Market Reactions in China to the US-Houthi Conflict:

An Event Study Approach

Rizky Yudaruddin

1a

, Dadang Lesmana

2b

, Felisitas Defung

1c

and Ardi Paminto

1d

1

Faculty of Economy and Business, Mulawarman University, Samarinda, Indonesia

2

Research and Development Agency East Kutai, Sangatta, Indonesia

Keywords: US-Houthi Conflict, Chinese Market, Market Reaction, Event Study.

Abstract: This study aims to examine market reactions in the Chinese market to the US-Houthi conflict, employing the

event study methodology with cumulative abnormal returns (CAR) as a proxy for market reactions. The

analysis focuses on a sample of 2,114 Chinese companies. The findings reveal that the Chinese market

exhibited significant reactions during the post-event period, with nearly all sectors affected rather than a single

sector. This suggests that the conflict disrupted the Suez Canal trade route, a critical pathway for China's trade

with Europe, leading to increased investor pessimism. These results provide implications for policy makers

and managers in overcoming supply chain disruptions due to the war.

1 INTRODUCTION

The Israel-Hamas conflict, which began on October

9, 2023, has had profound global repercussions,

influencing the geopolitical stance of multiple

nations. One significant outcome is the emergence of

another conflict involving the United States and the

Houthis. The Houthis declared their aggression

against ships associated directly or indirectly with the

United States, the United Kingdom, or Israel as an

expression of support for the Palestinian people

1

.

Since November 2023, the Houthis have carried out

over one hundred attacks on commercial vessels and

warships, escalating maritime risks

2

. These attacks

have resulted in at least two fatalities, four injuries,

and several individuals reported missin

3

. Pandey et al.

a

https://orcid.org/0000-0002-0850-9747

b

https://orcid.org/0000-0002-6489-0466

c

https://orcid.org/0000-0003-2654-4690

d

https://orcid.org/0000-0002-2354-0603

1

https://www.bbc.com/news/world-middle-east-67614911

2

https://www.washingtoninstitute.org/policy-analysis/

houthi-shipping-attacks-patterns-and-expectations-2025

3

https://www.reuters.com/world/middle-east/three-

missing- bulk-carrier-off-yemen-after-incident-

reported-shipping-source-2024-03-06/

4

https://www.nytimes.com/article/houthi-yemen-red-sea-

attacks.html

(2024) and Yudaruddin et al. (2024) demonstrated

that conflicts in the Middle East have increased

instability in capital markets, with the US-Houthi

conflict eliciting predominantly negative reactions in

global markets, particularly in the consumer cyclical

sector (Yudaruddin et al., 2025).

Additionally, the US-Houthi conflict has

disrupted a critical shipping route connecting Asia

and Europe, causing blockades and necessitating

rerouting via the southern tip of Africa. This has led

to significantly higher transportation costs and risks,

driving up global commodity prices

4

. Haralambides

(2024) reported a decline in the use of the Suez Canal

trade route due to the conflict, while traffic along the

Cape of Good Hope has surged. This disruption has

particularly affected China, which relies heavily on

118

Yudaruddin, R., Lesmana, D., Defung, F. and Paminto, A.

Market Reactions in China to the US-Houthi Conflict: An Event Study Approach.

DOI: 10.5220/0013474800003956

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 7th International Conference on Finance, Economics, Management and IT Business (FEMIB 2025), pages 118-125

ISBN: 978-989-758-748-1; ISSN: 2184-5891

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

trade with Europe (Gonen, 2023). These

developments prompted this study to examine market

reactions in China, given that previous conflicts (e.g.,

the Russia-Ukraine war, the Israel-Hamas conflict)

have consistently elicited negative responses.

The purpose of this study is to investigate the

impact of the US-Houthi conflict on the Chinese

capital market, focusing on market reactions across

different sectors and company sizes. This research

aims to understand how geopolitical tensions,

particularly those disrupting critical trade routes like

the Suez Canal, influence market stability in China, a

country with significant reliance on international

trade. By analyzing the sensitivity of the Chinese

market to such conflicts, this study seeks to provide

valuable insights into the broader implications of

geopolitical risks on emerging markets. The findings

are intended to guide policymakers, managers, and

investors in formulating strategies to address market

instability and mitigate the adverse effects of supply

chain disruptions.

This study contributes to the literature in three

ways. First, our study complements previous studies

that discuss market reactions in China, particularly in

the context of war, such as the Israel-Hamas conflict

(Yudaruddin et al., 2024) and the Russia-Ukraine war

(Boubaker et al., 2022; Wang and Su, 2024). Unlike

prior studies, this research focuses on the US-Houthi

conflict and its implications for the Suez Canal trade

route in China (Yudaruddin et al., 2025). Second, this

study highlights the heightened sensitivity of the

Chinese market to geopolitical risks, corroborating

findings from earlier studies (Yudaruddin et al., 2024;

Wang and Su, 2024). Furthermore, China's significant

role in the global economy implies that instability in

its market could have far-reaching consequences for

global markets (Kim, 2019). Third, the findings

provide valuable insights for policymakers, managers,

and investors in addressing supply chain disruptions

and mitigating market instability.

2 METHOD

This study examines 2,114 companies listed in the

Chinese market. The daily closing prices of the

sample companies, along with the Shanghai

Composite Index (SSEC), were obtained from the

investing.com database for the period spanning

December 1, 2022, to February 29, 2024.

5

https://www.nytimes.com/2024/01/11/us/politics/us-

houthi-missile-strikes.html

6

https://edition.cnn.com/2024/01/11/politics/us-strikes-

houthis-yemen/index.html

We employed the event study approach proposed

by Fama et al. (1969), which has been widely used in

recent studies on market reactions to geopolitical risk

such war (Lesmana & Yudaruddin, 2024b;

Yudaruddin et al., 2023; Yudaruddin & Lesmana,

2024b; Pandey, 2024; Boubaker et al., 2023). This

study focuses on the US-Houthi conflict that occurred

on January 11, 2024

5,6,7

, as the event day.

We utilized multiple event windows, including a

15-day pre-event period and a 15-day post-event

period, to capture market reactions comprehensively.

Furthermore, a 250-trading-day period prior to the

event window was used to calculate normal returns,

providing a robust benchmark that enhances the

accuracy and reduces potential biases in the study's

results.

