Economic Token Models in ReFi Projects: Token Design and

Incentive Mechanisms Analysis

Julia Staszczak

1a

, Mariusz Nowostawski

2b

and Patrick Mikalef

1c

1

Department of Computer Science, Norwegian University of Science and Technology, Trondheim, Norway

2

Department of Computer Science, Norwegian University of Science and Technology, Gjøvik, Norway

Keywords: Token Economy, Regenerative Finance, Morphological Classification, Digital Ecosystems.

Abstract: As cryptocurrency markets continue to captivate attention promising quick financial gains, it becomes

increasingly important to critically examine blockchain-based projects that attract significant investments.

This study provides insights into evaluating the viability of projects by analyzing and categorizing token

attributes through the application of a token morphological framework. This serves as a structured

examination of key parameters - purpose, governance, functional, and technical - to understand how different

design aspects interact within each project and influence long-term success. We explore sustainability-

oriented projects within the field of Regenerative Finance (ReFi) being a growing dimension of blockchain

innovation that integrates financial systems with ecological and social regeneration. The focused approach of

limiting the scope to three case studies ensures a deeper analysis and provides clarity in understanding the

nuances of token design while also identifying possible patterns across projects. Hence, we define token

archetypes offering valuable insights into how variations in token structure influence governance, user

incentives, and economic viability, extending micro-level perspective to broader economic dynamics. This

study sheds light on ownership and governance structures, token supply models, mechanisms for incentivizing

participation while limiting and mitigating speculative behavior, and mechanisms for token removal from

circulations. Understanding these aspects allow for shaping more impactful and resilient token economies and

provides actionable insights that can inform future projects, making it relevant for both academic and practical

implications. This comparative analysis contributes to the theoretical development of tokenomics by offering

a clearer understanding of how different token structures align with organizational goals and community

dynamics. In doing so, it bridges theoretical insights with practical applications.

1 INTRODUCTION

The facilitation of community ownership through the

potential of decentralization, enabled by the emerging

Web3 technology stack, is being continually explored

by the business world (World Economic Forum,

2023). This shift of control, from centralized entities

to the participants of the network, opens up ways for

more transparent digital ecosystems. Hence, by

leveraging blockchain technology the newly created

markets allow people to connect, engage, and

exchange value in ways that were previously difficult

to imagine (Au & Power, 2018). Those

disintermediated markets enable direct user

a

https://orcid.org/0009-0004-5950-5211

b

https://orcid.org/0000-0002-2809-8615

c

https://orcid.org/0000-0002-6788-2277

interactions (peer-to-peer) through digital assets.

Digital assets represent value such as

cryptocurrencies, NFTs, and tokens providing utility

or representing ownership (Deloitte, 2024). Those

innovations give rise to Decentralized Finance (DeFi),

simultaneously marking a transformative shift in the

financial landscape (Piyankov, 2024).

The open nature and disintermediation of digital

assets enable anyone to participate, fostering

inclusivity. Moreover, the ability to fractionalize

digital assets into smaller, transferable units, is another

major advantage which fosters greater liquidity

enabling more diverse participation in novel,

tokenized economies (Davidson et al., 2018). This

Staszczak, J., Nowostawski, M. and Mikalef, P.

Economic Token Models in ReFi Projects: Token Design and Incentive Mechanisms Analysis.

DOI: 10.5220/0013458300003929

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 27th International Conference on Enterprise Information Systems (ICEIS 2025) - Volume 1, pages 357-366

ISBN: 978-989-758-749-8; ISSN: 2184-4992

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

357

shift marks a significant departure from Web2, where

reading and writing were prevailing functions, and

data ownership was centralized. In the current Web3

landscape - also referred to as the Internet of Value

(Ibrus & Rohn, 2023) – not only information, but

economic assets can be easily transferred. The value is

represented by tokens governed by economic laws,

like supply and demand, leading to the emergence of

tokenomics (Au & Power, 2018).

Integrating tokens into online experiences is how

blockchain-based tokenomics reshapes value

distribution in digital ecosystems (Bogdanov et al.,

2024). The concept of tokenomics is not new. It can

be traced way back to traditional economies using

physical tokens in various forms, of which an example

shall be of casino chips acting as tokens in a controlled

economy, where their supply, value, and exchange

rate are determined by the issuer - the casino itself.

The economic model of a token encompasses its use,

value, creation, distribution, supply and demand, as

well as incentive mechanisms (Guan et al., 2024).

Optimal tokenomics is project-specific and requires

careful incentives design (or disincentives) aligning

with the project’s goals and encouraging desired

behaviors (Olas, 2024), which directly influences user

retention and further network growth. By leveraging

cryptographic tools such as zero-knowledge proofs,

alongside economic theories, tokenomics’ aim is to

design decentralized structures of incentive systems

that actively encourage positive behaviors while

minimizing risks of speculation or attacks – this shall

ultimately align individual actions with the long term

goals of the network (Freni et al., 2022). The concept

of zero-knowledge proofs refers to one party proving

to another party the validity of a statement without

revealing any information beyond the truth of the

statement itself (Blum et al., 1988), enabling for more

efficient and secure transactions. To build ecosystems

that are transparent, the field of tokenomics requires a

rigorous and interdisciplinary approach - defining and

automating mechanisms, such as staking, rewarding,

and burning, through smart contracts which is to offer

enforceability and avoid relying on external punishing

measures (Cowen, 2018).

As the world approaches a deadline for the

established UN SDGs, less than one fifth of the targets

are on track (United Nations, 2024), which

underscores the urgent need to focus on achieving

reliable impact, as multiple reports from the European

Commission, along various studies highlight the

prevalence of misleading green claims. With many

assertions found to be inaccurate (greenwashing), the

research suggests that providing transparent,

traceable, and tamper-proof data can significantly

reduce this phenomenon (Silkoset, 2024). This leads

to reimagining the business philosophy with the

mutually reinforcing pursuit of profit complemented

by sustainability (Polas et al., 2022). The world is

falling behind on climate goals due to private and

public opacity, inadequate accountability

mechanisms, and limited transparency and

interoperability of tracking systems, compounded by

insufficient growth in climate finance (Hoopes IV et

al., 2023). To achieve sustainability and broader social

responsibility goals the business models that promote

decentralization should be developed and the

advancement of creating a circular value within

products and services should take place (Upadhyay et

al., 2021). However, there is a lack of meaningful

discussion on how blockchain and Web3 technologies

can contribute to the circular economy across

dimensions of sustainable development (social,

environmental, and economic) (Böckel et al., 2021).

