Dynamization of Retail Pricing: From Traditional Price

Determinants to Automation Based on Artificial Intelligence

Christian Daase

1a

, Seles Selvan

1

, Dominic Strube

2b

, Daniel Staegemann

1c

,

Jennifer Schietzel-Kalkbrenner

3d

and Klaus Turowski

1e

1

Institute of Technical and Business Information Systems, Otto-von-Guericke University, Magdeburg, Germany

2

Hochschule Wismar, University of Applied Sciences, Technology, Business and Design, Wismar, Germany

3

Berufliche Hochschule Hamburg, Hamburg, Germany

Keywords: Retail Pricing Model, Dynamic Pricing, Retail Revenue, Artificial Intelligence, Systematic Literature Review.

Abstract: Setting product prices poses both challenges and chances for retailers, as higher prices per stock keeping unit

might lead to lower customer volume, while lower prices might result in insufficient turnover in relation to

costs. In the age of digitalization and artificial intelligence, understanding price determinants becomes even

more important as customer preferences shift and alternatives for purchasing products, such as online, are

within easy reach. Based on a systematic literature review, this study aims to build a comprehensive model

of traditional factors influencing customers’ price perception as fair, with an extension towards AI-driven data

integration and use case design to ultimately realize dynamic pricing models such as real-time demand pricing,

personalized pricing and further machine learning-based approaches. The final visualization is intended as

guidance for practitioners to evaluate their pricing strategies to determine if factors are currently being

overlooked and to consider how they could be incorporated into future decisions. Researchers can also use

the insights gained to build upon and expand the potential of AI integration into pricing automation.

1 INTRODUCTION

The retail sector is driving the global economy, and

its significant economic impact underscores the

importance of effective retail strategies. Although

there are many definitions of retail, most have in

common that the field encompasses activities

surrounding the sale of items to consumers for

personal use, including advertising, store

management, and other services (Peterson and

Balasubramanian 2002). While this definition

corresponds to business models where products are

sold directly to end consumers as the final link in the

value creation chain, the emergence of new models

such as direct-to-consumer (D2C) might necessitate a

redefinition of parts of the current retail landscape

(Daase et al. 2023).

a

https://orcid.org/0000-0003-4662-7055

b

https://orcid.org/0000-0003-3017-5189

c

https://orcid.org/0000-0001-9957-1003

d

https://orcid.org/0009-0009-3782-4963

e

https://orcid.org/0000-0002-4388-8914

Determining the final price of a product or service

plays a crucial role in various retail types, which can

generally be categorized into three main forms: brick-

and-mortar (B&M) retailing (i.e., selling from a

physical location), distance selling (i.e., including

mail-order), and online retailing (Weber and Schütte

2019). Usually, estimating the optimal price, meaning

the perfect balance between items sold, their

associated production costs, and revenue earned (i.e.,

optimizing the price elasticity), is a difficult task for

managers. The landscape has become more complex

after the COVID-19 pandemic, significantly

accelerating the transition to online shopping

(Roggeveen and Sethuraman 2020).

Numerous successful or failed campaigns can be

linked to immature pricing strategies. For example,

the Indian automotive company Tata failed to

position its model Nano on the market as the business

Daase, C., Selvan, S., Strube, D., Staegemann, D., Schietzel-Kalkbrenner, J. and Turowski, K.

Dynamization of Retail Pricing: From Traditional Price Determinants to Automation Based on Artificial Intelligence.

DOI: 10.5220/0013441000003929

In Proceedings of the 27th International Conference on Enterprise Information Systems (ICEIS 2025) - Volume 1, pages 617-629

ISBN: 978-989-758-749-8; ISSN: 2184-4992

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

617

did not align the pricing with appropriate branding to

ensure that customers perceive a realistic value, not

just low costs. Although the Nano was marketed with

good intentions as the world’s cheapest vehicle, the

branding led to it being perceived as poor quality and

a poor man’s car (Mukherjee 2021).

Although Walmart did not invent the concept of

everyday low pricing (EDLP), its successful

application was instrumental in its rapid ascent to the

top of the Fortune 500 (Ellickson and Misra 2008).

By consistently offering products at low prices

without relying on frequent special offers or

promotions, Walmart attracted a broad customer base

and maintained a competitive edge. Despite the

effectiveness of EDLP in establishing Walmart’s

dominance in the United States, the company

struggled in the German market. This case illustrates

regional variations in terms of successfully

implementing a strategy in one region while the same

approach fails in another (Ryu and Simpson 2011).

In addition to regional and cultural differences,

pricing strategies must align with the target

audience’s financial situation and preferences. From

a retailer’s perspective, a thorough pricing strategy

should take into account all relevant factors that

influence pricing decisions, based on the company’s

aspirations on the one hand and the customers’

requirements on the other. In recent decades, the retail

landscape has shifted, in particular due to the advent

of artificial intelligence (AI) and the rise of online

shopping. Given the enormous amounts of customer

data generated across various sectors like grocery,

drugstores, and so on (Grewal et al. 2021), AI

emerges as a potent tool capable of leveraging this

data to guide retail decisions.

In the airline industry’s distant past, buying a

ticket months in advance usually guaranteed a lower

price, while prices spiked as the departure date

approached. However, this rigid, rule-based pricing

often led to inefficiencies, such as insufficient

capacity utilization due to high prices simply because

the algorithm dictated it. As a result, airlines

struggled to cover basic costs like fuel and potential

customers were driven away by the lack of flexibility.

In contrast, today’s airlines have embraced dynamic

pricing, a model that adjusts prices in real-time based

on demand, availability, and other factors (Selc

̣

uk and

Avṣar 2019). This shift has allowed airlines to

optimize revenue and better meet customer

expectations. Incorporating AI-driven strategies can

significantly enhance this process by providing more

accurate demand forecasting, optimizing inventory

levels, and dynamically adjusting pricing based on

real-time data and market trends.

Given the complexity and range of issues retailers

face today, a deeper understanding of the factors

influencing effective pricing strategies becomes

essential. In this paper, the following research

question (RQ) is therefore addressed:

RQ: What are the determinant factors that should be

considered in the development of traditional and AI-

driven pricing approaches by retailers?

This paper aims to provide a comprehensive overview

of the determinants for pricing decisions of retailers.

Furthermore, a pricing model is compiled to illustrate

the interdependence and possible categorization of

the identified factors. In the final visualization, recent

advances in automated data collection and AI

enhancements are highlighted to complete the

common thread towards modern data-driven pricing

strategies in retail.

Following this introduction, Section 2 briefly

describes the methodology of this study in terms of a

systematic literature review (SLR). Section 3

examines determinants for defining an appropriate

profit margin that the retailer can add to its own costs.