Based on the works of Yudaruddin et al. (2023),

Yudaruddin and Lesmana (2024a), and Boubaker et

al. (2022), we use market reaction metrics such as

normal returns, abnormal returns, and cumulative

abnormal returns, defined as follows:

The normal rate of return is given by:

𝑅

,

= 𝛼

+ 𝛽

𝑅

,

+ ε

i,t

The abnormal rate of return is defined as:

𝐴𝑅

,

= 𝑅

,

− 𝛼

+ 𝛽

𝑅

,

Lastly, the cumulative abnormal rate of return:

𝐶𝐴𝑅

,

= 𝐴𝑅

,

where, R

i,t

is the return rate of stock i on the trading

day t, 𝑅

,

is the return rate of the trading market, α

i

and βi are regression coefficients. The expected

normal return of individual stock i can be calculated

when α

i

and βi remain stable during the estimation

period, while ε

i,t

is the idiosyncratic component of the

stock return. Furthermore, 𝐴𝑅

,

is the average

abnormal return rate of stock i on the trading day t,

obtained by subtracting the expected from the actual

return, and 𝐶𝐴𝑅

,

is the cumulative abnormal

return rate of stock i in the event window period (t

1,

t

2

).

The purpose of this study is to explore the market

response to the US-Houthi conflict in the Chinese

market. To achieve this, the analysis is conducted in

several stages. First, the overall market reaction is

examined, followed by a sectoral analysis across

Communication Services, Consumer Discretionary,

Consumer Staples, Energy, Financials, Healthcare,

Industrials, Information Technology, Materials, Real

Estate, and Utilities. Second, the analysis is

7

https://www.aljazeera.com/news/2024/1/11/any-us-

attack-on-yemens-houthis-will-not-go-without

Market Reactions in China to the US-Houthi Conflict: An Event Study Approach

119

segmented by company size, categorizing firms into

small, medium, and large. Third, the study explores

market reactions based on growth rates, divided into

low, medium, and high-growth companies. Finally,

the robustness of the results is tested using the

Wilcoxon signed-rank test and an alternative event

window of 150 days, ensuring the reliability and

validity of the findings.

3 RESULT AND DISCUSSION

3.1 The Impact of the US-Houthi

Conflict on Market Reactions by

Market

In Table 1, this section analyzes the market reaction in

China to the US-Houthi conflict, with a detailed

examination of sectoral differences. Building on the

research of He et al. (2019), which explored the

Chinese market reaction to COVID-19, this study

takes a distinct approach. The findings reveal that the

Chinese market generally reacted significantly

positively prior to the event and during the event

window (0, +1), but post-event, the market

experienced a significant negative reaction to the US-

Houthi conflict. This suggests that the Chinese market

remained stable before and during the event, but post-

event disruptions, particularly to the Suez Canal trade

route, had a profound impact. The negative reaction

reflects investors' concerns regarding the disruption of

the Suez Canal, a critical trade route connecting China

to Europe. According to IMFPortwatch (2024),

logistics in the Suez Canal declined by up to 70%,

significantly affecting Chinese companies, as the

canal plays a pivotal role in facilitating trade to Europe

(Gonen, 2023). Essalamy et al. (2020) and Wu et al.

(2022) highlight the Asian region's reliance on the

Suez Canal for its cost, time efficiency, and lower risk

of ship damage. The rerouting of trade increased

inefficiencies and disrupted the effectiveness of

distribution, negatively impacting corporate

performance. Investors interpreted these

developments as adverse signals, leading to panic

selling, which resulted in significant declines in stock

prices. This aligns with Basnet et al. (2022), who

found that geopolitical risks, such as the Russia-

Ukraine war, triggered pessimism among investors,

prompting them to exit markets. Similarly, Hoque and

Zaidi (2020) emphasize that geopolitical risks often

have a detrimental effect on stock returns in

developing countries.

More specifically, sectoral market reactions

reveal interesting trends. Prior to the event, some

sectors displayed significant positive reactions,

including consumer staples, energy, financials,

industrials, materials, and real estate. These findings

support Nerlinger and Utz (2022), who identified a

strong positive correlation between the energy sector

and geopolitical events. In contrast, sectors such as

communication services, consumer discretionary,

healthcare, and information technology exhibited

significant negative reactions. On the event day,

however, most sectors experienced significant

positive reactions, driven by China's monetary policy

interventions, such as interest rate cuts and support

for the property sector. These policies created

optimism among investors regarding economic

recovery. Several sectors, including consumer staples,

utilities, and information technology, reacted

positively to the monetary easing measures, which are

known to stabilize economies during crises in

developing countries (Lesmana and Yudaruddin,

2024a). Basistha and Kurov (2008) further note that

markets tend to react more strongly to monetary

policy during crises than under normal conditions.

