A Review on Large Language Models and Generative AI in Banking

Daniel Staegemann

1a

, Christian Haertel

1b

, Christian Daase

1c

, Matthias Pohl

2d

,

Mohammad Abdallah

3e

and Klaus Turowski

1f

1

Magdeburg Research and Competence Cluster VLBA, Otto-von-Guericke University Magdeburg, Magdeburg, Germany

2

Institute of Data Science, German Aerospace Center (DLR), Jena, Germany

3

Department of Software Engineering, Al-Zaytoonah University of Jordan, Amman, Jordan

Keywords: Generative AI, GenAI, Large Language Model, LLM, Literature Review, Banking, Finance.

Abstract: Since ChatGPT was presented to the public in 2022, generative artificial intelligence and especially large

language models (LLM) have attracted a lot of interest in academia and industry alike. One of the arguably

most interesting domains in that regard is banking. This is because it could, theoretically, heavily benefit from

their application but also brings very strict regulations and demands. To provide an overview of the current

state of research in this field of tension, a literature review across four major scientific databases was

conducted and the identified papers were analysed to, inter alia, determine, which types of studies are common,

for which tasks the use of LLMs is explored, and which challenges and concerns became apparent. Further,

the findings are discussed and some general observations are made.

1 INTRODUCTION

Since the release of ChatGPT to the public in 2022,

large language models (LLM) and generative

artificial intelligence (GenAI) have attracted

increasing interest inside and outside of academia

(Chang et al. 2024; Raiaan et al. 2024). With their

ability to produce complex outputs based on a

provided prompt, many see them as a promising

avenue to significantly increase productivity across

numerous domains (Brynjolfsson et al. 2023;

Filippucci et al. 2024; Simons et al. 2024).

However, despite their great potential, they also

suffer from significant drawbacks. Besides the

challenge of providing suitable prompts to obtain the

best possible output, one of the arguably biggest

issues of GenAI and LLMs is the correctness of the

created output. Their trustworthiness can especially

suffer due to the so-called hallucinations (Huang et

al. 2024; Perković et al. 2024). These occur when the

a

https://orcid.org/0000-0001-9957-1003

b

https://orcid.org/0009-0001-4904-5643

c

https://orcid.org/0000-0003-4662-7055

d

https://orcid.org/0000-0002-6241-7675

e

https://orcid.org/0000-0002-3643-0104

f

https://orcid.org/0000-0002-4388-8914

models make up information or references yet present

them as based on existing facts. While for some cases

(e.g., suggesting suitable formulations for writing an

email or giving the synopsis of a movie) this issue is

rather negligible, in other scenarios (e.g., in medical

settings or the legal domain) this can be highly

problematic. A domain where the use of GenAI could

potentially yield tremendous benefits, since huge

numbers of transactions and activities have to be

processed quickly, yet the significance of errors and

inaccuracies is high, is banking.

To explore the potential of implementing such

solutions as well as the accompanying challenges is

the goal of this work, for which a structured literature

review (SLR) will be conducted. Therefore, within

this paper, the following research question (RQ) shall

be answered:

RQ: What is the current state of incorporating GenAI,

respectively LLMs, in banking, according to the

scientific literature?

Staegemann, D., Haertel, C., Daase, C., Pohl, M., Abdallah, M. and Turowski, K.

A Review on Large Language Models and Generative AI in Banking.

DOI: 10.5220/0013472600003956

In Proceedings of the 7th International Conference on Finance, Economics, Management and IT Business (FEMIB 2025), pages 267-278

ISBN: 978-989-758-748-1; ISSN: 2184-5891

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

267

To answer the RQ, the remainder of this publication

will be structured as follows. After the introduction,

the review protocol that was followed for the SLR is

presented, which is ensued by a section that is

dedicated to the description of the papers that were

found in the search. Based on these, a discussion

follows. Finally, a conclusion is given, and avenues

for future work are outlined.

2 REVIEW PROTOCOL

To answer the RQ, a SLR was conducted. Since the

value of a SLR largely depends on its rigour and

reproducibility (Kraus et al. 2022; vom Brocke et al.

2009), before starting the search process, following

common practices (Okoli 2015; vom Brocke et al.

2015), a protocol was developed to guide the process.

The prescribed steps, as well as the corresponding

considerations and results, are described in the

following.

To identify potentially suitable literature, Scopus

1

and IEEE Xplore

2

(IEEE) were harnessed. While the

former was chosen due to its comprehensive coverage

across many scientific databases and publishers, the

latter was added because of IEEE’s significance in the

computer science domain. These were complemented

by the ACM Digital Library

3

(ACM), belonging to

the world’s largest computing society (ACM History

Committee 2025), and the AIS electronic Library

4

(AISeL), which, inter alia, contains the proceedings

of some of the premiere conferences in the

information systems domain.

All of them were queried with the same search

term that consisted of two components.

The first part aims at making sure that the concept

of GenAI is covered with a broad range of common

terms and spellings to assure comprehensiveness:

llm OR "large language model" OR "generative

ai" OR "gen ai" OR genai OR gpt

While there are several other LLMs besides

ChatGPT in use, it currently is the most popular one,

which is why it was explicitly included in the term,

whereas others were not.

In the second part, the banking domain is

addressed. However, for the purpose of this paper,

only “core” activities are considered, therefore,

related activities such as stock market trading are not

included. Thus, the corresponding term was as

follows:

1

https://www.scopus.com

2

https://ieeexplore.ieee.org

3

https://dl.acm.org/

bank* OR credit OR lend* OR financ* OR fintech

These two parts were connected with an AND, to

make sure that both aspects are significant in the

found papers. Moreover, to further strengthen the

focus, they had to appear in the document title.

Hence, the final search term, as used in Scopus,

with the others using the same parameters, was as

follows:

( TITLE ( llm OR "large language model" OR

"generative ai" OR "gen ai" OR genai OR gpt ) AND

TITLE ( bank OR credit OR lend* OR financ* OR

fintech ) )

To ensure the necessary quality, only conference

papers and journal articles were included, whereas

book chapters were not, since the latter are usually not

peer-reviewed. This is also the reason why, despite

their timeliness, which is especially relevant in a

quickly emerging domain like GenAI, preprint

services like arXiv

5

were not utilised as additional

sources of papers, since there are “concerns about the

research accuracy, quality, and credibility of preprints”

(Adarkwah et al. 2024).

Moreover, only papers that were written in

English were considered, which led to the exclusion

of one paper that was written in Chinese. This

decision was made since none of the authors

possesses the necessary language skills to adequately

analyse it and the use of AI-based tools for translation

could potentially lead to misrepresentations of the

content that could not be detected.

Based on the aforementioned stipulations, the

search in Scopus resulted in the identification of a

total of 87 papers, of which 29 were journal articles

and 58 from conferences. IEEE, in turn, yielded 24

papers, 2 from journals and 22 from conferences.

Through ACM, 1 journal article and 21 conference

papers were found, and AISeL contributed 1

additional journal article. Thus, overall, the keyword

search brought 134 items, with 33 from journals and

101 from conferences.