Traditional and AI-driven pricing models with

consideration of the retailer’s costs are discussed in

Section 4, before a unified model for price

determination in the age of AI is presented in Section

5. The paper closes with a conclusion in Section 6.

2 METHODOLOGY

The basis of the research is derived by means of a

systematic literature review (SLR), following the

guidelines of vom Brocke et al. (2009) to enhance

research robustness and scientific rigor. The SLR

protocol is designed to identify relevant scholarly

articles and case studies addressing traditional price

determinants and AI-driven pricing strategies in

retail. As primary databases, ScienceDirect and

Emerald Insight were chosen for their extensive

collections of peer-reviewed journals, reviews, and

book chapters from the fields of business, economics,

and information systems.

The search was further refined to the subject

areas: business, management, and accounting,

leading to the selected journals Journal of Retailing,

Journal of Retailing and Consumer Services, Journal

of Business Research, and Industrial Marketing

Management. Furthermore, a forward and backward

search was carried out throughout the SLR. Using the

advanced search, the article titles were restricted to

retail, pricing or retail strategies, and the abstracts

ICEIS 2025 - 27th International Conference on Enterprise Information Systems

618

were further specified to include sales or purchases

in the period from 2005 to 2024. In Emerald Insight,

the search was further narrowed to articles stating

only pricing in titles and retail in abstracts.

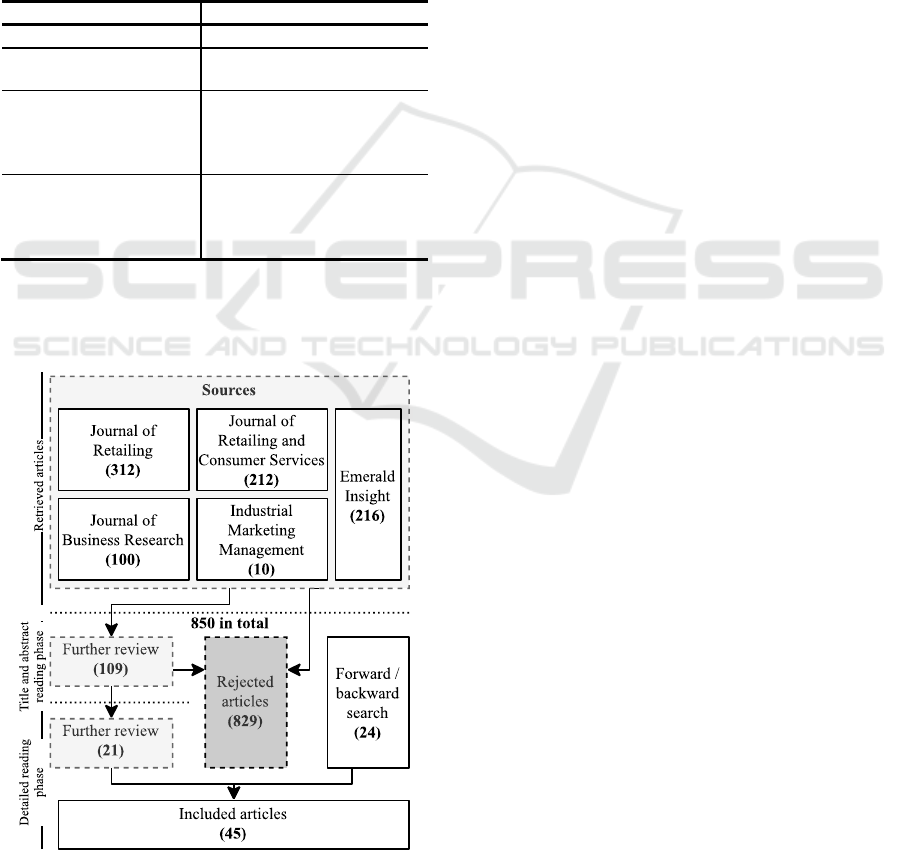

The review was divided into three phases. First,

the articles matching the given specifications were

automatically retrieved. Second, the titles and

abstracts of the articles were skimmed to assess their

potential for further review. Third, the full texts were

read and additional articles from the forward and

backward searches were captured. Inclusion and

exclusion criteria were applied throughout the review

process as listed in Table 1.

Table 1: Selection criteria.

Inclusion Exclusion

Written in En

g

lish Context other than retail

Published between 2005

and 2024

Introductions, sole abstracts,

corrections

Focus on price

determinants or factors

to improve customer

satisfaction

No peer review or outdated

article

Possibility of AI

automation for data

retrieval or decision-

makin

g

Inappropriate methodology

or superficial results

The review yielded a total of 61 articles from all

journals, databases and forward and backward

searches, as shown in Figure 1.

Figure 1: SLR search process.

3 DETERMINANTS OF PRICING

This section addresses the factors influencing the

profit margin that a retailer can add to products.

Although the cost to a retailer of procuring assortment

items is the fundamental factor, it is outside the

retailer’s control unless the retailer is the

manufacturer. Therefore, production costs are only

briefly described in Section 4. The factors described

in this section may also apply in part to manufacturers

selling their products to intermediaries.

3.1 Market Factors

This section covers fundamental concepts and

definitions of factors that can be directly influenced

by the retail sector in general or by particular

companies within it. This includes general marketing

considerations, market structure and concentration,

and retail channels and formats.

3.1.1 Marketing

In the business landscape, marketing functions as a

bridge between firms and their target groups.

Defining marketing can be challenging as the concept

has continually evolved over the past decades and

might be dynamically adjusted when a business

grows. Bartels (1951) defines marketing as the “field

of study which investigates the conditions and laws

affecting the distribution of commodities and

services”. The definition describes marketing as a

medium to exchange goods with consumers, thus

being a mere channel for promoting products and

services to the final target group.

However, the impact of today’s marketers is far

beyond this description. Historically viewed as

transactional facilitators, marketers have emerged

from an outdated view of themselves being solely

sales representatives into planners of comprehensive

value creation. The value creation process is complex

due to shifting consumer behaviors and their growing

knowledge of available products, especially with

respect to modern digital means to search and

compare products. Hence, R. Liu (2017) emphasizes

the importance of developing methods to effectively

identify, measure, and predict the ways in which

marketing strategies would enhance perceived value

during exchanges with customers.

Adapting to rapidly changing market conditions

is vital for organizations’ long-term success and

growth. This goal can be achieved through marketing

research and planning a suitable marketing strategy

that appeals to customers and provides a competitive

Dynamization of Retail Pricing: From Traditional Price Determinants to Automation Based on Artificial Intelligence

619

edge over rivals. A marketing strategy involves a

series of decisions that allow a company to make

crucial choices about its efforts and budget allocation

in selected markets and segments (Varadarajan 2010).

The marketing strategy process includes collecting

and analyzing data concerning the market, customers,

competitors, and industry trends to guide strategic

decisions. It also involves segmenting the market into

identifiable groups based on demographic,

psychographic, geographic, or behavioral

characteristics (Varadarajan 2010).

In summary, a sound marketing strategy can lead

to an enhancement of perceived value to customers

and an improved competitive public image. However,

the cost of marketing must also be considered to

decide whether it is worthwhile.