Post-event, all sectors exhibited significant

negative reactions to the US-Houthi conflict, with

two sectors showing delayed negative reactions 15

days after the event. These results highlight the broad

and severe impact of the conflict on all sectors,

compounded by China's worsening economic

conditions, which further dampened investor

sentiment. The findings corroborate previous studies

that

identified certain sectors as particularly

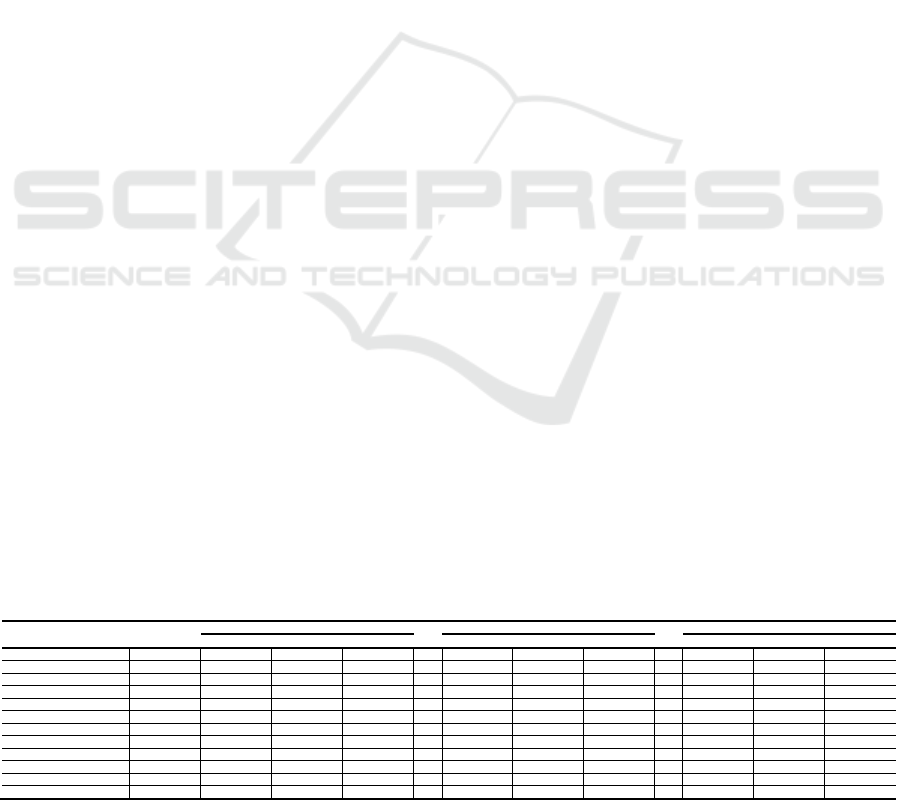

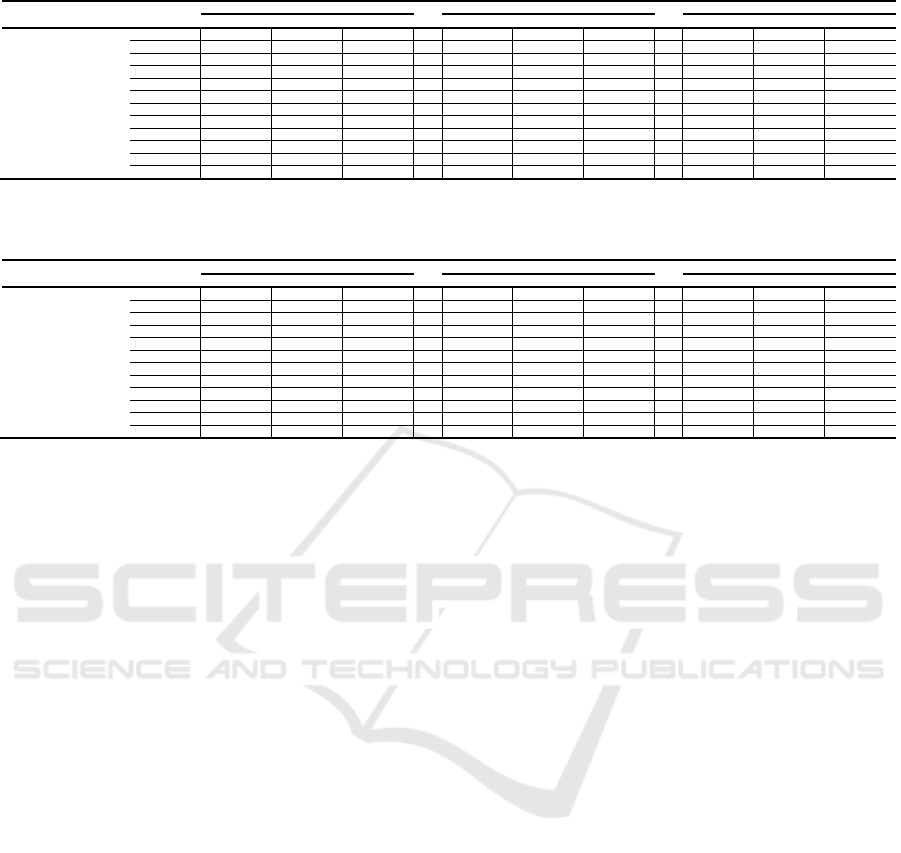

Table 1: Cumulative abnormal returns for pre-event, the event day, and post-event windows by markets.

Markets

Number of

Company

Pre-Event days Event days Post-Event days

(-15, 0) (-10, 0) (-5, 0) (-1, 0) (-1, +1) (0, +1) (0, +5) (0, +10) (0, +15)

All Sectors 2114 -0.0079*** 0.0137*** -0.0004 0.0084*** 0.0030*** 0.0052*** -0.0152*** -0.0418*** -0.1061***

Communication Services 36 -0.0548*** -0.0128 -0.0174*** 0.0116** 0.0006 0.0120** 0.0014 -0.0216 -0.0818***

Consumer Discretionar

y

299 -0.0210*** 0.0132** 0.0120*** 0.0073*** -0.0013 0.0006 -0.0122*** -0.0432*** -0.1224***

Consumer Staples 133 0.0084 0.0254*** 0.0061** 0.0196*** 0.0158*** 0.0013 -0.0194*** -0.0520*** -0.1214***

Energ

y

85 0.0557*** 0.0456*** 0.0094* -0.0008 0.0040 0.0034 -0.0123* -0.0212*** -0.0520***

Financials 76 -0.0096 0.0103** 0.0105*** -0.0003 -0.0008 -0.0002 0.0270*** 0.0483*** 0.0481***

Healthcare 221 -0.0278*** -0.0015 -0.0166*** 0.0046*** -0.0068*** -0.0029** -0.0342*** -0.0719*** -0.1560***

Industrials 503 0.0120 0.0291*** 0.0096 0.0108*** 0.0074*** 0.0120*** -0.0060 -0.0259 -0.0945***

Information Technolog

y

288 -0.0720*** -0.0237*** -0.0261*** 0.0086*** -0.0078*** 0.0010 -0.0249*** -0.0765*** -0.1713***

Materials 327 0.0231*** 0.0222*** -0.0009 0.0092*** 0.0088*** 0.0086*** -0.0182*** -0.0540*** -0.1265***

Real Estate 65 -0.0146** 0.0197*** 0.0154*** 0.0133*** 0.0138*** 0.0087*** -0.0171*** 0.0217** -0.0290*

Utilities 81 0.0071 0.0179*** -0.0079** -0.0014 0.0078*** 0.0121*** -0.0260*** -0.0315*** 0.0841

Note (s): CAR stands for cumulative abnormal return. The ordinate represents the event window. ***, **, and * are significant at 1%, 5%, and 10% confidence levels, respectively.

Source: Authors' calculation.