While technical frameworks have been extensively

developed and explored, their broader business and

societal impacts are still underexplored and not fully

understood (Freni et al., 2022). Regenerative Finance

(ReFi) which stands as a subset of DeFi, focuses on

promoting the SDGs (Grasmann, 2024), facilitating

funding flows, providing data-driven tools for

deriving financial value from regenerative impact, and

supporting new investment instruments backed by

tokenized ecological assets. There are at least 500

active ReFi solutions currently in existence (Carbon

Copy & ReFi DAO, 2024).

The research question of this study is: How do

token design choices shape economic dynamics in

tokenized ecosystems? By comparing three

blockchain-based projects, this study explores how

various elements of designing a token and token

economy contribute to the long-term success of

sustainability projects, identifying key lessons-learned

and strategies that can be applied to other blockchain-

based initiatives.

As tokens collectively represent the market value

in hundreds of billions of dollars, the research in this

domain is crucial for various groups - entrepreneurs,

developers, and users - enhancing their prospects for

achieving various economic goals (Hülsemann &

Tumasjan, 2019). Organizations are rendered to assess

specific needs addressed by digital assets as

blockchain projects grow in number. They must also

consider the involved parties, desired internal features

and processes, as well as strategies for distribution and

management, which requires rethinking structures and

aligning both individual and collective incentives to

create new efficiencies and opportunities (Lesavre et

al., 2020). As blockchain technology introduces a

ICEIS 2025 - 27th International Conference on Enterprise Information Systems

358

novel approach to coordinating economic activity,

embedding key institutional elements of market

capitalism: property rights, e.g. ledger entries and

private keys, exchange mechanisms through public

keys and P2P networks, native currency, i.e. crypto-

tokens, legal frameworks through code is law, and

financial systems, it stands of particular interest to

institutional economists (Davidson et al., 2018).

Valuable insights are being offered by the evolving

economic structures and decentralized mechanisms of

coordination through the emerging token economies

as a foundation for a long-term coopetition in the

digital age (Lamberty et al., 2023).

This study analyzes tokenomics through the

design of tokens in three projects within the field of

ReFi. Moreover, it bridges the design-oriented

framework with the economic dynamics, showing

how token systems can be evaluated both structurally

and economically. The initial findings highlight

diverse approaches to fostering engagement in ReFi

ecosystems from focusing on the tangible action and

behavioral change to the ones prioritizing system

performance and strategic participation.

2 BACKGROUND

The focus of tokenomics is in defining and evaluating

the economic characteristics of cryptographic tokens

that represent a secure and provable digital form of a

right that can serve multiple roles - value, stake, or

voting rights within decentralized systems (Lamberty

et al., 2023). The beginnings of tokenomics was

through utility tokens enabling transactions and

rewarding participants in decentralized apps (dApps),

evolving over time to address the diverse needs of the

expanding digital economy (Thomas, 2024). As

highlighted earlier, cryptographic tokens represent

diverse elements beyond mere financial speculation,

serving as essential tools for decentralized

coordination, governance, and optimization

(Lamberty et al., 2023). As the field progressed it

became significantly complex with the modern token

design reflecting strategic nuances - some projects

issuing separate tokens for the distinct purposes of

utility and governance (providing a stake in the

decision-making processes of a project), while others

integrating both functions into a single token

(Spaceseven, 2024). It is to be approached as an

iterative process of open-ended choices, tested and

refined over time, with the methods of implementation

embedded within the designs themselves (Schneider,

2018).

Tokens most usually serve three key functions:

incentivizing to join the platform (Enter), incentives

to engage with the platform (Stay and Play),

and incentives to remain long-term (Captivate)

(Cyber Studio, 2017), highlighting the multifaceted

nature of tokens within blockchain ecosystems. The

long term success of such systems depends on

designing well-structured tokenomics policies - while

they cannot directly control token prices, strategies of

token minting, supply adjustments, transaction fee

changes, and modifying validator rewards can help

achieve price equilibrium without compromising the

system's overall viability or decentralization (Kiayias

et al., 2024). Tokens must operate within a robust

system of widely accepted norms, off-chain

agreements, and on-chain technical rules in order to

realize their potential, and only once such

sociotechnical elements are integrated and accepted

does the value creation in inter-organizational

networks become possible (Sunyaev et al., 2021).

Nevertheless, beneath terms like tokenomics and

blockchain technology, humans are simply trying to

connect - communicate, produce, create, and

exchange within a market (Au & Power, 2018). The

lack of proper tokenomics and misaligned project

models, however, contributed to major collapses, as

seen with FTX and Terra, which extend beyond a

single project, as risk spillover effects reached further

into the crypto markets (Bouri et al., 2023). FTX’s

downfall was caused by unsustainable token models,

and over-leveraging, with the incentive structures

promoting risky and speculative behaviors (Conyers,

2024; Cryptoslav, 2022; Fang, 2023). However, this

major collapse was not a failure of crypto itself, but

of an organization marked by a centralized,

irresponsible power and lack of transparency - a

scenario already seen across various industries

(World Economic Forum, 2023). The FTT token was

artificially inflated (Ledoux & Smaili, 2024), which

allowed for maintaining a false perception of success,

though once the ecosystem collapsed, the lack of real

value became obvious. Terra’s failure, on the other

hand, was caused by a flawed stablecoin model and

weak governance, where short-term decisions

(inflating supply) destabilized the system as LUNA

and UST grew to a combined market cap of over $50

billion at their peak before collapse (Badev &

Watsky, 2023). With these examples the poorly

designed tokenomics exposes the possibility of the

domino’s effect highlighting the need for careful

design to ensure transparency and accountability. The

need to improve the balance, between attempts to

damage the industry’s reputation and the low rate of

visible success, remains (Mougayar, 2024). The

Economic Token Models in ReFi Projects: Token Design and Incentive Mechanisms Analysis

359

potential for expanding services and goods is

increased by a well-structured value, driving greater

demand and contrasting the ‘boom-collapse’ effect

seen in most token issuances (Villares, 2022).

Therefore, the detailed classification of token

archetypes necessities in cross-referencing with

broader economic dynamics to extend the

examination of token systems’ effectiveness. This is

to achieve macro-level insights in addition to micro-

level classification. Blueprint guidelines for a critical

discussion of our study is contained within

responsible tokenomics (Villares, 2022), of which

questions can be grouped in themes of token: supply

model, ownership and governance, participation and

speculation prevention ([dis]incentives), lifecycle

and adjustment mechanisms.