3.1.2 Market Structure

Market structure or concentration refers to measures

that describe how the shares are distributed among

participants in the market and how the competitive

landscape looks like for the sector. The Herfindahl-

Hirschman index (HHI) and concentration ratios

(CR) are two exemplary indicators of market

concentration (Naldi and Flamini 2014). HHI is

considered to be a more precise measure because it

takes into account all companies in an industry. The

HHI is calculated as the sum of all squares of all

market shares (i.e., S), thus leading to the following

formula:

𝐻𝐻𝐼 = 𝑆

(1)

The HHI value offers insight into the degree of

market concentration, where the maximum value

(i.e., a value of 1) represents a monopoly and the

minimum (i.e., 1 divided by the number of market

participants) means perfectly balanced competition.

From a mathematical perspective, markets can be

considered non-concentrated if the index value is

below 15 percent, moderately concentrated if the

value is between 15 and 25 percent, and highly

concentrated if the value exceeds 25 percent. Since in

economics this type of formula usually employs

whole numbers (e.g., 20 as percentage of market

share instead of 0.2), the values could also be

expressed as 1,500, 2,500, and so on (Pavic et al.

2016).

Before the emergence of the HHI, the CR index

was a more common measure of concentration. While

the HHI requires understanding the market shares of

all companies participating, the CR can be applied to

only the largest n companies (Naldi and Flamini

2014). The CR is determined by solely adding

together the market shares of the enterprises,

expressed as percentages, thus calculating how large

the total market share of the biggest n companies is.

Mathematically, it is denoted as the following

formula:

𝐶𝑅

=𝑆

(2)

The CR value can vary from almost 0 percent (for a

highly scattered market) to 100 percent (if n is equal

to the total number of market participants).

In terms of pricing, market power can have an

impact on the extent to which a retailer can exploit its

position, whether due to its unique regional proximity

to customers or the originality of the items sold.

However, the legal system needs to be factored in

when the formation of monopolies or oligopolies is

impending.

3.1.3 Retail Channels

Retail channels describe the various ways in which

products can be distributed among customers.

Different channels pose different challenges for

retailers and also have an impact on reasonable

pricing strategies as the costs to provide a certain

channel differ from each other. The most widely

provided channel is traditionally the physical retail

branch. It offers direct customer interaction, creating

a positive shopping experience and enables faster

delivery, since the customers themselves need to visit

the central location from which products are sold

(Gauri et al. 2021).

Alternatively, products can also be sold via more

than one channel. Beck and Rygl (2015) have created

a taxonomy of different variations of co-existing

retail channels. First, multi-channel retailing refers to

the provision of multiple options for customers to

purchase items (e.g., physical and online modes),

while the channels may not be integrated with each

other, meaning that no inventory or pricing data is

shared between channels, nor do customers have the

option to return items through a channel that was not

used for the purchase. Secondly, cross-channel

retailing refers to a model where multiple channels

are integrated with each other so that customers can,

for example, redeem a voucher in a physical store that

has been sent to their mobile app. However, only the

third model, known as omni-channel retailing, offers

full integration of all channels at once.

Depending on the retail channels offered, price

adjustments could be made taking into account the

delivery speed and the improved shopping

experience, for example if customers are willing to

ICEIS 2025 - 27th International Conference on Enterprise Information Systems

620

pay more when they have their purchases in their

hands immediately. On the other hand, the channel

provision costs need to be considered by the retailer.

3.1.4 Physical Retail Formats

Different retail formats have been established to meet

the expectations of numerous groups of customers.

Bonfrer et al. (2022) compiled a list of common

stationary retail formats, including supermarkets,

hypermarkets, discounters, mass merchandisers,

convenience stores, and traditional stores.

Supermarkets pose medium-sized to large spaces that

are in physical proximity to their customers and sell

everyday goods such as food. Hypermarkets are

usually larger than supermarkets, sell additionally

more general goods, and are designed to serve a

higher number of customers, while being located in

less urbanized areas. Discounters follow a rather low-

price strategy by limiting the service level to a

minimum and selling private label goods. Mass

merchandisers may sell a wider range of general

merchandise from different retail formats in an

extensive manner like hypermarkets, but usually not

focusing on food and everyday goods. Convenience

stores usually belong to a retail chain and provide a

small-sized assortment of essential items and food in

highly urbanized areas. Lastly, traditional stores can

be understood as independently owned small-sized

shops. Changes in the structure of retail store formats

across the global retail landscape have led retailers to

reevaluate their roles within these formats (Bonfrer et

al. 2022). Decisions regarding retail store formats are

crucial as they determine attributes such as store size,

location, layout, and customer service levels.

A retailer can either specialize in the assortment

by selling items from a small spectrum and from only

a few brands, or by diversifying the offered product

categories. When adapting the pricing strategy, a

retailer must therefore consider whether customers

would prefer a specialized service over their desire to

buy several products in one place. Possible costs here

may be related to inventory management, rent, and

personnel.

3.2 Retailers’ Strategical Factors

This section covers factors related to a retailer's

strategic direction based on its targeted role in the

value chain. Furthermore, possible paths to

improving the perceived value and shopping

experience are addressed.

3.2.1 Strategic Impact of Pricing for

Retailers

The worldwide economic decline from 2007 to early

2010 drove many companies to realign pricing

strategies in order to keep certain sales levels and

protect market share amidst reduced consumer

spending and aggressive competitor price cuts,

highlighting the strategic importance of pricing when

used as a short-term tactical tool (Piercy et al. 2010).

In their study, Kienzler and Kowalkowski (2017)

highlight that the primary issue identified in their

analysis is the lack of comprehensive reviews that

cover both business-to-consumer (B2C) and

business-to-business (B2B) perspectives. Their

research underscores that a well-crafted pricing

strategy is vital for delivering customer value,

guiding pricing decisions, and ensuring profitability.

Crafting an effective pricing strategy is influenced not

only by factors such as market conditions, company

goals, and customer characteristics, but also the

specific pricing context, which might also be part of

the aforementioned strategic alignment.

Piercy et al. (2010) discuss various pricing

strategies and their implications in competitive

positioning and market dynamics. They analyze how

companies use pricing approaches to navigate

economic conditions and competition. The authors

explore high-passive price strategies, where high

prices are used to enhance margins and emphasizing

non-price competitive factors, and low-active price

strategies employed by discounters to attract price-

sensitive customers through low prices, provided they

maintain cost efficiency. Additionally, they address

low-passive price strategies used by smaller firms

with lower costs, where pricing is kept discreetly to

avoid associating low prices with poor quality. These

strategies highlight the complex interplay between

pricing decisions and market positioning, as well as

the importance of aligning pricing strategies with

overall business objectives and market conditions.

While the pricing strategy details the company’s

method, the pricing objective specifies the particular

goals the company seeks to accomplish through its

pricing decisions. A sound pricing strategy for a

retailer should align pricing with customer value

perceptions, market conditions, and business

objectives while effectively communicating value.

