance, similar to the hy-

brid data scenario in centralized models.

4.4 Case Study 1: Evaluating FL

Performance with Synthetic Data

To further explore the benefits of FL at the client level,

we conducted an additional case study focusing on

three selected clients (Client 1, Client 3, and Client 5).

We evaluated their performance under various config-

urations to gain a deeper understanding of the impact

of FL and the use of synthetic data at the client level.

We utilized SVC and MLP based on the benchmark-

ing results of which MLP achieved the highest accu-

racy scores and SVC reached the best F1-scores.

For each client, we performed experiments us-

ing locally trained centralized models on three dif-

ferent data types: real data, synthetic data, and hy-

Synthetic Data Generation and Federated Learning as Innovative Solutions for Data Privacy in Finance

83

brid data. We trained the models on the individual

client’s data to represent a baseline for local training

without federated collaboration. In FL setup, we con-

ducted each model training over 10 rounds using the

FedAvg aggregation method. We evaluated two dis-

tinct model types at the end of the training process to

assess the impact of global collaboration and client-

specific fine-tuning:

• Global Federated Model: This model represents

the aggregated global model produced by the

server after the 10th communication round. It re-

flects the combined knowledge learned from all

participating clients.

• Client-Adapted Federated Model: This model is

derived from the global federated model after the

10th round but is further fine-tuned locally on

each client’s own data.

With the above model types, we aim to explore,

in detail, the performance improvements that FL can

bring to local clients when data centralization is not

feasible due to privacy concerns, regulatory restric-

tions, or operational constraints.

4.5 Case Study 2: Addressing

Imbalanced Class Distribution

In this case study, we investigated the potential of FL

to address a scenario where clients have highly imbal-

anced or incomplete class distributions. To simulate

such a scenario, we created three clients: one client

with no samples labeled as class 1 and two clients

with balanced class distributions. The setup reflects

real-world situations, such as a bank branch with no

recorded fraud cases, while other branches have suf-

ficient data for both classes. The data distribution

among the clients and the test set is summarized in

Table 2.

Table 2: Data distribution across clients and test set for Case

Study 2.

Class 0 Class 1

Client 1 5976 0

Client 2 2988 2988

Client 3 2988 2988

Test Data 659 659

When the first client trains a local model indepen-

dently, it has no knowledge of class 1 due to the ab-

sence of positive samples on its dataset. Therefore, its

local model can be incapable of predicting the posi-

tive class. On the other hand, by participating in FL,

that client can leverage knowledge aggregated from

other clients and gain access to information about

class 1 without sharing its raw data, thus preserving

data privacy.

Additionally, we explored the limitations of syn-

thetic data generation in this context. Even if syn-

thetic data were generated for the first client, the ab-

sence of positive samples would prevent the genera-

tion of meaningful data for class 1. Thus, it highlights

a critical scenario where FL provides a unique advan-

tage over local models and synthetic data augmenta-

tion.

For aggregation in this study, we employed the

FedF1 method, designed to optimize the federated

model for imbalanced data scenarios. By focusing

on F1-score optimization during aggregation, FedF1

ensures that the global model performs effectively

across clients with differing class distributions.

5 ANALYSIS OF THE RESULTS

In this study, we evaluate the performance of synthetic

data in centralized and FL approaches using four ML

models, including LR, SVC, SGDC, and MLP. In

Case Study 1, we investigate FL performance with

synthetic data. With Case Study 2, we address im-

balanced class distribution using FL approach. We

evaluated the synthetic data generated for centralized

training to assess its similarity to the real data. We

also compared feature distributions and inter-feature

relationships between the real and synthetic datasets.