The potential of this rapidly evolving landscape is

underscored by the economic potential of tokenization

- BCG and ADDX project asset tokenization to reach

$16 trillion by 2030 (Ledger Insights, 2022). The

sustainable token design is a critical area of study in

order to minimize the boom-and-bust cycles and by

merging tokenomics with social impact not only new

investment opportunities arise but also a

groundbreaking approach to tackling the world’s most

urgent challenges occurs (Faster Capital, 2024).

3 METHODOLOGICAL

FRAMEWORK

Although there exists a significant amount of research

on cryptographic tokens concentrating on their role in

driving incentive mechanisms (Schwiderowski et al.,

2024), a deeper and structured analysis of their design,

especially in ReFi projects, is lacking. This study

adopts the approach which addresses the complexity

of token classification and allows for defining token

archetypes of each project by understanding specific

parameters. We integrate a deductive approach by

using a constructed morphological framework of

token attributes (Oliveira et al., 2018), later supported

with an inductive approach to gain more insights from

the documentation analysis and further bridge micro

and macro perspectives. This approach allows for the

initial structured analysis, ensuring consistency and

rigor in classification for three distinct cases, further

enabling a comparative analysis across different

contexts. However, the insights are of which token

attributes interact within ecosystems, exposing

differences in design and functionality, while ensuring

the token design principles are being assessed within

a practical set of real-world applications.

The discipline of tokenomics is multifaceted and

requires expertise in various fields, from human

behaviour, through rigorous modelling, to strategic

thinking (Catena.MBA, 2024). Therefore, the design

of effective tokenomics encompasses not only

incentive mechanisms but also, often overlooked,

dimensions of market demands, such as choosing the

right business model (asset-backed tokens, crypto-

backed tokens, stablecoins), and establishing

governance structures through DAOs, community

rights, safeguarding mechanisms against attacks -

which as a whole can be defined into a broader

concept of ‘token dynamics’ (Binance Square, 2023).

Accordingly, we explore key mechanisms in which

specific designs operate and fulfil their roles for

driving desirable impact. The study employs

secondary qualitative data analysis (whitepapers,

technical documentation, reports). However, where

direct access to proprietary systems (private

blockchains) is unavailable, interviews, public

statements, or insights from project leaders are used.

We acknowledge data availability inconsistencies in

blockchain-based projects; therefore the study does

not impose artificial uniformity but rather helps better

visualize gaps and spot where transparency is lacking.

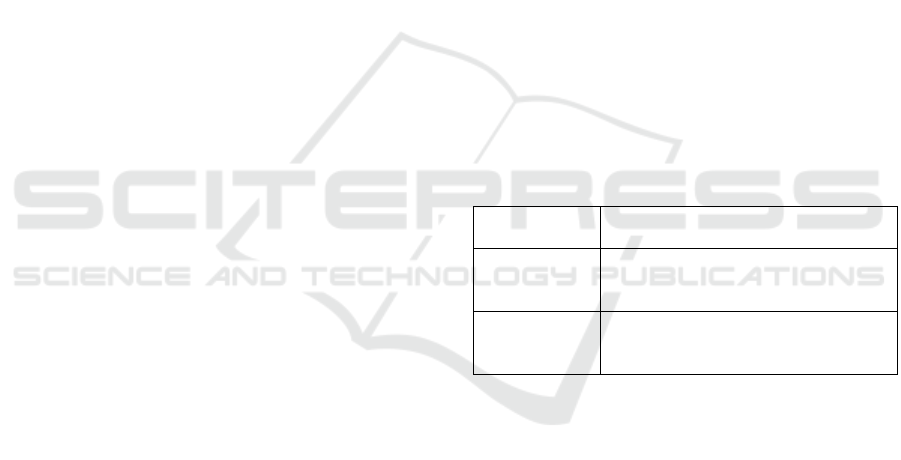

Table 1: Token Evaluation Criteria.

Token

A

ttributes

Framework-based analysis.

Token

Mechanism

Examination of token’s operational

structure (token execution and data

anchorin

g

in the ecos

y

stem

)

.

Token

Distribution

Exploration of lock-up periods,

allocation structure, fundraising

mechanisms.

4 RESULTS

4.1 Token Parameters and Archetypes

4.1.1 Plastiks

Plastiks is a green tech company that uses blockchain

ledger to verify and trace the recovery and recycling

of plastic waste, converting these actions into Plastic

Credits for environmental impact and support of the

circular economy (Plastiks, 2024a). The effective

waste management is necessary as the improved

quality of life alongside the population growth drive

industrialization resulting in the increased waste

generation, hence converting plastic waste into value-

added products is viewed as a key strategy for

achieving a circular economy (Bhubalan et al., 2022).