3.2.2 Reconsidering the Role of Retailers

The supply chain structure varies based on industry

or type of merchandise. It typically involves moving

goods from manufacturers to wholesalers to retailers

Dynamization of Retail Pricing: From Traditional Price Determinants to Automation Based on Artificial Intelligence

621

or directly from manufacturers to retailers in a two-

level supply chain. One such model is D2C retail,

which refers to an approach where businesses interact

with customers directly, without the involvement of

intermediaries or platforms, bypassing traditional

retail channels. Examples include brands like Warby

Parker and Gymshark (Kim et al. 2021), which

bypass traditional intermediaries and physical stores

by selling directly to consumers, allowing these

brands to achieve higher profit margins and offering

high-quality products at more competitive prices.

Also, in certain scenarios, retailers do not sell

directly to end consumers but function as

intermediaries for businesses operating within a B2B

model. In B2B retail or non-consumer retailing (Noad

and Rogers 2008), retailers provide products to other

businesses, which may use these products for further

production, resale, or internal use. In this context, the

retailer’s role transitions from being the final point of

sale to acting as a medium that facilitates the

distribution of goods from manufacturers to other

businesses. Therefore, they are not always the final

entity in the supply chain, as their role can vary

considerably based on the circumstances and strategic

choices of the business.

The role a retailer takes in a supply chain affects

how many profit margins are added to a product

throughout its journey to the next owner. For the

determination of the final price, this means that the

minimum turnover must cover more margins in

addition to the production costs the further away the

retailer's position is from the manufacturer, or less

margins the more the structure resembles a D2C

model.

3.2.3 Store Formats

The design and purpose of a stationary store can have

an impact on customers’ perception of value and thus

indirectly justify price adjustments. Depending on the

product category, some attributes can only be

perceived in person, such as tasting over a food

sample (Rieländer 2023) or the comfort, fit and

texture of clothing (Smink et al. 2019). While

retailers may be tempted to exploit this unique feature

of physical retail, it should be noted that one of the

emerging challenges here may be showrooming

(Wang and Wang 2022). This phenomenon describes

the habit of consumers visiting physical stores to

assess a product before searching online for a cheaper

price. Retailers are therefore faced with the task of

balancing the value-enhancing effects of their stores

with the temptation of customers not to buy a product

directly.

Another factor that can be considered in pricing is

the customer’s urge to purchase an item immediately,

which is another feature of stationary retail compared

to online shopping (Rieländer 2023). The design of a

store can positively influence shopping behavior,

whether by considering psychological factors such as

the preferred walking direction of customers

(Ferracuti et al. 2019) or by integrating in-store

advertising (Han et al. 2022). In addition, physical

retail is currently in a split situation where employees

can no longer create as much added value for the

customer as in the past, as consulting is increasingly

being taken over by online reviews (Bellis and Johar

2020). However, personal contact and service is still

valued, for example in the form of advice on food

recipes (Rieländer 2023), but the level of value

perception by customers for this needs to be kept high

enough to cover the additional costs of staff through

adjusted pricing of items.

3.3 Product Factors

A central aspect in pricing decisions is the product to

be sold itself. Depending on the quality, use, and

suitability for the current situation, different pricing

models may be deemed as appropriate by customers.

Furthermore, products can be advertised by their

respective manufacturers in addition to the retailer's

marketing efforts for their stores.

3.3.1 Product Life Cycle

Understanding the product life cycle (PLC), its

exploitation, and possible extension can help retailers

to align their pricing with the product’s market

position, which can influence its competitiveness in

the retail landscape. An empirical study by Castelli

and Brun (2010) emphasizes that the duration of the

PLC is an important determinant of fashion retailers’

pricing strategies. The study shows that demand in the

maturity phase of products is usually predictable,

allowing for high sales per stock keeping unit (SKU)

and the ability to maintain full pricing over longer

periods of time. Conversely, products that only reach

the introduction and decline phases require more

dynamic pricing strategies to adapt to rapidly

changing market trends.

The console war between the Nintendo 64 and

Sony’s PlayStation serves as a classic example of

strategic pricing in an oligopolistic competitive

market, illustrating how different pricing strategies

align with the PLC. The analysis by H. Liu (2010)

highlights Sony’s use of price skimming and

penetration pricing to gain a competitive edge.

ICEIS 2025 - 27th International Conference on Enterprise Information Systems

622

Initially, Sony focused on price skimming by setting

a high price for the PlayStation to appeal to extreme

gamers to maximize revenue from early adopters. As

the product transitioned to the growth stage, Sony

lowered the price to attract casual gamers, using

penetration pricing to expand its market share. These

pricing tactics not only optimized revenue and market

positioning but also demonstrated the critical role of

understanding the market structure and consumer

segmentation in pricing decisions.

3.3.2 Seasonality

Weather can affect the appeal of certain products,

such as snow shovels during winter storms or

sunscreen on sunny days. Retail firms traditionally

manage demand uncertainty through strategies such

as adjusting product assortments, quick responses,

and end-of-season price markdowns. However,

weather can unexpectedly influence sales, with events

like early cold snaps in winter or early warming in

spring affecting inventory turnover and pricing

(Bertrand et al. 2015). In the apparel industry, these

seasonal changes are further complicated by the need

to continuously introduce new fashion collections

throughout the year to draw consumers back to stores

(Bertrand et al. 2015). Thus, integrating weather

considerations into inventory and pricing strategies is

crucial for effectively managing demand uncertainty

and optimizing sales performance.

Other researchers highlight how weather can

affect consumer spending. For example, sunshine

might boost the mood by lowering negative emotions,

leading to increased spending (Murray et al. 2010).

Badorf and Hoberg (2020) conducted an analysis of

data from the German stores, revealing that weather

influences sales in complex, non-linear ways, with

variations across different seasons, store locations,

and product categories. For example, weather can

cause sales in individual stores to fluctuate by up to

23 percent on the same day, and its impact on

different product categories can vary significantly. In

addition, short-term weather forecasts can increase

the accuracy of the sales forecast by up to 1.5 percent,

while their effectiveness decreases with longer

forecast periods. However, since the study is limited

to the German market, insights might differ under

other circumstances.

3.3.3 Product Branding

If neither physical distance nor the assortment in

terms of product categories are distinguishable

factors for different pricing approaches, the quality of

service and the subjective perception of certain

product brands could become decisive. Service

quality has emerged as a critical element influencing

consumer decisions (Lu et al. 2011). This includes

various aspects, such as providing effective post-sale

support, engaging in impactful advertising, and

ensuring timely and efficient repairs. These service

components not only help in differentiating a brand

but also play a crucial role in building and

maintaining customer loyalty. Successful companies

like IBM and HP use their strong service reputations

to secure a competitive advantage (Lu et al. 2011),

which in turn can help the retailers who sell their

products.

Advertising fulfills two main roles: institutional

advertising, which seeks to enhance brand awareness

for the retail store, and promotional advertising,

which aims to boost traffic and sales for particular

products (Kumar et al. 2017). Interdependencies

between factors such as brand loyalty and PLC stage

might have an impact on the effectiveness of

advertising, with new brands benefiting more from

the advertising measures than already well-

established ones (Kumar et al. 2017). Effective

branding also enables a company to differentiate itself

in a competitive market by creating a distinctive

identity. As discussed in the introductory chapter, the

example of the Tata Nano (Mukherjee 2021)

illustrates how inappropriate branding can lead to an

unintended association of the product with negative

attributes.