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

120

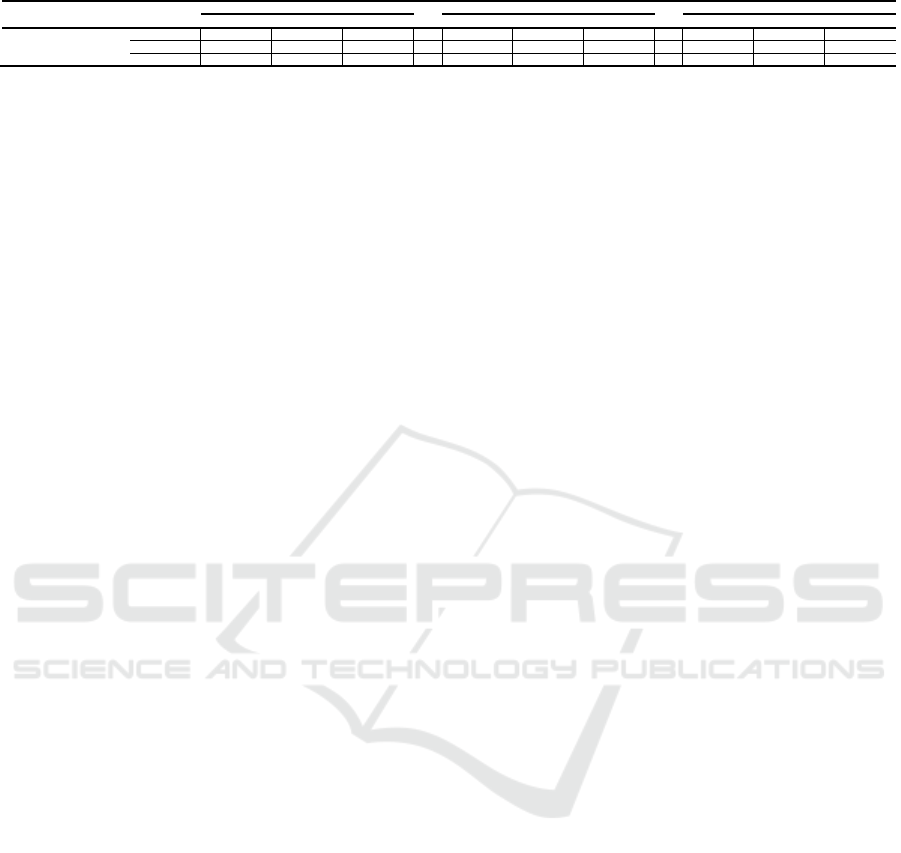

Table 2: Size-based Cumulative abnormal returns for before-event, the event day, and post-event windows.

Markets

Number of

Company

Pre-Event days Event days Post-Event days

(-15, 0) (-10, 0) (-5, 0) (-1, 0) (-1, +1) (0, +1) (0, +5) (0, +10) (0, +15)

Small Cap 530 -0.0054 0.0274*** 0.0009 0.0044*** -0.0026** 0.0018 -0.0265*** -0.0680*** -0.1751***

Mid Cap 538 -0.0116*** 0.0171*** -0.0013 0.0099*** 0.0017 0.0051*** -0.0223*** -0.0628*** -0.1535***

Large Cap 1046 -0.0072 0.0050 -0.0006 0.0097*** 0.0065*** 0.0071*** -0.0057 -0.0178* -0.0467***

Note (s): This table presents the cumulative abnormal return (CAR) of a size-based tercile portfolio formed using the average market value over the estimation period. ***, **, and * are significant at 1%, 5%, and 10%

confidence levels, respectively.

Source: Authors' calculation.

to war and macroeconomic shocks, including

consumer staples (Yudaruddin et al., 2023), utilities,

healthcare, information technology (He et al., 2019),

and real estate (Yudaruddin and Lesmana, 2024b).

Investor pessimism deepened as geopolitical risks

escalated due to the US-Houthi conflict, particularly

with changes in trade routes affecting Chinese

companies reliant on the Suez Canal. This pessimism

manifested in widespread share sell-offs, leading to

plunging stock prices (Basnet et al., 2022).

3.2 The Impact of the US-Houthi

Conflict on Market Reactions by

Size Firm

Next, we conduct an analysis of market reactions in

China based on company size, as presented in Table 2.

Our findings indicate that small and medium-sized

companies exhibit similar reactions to the US-Houthi

conflict before and after the event. Before the

announcement, these companies experienced a

significant negative reaction, followed by a significant

positive reaction on the event day, and then another

positive reaction 5 to 15 days post-event. In contrast,

large-scale companies reacted significantly positively

only on the event day but displayed a significant

negative reaction 10 to 15 days post-event. These

results suggest that the US-Houthi conflict impacts all

company sizes in China, with small and medium-sized

companies being the most affected. This heightened

impact reflects the vulnerability of smaller companies

that rely heavily on exports, as they tend to be less

stable than their larger counterparts. Additionally, the

disruption of trade routes and the resulting tariff

increases exacerbated the challenges faced by small

and medium-sized companies during the US-Houthi

conflict (Yudaruddin et al., 2025). Similar findings

were reported by Kamal et al. (2023) in their analysis

of the Russian-Ukrainian war in Australia, where

small and medium-sized companies were more

adversely affected than larger firms due to disrupted

export dependencies.

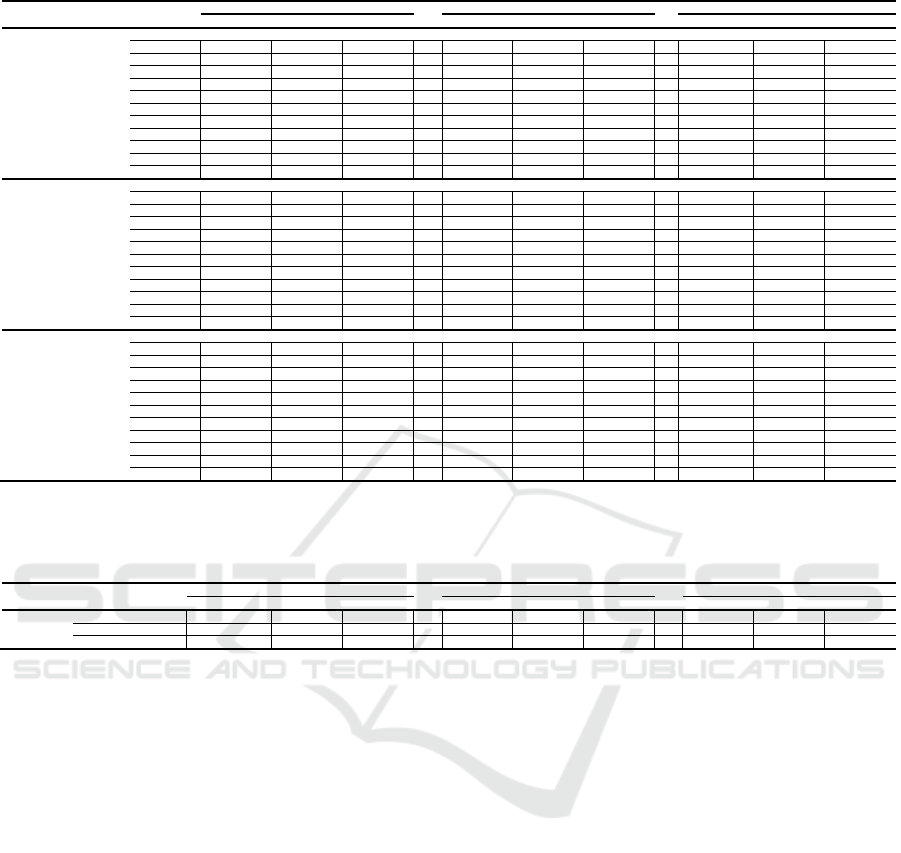

A deeper analysis of market reactions by sector

and company size (Table 3) provides further insights.