ICEIS 2025 - 27th International Conference on Enterprise Information Systems

360

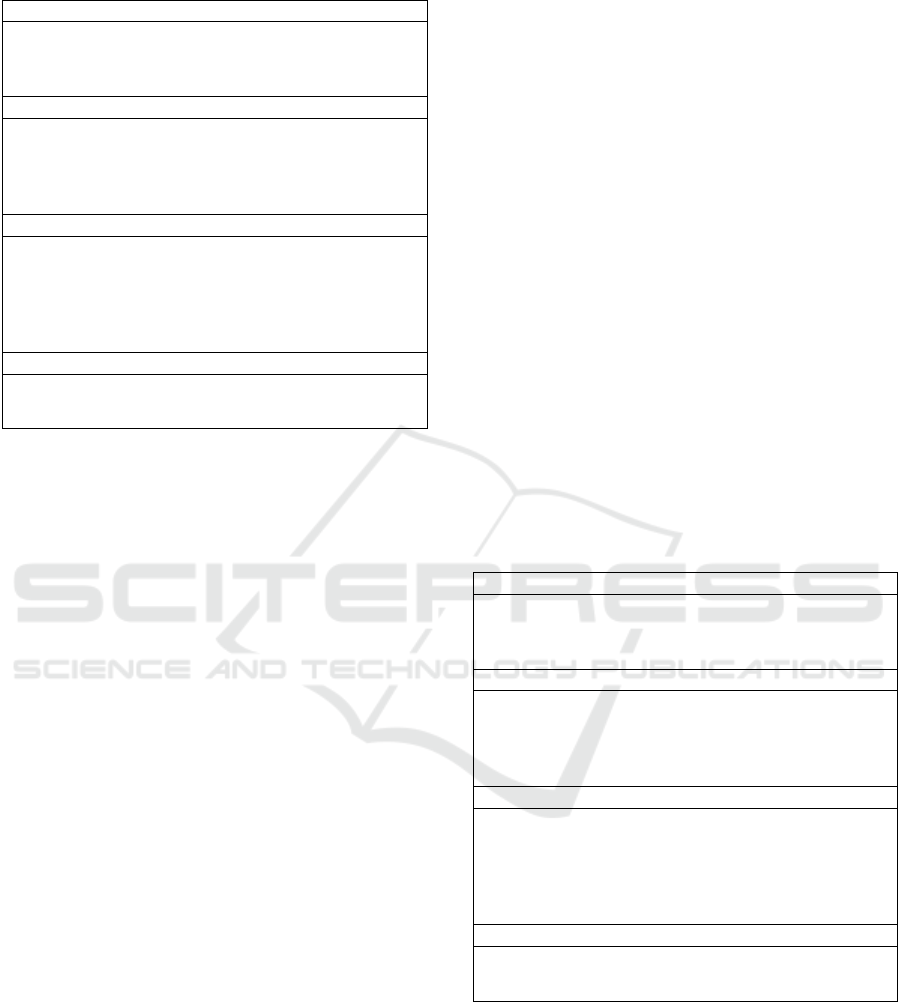

Table 2: PLASTIK Token Parameters Classification.

Pur

p

ose Parameters:

Class: Utility Token

Function: Work Token

Role: Value Exchange, Reward

Governance Parameters:

Representation: Digital

Supply: Pre-mined, one-off distribution

Incentive System: Enter Platform, Use Platform, Stay

Long-Term

Functional Parameters:

Spendability: Spendable

Tradability: Tradable

Burnability: Burnable

Expirability: Non-Expirable

Fungibility: Fungible

Technical Parameters:

Layer: Application (dApp)

Chain: Issued on top of a protocol

The PLASTIK Token facilitates the creation and

exchange of Plastic Credits (Plastiks, 2024a), tracks

their sale and the release of funds for waste recovery

efforts, reflecting the progress of the recovery process

of plastic (Plastiks, 2024b). When a Plastic Credit is

sold, 80% of the value is transferred to the Entity

(responsible for waste recovery) in PLASTIK tokens,

which are returned once all credits are sold - these

funds (held in custody until the credits are sold) are

then converted to USD, EUR, or USDT (stablecoin

pegged to US dollar) (Plastiks, 2024b). Nozama Tech

Ltd, the platform owner, retains 18% of the sale,

while 2% is used to buy PLASTIK tokens from the

market to reduce supply (Plastiks, 2024b). The smart

contract is responsible for managing token balances.

A total of 1,000,000,000 PLASTIK tokens have been

issued (with no further issuance possible) of which

Nozama Tech Ltd. controls 560,000,000 tokens, the

management team and advisors hold 140,000,000

tokens, and 300,000,000 tokens are publicly traded

(Plastiks, 2024b).

Tokens grant the right to access and participate in

the plastic recovery process. Initially exchanged for

plastic credits, when entering the platform’s

ecosystem, then tokens are used to track and fund

plastic recovery projects. Connecting plastic credit

sales with the release of funds serves as the long-term

engagement incentives for plastic recovery initiatives

by using them for transactions over time. The

PLASTIK token is spendable as for tracking and

managing plastic credit sales, as well as for the

release of funds. It is also tradable on the open

market, being a part of public blockchain (Celo - a

native layer where the smart contract operates, not

relying on another layer or platform for its

functionality) and to be exchanged for stablecoin or

fiat once the plastic recovery targets are achieved.

They are partially burnable as the project aims to

reduce the supply of tokens, through the market buy-

back. The expiration function isn’t described

therefore the presumption of no such function is made

as the long-term utility for the platform implies that

the token is used continuously in the ecosystem.

Archetype: The PLASTIK Token falls under

Work Token category rewarding entities involved in

the process of plastic recovery.

4.1.2 Ocean Protocol

Satoshi Nakamoto envisioned blockchain as a

scalable system capable of handling an unlimited

range of data applications, originally designing

Bitcoin with the vision of supporting a global data

economy (Louw, 2022). So far, the progress of the

data economy has been slow, largely overlooked, and

remaining highly centralized - controlled by a few

major tech conglomerates (Namdev, 2023).

Table 3: OCEAN Token Parameters Classification.

Pur

p

ose Parameters:

Class: Utility Token

Function: Hybrid (Usage and Work Token)

Role: Currency, Earnings, Reward, Right

Governance Parameters:

Representation: Digital

Supply: Pre-mined, scheduled distribution

Incentive System: Enter Platform, Use Platform, Stay

Long-Term

Functional Parameters:

Spendability: Spendable

Tradability: Tradable

Burnability: Burnable

Expirability: Non-Expirable

Fungibility: Fungible

Technical Parameters:

Layer: Protocol (Non-Native)

Chain: Issued on top of a protocol

Tokens are locked, being the utility tokens, which

means that they cannot be traded before the network

launch; otherwise, they would be classified as

securities (Pon, 2018). The OCEAN token primarily

functions as a Usage Token, granting access to the

decentralized data marketplace, enabling data

transactions, and interacting with DeFi protocols,

acting like an ‘access card’ (Oliveira et al., 2018). It

Economic Token Models in ReFi Projects: Token Design and Incentive Mechanisms Analysis

361

also has Work Token characteristics, incentivizing

(and reward) participants, such as data providers, for

sharing resources or securing the network. Thus,

OCEAN serves a hybrid role, allowing both usage for

platform access and rewards for contributions. Not

only does it function as a medium of exchange for

data and services within the Ocean Protocol

ecosystem, but also plays a role in Earnings

(rewarding data providers). However, the Currency

plays a dominant role. It represents access, data

ownership, and rights within the digital ecosystem of

the Ocean Protocol, with no direct connection to

physical or legal assets (Oliveira et al., 2018). The

project has a maximum token supply of 1.41 billion

OCEAN, with a circulating supply of 224,375,091

and a total supply of 974,807,052 (as of November

2024) (CoinGecko, 2024). The raise of funds occurs

through a public pre-launch token distribution for

whitelisted participants, indicating the prioritization

of a transparent and fair approach while avoiding

speculative bonuses. To ensure long-term stability the

project applies extended lock-up and vesting periods

in place (Pon, 2018). Contributor tokens are allocated

25–50%, subject to lock-up periods across three

phases—Seed, Pre-Launch, and Network Launch—

following a schedule-based supply model (Pon,

2018). By implementing fixed hard caps for each

phase and distribution schedules, the project

encourages long-term commitment from participants.

To ensure that early-stage investors cannot sell off

large amounts of tokens immediately, the lock-up and

vesting periods are tied to each phase promoting a

stable token economy along with incentivizing

ongoing engagement with the project. It is essential

to recognize that although such structured model of

distribution offers a more controlled growth while

mitigating speculative behaviors, it does not create

long-term value. It is project's ability to generate real

utility and demand to ensure value.