Premium brands can usually be sold at higher

prices than comparable products, but the profit

margin for the retailer depends on the retailer's own

cost of procuring the goods. Brand advertising, in

addition to the marketing efforts of the retailer, can

increase customer awareness of an offer and thus

positively influence the urge to buy a particular

product in a specific store.

3.4 Consumer Factors

As a final category, the potential customers

themselves with their general overarching

characteristics, which are summarized under the term

socio-demographics, or with their very specific

preferences can be used by retailers as decision

support for their pricing strategies.

3.4.1 Socio-Demographics

Consumer factors such as purchasing power,

preferences, and price sensitivity can significantly

impact pricing decisions. Socio-demographics refers

to the study and analysis of a population or group’s

Dynamization of Retail Pricing: From Traditional Price Determinants to Automation Based on Artificial Intelligence

623

statistical characteristics. These include factors such

as age, gender, income, education, household size,

social status, and so on (Weech-Maldonado et al.

2017).

For example, Simonovska (2015) found that the

prices of identical apparel products sold by Mango, a

Spanish apparel manufacturer, are positively

correlated with the per-capita income of the

destination country, indicating price discrimination

based on consumer income. The price elasticity

estimates suggest that generally higher-income

countries have lower price sensitivity, leading to

higher prices for identical items in those markets.

The work by Ellickson and Misra (2008) also

highlights the significance of consumer socio-

demographics in shaping pricing strategies. It is

assumed that retailers tend to select pricing strategies

based on the preferences of their target audience.

Their findings suggest that lower-income consumers

tend to favor everyday low pricing, while higher-

income consumers tend to favor high-low pricing

models (i.e., regular promotions). Gauri et al. (2008)

also observed that as the average income and

population density in the market area rise, retailers

show a preference for a high-low or hybrid pricing

strategy.

3.4.2 Consumer Preferences

Besides socio-demographic factors, the personal

preferences of consumers can also influence

purchasing decisions and, conversely, the optimal

pricing strategy of a retailer, even if they are partly

dependent on overarching economic circumstances.

The study by Binkley and Chen (2016)

emphasizes the impact of customers’ preferences for

prices and store formats, with geographic proximity

being a significant factor. They discovered that

shoppers who buy many items in one trip tend to pay

higher prices on average, likely due to not searching

for the best deals. Furthermore, convenience appears

to be the primary factor in store choice, with those

living closer to supercenters and conventional

supermarkets paying higher average prices.

Key factors influencing customers’ preferences

can also be related to the store’s atmosphere,

including location and convenience, with car owners

favoring stores that offer good parking facilities

(Maslakçi et al. 2021). An inviting store atmosphere,

exceptional service, and a prime location can boost

customer spending and encourage continuing

noticeable shopping behavior in the future. Consumer

preferences can also be influenced by gender. In a

study conducted by Mortimer and Clarke (2011), it

was found that men place less importance on store

ambiance compared to women. Female shoppers

prioritize weekly specials, regular discounts, and

promotional pricing more than men. However, men

placed slightly more importance on the availability of

the specific items they are looking for.

In summary, preferences for store formats and

geographic proximity shape purchasing decisions.

Convenience and the appeal of the store atmosphere

are crucial to consumers' motivation and shopping

habits, and therefore their willingness to pay certain

prices.

4 PRICING MODELS

This section provides an overview of traditional and

rather static pricing models and a comparison with

more recent, dynamic AI- driven approaches.

4.1 Traditional Pricing Models

Once the retailer has determined the costs of a

product, the price can be set using various pricing

strategies, which can be extended by the previously

established determinants, provided these are known.

Examples of common traditional pricing strategies,

without claiming to be exhaustive, are cost-plus

pricing, value-based pricing, everyday low pricing,

high-low pricing, and competitive pricing.

Cost-plus pricing describes the sole approach of

first calculating the costs that the retailer has for

procuring the assortment items and then adding a

desired profit margin. If costs increase, it is generally

considered fair for the retailer to increase the retail

price, while it is considered unfair if prices are

increased due to market share and power (Alnes and

Haugom 2024). However, the originally targeted

profit margin can be influenced by the market

position at the time. Value-based pricing, on the other

hand, incorporates the perceived value to the

customer into the pricing decision. This can include

the frequency, volume, and duration of use in a

quantity-based approach or the availability of a

product or solution at a certain time/price ratio in an

outcome-based approach (Sharma and Iyer 2011).

Everyday-low-pricing, as introduced earlier, is a

strategy that demands retailers to offer low prices

regularly on products without the need for frequent

promotions (Ellickson and Misra 2008). In contrast,

high-low pricing is a strategy where a retailer

maintains a high regular price for a product and

occasionally offers substantial discounts (Fassnacht

and El Husseini 2013). In competitive markets,

ICEIS 2025 - 27th International Conference on Enterprise Information Systems

624

retailers may also take into account the pricing

decisions of other participants, possibly including the

strategic factors described in Section 3.2 (Sharma and

Iyer 2011), leading to the competitive pricing model.

4.2 AI-Driven Pricing Models

While traditional strategies provide stability, AI-

driven pricing offers predictability and adaptability.

Among established or tested dynamic pricing

strategies implemented with the help of AI are real-

time demand pricing, personalized pricing, and

generic forms of machine learning-based pricing.

The aim of dynamic pricing is to adjust prices for

goods in real-time in response to factors such as

demand, supply, competition. Vomberg (2021)

describes dynamic pricing in two key dimensions,

frequency and range of price changes. The former

specifies the number of price changes within a certain

timeframe (i.e., how often prices are adjusted), while

the latter refers to the intensity of changes in that

timeframe (i.e., the difference between the highest

and the lowest price). Real-time demand pricing

focuses on reacting instantaneous to changes in

demand. By leveraging real-time data and analytics,

this strategy dynamically sets prices according to the

demand for a product or service. This strategy is

particularly recognizable in goods markets where

demand changes very frequently, such as electricity

(Fang and Wang 2023) or gasoline (Perdiguero

García 2010). Pricing, in which prices are tailored to

individual customer characteristics, behaviors, and

preferences can be termed as personalized pricing.

Individualizing prices is achieved by using the

information consumers leave behind as digital traces

(Vomberg 2021).

Machine learning (ML) models continuously

refine and improve the price determination process

based on historical data, customer interactions,

market dynamics, and any data that can be provided

as a suitable feature set. In addition to processing

historical sales data, ML models can uncover unseen

patterns in the data that humans might not have

noticed (Subbarayudu et al. 2023).

4.2.1 Shift Towards AI – Data Perspective

From a data perspective, AI-driven pricing involves

the utilization of large datasets to fine-tune pricing

strategies. This approach allows businesses to react to

market fluctuations quickly, understand customer

needs, and implement pricing strategies that are both

responsive and backed by data.