However, since multiple databases were used for

the search, several duplicates occurred that were

removed in the next step. After doing so, 109 items

remained, with 31 being from journals and 78 from

conferences. Naturally, not each of these papers fit

the intended scope, which made additional filtering

necessary. Aligned with common practices (vom

Brocke et al. 2015), this was performed in multiple

steps to assure a high degree of diligence while still

maintaining efficiency.

4

https://aisel.aisnet.org/

5

https://arxiv.org/

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

268

For all of these phases, a joint set of inclusion and

exclusion criteria, as depicted in Table 1, was defined

in advance to serve as the foundation of the filter

process. Hereby, for a paper to be deemed suitable,

each of the inclusion criteria had to be met, whereas

when at least one of the exclusion criteria applied, it

was removed from the set.

As already highlighted in the description of the

keyword search, to be included, a paper had to be

published either in the proceedings of a scientific

conference or in a scientific journal. Further, it has to

be written in English. Due to this work’s RQ, it also

has to focus on the banking sector. This is further

sharpened by the exclusion of adjacent or auxiliary

activities such as stock market prediction,

respectively trading, or the automated analysis of

financial documents. Moreover, primarily technical

considerations (e.g., benchmarking and performance

comparisons of different tools) or papers describing

(the creation of) datasets for training or benchmarking

purposes were also excluded. The same applied when

the focus was not on banking itself, but it was merely

used as a domain to research something else (e.g., the

use of LLMs in the development/testing for banking

software). It also led to exclusion if a paper rather

generically addressed aspects such as LLMs’ impact

on organisations, matters of acceptance/trust, or

privacy considerations. Instead, only papers that

provide insights into (potential) application scenarios

of LLMs in banking were sought after.

In the first step, the papers were filtered based on

their title. Whenever it clearly indicated that a

publication does not fit the intended scope, it was

excluded from the list. Following this, 26 journal

articles and 66 conference papers were left for

consideration.

Yet, since titles have a rather limited capability of

conveying a paper’s content, the former measure

could not be handled too strictly, which is why,

afterward, the abstracts and keywords were consulted

to further narrow down the considered literature. For

instance, since the automated analysis of financial

documents and reports to populate database tables

with their content is an auxiliary activity,

corresponding papers were not further regarded. This

step reduced the number of remaining papers

significantly, to 27, of which 8 were journal articles

and 19 conference papers.

Finally, to further assess the suitability of the

papers to the RQ’s scope, they were read in total, and

those that did not fit were excluded. In doing so, 13

more papers across were dropped. Thus, the final

literature set comprises 14 papers, of which 9 are

from conferences and 5 appeared in journals.

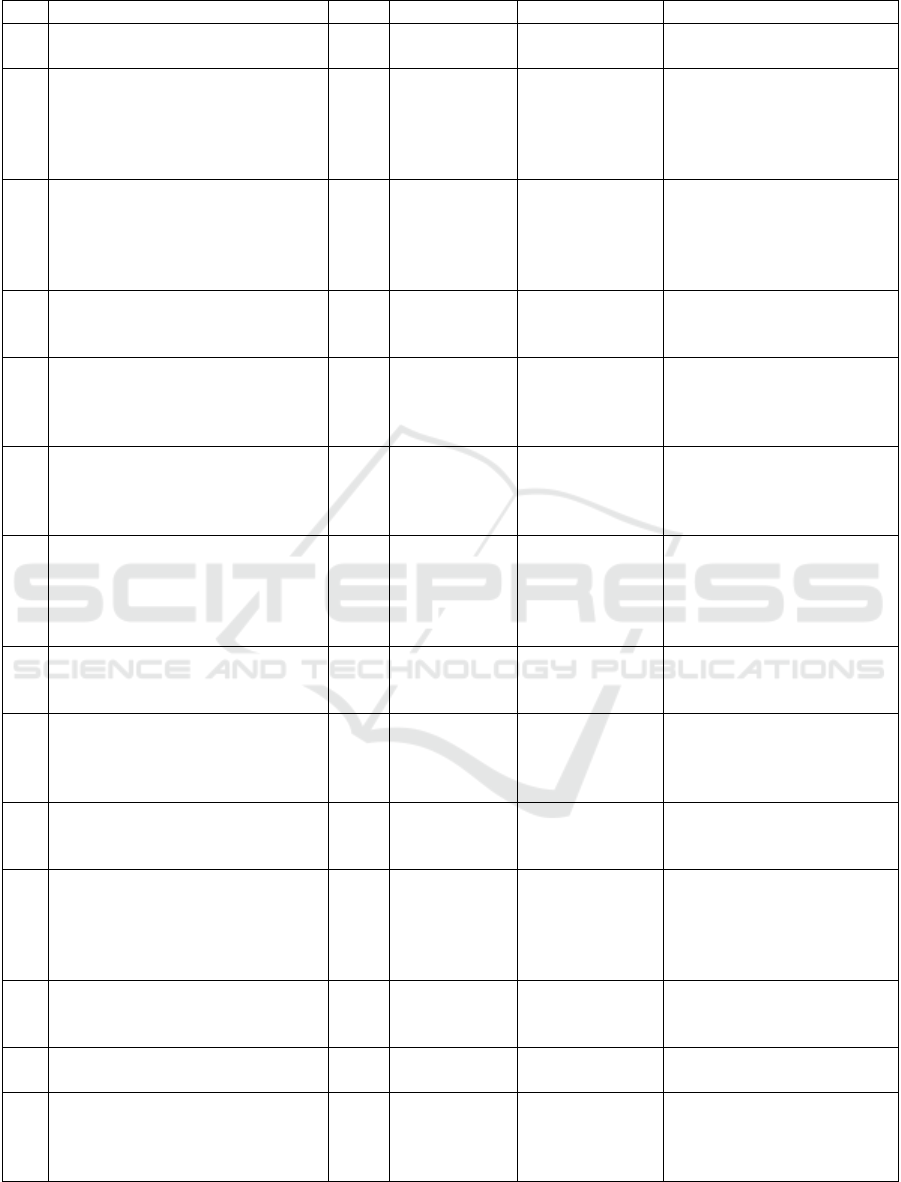

Table 1: The search's inclusion and exclusion criteria.

Inclusion Criteria Exclusion Criteria

The paper is

published in the

proceedings of a

scientific

conference or in a

scientific journal

The paper is not actually focused on

banking but only uses it as an

example or as a mean to research

something else

The paper is written

in English

The paper focusses on stock market

predictions or trading

The paper focusses

on the application

of LLMs in banking

The paper primarily deals with the

automated analysis of financial

reports

The paper discusses

application

scenarios or

(potential) use cases

The paper primarily focusses on

technical considerations (e.g.,

benchmarking and comparisons of

tools)

The paper just presents a new

banking focussed data set for

training or benchmarking purposes

The paper rather generically

addresses aspects such as LLMs’

impact on organisations, matters of

acceptance/trust, or privacy

considerations without discussing

actual application scenarios

3 FINDINGS

Resulting from the search, 14 publications were

identified that, despite no time frame being specified

to limit the extent of the search, all emerged in 2023

or 2024. This is, however, not surprising since the

tremendous interest in LLMs only started rather

recently, and the search was carried out too early for

many papers from 2025 already being available for

consideration.