As a matter of token allocation, a fifth of the total

OCEAN supply is dedicated to the project’s founders,

5% to the protocol foundation, and 15% to SAFT

purchasers, with the remaining tokens distributed to

Ocean network nodes (Kriptomat, 2021). A SAFT

(Simple Agreement for Future Tokens) essentially

grants investors the right to receive functional utility

tokens once the network is live (shall not be confused

with SAFE) though its regulatory status is still

unclear (Batiz-Benet et al., 2017). Additionally,

OCEAN is deflationary, as 5% of all network revenue

is burned, which means the token supply will

decrease at an accelerating rate as adoption of the

Ocean Protocol grows (Kriptomat, 2021). Tokens

cannot be spent during the lock-up phase, but become

spendable post-network launch, aligning with their

utility role (Pon, 2018). Bridging the gap between

data industry and DeFi requires data tokens (ERC-20

tokens) - stored in crypto wallets, traded on

exchanges, transferred to decentralized autonomous

organizations (DAOs), and used for various other

DeFi activities (Kriptomat, 2021). The protocol of the

project is built on top of the Ethereum Ecosystem:

Polygon, Optimism, Energi, Polkadot, Sora

(CoinGecko, 2024).

Archetype: The OCEAN Token falls under

Funding Token category, incorporating also

elements of Work Token (data contributions) and

Asset Token (representing ownership or control over

a share of the assets within the protocol).

4.1.3 Toucan Protocol

The ReFi community has faced criticism for

prioritizing digital engagement over tangible climate

impact, making it crucial for the industry to focus on

real, verifiable emissions reductions and regenerative

practices (Hoopes IV et al., 2023). Differences

between various projects and their specific

characteristics make carbon credits often hard to buy

or sell quickly causing this asset class to be less liquid

(Toucan Protocol, 2024c). Currently, the trade of

verifiable carbon credits is limited by economies of

scale, as offsets are typically traded in bulk on the

voluntary carbon market; however, a public ledger

allows carbon offsets to be linked to individual

products on a microscale (WEF et al., 2018).

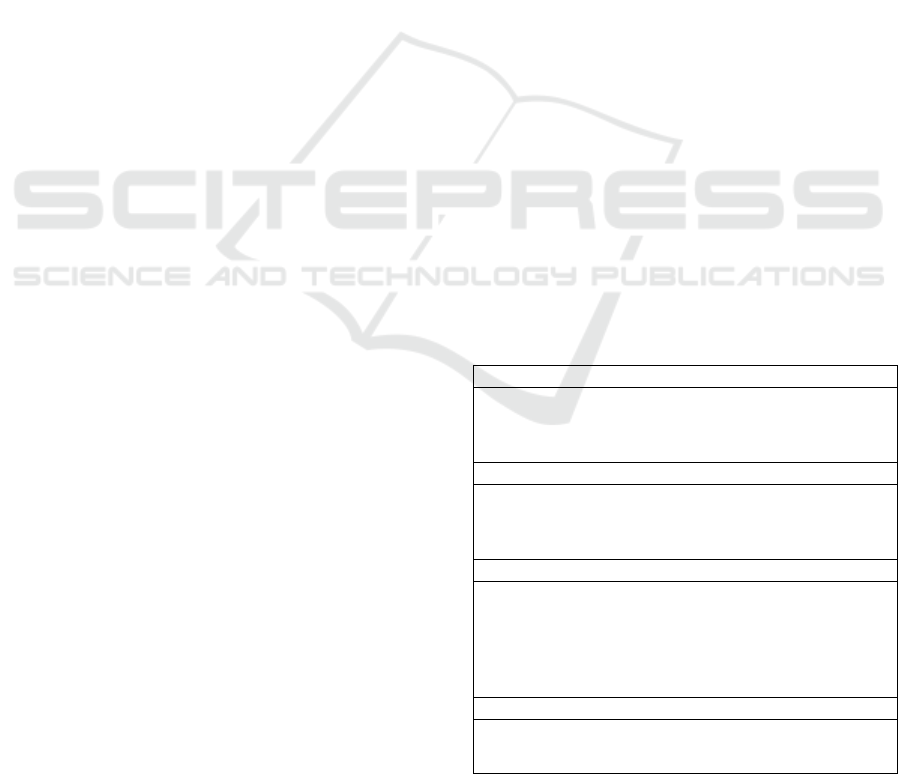

Table 4: TCO2 Token Parameters Classification.

Purpose Parameters:

Class: Utility Token

Function: Asset-Based Token

Role: Value Exchange

Governance Parameters:

Representation: Digital

Supply: Schedule-based

Incentive System: Use Platform and Stay Long-Term

Functional Parameters:

Spendability: Spendable

Tradability: Tradable

Burnability: Burnable

Expirability: Non-Expirable

Fungibility: Fungible

Technical Parameters:

Layer: Protocol (Non-Native)

Chain: Issued on top of a protocol

ICEIS 2025 - 27th International Conference on Enterprise Information Systems

362

Toucan does not issue carbon credits, but rather

provides infrastructure for tokenizing existing credits

from the Voluntary Carbon Market (VCM) in which

carbon credits are classified as commodities rather

than securities, meaning that in tokenized market,

they are treated as utility tokens (Toucan, 2022). The

platform is pioneering real-world asset (RWA)

tokenization, having brought $100 million worth of

carbon credits on-chain and facilitated $4 billion in

transactional volume, since its establishment in 2021

(Toucan Protocol, 2024a). Key products of the project

include the Puro Carbon Bridge, which allows to

tokenize carbon removal credits (CORCs) with TCO2

Tokens representing one ton of carbon avoided or

removed (tokenized carbon credits tied to specific

environmental projects). In order to convert CORCs

into TCO2 tokens (via the Puro Carbon Bridge) users

first provide required details (CORCs serial number,

the project name, the wallet address), then the credits

are locked in account within the Puro Registry,

ensuring that the physical credits cannot be double-

used (Puro Earth Registry, 2024). A Batch NFT is

then created as an on-chain asset containing detailed

information about the tokenization process and is

fractionalized into TCO2 tokens (each representing

one CORC) - these tokens are delivered to the

specified wallet for use in on-chain carbon markets.

The Batch NFT is a unique representation of a carbon

credits’ collection, where the fractionalized TCO2

tokens are fungible and allow for more accessible

participation in the carbon credit market. This system

ensures that each TCO2 token directly corresponds to

verified carbon removal (Toucan Protocol, 2024e).