In the traditional approach, retailers often relied

on simplistic pricing models and educated guesses,

which could lead to inefficiencies such as

overstocking and reduced sales from poorly informed

decisions. Weber and Schütte (2019) discuss the

application of ML in various areas of the retail

industry. Techniques such as classification,

predictive analytics, clustering, optimization, and

ranking algorithms, rely heavily on data to function

effectively. By categorizing products, forecasting

sales, segmenting customers, and optimizing

operations, these methods demonstrate how vital data

is in making informed decisions and enhancing

efficiency in retail.

Kayikci et al. (2022) introduce a four-stage data-

driven dynamic pricing strategy intended to reduce

food waste in Turkish retailers, utilizing

hyperspectral imaging sensors to evaluate the

freshness of produce. Starting from a freshness stage,

where the product’s initial price is set, the price

decreases until the food reaches the final disposal

stage in case it was not sold. This model aims to

optimize pricing throughout the freshness lifecycle of

the product, thereby minimizing food waste and

improving profitability.

A lot of the data mentioned can be difficult to

handle or even to collect in manual decision-making

processes. However, by using AI technologies, data

can be collected from sensors, smart devices, social

networks, and cameras, for example, and further

processed with numerical or image and video

analytics (Daase et al. 2023; Haertel et al. 2022).

4.2.2 Shift Towards AI – Solution

Perspective

AI-driven pricing strategies extend beyond merely

setting prices but can also adopt a solution-centric

approach that enhances customer satisfaction. Grewal

et al. (2023) explore the transformative impact of

digital innovations on the retail industry by

examining in-store technologies’ effects on

customers and employees. For example, employees’

efficiency might be boosted through security robots

for crime prevention, cleaning robots, or robots that

scan shelves for missing items. Examples of

technologies that can improve the customer

experience include self-checkout and payment

systems, personalized discounts, and information

about the environmental impact of a product (Grewal

et al. 2023).

With in-store video analytics, some retailers are

focusing on fine-tuning their stores for optimization.

An experiment by Ferracuti et al. (2019) identified

Dynamization of Retail Pricing: From Traditional Price Determinants to Automation Based on Artificial Intelligence

625

popular store departments and shopper routes using

real-time location systems that allow to develop

targeted marketing and merchandising strategies

based on consumer behavior. In this way, retailers can

enhance store profitability by concentrating

marketing efforts on high-traffic areas where

shoppers spend more time. In terms of pricing

strategies, it is conceivable that the correct placement

of items could entice customers to buy them, even if

they were not originally intending to do so, rather

than relying on an unusually low price to tempt

customers to visit the area of the store with that item.

AI integration can help in two ways, either by

increasing the reasonable price of a product or by

reducing a retailer's overall costs, which would be

distributed proportionally across the SKUs sold. Price

increases can be justified by an improved customer

experience while cost reductions can be achieved

through theft prevention or automation, for example.

5 PRICING STRATEGY MODEL

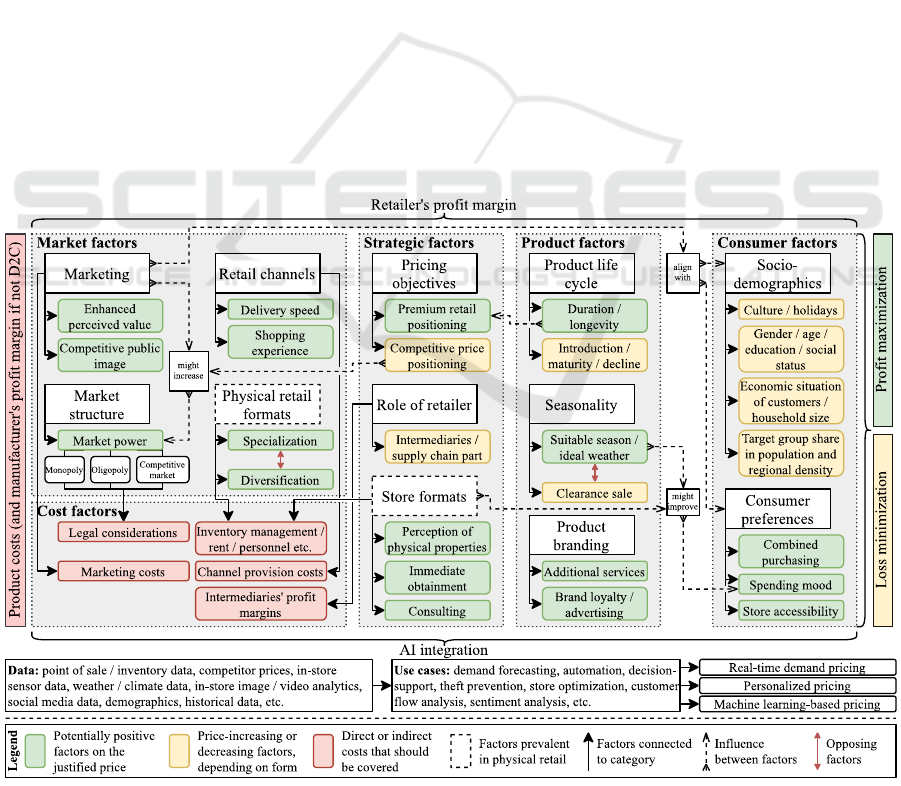

The model of factors influencing the pricing strategy

derived from the SLR is illustrated in Figure 2.

Starting from the production cost of a product and the

manufacturer's profit margin (if the supply chain does

not follow the D2C scheme), the retailer's profit

margin is added. General market factors include, as

described in Section 3.1, marketing efforts, the

current market structure, the retail channels that can

be offered in the given environment and, if provided

by the retailer, the physical retail formats. In terms of

interconnections, marketing can be used as a tool to

increase market share and thus the power to set the

pivotal prices for goods. If a physical assortment is

maintained, there may be a trade-off between

specialization (i.e. customers value the specialized

service and distinguished item selection) and

diversification (i.e. customers value the ability to buy

different products in one trip). Since pure online

stores can have distributed storage capacities and

customers do not have to spend a lot of effort to

switch from one rather specialized online store to

another, this category is more prevalent in stationary

retail. Costs associated with the pricing of products

are a significant part of this category. Marketing

costs, channel provision costs, inventory and facility

management must be taken into account in the overall

revenue calculation, as well as legal considerations if

required by current market power and local

regulations.

Figure 2: Price determination model and potential for AI integration.

ICEIS 2025 - 27th International Conference on Enterprise Information Systems

626

Strategic factors, as described in Section 3.2, include

the underlying objectives of the pricing strategy

chosen by the retailer, the desired role within the

supply chain and the store formats in terms of the

external perception that customers should receive.