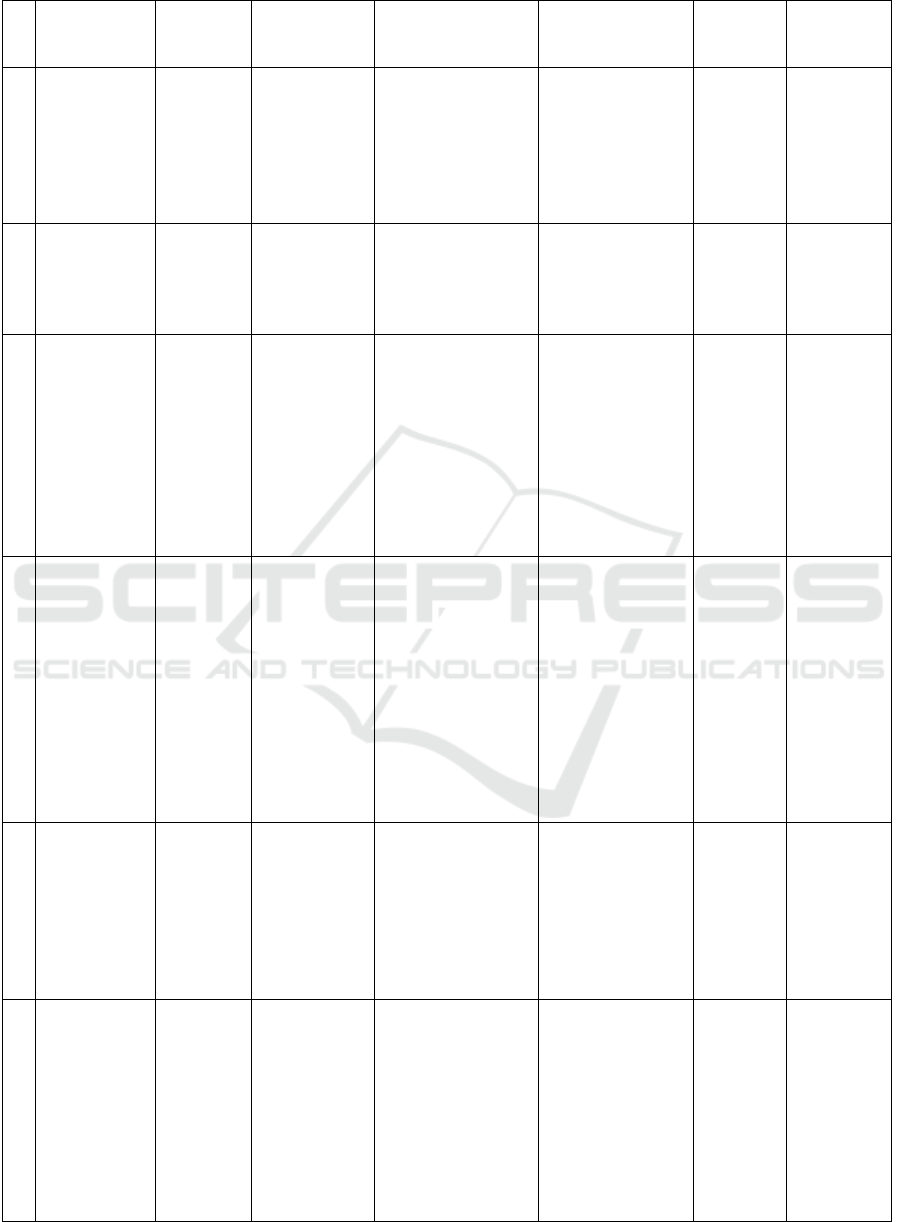

An overview of the identified papers is given in

Table 2. There, besides the title, publication year,

reference, and publication type, it is also depicted

where the paper was found, and an ID for further use

within the publication at hand is assigned. The latter

allows it to refer to specific papers in a more

convenient fashion, which will be used within Table 3

but adds no value beyond that. The former, however,

reveals an interesting insight that is also important

outside of the scope of this particular literature review.

Namely,

it emphasises the importance of not only

querying one single database but instead multiple

when attempting to create a comprehensive picture of

the domain, since there is no single all-encompassing

source.

A Review on Large Language Models and Generative AI in Banking

269

Table 2: The identified papers.

ID Title Yea

r

T

y

pe Found in Reference

1 Applications of Generative AI

in Fintech

2023 Conference Scopus (Barde and Kulkarni 2023)

2 A Study On Generative Ai And

Its Impact On Banking And

Financial Services Sector: Data

Privacy & Sustainable

Perspective

2023 Conference IEEE Xplore,

Scopus

(Ramaswamy and

Bagrecha 2023)

3 Enhancing Credit Risk Reports

Generation using LLMs: An

Integration of Bayesian

Networks and Labeled Guide

Promptin

g

2023 Conference ACM Digital

Library

(Teixeira et al. 2023)

4 From fiction to fact: the growing

role of generative AI in business

and finance

2023 Journal Scopus (Chen et al. 2023)

5 LLMs for Financial

Advisement: A Fairness and

Efficacy Study in Personal

Decision Makin

g

2023 Conference ACM Digital

Library

(Lakkaraju et al. 2023)

6 AI versus AI in Financial

Crimes & Detection: GenAI

Crime Waves to Co-

Evolutionar

y

AI

2024 Conference ACM Digital

Library

(Kurshan et al. 2024)

7 An Intelligent LLM-Powered

Personalized Assistant for

Digital Banking Using

LangGraph and Chain of

Thou

g

hts

2024 Conference IEEE Xplore (Easin et al. 2024)

8 Bankruptcy Prediction: Data

Augmentation, LLMs and the

N

eed for Auditor's Opinion

2024 Conference ACM Digital

Library

(Sideras et al. 2024)

9 Credit scoring model for fintech

lending: An integration of large

language models and FocalPoly

loss

2024 Journal Scopus (Xia et al. 2024)

10 Empowering financial futures:

Large language models in the

modern financial landscape

2024 Journal Scopus (Cao et al. 2024)

11 Enhancing Graph Database

Interaction through Generative

AI-Driven Natural Language

Interface for Financial Fraud

Detection

2024 Conference IEEE Xplore,

Scopus

(Simran and Geetha 2024)

12 Generative AI in Shariah

Advisory in Islamic Finance: An

Experimental Study

2024 Journal AIS electronic

Library

(Jokhio and Jaffer 2024)

13 LLMs in Banking: Applications,

Challenges, and Approaches

2024 Conference ACM Digital

Library

(Fan 2024)

14

N

ew Paradigm for Economic

and Financial Research With

Generative AI: Impact and

Perspective

2024 Journal IEEE Xplore,

Scopus

(Zheng et al. 2024)

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

270

The first paper, Applications of Generative AI in

The order of the papers within the table is purely

based on the publication year and the alphabetical

order of the titles and holds no further meaning.

However, in the following introduction of these

papers, it will still be adhered to, to increase clarity.