Other products are Carbon Pools which bundle

TCO2 tokens (Toucan Protocol, 2024a). This process

of tokens commoditization (grouping similar credits

together), with the use of carbon reference tokens

NCT and BCT, enables the creation of a standardized

product that can be traded on decentralized exchanges

(DEXs), offering greater liquidity than individual

project credits (Toucan Protocol, 2024b). BCT and

NCT tokens are backed by real-world carbon credits

that have been tokenized through the Toucan

Protocol's bridging process (simply, backed by TCO2

tokens). Additionally, the Green NFT Extension tool

enables embedding carbon removal credits in ERC-

721 collections, while the dApp facilitates actions of

depositing, redeeming, and retiring tokenized carbon

credits (Toucan Protocol, 2024a), broadening the

usability of tokenized credits.

The token supply depends on the issuance of new

carbon credits from verified environmental projects.

TCO2 token is issued on top of the Regen Network -

a public blockchain built with the Cosmos SDK

(Polygon Labs, 2023). Tokens are spendable - to be

used for carbon offset transactions and potentially

other green initiatives, and tradable in the market for

carbon credits. To ensure that the credits cannot be

reintroduced or reused the retiring process occurs

(permanent removal akin to burning) which functions

as their complete elimination from the ecosystem in a

way that guarantees no further transactions or claims

can be made on those credits (Toucan Protocol,

2024d). There is not inherent expiration date

indicated as tied to the token.

Archetype: The TCO2 Token best fits into the

Asset Token category, however without the purpose

of a voting right - which might be rather seen in

tokenized security tokens (European Securities and

Markets Authority, 2024).

5 DISCUSSION

We position our analysis with a complementary

blueprint of responsible tokenomics drawing on

Villares’ (Villares, 2022) contributions, which focus

on the broader economic considerations and provide

valuable context for our examination. From the

ownership and governance perspective, only

OCEAN token grants the right to participate in the

governance process of the protocol, though the

significant portion is allocated to Ocean Protocol

Foundation. Users of Plastiks might influence the

development of the ecosystem, but governance is

largely centralized around Nozama Tech Ltd which

controls a significant amount of the supply. The

governance over the Toucan protocol, however, is

largely off-chain and handled by the protocol

developers. Hence, the future of these projects

heavily depends on the balance of power between

centralized entities and the broader community.

Furthermore, another interesting and varying aspect

observed in the analysis reliant upon the project’s

goals are supply models. The PLASTIK token has a

fixed, pre-mined supply of 1 billion tokens,

characterized by one-off distribution - the total token

supply is capped at issuance. The OCEAN token

supply has a maximum cap of 1.41B tokens which

are released gradually over time according to a

predefined schedule, distributing tokens for staking

rewards, liquidity mining (Nexera, 2021), and

participation in the ecosystem’s growth. For TCO2

tokens the supply is schedule-based as certain events

occur - the issuance of tokenized carbon credits, and

no maximum supply cap stated upfront. Each model

impacts future supply control, inflation risk, and

adaptability in different ways. PLASTIK’s supply

Economic Token Models in ReFi Projects: Token Design and Incentive Mechanisms Analysis

363

ensures no inflation but it could potentially lead to

more speculative behaviors in pump-and-dump

schemes. OCEAN’s gradual release on the other

hand allows for continuous incentives and ecosystem

growth. Long-term inflation risks are lowered as the

scheduled distribution allows for better predictions

though possible illiquidity remains. TCO2’s

schedule-based supply model comes with risks of

dependency on external factors and supply

constraints. Furthermore, the participation and

prevention of speculative behaviors can be viewed

from the incentive context. In case of Plastiks the

model is action-based and transactional, aimed at

rewarding environmentally positive activities, where

the aforementioned fixed supply can be viewed as a

mechanism of preventing inflation and the redeemed

tokens serve as creating a more transparent and

verifiable system. Earning OCEAN tokens happens

by engaging in activities of staking, data sharing, or

participating in governance decisions (voting on key

proposals) and the supply cap shall mitigate the

speculation risks. Toucan project’s rewards stem

from tokenizing carbon credits and participating in

carbon trading, where speculation risks are

minimized by the underlying real-world value of

carbon credits, which ensures the value of the TCO2

token. Lastly, the aspect of removing tokens from

circulation attracts some questions. Currently, there

are no suggestions of large numbers of PLASTIK

tokens having been lost or burnt, though the returns

on tokens indicate their permanent removal once

specific goals are achieved. OCEAN tokens on the

other hand might be locked or staked for long-term

incentives and TCO2 tokens’ exact number burnt is

tied to offset activities rather than speculative

activity.

The analysis of different projects demonstrates

that there is no one-size-fits-all approach. While

Toucan Protocol exposes how standardization and

liquidity provision make tokenized assets appealing

for environmental markets, Ocean Protocol

showcases how data sharing and monetization can be

strategically incentivized. Direct incentives,

however, that effectively drive consumer and

corporate engagement are illustrated in Plastiks case.

It is worth bearing in mind that even well-designed

incentives can lead to unintended consequences if the

project lacks strong governance as presented in the

cases provided in the Background section. Each

project demonstrates that robust structures i.e. hybrid

as seen in Ocean Protocol, allow to enhance trust as

well as align user actions with the project's mission.

6 CONCLUSION

Much of the current discourse in tokenomics revolves

around supply, demand, and incentive mechanisms.

While leveraging multiple token-based incentives can

enhance various aspects, such as transaction volume

and strategic engagement (Ballandies, 2022), a

narrow focus on incentives overlooks critical factors

like value creation, governance, and business logic

(Binance Square, 2023). Some projects employ multi-

layered token systems, incorporating NFTs and

multiple token roles which facilitates different

ecosystem functions. Similarly in other cases, a single

token may serve diverse purposes. Therefore,

tokenomics research requires a more holistic

approach – it necessitates a broader analytical

approach that considers the full spectrum of token

interactions and their systemic impact.

The limitations of this study are in the number of

projects examined as well as the less structured

approach to the analysis of token dynamics elements.

While the comparison of PLASTIK, OCEAN, and

TCO2 tokens, reveals the diverse ways tokens can

serve utility, governance, and asset ownership roles,

demonstrating the importance of aligning tokenomics

design with the objectives of each project, Phase 2 of

this study would employ a more complex and holistic

framework such as Token System Configurator

(Schubert et al., 2021). This offers even more detailed

modelling of the economic dynamics and decision-

making processes, allowing to focus more on the

interactions between tokens and their ecosystems.