Among small companies, sectoral reactions varied

significantly prior to the conflict. Negative reactions

were observed in the healthcare, information

technology, and communication services sectors,

while positive reactions occurred in the consumer

discretionary, consumer staples, energy, industrials,

materials, real estate, and utilities sectors. The

negative reactions likely stemmed from investor

concerns regarding the disruption of the Red Sea-Suez

Canal trade route, a vital export pathway from China

to Europe. From the event day to the post-event period,

most sectors consistently showed negative reactions,

with the exception of the financial sector, which

remained resilient. This aligns with Yudaruddin et al.

(2024), who found that most sectors exhibited

significant negative reactions to the Israel-Hamas

conflict, although the financial sector displayed a

significant positive reaction post-event.

Medium-sized companies demonstrated a more

uniform pattern of reactions both before and after the

announcement. Prior to the event, significant negative

reactions were observed in the healthcare and

information technology sectors, while significant

positive reactions were recorded in the consumer

discretionary, consumer staples, industrials, materials,

real estate, and utilities sectors. On the event day,

medium-sized companies, as indicated in baseline

Table 1, experienced significant positive reactions

across multiple sectors, including communication

services, consumer staples, industrials, materials, real

estate, and utilities, reflecting a shift from negative to

positive sentiment. However, post-event reactions

turned predominantly negative across almost all

sectors except financial and real estate, highlighting

the broader economic impact of the conflict.

Finally, large-scale companies showed positive

reactions on the event day, particularly in the

communication services, consumer discretionary,

consumer staples, industrials, materials, real estate,

and utilities sectors. However, the healthcare and

information technology sectors reacted significantly

negatively, underscoring the high sensitivity of the

healthcare sector to geopolitical risks. This finding

aligns with He et al. (2019), who observed a similar

negative reaction in the healthcare sector during the

COVID-19 pandemic, despite high demand within the

sector. Post-event, the majority of sectors across both

small and large companies exhibited negative

reactions, reinforcing the findings of previous studies

on the prolonged impact of geopolitical risks on

market vulnerability. These include the consumer

staples sector (Yudaruddin et al., 2023; Hohler et al.,

Market Reactions in China to the US-Houthi Conflict: An Event Study Approach

121

Table 3: Cumulative abnormal returns for pre-event, the event day, and post-event windows by sector and size base.

Markets

Number of

Company

Pre-Event days Event days Post-Event days

(-15, 0) (-10, 0) (-5, 0) (-1, 0) (-1, +1) (0, +1) (0, +5) (0, +10) (0, +15)

Panel A: Small Cap

Communication Services 7 -0.0586** 0.0032 -0.0097 0.0031 -0.0124** -0.0001 -0.0338* -0.1102*** -0.2315***

Consumer Discretionar

y

99 -0.0067 0.0284*** 0.0168*** 0.0019 -0.0095*** -0.0053 -0.0136* -0.0575*** -0.1656***

Consumer Staples 39 0.0016 0.0274** 0.0105** 0.0128*** 0.0031 -0.0034 -0.0268*** -0.0591*** -0.1593***

Energ

y

13 0.0279 0.0545** 0.0187 0.0018 0.0006 -0.0033 -0.0631*** -0.0789*** -0.0952

Financials 2 -0.0173 0.0595 0.0315 0.0012 -0.0306** -0.0356 0.2169 0.2715* 0.1056

Healthcare 45 -0.0222*** 0.0114 -0.0108** 0.0060*** -0.0079*** -0.0050* -0.0476*** -0.0782*** -0.1943***

Industrials 135 0.0036 0.0359*** -0.0015 0.0023 -0.0006 0.0073*** -0.0283*** -0.0717*** -0.1888***

Information Technolog

y

62 -0.0601*** -0.0035 -0.0235*** 0.0042** -0.0120*** -0.0023 -0.0404*** -0.1018*** -0.2242***

Materials 91 0.0243*** 0.0373*** 0.0001 0.0052** 0.0038 0.0073*** -0.0193*** -0.0726*** -0.1841***

Real Estate 21 -0.0123 0.0313** 0.0216*** 0.0148*** 0.0153** 0.0116** -0.0148** 0.0073 -0.0427

Utilities 16 0.0037 0.0374*** -0.0070 -0.0019 0.0039 0.0131*** -0.0323*** -0.0533*** -0.1095***

Panel B: Mid Cap

Communication Services 7 -0.0404 0.0129 0.0054 0.0440*** 0.0170 0.0195 0.0119 -0.0598** -0.1459***

Consumer Discretionar

y

77 -0.0169 0.0158 0.0152** 0.0061 -0.0095* -0.0036 -0.0236*** -0.0562*** -0.1359***

Consumer Staples 30 -0.0082 0.0294*** 0.0066 0.0207*** 0.0141*** -0.0030 -0.0300*** -0.0674*** -0.1492***

Energ

y

14 0.0039 0.0286 -0.0308 -0.0032 -0.0003 0.0130 0.0002 -0.0244 -0.0960**

Financials 2 -0.0478 -0.0045 -0.0265 0.0114 0.0050 0.0034 0.0885 0.2888 0.1075

Healthcare 58 -0.0304*** 0.0054 -0.0143** 0.0060* -0.0067** -0.0038 -0.0387*** -0.0868*** -0.1810***

Industrials 145 0.0056 0.0285*** 0.0045 0.0068*** 0.0016 0.0069*** -0.0249*** -0.0611*** -0.1533***

Information Technolog

y

83 -0.0663*** -0.0120 -0.0242*** 0.0119*** -0.0071** 0.0046** -0.0250*** -0.0914*** -0.1989***

Materials 88 0.0223*** 0.0260*** 0.0031 0.0138*** 0.0144*** 0.0129*** -0.0078 -0.0558*** -0.1504***

Real Estate 16 -0.0024 0.0370*** 0.0192*** 0.0161*** 0.0208** 0.0114 -0.0192 0.0056 -0.0581

Utilities 18 0.0066 0.0180** -0.0032 0.0069** 0.0149*** 0.0177*** -0.0342*** -0.0525*** -0.1169***

Panel C: Large Cap

Communication Services 22 -0.0582** -0.0261 -0.0271*** 0.0040 -0.0003 0.0135** 0.0093 0.0186 -0.0138