The first paper, Applications of Generative AI in

Fintech (Barde and Kulkarni 2023) aims to provide

an overview of the different ways that GenAI can be

incorporated by companies that are active in the

financial technology sector. What is really

noteworthy, however, is that it particularly focuses on

its use by specific institutions. Thus, it compiles

valuable insights into how global leaders such as,

inter alia, Bloomberg, Goldman Sachs, and Wells

Fargo harness the new opportunities to advance their

operations.

While not the only content of the presented work,

the arguably most relevant part with regard to this

paper of A Study On Generative Ai And Its Impact On

Banking And Financial Services Sector: Data

Privacy & Sustainable Perspective (Ramaswamy and

Bagrecha 2023) is the conducted survey amongst a

somewhat heterogeneous group of participants (even

though with a strong emphasis on employees) from

India to explore their opinions on and sentiment

towards GenAI in banking.

The development of a prompt-engineering

method (referred to as “Labeled Guide Prompting”)

is described in Enhancing Credit Risk Reports

Generation using LLMs: An Integration of Bayesian

Networks and Labeled Guide Prompting (Teixeira et

al. 2023). Here, it is demonstrated how ChatGPT can

be used to create high-quality credit risk reports when

provided with suitable examples and appropriate

structure and guidance through the prompt. For the

evaluation, data from credit applications was used,

and human credit analysts were tasked to assess the

quality of LLM and human-generated reports in a

blinded setting. Hereby, the LLM reports were

usually preferred, highlighting the approach’s

potential.

A non-exhaustive overview of different types of

tasks for GenAI related to banking is given in From

fiction to fact: the growing role of generative AI in

business and finance (Chen et al. 2023). For each of

them, identical requests are sent to ChatGPT 3.5,

ChatGPT 4, and Google’s Bard, and the

corresponding responses are shown and compared.

Further, the paper also comprises a case study for

sentiment analysis and contains considerations

regarding ethical concerns, technical limitations, and

legal aspects.

Another comparison of the suitability of ChatGPT

and Bard for certain financial tasks was presented in

LLMs for Financial Advisement: A Fairness and

Efficacy Study in Personal Decision Making

(Lakkaraju et al. 2023). However, this time, the focus

was on the advisement of customers on credit card-

related questions. Hereby, not only general requests

to deliver information were considered, but also how

specific scenarios should be handled, which required

the assistants to perform mathematical calculations

and compare the parameters of different products.

Furthermore, it was also examined if the (likely;

based on the name) gender or ethnicity of the user

impacted the provided answer. This, in turn, adds an

important aspect to the overall discourse, since

avoiding such biases is an important duty when

developing automated systems.

How GenAI can be harnessed to combat financial

crime but also which challenges are encountered in

this endeavour, and in which ways it can be abused

by criminals is addressed in AI versus AI in Financial

Crimes & Detection: GenAI Crime Waves to Co-

Evolutionary AI (Kurshan et al. 2024). Even though

the latter is not within the scope of this study, it is still

highly important for all actors in the financial system

to be aware of the potential exploits and the

associated risks, to reduce the likelihood of falling

victim to them. Hereby, the paper provides a high-

level overview that can constitute a valuable starting

point for further research into the respective areas that

are most relevant for one’s situation.

Another study that deals with the use of LLMs as

personal banking assistants is An Intelligent LLM-

Powered Personalized Assistant for Digital Banking

Using LangGraph and Chain of Thoughts (Easin et al.

2024). However, in contrast to the study of

(Lakkaraju et al. 2023), here, instead of credit card

consulting, support with general banking activities

(e.g., adding money or paying bills) is targeted. For

this, at first, a single-agent system was proposed,

which was later amended by the development of a

multi-agent architecture. In both cases, the customer

interacts with a single virtual assistant, which assures

the convenience of using it. However, whereas in the

first approach, the assistant accesses all the relevant

tools, in the second one, instead, it communicates

with another set of agents, of which each is

specifically developed to handle one distinct task. It

then gets passed the results and presents them to the

user. This way, a high degree of modularity and

specialisation can be achieved, similar to, for instance,

a microservice architecture (Shakir et al. 2021), while

not negatively impacting usability.

A Review on Large Language Models and Generative AI in Banking

271

An approach to improve bankruptcy predictions

through the use of LLMs is presented in Bankruptcy

Prediction: Data Augmentation, LLMs and the Need

for Auditor's Opinion (Sideras et al. 2024). Here, it is

suggested to incorporate the opinions of auditors that

is included in financial reports as an additional input

to the prediction algorithm that shall determine if a

company will go bankrupt in the foreseeable future.

Hereby, one challenge was the small percentage of

companies that actually go bankrupt, leading to a

heavily imbalanced distribution of the data. To deal

with this issue, LLMs were harnessed to generate

realistic synthetic data. Besides this data

augmentation, also the idea of directly tasking LLMs

with making corresponding predictions is explored.

However, while LLMs have been found to perform

well in many different tasks (Chang et al. 2024), here

the performance was not deemed sufficient. Yet, this

does not necessarily mean that the general idea is

unsuitable. Potentially, more sophisticated prompts

or future improvements in the LLMs might yield

better results.

The idea of incorporating narrative data into the

decision-making process is also explored in Credit

scoring model for fintech lending: An integration of

large language models and FocalPoly loss (Xia et al.

2024). This time, however, the focus is on credit

scoring. Within the paper, several LLMs are

compared regarding their ability to extract valuable

information that can improve the accuracy of the risk

prediction. Hereby, the authors found that

incorporating the LLMs indeed increased the

performance. Furthermore, they also showed that

using a LLM tailored to the language of the use case

(in this case Chinese) can lead to better performance

compared to, for instance, ChatGPT, which is

primarily trained on English sources.

In Empowering financial futures: Large language

models in the modern financial landscape (Cao et al.

2024), an overview of numerous potential application

areas of LLMs in the financial sector in general is

given, of which many are also relevant when it

specifically comes to banking. Additionally, several

challenges are discussed. While these are not

necessarily just applicable to the financial sector, due

to its critical and impactful nature, they are especially

significant and, thus, need to be addressed

appropriately.

Another attempt at dealing with financial fraud is

shown in Enhancing Graph Database Interaction

through Generative AI-Driven Natural Language

Interface for Financial Fraud Detection (Simran and

Geetha 2024). Here, a pipeline is built that simplifies

the analysis by allowing the user to control the

application with natural language requests via a web

interface, significantly increasing user-friendliness.

These are then transformed into a query and

forwarded to a database to retrieve the relevant data.

Subsequently, a LLM is provided with the data,

analyses them, and predicts if a transaction is

fraudulent. The results are then shown to the user.

Furthermore, for the LLM, different alternatives are

compared regarding their performance.

A rather unique, yet very interesting, case is

presented in Generative AI in Shariah Advisory in

Islamic Finance: An Experimental Study (Jokhio and

Jaffer 2024). To guide the decisions of banks that

have to or aspire to comply with shariah regulations,

experts are needed that are well-versed in both

domains, shariah regulations and banking. Yet, this

particular combination is relatively rare, potentially

creating a corresponding bottleneck. Aiming to

alleviate this issue, the authors explored how feasible

the use of (different) LLMs is to identify shariah

compliance issues, provide corresponding references

from the shariah, and give guidance on how to

proceed.