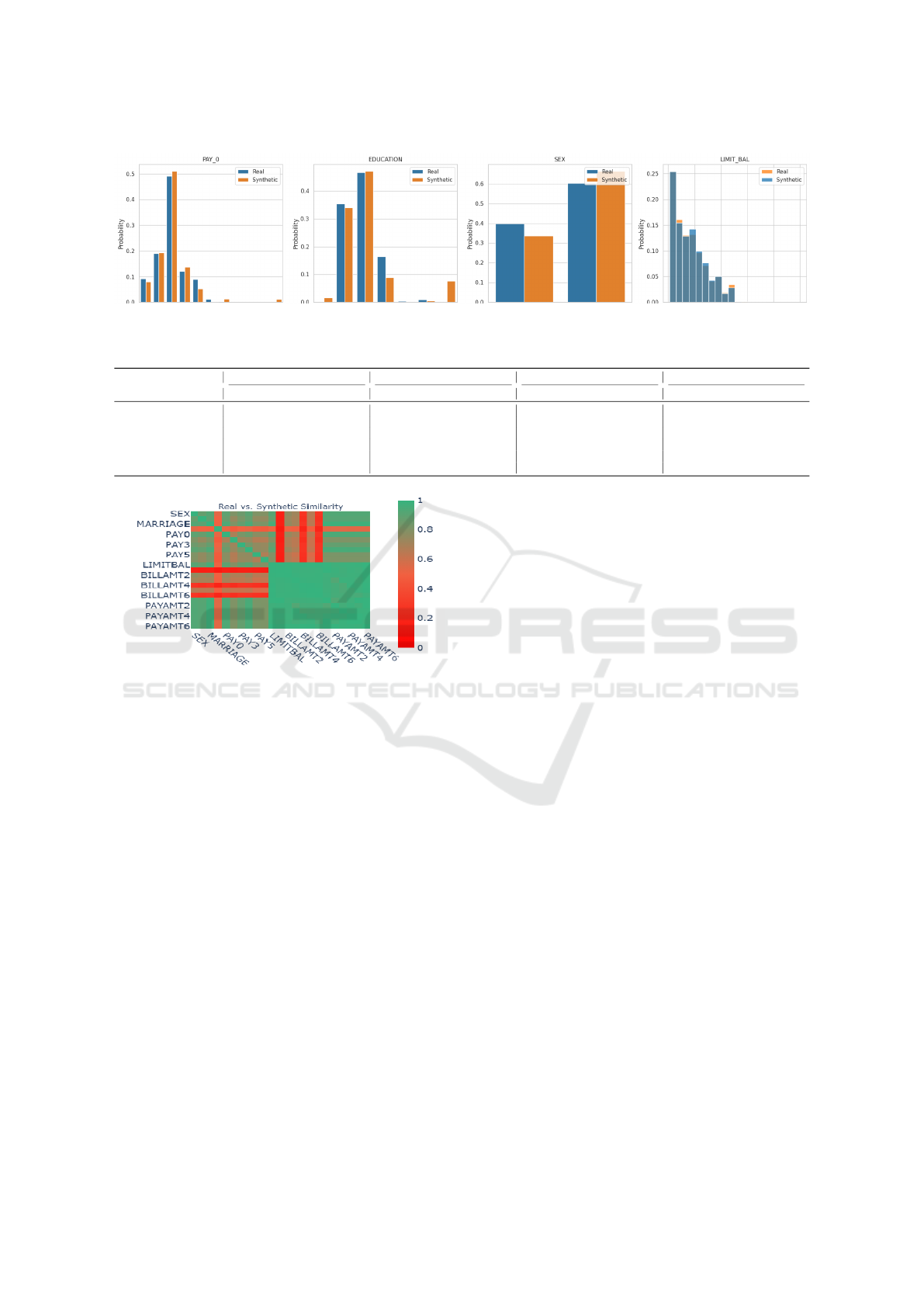

Figure 3 shows the probability distributions of se-

lected features (e.g., Gender, Pay0, Age, and Lim-

itbal) and illustrate a close match between syn-

thetic dataset and real dataset. Furthermore, Figure

4 presents the column pair trends and correlations

and also demonstrate strong consistency across both

datasets. The evaluation using the SDV framework

provided additional metrics to quantify the quality of

the synthetic data as follows:

• Column Shapes Score: 92.27%

• Column Pair Trends Score: 77.29%

• Overall Quality Score: 84.78%

In the subsections, we discuss, in detail, the ef-

fect of the different data types, FL and centralized

approaches, selected ML algorithms, and imbalanced

class distribution.