Furthermore, insights from a quantitative data

analysis would be valuable to enhance the study with

token performance, e.g. through market trends, token

price fluctuations, and on-chain activity, user

engagement, e.g. through participation rates,

transaction volumes, and staking behaviours, as well

as detailed token distribution, staking metrics, and

reward issuance analysis to assess the efficiency and

effectiveness of token systems design.

REFERENCES

Au, S. and Power, T. 2018. Tokenomics: The crypto shift

of blockchains, ICOs, and tokens. Packt Publishing Ltd.

Ballandies, M.C., 2022. To incentivize or not: impact of

blockchain-based cryptoeconomic tokens on human

information sharing behavior. IEEE Access, 10,

pp.74111-74130.

Batiz-Benet, J., Santori, M. and Clayburgh, J., 2017. The

SAFT project: Toward a compliant token sale

framework. SAFT Project White Paper, Cooley.

ICEIS 2025 - 27th International Conference on Enterprise Information Systems

364

Bhubalan, K., Tamothran, A.M., Kee, S.H., Foong, S.Y.,

Lam, S.S., Ganeson, K., Vigneswari, S., Amirul, A.A.

and Ramakrishna, S., 2022. Leveraging blockchain

concepts as watermarkers of plastics for sustainable

waste management in progressing circular economy.

Environmental Research, 213, p.113631.

Binance Square. 2023. Vitalik Buterin: We must go beyond

the concept of tokenomics.

https://www.binance.com/en/square/post/535695

Blum, M., Feldman, P., & Micali, S. 2019. Non-interactive

zero-knowledge and its applications. In Providing

Sound Foundations for Cryptography: On the Work of

Shafi Goldwasser and Silvio Micali (pp. 329-349).

Böckel, A., Nuzum, A.K. and Weissbrod, I., 2021.

Blockchain for the circular economy: analysis of the

research-practice gap. Sustainable Production and

Consumption, 25, pp.525-539.

Bogdanov, A., Khvatov, V., Uteshev, A. and Shchegoleva,

N., 2024. Virtual Blockchain Network: A New Way to

Safe Data Exchange. Physics of Particles and Nuclei,

55(3), pp.394-397.

Bouri, E., Kamal, E., & Kinateder, H. 2023. FTX Collapse

and systemic risk spillovers from FTX Token to major

cryptocurrencies. Finance Research Letters, 56,

104099.

Carbon Copy & ReFi DAO. 2024. The State of ReFi A

Closer Look at Web3 Regenerative Finance.

Catena.MBA. (2024). Why Tokenomics Is Far More

Complex Than It Seems.

https://medium.com/@CatenaMBA/why-tokenomics-

is-far-more-complex-than-it-seems-adba7091e07f

CoinGecko. 2024. Ocean Protocol Price.

https://www.coingecko.com/en/coins/ocean-protocol

Conyers. 2024. The Importance of Sound Corporate

Governance for Virtual Asset Service Providers:

Lessons from Past Failures.

https://www.conyers.com/publications/view/the-

importance-of-sound-corporate-governance-for-

virtual-asset-service-providers-lessons-from-past-

failures

Cowen, T. 2018. Vitalik Buterin on Cryptoeconomics and

Markets.https://conversationswithtyler.com/episodes/v

italik-buterin/

Cryptoslav, I. 2022. Explaining The FTX Collapse—Is This

The End of Crypto? Coinmarketcap.

https://coinmarketcap.com/academy/article/explaining

-the-ftx-collapse-is-this-the-end-of-crypto

Cyber Studio. 2017. What are you token about? Blockchain

token economics and rights.

https://hackernoon.com/token-economy-

4a38ad02a239

Davidson, S., De Filippi, P., & Potts, J. 2018. Blockchains

and the economic institutions of capitalism. Journal of

Institutional Economics, 14(4), 639–658.

Deloitte. 2024. What are digital assets?

https://www2.deloitte.com/us/en/pages/about-

deloitte/solutions/blockchain-digital-assets-

definition.html

European Securities and Markets Authority. 2024.

Consultation paper. On the draft Guidelines on the

conditions and criteria for the qualification of crypto-

assets as financial instruments (ESMA75-453128700-

52).

Fang V. 2023. FTX Bankruptcy – A Failure of Centralized

Governance in the Name of Decentralized

Cryptocurrencies. Harvard Law School.

https://bankruptcyroundtable.law.harvard.edu/2023/02

/28/crypto-bankruptcy-series-ftx-bankruptcy-a-failure-

of-centralized-governance-in-the-name-of-

decentralized-cryptocurrencies/

Faster Capital. 2024. Crypto social impact: Tokenomics for

Social Impact Projects: Beyond Speculation.

https://fastercapital.com/content/Crypto-social-impact-

-Tokenomics-for-Social-Impact-Projects--Beyond-

Speculation.html

Freni, P., Ferro, E., & Moncada, R. 2022. Tokenomics and

blockchain tokens: A design-oriented morphological

framework. Blockchain: Research and Applications,

3(1), 100069.

Guan, C., Liu, W., Yu, Y. and Ding, D., 2024. Tokenomics

in the Metaverse: understanding the lead–lag effect

among emerging crypto tokens. Financial Innovation,

10(1), p.88.

Hoopes, J IV., Lerner, A., & Mezzatesta, M. 2023.

Blockchain for Scaling Climate Action. World

Economic Forum.

Hülsemann, P. and Tumasjan, A., 2019. Walk this Way!

Incentive structures of different token designs for

blockchain-based applications.

Ibrus, I. and Rohn, U., 2023. The web of value. Internet

Policy Review, 12(1).

Kiayias, A., Lazos, P. and Penna, P., 2024. Single-token vs

Two-token Blockchain Tokenomics. arXiv preprint

arXiv:2403.15429.

Kriptomat. 2021. What is cryptocurrency Ocean Protocol

(OCEAN) and how does it work?

https://kriptomat.io/cryptocurrency-prices/ocean-

protocol-ocean-price/what-is/

Lamberty, R., Poddey, A., Galindo, D., de Waard, D.,

Kölbel, T. and Kirste, D., 2020. Efficiency in Digital

Economies--A Primer on Tokenomics. arXiv preprint

arXiv:2008.02538.

Ledger Insights. 2022. BCG, ADDX estimate asset

tokenization to reach $16 trillion by 2030. Capital

Markets. https://www.ledgerinsights.com/bcg-addx-

estimate-asset-tokenization-to-reach-16-trillion-by-

2030/

Ledoux, E.L. and Smaili, N., 2024. Cryptocurrency frauds:

the FTX story. Journal of Financial Crime.