Here, competitive price positioning can have a

positive impact on market power in the long term by

paying for it with the short-term disadvantages of

lower prices. Similarly, the role of the retailer in the

supply chain can have ambiguous effects. The further

away the retailer is from the manufacturer, the greater

the profit margins that have already been added to the

cost of production and that must be factored into the

final price. However, the role of the retailer as the

final point of sale offers a wider range of usable

influencing factors, as shown in the figure.

The third category (product factors), as described

in Section 3.3, summarizes the effects based on the

PLC, seasonality and specific product branding.

Similar to the competitive price positioning from the

previous category, taking into account the current

stage of acceptance of a product in the market can

either help to consolidate its position or exploit the

achieved need of customers to own it. The PLC, and

in particular all factors related to the quality of a

product, can further enhance the retailer's strategic

direction as a seller of premium goods. In terms of

seasonality, ideal climatic conditions (e.g., due to the

time of year) can further enhance the utility value of

a product. However, as the season comes to an end

and this incentive diminishes, retailers may want to

implement clearance sales to avoid potential losses

while reducing their profit margin.

Lastly, the consumer factors described in Section

3.4 can be considered the most contextual ones.

Socio-demographics such as culture, statistical

distributions and the average economic situation can

either positively or negatively influence the prices

that can be charged for certain goods at different

times of the year. Consumer preferences, on the other

hand, are more tangible for retailers as they can be

extracted from historical data or market research.

While both categories form the basis for marketing

efforts to target consumers, spending mood, as a

vague concept, can be improved in different ways, for

example through the store atmosphere or generally

good weather. All of the retailer's efforts in setting

product prices ultimately lead either to profit

maximization or to loss minimization if the cost

categories shown in the figure cannot be fully

compensated.

AI integration, as outlined in Section 4.2, consists

of three parts: data sourcing, use case solutions and

the implementation of an appropriate pricing strategy.

Useful data can be manifold, including information

from physical retail such as video data, sales and

inventory data, and digital sources such as social

media. In addition, statistical information in

conjunction with demographics or aggregated

historical and competitor data can play a central role.

Similarly diverse are the individual use cases that can

be fueled by this data, ranging from customer

behavior and sentiment analysis to cost-reducing use

cases such as theft prevention, store optimization and

automation. More generally, demand forecasting and

decision support for managers pave the way for real-

time demand pricing, personalized pricing and other

generic ML-based pricing strategies.

6 CONCLUSION

This paper builds on research related to retail pricing

and marketing and aims to provide clarity on the

determinants of pricing decisions. In addition,

modern AI-driven data collection and use cases

related to price factor categories and corresponding

dynamic pricing strategies such as real-time demand

pricing, personalized pricing, and general ML-based

pricing approaches are presented.

From a theoretical perspective, this paper extends

beyond the exploration of individual price

determinants and their exact mathematical

relationships by presenting an abstract pricing model

in

Figure 2 including all factors identified in the

literature that should be considered by retailers. From

a practical perspective, participants in real markets

can use the model to review their pricing strategies to

determine if there are factors that have been

overlooked and to consider how currently neglected

factors might be incorporated into future pricing

decisions. As the SLR is not exhaustive, future

research could extend the findings by including more

sources and refining the model. As AI is a field that

is currently in constant evolution, the technical

implications may also need to be adapted.

REFERENCES

Alnes, P. K., & Haugom, E. (2024). The effects of price

framing and magnitude of price differences on

perceived fairness when switching from static to

variable pricing. In Journal of Retailing and Consumer

Services, 81, 103952.

Badorf, F., & Hoberg, K. (2020). The impact of daily

weather on retail sales: An empirical study in brick-and-

Dynamization of Retail Pricing: From Traditional Price Determinants to Automation Based on Artificial Intelligence

627

mortar stores. In Journal of Retailing and Consumer

Services, 52, 101921.

Bartels, R. (1951). Can Marketing be a Science? In Journal

of Marketing, 15(3), 319–328.

Beck, N., & Rygl, D. (2015). Categorization of multiple

channel retailing in Multi-, Cross-, and Omni ‐

Channel Retailing for retailers and retailing. In Journal

of Retailing and Consumer Services, 27, 170–178.

Bellis, E. de, & Johar, G. V. (2020). Autonomous Shopping

Systems: Identifying and Overcoming Barriers to

Consumer Adoption. In Journal of Retailing, 96(1), 74–

87.

Bertrand, J.‑L., Brusset, X., & Fortin, M. (2015). Assessing

and hedging the cost of unseasonal weather: Case of the

apparel sector. In European Journal of Operational

Research, 244(1), 261–276.

Binkley, J. K., & Chen, S. E. (2016). Consumer Shopping

Strategies and Prices Paid in Retail Food Markets. In

Journal of Consumer Affairs, 50(3), 557–584.

Bonfrer, A., Chintagunta, P., & Dhar, S. (2022). Retail store

formats, competition and shopper behavior: A

Systematic review. In Journal of Retailing, 98(1), 71–

91.

Castelli, C. M., & Brun, A. (2010). Alignment of retail

channels in the fashion supply chain. In International

Journal of Retail & Distribution Management, 38(1),

24–44.

Daase, C., Volk, M., Staegemann, D., & Turowski, K.

(2023). The Future of Commerce: Linking Modern

Retailing Characteristics with Cloud Computing

Capabilities. In Proceedings of the 25th International

Conference on Enterprise Information Systems.

SCITEPRESS - Science and Technology Publications.

Ellickson, P. B., & Misra, S. (2008). Supermarket Pricing

Strategies. In Marketing Science, 27(5), 811–828.

Fang, D., & Wang, P. (2023). Optimal real-time pricing and

electricity package by retail electric providers based on

social learning. In Energy Economics, 117, 106442.

Fassnacht, M., & El Husseini, S. (2013). EDLP versus Hi–

Lo pricing strategies in retailing—a state of the art

article. In Journal of Business Economics, 83(3), 259–

289.

Ferracuti, N., Norscini, C., Frontoni, E., Gabellini, P.,

Paolanti, M., & Placidi, V. (2019). A business

application of RTLS technology in Intelligent Retail

Environment: Defining the shopper's preferred path and

its segmentation. In Journal of Retailing and Consumer

Services, 47, 184–194.

Gauri, D. K [Dinesh Kumar], Jindal, R. P., Ratchford, B.,

Fox, E., Bhatnagar, A., Pandey, A., Navallo, J. R.,

Fogarty, J., Carr, S., & Howerton, E. (2021). Evolution

of retail formats: Past, present, and future. In Journal of

Retailing, 97(1), 42–61.

Gauri, D. K [Dinesh Kumar], Trivedi, M., & Grewal, D.

(2008). Understanding the Determinants of Retail

Strategy: An Empirical Analysis. In Journal of

Retailing, 84(3), 256–267.

Grewal, D., Benoit, S., Noble, S. M., Guha, A., Ahlbom,

C.‑P., & Nordfält, J. (2023). Leveraging In-Store

Technology and AI: Increasing Customer and

Employee Efficiency and Enhancing their Experiences.

In Journal of Retailing, 99(4), 487–504.