Another overview that highlights how LLMs can

support banking operations is given in LLMs in

Banking: Applications, Challenges, and Approaches

(Fan 2024). Here, various application avenues are

outlined and, using real world examples, it is

highlighted how these can bring tangible business

value. Moreover, similar to several of the priorly

introduced papers, potential challenges are discussed,

and potential mitigation strategies are mentioned.

Additionally, brief strategic recommendations are

given for banks that intend to utilize LLMs in their

operations.

Finally, an outlook on research in the field of

GenAI application in finance is given in New

Paradigm for Economic and Financial Research

With Generative AI: Impact and Perspective (Zheng

et al. 2024). While the focus is somewhat different

from the other papers and not directly aimed at the

incorporation of LLMs in banking but instead on the

scientific side, it also prominently discusses potential

application areas as well as challenges that have to be

considered. Thus, it contributes to the corresponding

discourse.

4 DISCUSSION

Even though the focus of this review was

intentionally kept rather narrow, the versatility of

GenAI in the banking sector still shows in the

plethora

of different tasks and approaches that are

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

272

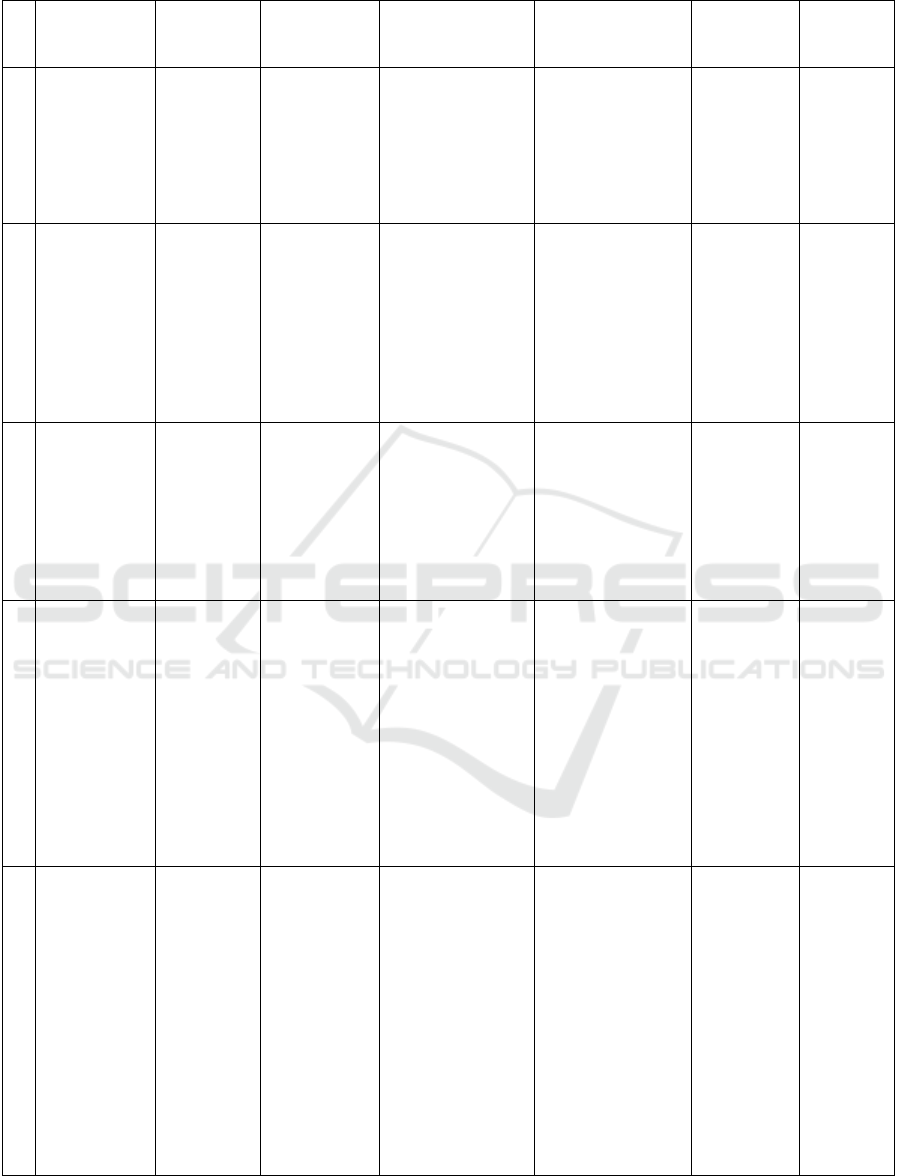

Table 3: Overview of the presented papers.

ID Type of

Research

Results

Addresse

d

Area

What Was

Done?

Tasks Mentione

d

Challenges/

Concerns

Used

Model(s)

Prompting

1 Overview The

financial

sector in

general

An overview

of diverse

applications

scenarios of

GenAI was

given

Credit risk

evaluations;

Customer service

operations;

Banking

operations; Data

analysis

Biases

N

ot

applicable

N

ot

applicable

2 Survey Banking

in general

Survey on

opinions/

sentiment

regarding

GenAI

Customer service

operations;

Financial planning

Data privacy;

User acceptance

N

ot

applicable

N

ot

applicable

3 Specific

development:

Prompting

strategy

Credit

risk

analysis

Development

and

evaluation of

a prompting

strategy

Generation of

credit risk reports

The prioritization

of ChatGPT in

presenting

information

GPT-4 Prompts

shown in

parts;

“Labeled

Guide

Prompting”

proposed;

Few-shot

prompting

applie

d

4 Overview;

Case study

The

financial

sector in

general

Comparison

of GPT 3.5,

GPT 4, and

Bard for

different

tasks;

Sentiment

analysis case

study

Customer service

operations; Risk

management;

Decision support

Data

p

rivacy;

Lack of

legislation;

Quality of

responses;

Overreliance;

Sensitivity to

prompting

template; Energy

consumption;

Impact on labour

marke

t

GPT-3.5;

GPT-4;

Bard

N

ot shown

5 Specific

development:

Application

scenario

LLM as

banking

assistant

Feasibility of

LLM-

chatbots as

assistant/

advisor for

rather

challenging

tasks teste

d

Customer service

operations;

Financial advisor

Biases ChatGPT

(version

not

stated);

Bard

N

ot shown

6 Overview Fraud

detection

An overview

on GenAI-

based crimes

and

opportunities

for crime

detection

through

LLMs was

g

iven

Fraud detection;

money laundering

detection

Potential of

LLMs for use in

criminal

activities

N

ot

applicable

N

ot

applicable

A Review on Large Language Models and Generative AI in Banking

273

Table 3: Overview of the presented papers (cont.).

ID Type of

Research

Results

Addressed

Area

What Was

Done?