Consumer Discretionar

y

123 -0.0352*** -0.0007 0.0062 0.0124*** 0.0103*** 0.0082*** -0.0039 -0.0235*** -0.0792***

Consumer Staples 64 0.0204** 0.0223*** 0.0032 0.0232*** 0.0245*** 0.0064** -0.0099* -0.0404*** -0.0853***

Energ

y

58 0.0745*** 0.0477*** 0.0170*** -0.0008 0.0058 0.0026 -0.0039 -0.0076 -0.0317**

Financials 72 -0.0083 0.0094** 0.0109*** -0.0006 -0.0002 0.0005 0.0200*** 0.0354*** 0.0449***

Healthcare 118 -0.0286*** -0.0098** -0.0199*** 0.0033 -0.0064** -0.0017 -0.0268*** -0.0623*** -0.1291***

Industrials 223 0.0213 0.0254 0.0198 0.0186** 0.0160*** 0.0181** 0.0197 0.0246 0.0008

Information Technolog

y

143 -0.0804*** -0.0392*** -0.0284*** 0.0086*** -0.0064** 0.0005 -0.0181*** -0.0568*** -0.1324***

Materials 148 0.0228*** 0.0106** -0.0041 0.0088*** 0.0086*** 0.0069*** -0.0237*** -0.0415*** -0.0767***

Real Estate 28 -0.0233** 0.0011 0.0086 0.0105*** 0.0087** 0.0050* -0.0176*** 0.0417*** -0.0021

Utilities 47 0.0084 0.0112 -0.0100* -0.0044 0.0064 0.0096** -0.0208*** -0.0161** 0.2270

Note (s): The ordinate represents the event window. ***, **, and * are significant at 1%, 5%, and 10% confidence levels, respectively.

Source: Authors' calculation.

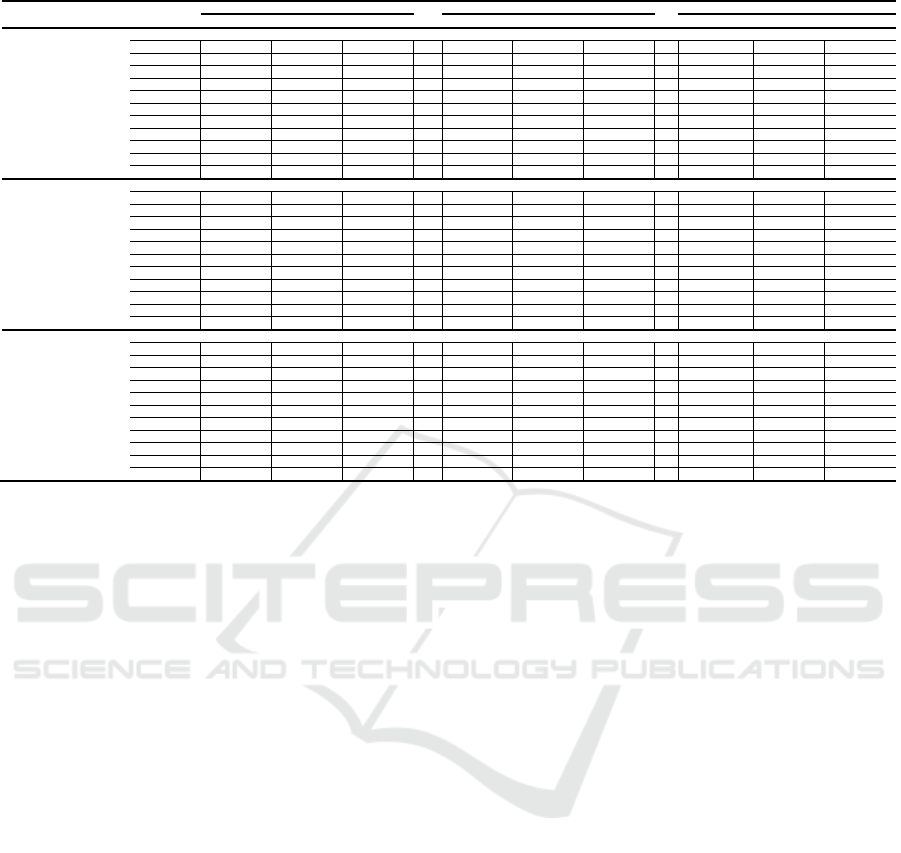

Table 4. Growth-based cumulative abnormal return over the window slides for before-event, the event day, and post-event

windows

Markets Number of Company

Pre-Event days Event days Post-Event days

(-15, 0) (-10, 0) (-5, 0) (-1, 0) (-1, +1) (0, +1) (0, +5) (0, +10) (0, +15)

Low 530 0.0041 0.0221*** 0.0076*** 0.0044*** 0.0060*** 0.0052*** -0.0111*** -0.0038 -0.0318***

Mediu

m

525 0.0004 0.0211*** 0.0017 0.0071*** 0.0030** 0.0048*** -0.0146*** -0.0440*** -0.1205***

High 1059 -0.0181*** 0.0058 -0.0055 0.0111*** 0.0014 0.0054*** -0.0175*** -0.0598*** -0.1361***

Note (s): This table presents the cumulative abnormal return (CAR) of three book-to-market equity groups based on the breakpoints for the bottom 25% (Low), middle 50% (Medium), and top 25% (High) of the ranked values

of the average book-to-market ratio over the estimation period. The ordinate represents the event window. ***, **, and * are significant at 1%, 5%, and 10% confidence levels, respectively.

Source: Authors' calculation.

3.3 The Impact of the US-Houthi

Conflict on Market Reactions by

Growth Firm

In the next section, we explore China’s market

reaction to the US-Houthi conflict based on company

growth rates, classified into three categories: low,

medium, and high growth (Table 4). The findings

reveal differing market reactions before the event.

Companies with low and medium growth

experienced significant positive reactions to the US-

Houthi conflict, while companies with high growth

showed significant negative reactions. These results

suggest that high-growth companies, which are more

likely to have international trade relations, were

negatively impacted by geopolitical tensions. The

anticipation of war, signaled by military mobilization

and fleet preparations, created negative investor

sentiment. This pessimism stemmed from concerns

over potential trade route disruptions, particularly in

the Suez Canal, a vital trade artery. These findings

are consistent with Kamal et al. (2023), who

demonstrated that companies engaged in

international trade are more susceptible to

geopolitical risks. Furthermore, the results

underscore the critical role of supply chains in

companies of all growth rates. Disruptions to these

chains negatively impacted investor confidence,

amplifying concerns compared to prior geopolitical

events like the Israel-Palestine conflict.