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

84

Figure 3: Probability distributions of selected features for real and synthetic data.

Table 3: Comparative analysis of different algorithms for Central and FL models.

SGD SVC LR MLP

F1 Acc Recall Prec F1 Acc Recall Prec F1 Acc Recall Prec F1 Acc Recall Prec

Central - Real Data 0.4926 0.6320 0.55 0.56 0.5977 0.6540 0.64 0.60 0.5699 0.6913 0.57 0.56 0.4922 0.7713 0.52 0.57

Central - Synthetic Data 0.4852 0.5804 0.55 0.55 0.6386 0.7190 0.66 0.63 0.5797 0.7003 0.58 0.57 0.4548 0.7723 0.50 0.53

Central - Hybrid Data 0.4939 0.6080 0.55 0.58 0.6335 0.7057 0.66 0.62 0.5772 0.6960 0.58 0.57 0.4667 0.7795 0.51 0.62

FL - Real Data 0.4573 0.5589 0.53 0.54 0.6037 0.6637 0.65 0.60 0.5695 0.6943 0.57 0.56 0.3944 0.5684 0.48 0.49

FL - Synthetic Data 0.3829 0.4561 0.52 0.48 0.6674 0.7980 0.65 0.70 0.5532 0.6913 0.55 0.55 0.3954 0.5055 0.49 0.49

FL - Hybrid Data 0.4009 0.4601 0.53 0.54 0.6447 0.7370 0.66 0.63 0.5568 0.6960 0.56 0.55 0.3042 0.3446 0.48 0.51

Figure 4: Column pair trends for real and synthetic data.

5.1 Benchmarking: Evaluating

Synthetic Data in Centralized and

FL Approaches

In this subsection, we compare the performance of

centralized and FL approaches using real data, syn-

thetic data and hybrid data.

The results presented highlight an insight into the

effectiveness of synthetic data in ML models, both in

centralized and FL frameworks. One of the primary

goals of this study was to evaluate whether models

trained on synthetic data could achieve performance

comparable to, or even exceed, those trained on real

data. From Table 3, we observe that while different

algorithms show varying levels of performance, the

use of synthetic data produces results that are com-

parable to—and occasionally better than—those ob-

tained using real data. Figure 5 visually illustrates

this observation, showcasing the performance distri-

bution of centralized and FL models across different

data configurations. The violin plots clearly demon-

strate that synthetic data yields performance distribu-

tions comparable to those of real data, further high-

lighting its effectiveness in both centralized and FL

settings.For instance, in the centralized models, the

SVC algorithm achieved an F1-score of 0.6386 with

synthetic data, outperforming the corresponding F1-

score of 0.5977 when trained on real data. A similar

trend is observed in FL models, where the synthetic

data-based SVC achieved an F1-score of 0.6674, ex-

ceeding the F1-score of 0.6037 obtained with real

data.

To delve deeper into the comparative performance

of the datasets, Table 4 provides a focused analysis of

F1-scores across all experimental setups. This table

shows that in both centralized and FL models, syn-

thetic data consistently performs competitively. Al-

though hybrid datasets often improve model perfor-

mance compared to real data (e.g., the F1-score of

0.4939 for the SGD method in centralized settings or

the F1-score of 0.6447 for the SVC algorithm in FL),

the gains over synthetic data are typically insignifi-

cant. This indicates that using synthetic data alone is

usually enough to produce competitive results, even

though hybrid data may be useful in certain situa-

tions. In many instances, hybrid data perform simi-

larly to synthetic data, suggesting that the additional

complexity of integrating real data may not always be

necessary.

The results underline that the quality of model pre-

dictions is unaffected by the use of synthetic data.

In contrast, synthetic data’s competitive performance

shows that it can potentially ease privacy issues, since

using the synthetic data provides similar results with-

out compromising the privacy of sensitive data in both

centralized and FL environments. The success of syn-

thetic data in achieving comparable or superior per-

Synthetic Data Generation and Federated Learning as Innovative Solutions for Data Privacy in Finance

85

Figure 5: Performance distribution of centralized and federated models across different data configurations.