Grewal, D., Gauri, D. K [Dinesh K.], Roggeveen, A. L., &

Sethuraman, R. (2021). Strategizing Retailing in the

New Technology Era. In Journal of Retailing, 97(1), 6–

12.

Haertel, C., Nahhas, A., Daase, C., Volk, M., & and

Turowski, K. (2022). A Holistic View of Adaptive

Supply Chain in Retailing Industry. In AMCIS 2022

Proceedings.

Han, Y., Chandukala, S. R., & Li, S. (2022). Impact of

different types of in-store displays on consumer

purchase behavior. In Journal of Retailing, 98(3), 432–

452.

Kayikci, Y., Demir, S., Mangla, S. K., Subramanian, N., &

Koc, B. (2022). Data-driven optimal dynamic pricing

strategy for reducing perishable food waste at retailers.

In Journal of Cleaner Production, 344, 131068.

Kienzler, M., & Kowalkowski, C. (2017). Pricing strategy:

A review of 22 years of marketing research. In Journal

of Business Research, 78, 101–110.

Kim, N. L., Shin, D. C., & Kim, G. (2021). Determinants of

consumer attitudes and re-purchase intentions toward

direct-to-consumer (DTC) brands. In Fashion and

Textiles, 8(1).

Kumar, V., Anand, A., & Song, H. (2017). Future of

Retailer Profitability: An Organizing Framework. In

Journal of Retailing, 93(1), 96–119.

Liu, H. (2010). Dynamics of Pricing in the Video Game

Console Market: Skimming or Penetration? In Journal

of Marketing Research, 47(3), 428–443.

Liu, R. (2017). A Reappraisal on Marketing Definition and

Marketing Theory. In

Journal of Eastern European and

Central Asian Research, 4(2).

Lu, J.‑C., Tsao, Y.‑C., & Charoensiriwath, C. (2011).

Competition under manufacturer service and retail

price. In Economic Modelling, 28(3), 1256–1264.

Maslakçi, A., Yeşilada, F., & Yeşilada, T. (2021). The

Moderating Role of Shopping Frequency on the

Relationship Between Store Image and Satisfaction:

Evidence from Cyprus. In International Journal of

Business, 26(2), 1–16.

Mortimer, G., & Clarke, P. (2011). Supermarket consumers

and gender differences relating to their perceived

importance levels of store characteristics. In Journal of

Retailing and Consumer Services, 18(6), 575–585.

Mukherjee, J. (2021). Tata Nano: Case of Repositioning:

Case Analysis. In Vikalpa: The Journal for Decision

Makers, 46(3), 188–190.

Murray, K. B., Di Muro, F., Finn, A., & Popkowski

Leszczyc, P. (2010). The effect of weather on consumer

spending. In Journal of Retailing and Consumer

Services, 17(6), 512–520.

Naldi, M., & Flamini, M. (2014). The CR4 Index and the

Interval Estimation of the Herfindahl-Hirschman Index:

An Empirical Comparison. In SSRN Electronic Journal.

Noad, J., & Rogers, B. (2008). The importance of retail

atmospherics in B2B retailing: the case of BOC. In

International Journal of Retail & Distribution

Management, 36(12), 1002–1014.

ICEIS 2025 - 27th International Conference on Enterprise Information Systems

628

Pavic, I., Galetic, F., & Piplica, D. (2016). Similarities and

Differences between the CR and HHI as an Indicator of

Market Concentration and Market Power. In British

Journal of Economics, Management & Trade, 13(1), 1–

8.

Perdiguero García, J. (2010). Dynamic pricing in the

spanish gasoline market: A tacit collusion equilibrium.

In Energy Policy, 38(4), 1931–1937.

Peterson, R. A., & Balasubramanian, S. (2002). Retailing in

the 21st century: reflections and prologue to research.

In Journal of Retailing, 78(1), 9–16.

Piercy, N. F., Cravens, D. W., & Lane, N. (2010). Thinking

strategically about pricing decisions. In Journal of

Business Strategy, 31(5), 38–48.

Rieländer, P. (2023). Creating Value Through Value

Creation: How the Stationary Grocery Trade Creates

Added Value for Its Customers in Times of Online

Competition. In Multisensory in Stationary Retail.

Springer Fachmedien Wiesbaden.

Roggeveen, A. L., & Sethuraman, R. (2020). How the

COVID-19 Pandemic May Change the World of

Retailing. In Journal of Retailing, 96(2), 169–171.

Ryu, J. S., & Simpson, J. J. (2011). Retail

internationalization: Lessons from "Big Three" global

retailers’ failure cases. In Journal of Business and

Retail Management Research, 6(1).

Selc

̣

uk, A. M., & Avṣar, Z. M. (2019). Dynamic pricing in

airline revenue management. In Journal of

Mathematical Analysis and Applications, 478(2),

1191–1217.

Sharma, A., & Iyer, G. R. (2011). Are pricing policies an

impediment to the success of customer solutions? In

Industrial Marketing Management, 40(5), 723–729.

Simonovska, I. (2015). Income Differences and Prices of

Tradables: Insights from an Online Retailer. In The

Review of Economic Studies, 82(4), 1612–1656.

Smink, A. R., Frowijn, S., van Reijmersdal, E. A., van

Noort, G., & Neijens, P. C. (2019). Try online before

you buy: How does shopping with augmented reality

affect brand responses and personal data disclosure. In

Electronic Commerce Research and Applications, 35,

100854.

Subbarayudu, Y., Reddy, G. V., Raj, M. V. K., Uday, K.,

Fasiuddin, M. D., & Vishal, P. (2023). An efficient

novel approach to E-commerce retail price optimization

through machine learning. In E3S Web of Conferences,

391, 1104.

Varadarajan, R. (2010). Strategic marketing and marketing

strategy: domain, definition, fundamental issues and

foundational premises. In Journal of the Academy of

Marketing Science, 38(2), 119–140.

vom Brocke, J., Simons, A., Niehaves, B., Riemer, K.,

Plattfaut, R., & Cleven, A. (2009). Reconstructing the

Giant: On the Importance of Rigour in Documenting

the Literature Search Process. In In ECIS 2009

Proceedings.

Vomberg, A. (2021). Pricing in the digital age: A roadmap

to becoming a dynamic pricing retailer. In The digital

transformation handbook

‐

From academic research to

practical insights. University of Groningen Press.

Wang, J., & Wang, S. (2022). Revisiting the showrooming

effect on online and offline retailers: The strategic role

of in-store service. In Journal of Retailing and

Consumer Services, 66, 102884.

Weber, F., & Schütte, R. (2019). A Domain-Oriented

Analysis of the Impact of Machine Learning—The

Case of Retailing. In Big Data and Cognitive

Computing, 3(1), 11.

Weech-Maldonado, R., Miller, M. J., & Lord, J. C. (2017).

The Relationships Among Socio-Demographics,

Perceived Health, and Happiness. In Applied Research

in Quality of Life, 12(2), 289–302.

Dynamization of Retail Pricing: From Traditional Price Determinants to Automation Based on Artificial Intelligence

629