To further examine sector-specific market

reactions based on growth rates, we analyzed the data

in Table 5. Among low-growth companies, the

results were largely consistent with previous findings,

with a few sector-specific deviations. For instance,

the energy sector exhibited a significant negative

reaction before the event, which persisted post-

announcement. Similarly, the information

technology sector showed significant negative

reactions before the event. However, most sectors

aligned with baseline findings, except for the

communication services sector.

Medium-growth companies display more varied

sectoral reactions compared to low-growth firms.

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

122

Table 5: Cumulative abnormal returns for pre-event, the event day, and post-event windows by sector and size base.

Markets

Number of

Company

Pre-Event days Event days Post-Event days

(-15, 0) (-10, 0) (-5, 0) (-1, 0) (-1, +1) (0, +1) (0, +5) (0, +10) (0, +15)

Panel A: Low

Communication Services 7 -0.0539* -0.0210 -0.0170*** 0.0002 -0.0075 0.0028 0.0172 0.0327 0.0281

Consumer Discretionar

y

58 0.0023 0.0399*** 0.0217*** 0.0085** 0.0080 0.0058 -0.0033 -0.0041 -0.0537***

Consumer Staples 13 -0.0051 0.0216*** 0.0141*** 0.0170*** 0.0150*** 0.0057 -0.0181** -0.0158 -0.0916***

Energ

y

32 0.0227* 0.0238*** -0.0085 -0.0149*** -0.0123*** -0.0069** -0.0297*** -0.0063 0.0151

Financials 60 0.0040 0.0160*** 0.0156*** -0.0010 0.0012 0.0019 0.0220*** 0.0328*** 0.0615***

Healthcare 28 -0.0029 0.0194** 0.0015 0.0127*** 0.0053* -0.0007 -0.0332*** -0.0324*** -0.0774***

Industrials 131 0.0007 0.0183*** 0.0062** 0.0023 0.0058*** 0.0069*** -0.0129*** -0.0015 -0.0301***

Information Technolog

y

24 -0.0521*** -0.0021 -0.0112** 0.0063* -0.0010 0.0051 -0.0196*** -0.0243* -0.1025***

Materials 95 0.0276*** 0.0301*** 0.0082*** 0.0093*** 0.0115*** 0.0069*** -0.0176*** -0.0365*** -0.0791***

Real Estate 46 -0.0184** 0.0158** 0.0144*** 0.0121*** 0.0149*** 0.0095** -0.0123*** 0.0468*** 0.0030

Utilities 36 0.0277*** 0.0303*** 0.0002 -0.0024 0.0067* 0.0100*** -0.0173** -0.0165** -0.0277**

Panel B: Medium

Communication Services 6 -0.0580* -0.0288 -0.0086* -0.0006 -0.0130** -0.0060 -0.0092 -0.0326 -0.0462

Consumer Discretionar

y

104 -0.0165 0.0183** 0.0116** 0.0069** -0.0005 0.0036 -0.0081 -0.0411*** -0.1233***

Consumer Staples 31 0.0000 0.0280*** 0.0116** 0.0169*** 0.0110*** 0.0004 -0.0169* -0.0368*** -0.1107***

Energ

y

26 0.0533*** 0.0434*** 0.0153*** -0.0016 0.0074 0.0057 0.0084 -0.0096 -0.0402*

Financials 14 -0.0600*** -0.0115 -0.0101 0.0020 -0.0090** -0.0095** 0.0495* 0.1173*** -0.0032

Healthcare 53 -0.0215*** 0.0035 -0.0175*** 0.0017 -0.0094*** -0.0062*** -0.0416*** -0.0810*** -0.1674***

Industrials 118 0.0254*** 0.0402*** 0.0089** 0.0094*** 0.0086*** 0.0108*** -0.0107** -0.0418*** -0.1178***

Information Technolog

y

46 -0.0477*** -0.0045 -0.0170*** 0.0112*** -0.0046 0.0011 -0.0279*** -0.0761*** -0.1737***

Materials 89 0.0296*** 0.0285*** 0.0001 0.0092*** 0.0106*** 0.0111*** -0.0120* -0.0517*** -0.1273***

Real Estate 10 -0.0173 0.0135 0.0059 0.0051 -0.0048 -0.0065 -0.0398** -0.0361* -0.1149***

Utilities 28 -0.0131 0.0038 -0.0095*** -0.0022 0.0048 0.0096*** -0.0346*** -0.0433*** -0.0853***

Panel C: High

Communication Services 23 -0.0543** -0.0061 -0.0197** 0.0183** 0.0067 0.0195*** -0.0006 -0.0353 -0.1246***

Consumer Discretionar

y

137 -0.0344*** -0.0020 0.0082 0.0071** -0.0059 -0.0037 -0.0191*** -0.0613*** -0.1509***

Consumer Staples 89 0.0133* 0.0250*** 0.0031 0.0209*** 0.0176*** 0.0010 -0.0204*** -0.0625*** -0.1295***

Energ

y

27 0.0972** 0.0734*** 0.0249* 0.0167** 0.0201** 0.0135 -0.0116 -0.0501*** -0.1430***

Financials 2 -0.0658 -0.0047 0.0033 0.0067 -0.0068 -0.0027 0.0182 0.0285 0.0055

Healthcare 140 -0.0351*** -0.0076 -0.0198*** 0.0040* -0.0082*** -0.0021 -0.0316*** -0.0764*** -0.1674***

Industrials 254 0.0116 0.0295 0.0118 0.0159** 0.0076 0.0152** -0.0003 -0.0310 -0.1168**

Information Technolog

y

218 -0.0793*** -0.0301*** -0.0297*** 0.0083*** -0.0092*** 0.0006 -0.0248*** -0.0823*** -0.1784***

Materials 143 0.0160** 0.0130** -0.0078** 0.0090*** 0.0059** 0.0081*** -0.0224*** -0.0671*** -0.1574***

Real Estate 9 0.0079 0.0464** 0.0312* 0.0285*** 0.0288* 0.0217* -0.0164** -0.0422 -0.0973**

Utilities 17 -0.0032 0.0150 -0.0226** 0.0020 0.0151 0.0206* -0.0306*** -0.0440*** 0.6002

Note (s): The ordinate represents the event window. ***, **, and * are significant at 1%, 5%, and 10% confidence levels, respectively.

Source: Authors' calculation.

Before the announcement, sectors such as

communication services, financials, healthcare,

information technology, and utilities exhibit

significant negative reactions. This divergence

suggests that medium-growth companies have a less

robust positive reaction compared to low-growth

firms. On the event day, there are both positive and

negative reactions across sectors. Sectors like

consumer discretionary, consumer staples,

industrials, information technology, materials, and

utilities show significant positive reactions.