Table 4: F1-Scores Across Centralized and Federated Learning Models Using Real, Synthetic, and Hybrid Data

Centralized Models FL Models

Real Data Synthetic Data Hybrid Data Real Data Synthetic Data Hybrid Data

SGD 0.4926 0.4852 0.4939 0.4573 0.3829 0.4009

SVC 0.5977 0.6386 0.6335 0.6037 0.6674 0.6447

LR 0.5699 0.5797 0.5772 0.5695 0.5532 0.5568

MLP 0.4922 0.4548 0.4667 0.3944 0.3954 0.3042

formance reaffirms its value as an alternative, espe-

cially in domains where real data is limited, sensitive,

or inaccessible.

5.2 Case Study 1: Evaluating FL

Performance with Synthetic Data

In this subsection, we compare the performance of

centralized and FL approaches across different clients

for FL global models, as well as fine-tuned FL mod-

els.

The results presented in Table 5 and Table 6 pro-

vide insights into the client-level impact of FL models

compared to centralized models. From the results, it

is evident that FL models generally achieve perfor-

mance that is comparable to, or even exceeds, that of

centralized models across most clients. For instance,

in Table 5, the FL global model for SVC achieved

an F1-score of 0.6649 for Client 2, outperforming the

centralized model’s F1-score of 0.5603. Similarly, in

Table 6, for the MLP model, the FL model achieved

an F1-score of 0.4673 for Client 2, which is compara-

ble to the centralized model’s F1-score of 0.4673. The

results show the effectiveness of FL in maintaining or

improving performance at the client level, ensuring

that models trained in a decentralized manner are ca-

pable of matching the results of centralized training.

5.3 Case Study 2: Addressing

Imbalanced Class Distributions

In this case study we focused on the limitations of

synthetic data in addressing class imbalance, partic-

ularly when certain classes are entirely absent from

a client’s local dataset. In such scenarios, synthetic

data generation alone fails to resolve the issue, as it

relies solely on the local data distribution and cannot

create representations for missing classes. FL, how-

ever, overcomes this limitation by aggregating knowl-

edge from multiple clients, enabling the global model

to learn from distributed datasets where the missing

class is present.

Table 7 highlights the performance of centralized

models and FL strategies, FedAvg and FedF1. The FL

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

86

Table 5: Client-Specific Evaluation of SVC in Centralized and Federated Learning Models.

Client 1 Client 2 Client 3

Precision Recall F1-Score Accuracy Precision Recall F1-Score Accuracy Precision Recall F1-Score Accuracy

Central - Real Data 0.6016 0.6428 0.5939 0.6510 0.5868 0.6261 0.5603 0.6020 0.6263 0.6723 0.6275 0.6893

FL - Real Data 0.6016 0.6428 0.5939 0.6510 0.5868 0.6261 0.5603 0.6020 0.6263 0.6723 0.6275 0.6893

FL Global - Real Data 0.6078 0.6498 0.6037 0.6637 0.6078 0.6498 0.6037 0.6637 0.6078 0.6499 0.6037 0.6637

Central - Synthetic Data 0.6792 0.6431 0.6558 0.7867 0.5948 0.6188 0.5988 0.6867 0.7117 0.6099 0.6270 0.8003

FL - Synthetic Data 0.6792 0.6436 0.6576 0.7867 0.5948 0.6188 0.5988 0.6867 0.7117 0.6099 0.6270 0.8003

FL Global - Synthetic Data 0.6996 0.6514 0.6673 0.7980 0.6996 0.6514 0.6673 0.7980 0.6996 0.6514 0.6673 0.7980

Central - Hybrid Data 0.6215 0.6546 0.6277 0.7060 0.5761 0.6092 0.5579 0.6097 0.6895 0.6594 0.6710 0.7917

FL - Hybrid Data 0.6215 0.6546 0.6277 0.7060 0.5761 0.6092 0.5579 0.6097 0.6895 0.6594 0.6709 0.7917

FL Global - Hybrid Data 0.6373 0.6581 0.6447 0.7370 0.6373 0.6581 0.6447 0.7370 0.6373 0.6581 0.6447 0.7370

Table 6: Client-Specific Evaluation of MLP in Centralized and Federated Learning Models.