Lesavre, L., Varin, P., & Yaga, D. 2020. Blockchain

networks: Token design and management overview.

National Institute of Standards and Technology.

Louw, L. 2022. Blockchain technology for the data

economy. BSV Academy.

https://academy.bsvblockchain.org/blog/infographic-

blockchain-technology-for-the-data-economy

Mougayar, W. 2024. Negative News Are Killing Crypto’s

Progress. https://wamougayar.xyz/negative-news-are-

killing-cryptos-progress

Economic Token Models in ReFi Projects: Token Design and Incentive Mechanisms Analysis

365

Namdev K. 2023. Ocean Tokenomics—The impeccable

Token ecosystem of Ocean Protocol.

https://medium.com/@Wanderclyffe/ocean-

tokenomics-the-impeccable-token-ecosystem-of-

ocean-protocol

Nexera. 2021. Ocean Protocol Joins AllianceBlock

Liquidity Mining Partnership Program Strengthening

Economical and Societal Ties.

https://medium.com/@Nexera/ocean-protocol-joins-

allianceblock-liquidity-mining-partnership-program-

strengthening-economical-f3b265eba49

Olas K. 2024. What is a Token Economy? An Introduction

to Token Economy (Tokenomics). Nextrope.

https://nextrope.com/what-is-a-token-economy/

Oliveira, L., Zavolokina, L., Bauer, I. and Schwabe, G.,

2018, December. To token or not to token: Tools for

understanding blockchain tokens. ICIS.

Piyanko, H.. (2024). DeFi Tokenomics [FinDaS].

https://www.findas.org/blogs/defi-tokenomics

Plastiks. 2024. Plastiks: Leading the Way to Verified

Plastic Recovery.

https://medium.com/@plastiks/plastiks-leading-the-

way-to-verified-plastic-recovery-7d9e298189f9

Plastiks. 2024. The Plastiks’ Whitepaper. June 2024.

https://cdn.prod.website-

files.com/653b50712d451bd4b07752c0/6686b6de740

48ab40a63da56_Whitepaper-2024_July.pdf

Polas, M.R.H., Kabir, A.I., Sohel-Uz-Zaman, A.S.M.,

Karim, R. and Tabash, M.I., 2022. Blockchain

technology as a game changer for green innovation:

Green entrepreneurship as a roadmap to green

economic sustainability in Peru. Journal of Open

Innovation: Technology, Market, and Complexity, 8(2),

p.62.

Polygon Labs. 2023. Regen Network Launches Bridge to

Polygon With Toucan Protocol.

https://polygon.technology/blog/regen-network-

launches-bridge-to-polygon-with-toucan-protocol

Pon, B. 2018. Ocean Tokenomics. Ocean Protocol.

https://blog.oceanprotocol.com/ocean-tokenomics-

d34f28c480a8

Puro Earth Registry. 2024. Puro Registry for durable carbon

removal credits. https://registry.puro.earth/carbon-

sequestration/retirements

Schneider, N., 2018. An Internet of ownership: Democratic

design for the online economy. The Sociological

Review, 66(2), pp.320-340.

Schubert, N., Obermeier, D., Kohlbrenner, F. and Sandner,

P., 2021, August. Development of a token design

framework. In 2021 IEEE International Conference on

Decentralized Applications and Infrastructures

(DAPPS) (pp. 30-38). IEEE.

Schwiderowski, J., Pedersen, A.B. and Beck, R., 2024.

Crypto tokens and token systems. Information Systems

Frontiers, 26(1), pp.319-332.

Silkoset, R. 2024. How blockchain technology can

effectively combat greenwashing in sustainable

markets. BI Business Review.

https://www.bi.edu/research/business-review

Spaceseven. 2024. Governance vs. Utility Tokens—

Understanding the Differences.

https://medium.com/@Spaceseven/governance-vs-

utility-tokens-understanding-the-differences

Stefan Grasmann. 2024. Regenerative Finance (ReFi).

European Innovation Forum. https://innovation-

forum.org/regenerative-finance-refi/

Sunyaev, A., Kannengießer, N., Beck, R., Treiblmaier, H.,

Lacity, M., Kranz, J., Fridgen, G., Spankowski, U. and

Luckow, A., 2021. Token economy. Business &

Information Systems Engineering, 63(4), pp.457-478.

Thomas, D. 2024. The Evolution of Tokenomics: From

Utility Tokens to Security Tokens and Beyond.

https://medium.com/@daisygarciathomas/the-

evolution-of-tokenomics-from-utility-tokens-to-

security-tokens-and-beyond-8f124ef8bf36

Toucan. 2022. Public Consultation: Verra’s Approach to

Third-Party Crypto Instruments and Tokens.

https://blog.toucan.earth/content/files/2023/01/Toucan

_Verra_response.pdf

Toucan Protocol. 2024a. Toucan Documentation.

https://docs.toucan.earth/

Toucan Protocol. 2024b. Toucan Documentation_Carbon

credits. https://docs.toucan.earth/resources/carbon-

markets/credits

Toucan Protocol. 2024c. Toucan Documentation_Carbon

Pools. https://docs.toucan.earth/toucan/carbon-pools

Toucan Protocol. 2024d. Toucan Documentation_Carbon

Retirements. https://docs.toucan.earth/toucan/retire-

credits

Toucan Protocol. 2024e. Toucan

Documentation_Tokenization.

https://docs.toucan.earth/toucan/carbon-bridge/puro-

carbon-bridge/tokenization

United Nations. 2024. With less than one fifth of targets on

track, world is failing to deliver on promise of the

Sustainable Development Goals.

https://www.un.org/en/with-less-than-one-fifth-of-

targets-on-track

Upadhyay, A., Mukhuty, S., Kumar, V. and Kazancoglu,

Y., 2021. Blockchain technology and the circular

economy: Implications for sustainability and social

responsibility. Journal of cleaner production, 293,

p.126130.

Villares, L.C., 2022. Perspective Chapter: Cryptocurrencies

Effectiveness for Nature. In Blockchain Applications-

Transforming Industries, Enhancing Security, and

Addressing Ethical Considerations. IntechOpen.

WEF, PwC and Stanford Woods Institute for the

Environment. 2018. Building Block(chain)s for a Better

Planet. Fourth Industrial Revolution for the Earth

Series. World Economic Forum.

World Economic Forum. 2023. Why we still need

cryptocurrency for an ‘internet of value.’ World

Economic Forum. Why we still need cryptocurrency for

an ‘internet of value’

ICEIS 2025 - 27th International Conference on Enterprise Information Systems

366