Tasks Mentione

d

Challenges/

Concerns

Used

Model(s)

Prompting

7 Specific

development:

Application

LLM as

banking

assistant

Development

of a (multi-

agent)

personalized

assistant for

digital

b

anking

Various banking

tasks (e.g., add

money or pay

bills)

N

ot mentione

d

GPT-3.5 Short

prompts

shown;

Chain of

Thoughts

prompting

mentione

d

8 Specific

development:

Application

scenario

Bankruptcy

prediction

Use of LLM

to predict if a

company

will go

bankrupt

based on

auditor's

opinion in a

repor

t

N

arrative

extraction to

improve

bankruptcy

prediction; Use

of LLM to

predict

bankruptcy

Low quality of

LLM predictions

Llama-3;

Finance-

chat (fine-

tuned

Llama-2

model)

Prompts

shown;

Zero-shot

prompting

9 Specific

development:

Application

scenario

Credit risk

analysis

Extraction of

narrative

data from

credit report

to enhance

credit risk

assessment

model

Extraction of

narrative data

Data security/

privacy;

Information

extraction

capability

may be language-

dependent

GPT-4;

GPT-3.5;

Bert;

ERNIE 4.0;

Turbo;

Doubao

N

ot

mentioned

10 Overview The

financial

sector in

general

An overview

of diverse

applications

potentials of

LLMs in

finance as

well as

challenges

was given

Customer service

operations; Fraud

detection/

prevention;

Market analysis;

Financial

advisor;

Regulatory

compliance;

Legal document

analysis; Data

anal

y

sis

Biases; Ethical

considerations;

Data security/

privacy; Quality

of responses;

User acceptance

N

ot

applicable

N

ot

applicable

11 Specific

development:

Application

scenario

Fraud

detection

Automated

conversion

of natural

language

into graph

database

queries to

make fraud

detection

tasks more

accessible;

Fraud

prediction by

LLM

Conversion of

natural language

into database

queries; Fraud

detection

Scalability

challenges with

increasing

transaction

volumes

impacting real-

time processing

T5 model;

Llama-2;

FinBERT;

RoBERTa;

DistilBERT

N

ot

mentioned

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

274

Table 3: Overview of the presented papers (cont.).

ID Type of

Research

Results

Addressed

Area

What Was

Done?

Tasks Mentione

d

Challenges/

Concerns

Used

Model(s)

Prompting

12 Specific

development:

Application

scenario

Policy

adherence

support

Evalua

t

ion of

the capacity

of generic

LLMs to

provide

shariah

advisory in

Islamic

finance based

on ten

hypothetical

financing

scenarios

Identify shariah

compliance issues;

Provide the

corresponding

sharia references;

Offer shariah

guidance on

handling the issues

Limitations in

providing shariah

guidance

GPT-4;

Gemini;

Meta AI

N

ot

mentioned

13 Overview Banking

in general

An overview

of diverse

applications

potentials of

LLMs in

banking as

well as

challenges

was given

Customer

acquisition and

relationship

management;

Account

management;

Customer service

operations; Loans

and credit

management;

Investment and

wealth

management;

Regulatory

compliance; Risk

mana

g

emen

t

Data privacy/

security; Biases;

Interpretability

and transparency;

Technical

challenges;

Maintenance

N

ot

applicable

N

ot

applicable

14 Overview The

financial

sector in

general

An overview

of diverse

applications

potentials of

LLMs in

finance was

given

Fraud detection;

Policy analysis;

Extreme scenario

analysis;

Economic and

financial

predictions;

Portfolio

management

Data privacy/

security; Biases;

Ethical

considerations;

Quality of the

results;

Transparency;

Dependence on

major technology

corporations;

Impact on labour

marke

t

N

ot

applicable

N

ot

applicable

presented in the identified papers. To provide a

comprehensive overview of their contents, in Table 3,

a matrix is shown that summarizes the most important

aspects (Webster and Watson 2002).

This comprises firstly the general type of research

results that were obtained, which area was addressed,

and a brief summary of what was actually done with

regards to this study’s scope. Moreover, it is depicted,

which tasks for LLMs were mentioned and which

challenges and concerns related to the use of GenAI

and LLMs in banking were highlighted.

Finally, for those cases where it was applicable

and stated, it is noted which LLMs were used in the

described research endeavour and which prompting

strategies were applied.

- Auffällig, dass wenig/kein ChatGPT.

Erklärung: Daten sind sensibel

When

looking at the type of research results, it

A Review on Large Language Models and Generative AI in Banking

275

becomes apparent that many of the papers attempt to

provide an overview of the application potentials.

This emphasises that the novelty of the domain goes

along with a great sense of uncertainty and

exploration regarding the potential of this technology.

Whereas more established topics are usually

advanced by specific developments and theories that

add incremental knowledge, here, just understanding

its actual significance is already a challenge in its own.

Yet, none of the aforementioned papers is a

structured literature review, highlighting the

significance of the study at hand in providing a more

systematised overview of the domain.

The current lack of maturity is also emphasized

when scrutinizing the specific developments, be it

tools, prompting strategies, or further attempts at

exploring potential application scenarios.

Initially, it was intended to add another column to

the table to indicate if the specific developments were

evaluated in real-life scenarios or in an experimental

way. Yet, after analysing the literature, it was found

that all of them took place in experimental settings,

and not a single one was already (at least at the time

these papers were written) used productively. This is,

however, not surprising, factoring in the lacking

maturity of the technology in combination with the

critical nature, strict regulations, and high demands of

the banking industry as well as the competitive

advantages that can be achieved through

corresponding solutions that are superior compared to

the competition’s ones. Nevertheless, describing the

use of LLMs in real-world settings, as already to

some degree done in (Barde and Kulkarni 2023),

could provide valuable additional insights and would

most likely be appreciated by many.

The general description of (potential) tasks for

LLMs is, however, done plentiful across the

identified papers. One of the most frequently

mentioned ones is the dealing with customer service

operations, respectively, the role of personalized

assistants. The use of LLMs as financial advisors or

planners was also frequently mentioned. However,

this would, naturally, require highly sophisticated and

trustworthy solutions, yet, currently, the public’s trust

in AI for those tasks is rather limited (Ramaswamy

and Bagrecha 2023).

Other popular tasks include the extraction of

information to, for instance, amend actually existing

processes and varying prediction tasks. Hereby,

especially credit risk assessment and fraud detection

or prevention seem to be popular research directions.

Here, some of the results are surprisingly impressive

(Simran and Geetha 2024), indicating that LLMs are

already very competent in this field.

Increasing accessibility by acting as an easy-to-

use interface, for instance for the use of databases

(Simran and Geetha 2024), also appears as a

promising approach. Moreover, the creation of

realistic synthetic (text-based) data, which can be

used for varying purposes such as testing or the

training of algorithms (Staegemann et al. 2023), is

also a strength of LLMs.

The final big group of tasks that stood out in the

identified papers comprised the analysis of policies,

the analysis of legal texts, and the provisioning of

guidance on related matters. Even though the

corresponding quality is not yet sufficient to replace

the respective experts (Jokhio and Jaffer 2024),

providing some support can already bring significant

benefits.

Nevertheless, there are also considerable

challenges associated with the use of LLMs in general

and especially in the banking sector. The ones that are

mentioned the most are the threat of biases

influencing the results, and issues regarding data

privacy and security as well as transparency. Ethical

considerations and a potentially negative impact on

the labour market are also stated. Another big concern

is, as mentioned earlier, the quality of the results that

is oftentimes insufficient for productive use in critical

tasks. Consequently, trust, respectively a lack of it, as

also highlighted before, is, therefore, another big

barrier for LLMs in many finance-related roles.