Client 1 Client 2 Client 3

Precision Recall F1-Score Accuracy Precision Recall F1-Score Accuracy Precision Recall F1-Score Accuracy

Central - Real Data 0.5190 0.5035 0.4679 0.7645 0.4982 0.5036 0.4673 0.7574 0.5240 0.5107 0.4850 0.7549

FL - Real Data

0.5406 0.5286 0.5248 0.7030 0.5557 0.5378 0.5286 0.7299 0.5588 0.5617 0.5380 0.6671

FL Global - Real Data 0.4922 0.4833 0.3944 0.5684 0.4922 0.4833 0.3944 0.5684 0.4922 0.4833 0.3944 0.5684

Central - Synthetic Data 0.4546 0.4974 0.4461 0.7687 0.4894 0.5014 0.4595 0.7644 0.4510 0.4903 0.4478 0.7524

FL - Synthetic Data 0.4941 0.4988 0.4688 0.7433 0.5094 0.5130 0.4904 0.7067 0.4985 0.5031 0.4770 0.7266

FL Global - Synthetic Data 0.4871 0.4920 0.3954 0.5055 0.4871 0.4920 0.3954 0.5055 0.4871 0.4920 0.3954 0.5055

Central - Hybrid Data 0.5414 0.5044 0.4631 0.7689 0.4997 0.5035 0.4634 0.7643 0.4828 0.4972 0.4632 0.7515

FL - Hybrid Data 0.5607 0.5496 0.5271 0.6910 0.5415 0.5265 0.4974 0.6906 0.5580 0.5752 0.5482 0.6348

FL Global - Hybrid Data

0.5093 0.4869 0.3042 0.3446 0.5093 0.4869 0.3042 0.3446 0.5093 0.4869 0.3042 0.3446

Table 7: Case 2 - Comparison of Centralized Learning and Federated Learning with Different Strategies.

F1 Precision Recall Accuracy

Real Synthetic Hybrid Real Synthetic Hybrid Real Synthetic Hybrid Real Synthetic Hybrid

Central 0.3333 0.3333 0.3333 0.7500 0.7500 0.7500 0.5000 0.5000 0.5000 0.5000 0.5000 0.5000

FL Avg 0.3333 0.3333 0.3333 0.7500 0.7500 0.7500 0.5000 0.5000 0.5000 0.5000 0.5000 0.5000

FL Avg Global 0.3891 0.3894 0.3544 0.5399 0.5656 0.5913 0.5013 0.5015 0.5035 0.50013 0.5001 0.5035

FL FedF1 0.3333 0.3333 0.3333 0.7500 0.7500 0.7500 0.5000 0.5000 0.5000 0.5000 0.5000 0.5000

FL Global FedF1 0.4000 0.4003 0.4118 0.4952 0.4894 0.5998 0.4996 0.4799 0.4937 0.4996 0.4799 0.4937

Global FedF1 model achieves an F1-score of 0.4000

for real data, outperforming the centralized model

(F1-score: 0.3333). This demonstrates FL’s ability to

leverage data from other clients to predict underrep-

resented classes effectively, a capability that synthetic

data alone cannot provide.

Moreover, the FedF1 strategy proves more effec-

tive than FedAvg by prioritizing F1-scores during ag-

gregation, thereby enhancing the global model’s abil-

ity to handle imbalanced data. For example, when

using hybrid data (real + synthetic), the FL Global

FedF1 model achieves a F1-score of 0.4118, com-

pared to 0.3544 for FedAvg. These results underscore

the critical role of FL in scenarios where local data

distributions are severely imbalanced.

These results demonstrate that FL, particularly

with the FedF1 strategy, effectively addresses class

imbalance in decentralized environments. Unlike

synthetic data generation, which is constrained by

local data distributions, FL aggregates distributed

knowledge across clients, enabling robust model

training even in the absence of certain classes. This

highlights FL’s potential as a practical approach for

scenarios where class imbalance cannot be resolved

through conventional means.

6 FINAL REMARKS

This study highlights the potential of combining syn-

thetic data and FL to address critical challenges in

ML, such as data privacy, class imbalance, and decen-

tralized learning. Synthetic data emerged as a reliable

alternative to real data, consistently achieving com-

parable performance across both centralized and FL

settings. Its effectiveness underscores its applicabil-

ity for applications where privacy or data accessibil-

ity constraints make the use of real data impractical.

These results are particularly relevant for applications

in financial institutions, where data privacy regula-

tions prevent direct data sharing between entities, the

combination of synthetic data and FL enables collab-

orative learning without compromising sensitive in-

formation, ensuring that institutions can achieve per-

formance comparable to centralized models without

exposing their data.

At the same time, FL demonstrated its capacity to

enhance model robustness by leveraging distributed

knowledge across clients. This capability proved par-

ticularly crucial in scenarios where synthetic data

alone was insufficient, such as when certain classes

were entirely absent from a client’s local dataset. By

Synthetic Data Generation and Federated Learning as Innovative Solutions for Data Privacy in Finance

87

integrating data from other clients, FL effectively mit-

igated these limitations, enabling the global model to

address class imbalances and improve prediction ac-

curacy. Compared to traditional centralized learning

approaches, this combination not only preserves data

privacy but also enhances model robustness by lever-

aging distributed knowledge, making it particularly

effective in scenarios with class imbalances or miss-

ing labels.

The findings suggest that synthetic data and FL

are not only complementary but also mutually rein-

forcing. Synthetic data provides the foundation for

privacy-preserving ML, while FL extends this foun-

dation to handle more complex challenges inherent

in decentralized environments. Together, these ap-

proaches form a robust framework for developing

high-performing and privacy-conscious ML models

suitable for real-world applications.

For future work, there are several potential direc-

tions to build upon our current findings. First, the im-

pact of alternative synthetic data generation methods

could be examined, focusing on how different tech-

niques influence model performance in both central-

ized and FL frameworks. Furthermore, expanding the

scope of the study to include diverse datasets from

various domains would help validate the robustness

and applicability of the proposed approach. Another

promising avenue involves testing more advanced

classification algorithms to explore their potential for

improving both predictive accuracy and generaliza-

tion across heterogeneous environments. These direc-

tions would collectively contribute to a deeper under-

standing of the interplay between synthetic data and

FL in addressing real-world ML challenges.

REFERENCES

Ahmed, S., Alshater, M. M., El Ammari, A., and Ham-

mami, H. (2022). Artificial intelligence and machine

learning in finance: A bibliometric review. Research

in International Business and Finance, 61:101646.

Aktas¸, M., Akkus¸ Halepmollası, R., and T

¨

oreyin, B. U.

(2024). Enhancing credit risk assessment with fed-

erated learning through a comparative study. In 8th

EAI International Conference on Robotic Sensor Net-

works.

Assefa, S. A., Dervovic, D., Mahfouz, M., Tillman, R. E.,

Reddy, P., and Veloso, M. (2020). Generating syn-

thetic data in finance: opportunities, challenges and

pitfalls. In Proceedings of the First ACM International

Conference on AI in Finance, pages 1–8.

Awosika, T. et al. (2023). Transparency and privacy: The

role of explainable ai and federated learning in finan-

cial fraud detection. Journal of Financial Technology

and Ethics, 8(1):15–30.

Bottou, L. (2010). Large-scale machine learning with

stochastic gradient descent. In Proceedings of COMP-

STAT’2010, pages 177–186. Springer.

Cao, L. (2022). Ai in finance: challenges, techniques,

and opportunities. ACM Computing Surveys (CSUR),

55(3):1–38.

Cohen, I. G. and Mello, M. M. (2018). Hipaa and pro-

tecting health information in the 21st century. Jama,

320(3):231–232.

Cortes, C. and Vapnik, V. (1995). Support-vector networks.

Machine Learning, 20(3):273–297.

Goodfellow, I., Bengio, Y., and Courville, A. (2016). Deep

Learning. MIT Press.