Additionally, as to be expected for a rather new type

of tool, technical challenges are also a big factor that

needs to be dealt with.

While many other obstacles are also pointed out,

a major one is the legal situation around LLMs and

their use. This is not restricted to the financial sector

and also applies to many other areas (Barqawi and

Abdallah 2024), but is, naturally, especially

significant in such a strictly regulated domain.

Even though this might not be a challenge per se,

it was also experienced that language-specific LLMs

outperform general ones, when dealing with other

languages than English (Xia et al. 2024). This is in

line with other works (Noels et al. 2024; Zhang et al.

2024) and suggests that organizations should make

their model-choice under consideration of the

language that the LLM shall operate in, or potentially

even run several specialized LLMs that are addressed

based on the language relevant to the respective

request. This way, one LLM could be used as the

point of contact and forward the requests to the

underlying LLM most suited for the task and/or

language. This would be similar to the solution

suggested in (Easin et al. 2024).

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

276

Currently, however, the use of language-specific

LLMs is still rather rare, at least based on the

literature, and general LLMs are the most common

ones. This is also visible in the identified papers,

where ChatGPT is the most commonly found LLM.

While this is not surprising, due to its popularity, it is,

in contrast to other options, not specialized on tasks

in the financial sector. With growing maturity of the

domain, a development towards the use of more

specialized models for such tasks appears to be likely.

Further, unfortunately, the low maturity of the

domain also shows in a lack of standards for the

reporting of LLM projects. Therefore, in many cases,

relevant information such as the applied prompting

strategy/strategies, the prompts themselves, or even

the specific version of the LLM that was used are

missing. The same applies to a more detailed

breakdown of the evaluations. This, in turn, makes it

harder to contextualize the findings.

5 CONCLUSION

With the use of GenAI and LLMs being in its infancy,

many domains are trying to find ways to harness their

power. An example with especially high stakes is the

banking sector since it could hugely benefit but also

brings strict regulations. To obtain an overview of the

research on the use of LLMs in core tasks in banking

that can be used as a starting point for future research

endeavours, a structured literature review was

conducted. To this end, four scientific databases were

searched and the found papers were subsequently

analysed to identify application scenarios, challenges

and concerns, and current themes. In the future, this

could be expanded by also incorporating other facets

of finance such as stock trading.

REFERENCES

ACM History Committee. (2025). “ACM History,”

available at https://www.acm.org/about-acm/acm-

history, accessed on Jan 10 2025.

Adarkwah, M. A., Islam, A. Y. M. A., Schneider, K., Luckin,

R., Thomas, M., and Spector, J. M. (2024). “Are

Preprints a Threat to the Credibility and Quality of

Artificial Intelligence Literature in the ChatGPT Era? A

Scoping Review and Qualitative Study,” International

Journal of Human–Computer Interaction, pp. 1-14 (doi:

10.1080/10447318.2024.2364140).

Barde, K., and Kulkarni, P. A. (2023). “Applications of

Generative AI in Fintech,” in The Third International

Conference on Artificial Intelligence and Machine

Learning Systems, Bangalore India. 25.10.2023 -

28.10.2023, New York, NY, USA: ACM, pp. 1-5 (doi:

10.1145/3639856.3639893).

Barqawi, L., and Abdallah, M. (2024). “Copyright and

generative AI,” Journal of Infrastructure, Policy and

Development (8:8), p. 6253 (doi:

10.24294/jipd.v8i8.6253).

Brynjolfsson, E., Li, D., and Raymond, L. (2023).

“Generative AI at Work,” NBER Working Paper Series

31161, Cambridge, MA: National Bureau of Economic.

Cao, X., Li, S., Katsikis, V., Khan, A. T., He, H., Liu, Z.,

Zhang, L., and Peng, C. (2024). “Empowering financial

futures: Large language models in the modern financial

landscape,” EAI Endorsed Transactions on AI and

Robotics (3) (doi: 10.4108/airo.6117).

Chang, Y., Wang, X., Wang, J., Wu, Y., Yang, L., Zhu, K.,

Chen, H., Yi, X., Wang, C., Wang, Y., Ye, W., Zhang,

Y., Chang, Y., Yu, P. S., Yang, Q., and Xie, X. (2024).

“A Survey on Evaluation of Large Language Models,”

ACM Transactions on Intelligent Systems and

Technology (15:3), pp. 1-45 (doi: 10.1145/3641289).

Chen, B., Wu, Z., and Zhao, R. (2023). “From fiction to fact:

the growing role of generative AI in business and

finance,” Journal of Chinese Economic and Business

Studies (21:4), pp. 471-496 (doi:

10.1080/14765284.2023.2245279).

Easin, A. M., Sourav, S., and Tamás, O. (2024). “An

Intelligent LLM-Powered Personalized Assistant for

Digital Banking Using LangGraph and Chain of

Thoughts,” in 2024 IEEE 22nd Jubilee International

Symposium on Intelligent Systems and Informatics

(SISY), Pula, Croatia. 19.09.2024 - 21.09.2024, IEEE, pp.

625-630 (doi: 10.1109/SISY62279.2024.10737601).

Fan, M. (2024). “LLMs in Banking: Applications,

Challenges, and Approaches,” in Proceedings of the

International Conference on Digital Economy,

Blockchain and Artificial Intelligence, Guangzhou

China. 23.08.2024 - 25.08.2024, New York, NY, USA:

ACM, pp. 314-321 (doi: 10.1145/3700058.3700107).

Filippucci, F., Gal, P., Jona-Lasinio, C., Leandro, A., and

Nicoletti, G. (2024). “The impact of Artificial

Intelligence on productivity, distribution and growth:

Key mechanisms, initial evidence and policy challenges,”

OECD Artificial Intelligence Papers, OECD.

Huang, L., Yu, W., Ma, W., Zhong, W., Feng, Z., Wang, H.,

Chen, Q., Peng, W., Feng, X., Qin, B., and Liu, T. (2024).

“A Survey on Hallucination in Large Language Models:

Principles, Taxonomy, Challenges, and Open Questions,”

ACM Transactions on Information Systems (doi:

10.1145/3703155).

Jokhio, M. N., and Jaffer, M. A. (2024). “Generative AI in

Shariah Advisory in Islamic Finance: An Experimental

Study,” Business Review (19:2), pp. 74-92 (doi:

10.54784/1990-6587.1665).

Kraus, S., Breier, M., Lim, W. M., Dabić, M., Kumar, S.,

Kanbach, D., Mukherjee, D., Corvello, V., Piñeiro-

Chousa, J., Liguori, E., Palacios-Marqués, D.,

Schiavone, F., Ferraris, A., Fernandes, C., and Ferreira,

J. J. (2022). “Literature reviews as independent studies:

guidelines for academic practice,” Review of

Managerial Science (16:8), pp. 2577-2595 (doi:

10.1007/s11846-022-00588-8).