Ho, J., Jain, A., and Abbeel, P. (2020). Denoising diffusion

probabilistic models. Advances in neural information

processing systems, 33:6840–6851.

Hoofnagle, C. J., Van Der Sloot, B., and Borgesius, F. Z.

(2019). The european union general data protection

regulation: what it is and what it means. Information

& Communications Technology Law, 28(1):65–98.

Hosmer, D. W., Lemeshow, S., and Sturdivant, R. X. (2013).

Applied Logistic Regression. Wiley.

Jolicoeur-Martineau, A. et al. (2023). Generating and im-

puting tabular data via diffusion and flow based gra-

dient boosted trees. Advances in Neural Information

Processing Systems (NeurIPS).

Khaled, A. et al. (2024). Synthetic data generation and

impact analysis of machine learning models for en-

hanced credit card fraud detection. Journal of Artifi-

cial Intelligence and Applications, 12(3):45–60.

Lu, Y., Shen, M., Wang, H., Wang, X., van Rechem, C.,

Fu, T., and Wei, W. (2023). Machine learning for

synthetic data generation: a review. arXiv preprint

arXiv:2302.04062.

McMahan, B., Moore, E., Ramage, D., Hampson, S., and

y Arcas, B. A. (2017). Communication-efficient learn-

ing of deep networks from decentralized data. In Ar-

tificial intelligence and statistics, pages 1273–1282.

PMLR.

Mothukuri, V., Parizi, R. M., Pouriyeh, S., Huang, Y., De-

hghantanha, A., and Srivastava, G. (2021). A survey

on security and privacy of federated learning. Future

Generation Computer Systems, 115:619–640.

Sattarov, E. et al. (2023). Findiff: Diffusion models for

financial tabular data generation. Financial Data Sci-

ence Journal, 9(2):75–90.

Sohl-Dickstein, J., Weiss, E., Maheswaranathan, N., and

Ganguli, S. (2015). Deep unsupervised learning us-

ing nonequilibrium thermodynamics. In International

conference on machine learning, pages 2256–2265.

PMLR.

Truong, N., Sun, K., Wang, S., Guitton, F., and Guo, Y.

(2021). Privacy preservation in federated learning: An

insightful survey from the gdpr perspective. Comput-

ers & Security, 110:102402.

¨

Ulver, B., Yurto

˘

glu, R. A., Dervis¸o

˘

glu, H., Halepmollası,

R., and Haklıdır, M. (2023). Federated learning in pre-

dicting heart disease. In 2023 31st Signal Processing

and Communications Applications Conference (SIU),

pages 1–4. IEEE.

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

88

Wang, H. et al. (2024). A novel federated learning approach

with knowledge transfer for credit scoring. IEEE

Transactions on Neural Networks and Learning Sys-

tems.

Yang, Q., Liu, Y., Chen, T., and Tong, Y. (2019). Federated

machine learning: Concept and applications. ACM

Transactions on Intelligent Systems and Technology

(TIST), 10(2):1–19.

Yeh, I.-C. and Lien, C.-h. (2009). The comparisons of data

mining techniques for the predictive accuracy of prob-

ability of default of credit card clients. Expert systems

with applications, 36(2):2473–2480.

Yurto

˘

glu, R. A., Dervis¸o

˘

glu, H.,

¨

Ulver, B., Halepmollası,

R., and Haklıdır, M. (2024). A novel transformation

through digital twin and federated learning integra-

tion: A case study on cardiovascular disease predic-

tion. In International Conference on Information and

Communication Technologies for Ageing Well and e-

Health, pages 91–113. Springer.

Zhang, C., Xie, Y., Bai, H., Yu, B., Li, W., and Gao, Y.

(2021). A survey on federated learning. Knowledge-

Based Systems, 216:106775.

Zhang, L. et al. (2024). The effects of data imbalance under

a federated learning approach for credit risk forecast-

ing. International Journal of Data Mining and Ana-

lytics, 16(4):230–245.

Synthetic Data Generation and Federated Learning as Innovative Solutions for Data Privacy in Finance

89