A Review on Large Language Models and Generative AI in Banking

277

Kurshan, E., Mehta, D., and Balch, T. (2024). “AI versus AI

in Financial Crimes & Detection: GenAI Crime Waves

to Co-Evolutionary AI,” in Proceedings of the 5th ACM

International Conference on AI in Finance, Brooklyn

NY USA. 14.11.2024 - 17.11.2024, New York, NY,

USA: ACM, pp. 745-751 (doi:

10.1145/3677052.3698655).

Lakkaraju, K., Jones, S. E., Vuruma, S. K. R., Pallagani, V.,

Muppasani, B. C., and Srivastava, B. (2023). “LLMs for

Financial Advisement: A Fairness and Efficacy Study in

Personal Decision Making,” in 4th ACM International

Conference on AI in Finance, Brooklyn NY USA.

27.11.2023 - 29.11.2023, New York, NY, USA: ACM,

pp. 100-107 (doi: 10.1145/3604237.3626867).

Noels, S., Blaere, J. de, and Bie, T. de. (2024). “A Dutch

Financial Large Language Model,” in Proceedings of

the 5th ACM International Conference on AI in Finance,

Brooklyn NY USA. 14.11.2024 - 17.11.2024, New York,

NY, USA: ACM, pp. 283-291 (doi:

10.1145/3677052.3698628).

Okoli, C. (2015). “A Guide to Conducting a Standalone

Systematic Literature Review,” Communications of the

Association for Information Systems (37), pp. 879-910

(doi: 10.17705/1CAIS.03743).

Perković, G., Drobnjak, A., and Botički, I. (2024).

“Hallucinations in LLMs: Understanding and

Addressing Challenges,” in 2024 47th MIPRO ICT and

Electronics Convention (MIPRO), Opatija, Croatia.

20.05.2024 - 24.05.2024, IEEE, pp. 2084-2088 (doi:

10.1109/MIPRO60963.2024.10569238).

Raiaan, M. A. K., Mukta, M. S. H., Fatema, K., Fahad, N.

M., Sakib, S., Mim, M. M. J., Ahmad, J., Ali, M. E., and

Azam, S. (2024). “A Review on Large Language

Models: Architectures, Applications, Taxonomies,

Open Issues and Challenges,” IEEE Access (12), pp.

26839-26874 (doi: 10.1109/ACCESS.2024.3365742).

Ramaswamy, S., and Bagrecha, C. (2023). “A Study On

Generative Ai And Its Impact On Banking And

Financial Services Sector: Data Privacy & Sustainable

Perspective,” in 2023 IEEE Technology & Engineering

Management Conference - Asia Pacific (TEMSCON-

ASPAC), Bengaluru, India. 14.12.2023 - 16.12.2023,

IEEE, pp. 1-5 (doi: 10.1109/TEMSCON-

ASPAC59527.2023.10531592).

Shakir, A., Staegemann, D., Volk, M., Jamous, N., and

Turowski, K. (2021). “Towards a Concept for Building

a Big Data Architecture with Microservices,” in

Proceedings of the 24th International Conference on

Business Information Systems, Hannover,

Germany/virtual. 14.06.2021 - 17.06.2021, pp. 83-94

(doi: 10.52825/bis.v1i.67).

Sideras, A., Bougiatiotis, K., Zavitsanos, E., Paliouras, G.,

and Vouros, G. (2024). “Bankruptcy Prediction: Data

Augmentation, LLMs and the Need for Auditor's

Opinion,” in Proceedings of the 5th ACM International

Conference on AI in Finance, Brooklyn NY USA.

14.11.2024 - 17.11.2024, New York, NY, USA: ACM,

pp. 453-460 (doi: 10.1145/3677052.3698627).

Simons, W., Turrini, A., and Vivian, L. (2024). “Artificial

Intelligence: Economic Impact, Opportunities,

Challenges, Implications for Policy,” European

Economy Discussion Papers 210, European Union.

Simran, T., and Geetha, J. (2024). “Enhancing Graph

Database Interaction through Generative AI-Driven

Natural Language Interface for Financial Fraud

Detection,” in 2024 15th International Conference on

Computing Communication and Networking

Technologies (ICCCNT), Kamand, India. 24.06.2024 -

28.06.2024, IEEE, pp. 1-8 (doi:

10.1109/ICCCNT61001.2024.10725408).

Staegemann, D., Pohl, M., Haertel, C., Daase, C., Abdallah,

M., and Turowski, K. (2023). “An Overview of the

Approaches for Generating Test Data in the Context of

the Quality Assurance of Big Data Applications,” in

2023 17th International Conference on Signal-Image

Technology & Internet-Based Systems (SITIS), Bangkok,

Thailand. 08.11.2023 - 10.11.2023, IEEE, pp. 30-37

(doi: 10.1109/SITIS61268.2023.00015).

Teixeira, A. C., Marar, V., Yazdanpanah, H., Pezente, A.,

and Ghassemi, M. (2023). “Enhancing Credit Risk

Reports Generation using LLMs: An Integration of

Bayesian Networks and Labeled Guide Prompting,” in

4th ACM International Conference on AI in Finance,

Brooklyn NY USA. 27.11.2023 - 29.11.2023, New York,

NY, USA: ACM, pp. 340-348 (doi:

10.1145/3604237.3626902).

vom Brocke, J., Simons, A., Niehaves, B., Reimer, K.,

Plattfaut, R., and Cleven, A. (2009). “Reconstructing the

Giant: On the Importance of Rigour in Documenting the

Literature Search Process,” in Proceedings of the ECIS

2009, Verona, Italy. 08.06.2009 - 10.06.2009.

vom Brocke, J., Simons, A., Riemer, K., Niehaves, B.,

Plattfaut, R., and Cleven, A. (2015). “Standing on the

Shoulders of Giants: Challenges and Recommendations

of Literature Search in Information Systems Research,”

Communications of the Association for Information

Systems (37) (doi: 10.17705/1CAIS.03709).

Webster, J., and Watson, R. T. (2002). “Analyzing the Past

to Prepare for the Future: Writing a Literature Review,”

MIS Quarterly (26:2), pp. xiii-xxiii.

Xia, Y., Han, Z., Li, Y., and He, L. (2024). “Credit scoring

model for fintech lending: An integration of large

language models and FocalPoly loss,” International

Journal of Forecasting (doi:

10.1016/j.ijforecast.2024.07.005).

Zhang, X., Xiang, R., Yuan, C., Feng, D., Han, W., Lopez-

Lira, A., Liu, X.-Y., Qiu, M., Ananiadou, S., Peng, M.,

Huang, J., and Xie, Q. (2024). “Dólares or Dollars?

Unraveling the Bilingual Prowess of Financial LLMs

Between Spanish and English,” in Proceedings of the

30th ACM SIGKDD Conference on Knowledge

Discovery and Data Mining, R. Baeza-Yates and F.

Bonchi (eds.), Barcelona Spain. 25.08.2024 -

29.08.2024, New York, NY, USA: ACM, pp. 6236-

6246 (doi: 10.1145/3637528.3671554).

Zheng, X., Li, J., Lu, M., and Wang, F.-Y. (2024). “New

Paradigm for Economic and Financial Research With

Generative AI: Impact and Perspective,” IEEE

Transactions on Computational Social Systems (11:3),

pp. 3457-3467 (doi: 10.1109/TCSS.2023.3334306).

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

278