Conversely, communication services, financials, and

healthcare sectors display significant negative

reactions. Post-announcement, most sectors

experience significant negative reactions to the US-

Houthi conflict, with the exception of the

communication services and financial sectors, which

remain resilient.

Finally, we analyze large-growth companies and

find their sectoral reactions largely consistent with

baseline findings. A few sectors deviate from the

baseline, such as consumer staples, energy, and real

estate, which react positively before the

announcement. On the event day, only the healthcare

and information technology sectors deviate from

baseline expectations. After the announcement, all

sectors demonstrate consistent reactions, further

reinforcing earlier findings. These results highlight

how high-growth companies, often in the midst of

expansion, are particularly reliant on efficient

international distribution via sea routes. This reliance

makes them more vulnerable to disruptions like those

caused by the US-Houthi conflict. Kamal et al.

(2023) similarly observed that companies dependent

on international distribution channels, such as the

Suez Canal, are disproportionately affected by

supply chain disruptions. Such disruptions result in

additional costs from alternative shipping routes,

including increased fuel expenses, vessel

maintenance, and cooling requirements for

perishable goods (Hohler et al., 2024).

3.4 Robustness Test

In this section, we conduct a robustness test to

examine the consistency of the results obtained in the

previous section. We perform two distinct analyses:

first, we apply the Wilcoxon test (Table 6), and

second, we use a 150-day transaction window to

further substantiate our findings (Table 7). Our

analysis reveals that the market reacts significantly

negatively before the announcement, but shifts to a

significantly positive reaction at the time of the

announcement. Subsequently, the market reacts

significantly negatively again up to 30 days after the

announcement. These results demonstrate the

consistency of the market reaction observed in the

baseline (Table 1). This finding also highlights the

heightened concerns among investors in China,

driven by the disruption of the China-Europe trade

Market Reactions in China to the US-Houthi Conflict: An Event Study Approach

123

Table 6: Robustness test using non–parametric tests (Wilcoxon signed-rank Test).

Markets

Number of

Company

Pre-Event days Event days Post-Event days

(-15, 0) (-10, 0) (-5, 0) (-1, 0) (-1, +1) (0, +1) (0, +5) (0, +10) (0, +15)

All Sectors 2114 -4.344*** 10.678*** -2.887*** 15.424*** 3.497*** 9.811*** -20.328*** -25.597*** -32.568***

Communication Services 36 -3.551*** -1.697* -3.661*** 2.074** -0.440 2.247** -0.157 -1.555 -2.891***

Consumer Discretionar

y

299 -2.752*** 3.975*** 3.874*** 4.966*** -0.577 1.170 -5.542*** -9.058*** -12.853***

Consumer Staples 133 2.357** 6.242*** 2.826*** 8.517*** 6.444*** 1.178 -5.654*** -8.382*** -9.148***

Energ

y

85 4.274*** 5.983*** 2.215** -0.949 0.186 0.296 -2.807*** -2.890*** -4.099***

Financials 76 -1.222 2.092** 3.339*** 0.285 -0.404 -0.311 6.353*** 6.881*** 6.373***

Healthcare 221 -6.723*** -0.050 -7.028*** 3.637*** -4.104*** -2.218** -10.401*** -11.015*** -12.412***

Industrials 503 2.215** 8.364*** 1.163 6.618*** 3.879*** 9.010*** -8.780*** -11.075*** -15.241***

Information Technolog

y

288 -11.602*** -6.548*** -10.778*** 6.897*** -5.824*** 0.515 -10.258*** -13.255*** -14.298***

Materials 327 6.782*** 8.087*** 0.673 8.180*** 5.925*** 7.853*** -8.709*** -12.171*** -14.255***

Real Estate 65 -2.003** 3.669*** 4.480*** 5.747*** 4.277*** 3.571*** -4.499*** 2.493** -2.179**

Utilities 81 1.693* 3.670*** -2.272** -1.184 3.552*** 5.323*** -6.467*** -5.511*** -5.276***

Note (s): CAR stands for cumulative abnormal return. The ordinate represents the event window. ***, **, and * are significant at 1%, 5%, and 10% confidence levels, respectively.

Source: Authors' calculation.

Table 7: Robustness test using estimation window 150 days.

Markets Number of

Company

Pre-Event days Event days Post-Event days

(-15, 0) (-10, 0) (-5, 0) (-1, 0) (-1, +1) (0, +1) (0, +5) (0, +10) (0, +15)

All Sectors 2114 -0.0233* 0.0018 -0.0087 0.0032 -0.0044 0.0001 -0.0309** -0.0744** -0.1565***

Communication Services 36 -0.0524*** -0.0110 -0.0166*** 0.0119** 0.0011 0.0124** 0.0023 -0.0197 -0.0806***

Consumer Discretionar

y

299 -0.0263*** 0.0089 0.0119*** 0.0068*** -0.0020 -0.0000 -0.0130*** -0.0489*** -0.1269***

Consumer Staples 133 0.0066 0.0234*** 0.0065** 0.0194*** 0.0159*** 0.0013 -0.0178*** -0.0534*** -0.1220***

Energ

y

85 0.0499*** 0.0416*** 0.0071 -0.0015 0.0029 0.0027 -0.0144* -0.0252*** -0.0578***

Financials 76 -0.0097 0.0104** 0.0099*** -0.0003 -0.0009 -0.0002 0.0268*** 0.0487*** 0.0475***

Healthcare 221 -0.0301*** -0.0034 -0.0159*** 0.0045*** -0.0070*** -0.0032** -0.0345*** -0.0744*** -0.1555***

Industrials 503 0.0115 0.0290*** 0.0089 0.0109*** 0.0073*** 0.0120*** -0.0064 -0.0255 -0.0945***

Information Technolog

y

288 -0.1616* -0.0942 -0.0827 -0.0268 -0.0587 -0.0338 -0.1327 -0.2967 -0.5241

Materials 327 0.0131*** 0.0157*** -0.0033 0.0080*** 0.0071*** 0.0074*** -0.0232*** -0.0616*** -0.1346***

Real Estate 65 -0.0238*** 0.0121** 0.0140*** 0.0111*** 0.0103*** 0.0056** -0.0196*** 0.0145 -0.0380**

Utilities 81 0.0078 0.0186*** -0.0084** -0.0013 0.0079*** 0.0123*** -0.0259*** -0.0303*** 0.0841

Note (s): CAR stands for cumulative abnormal return. The ordinate represents the event window. ***, **, and * are significant at 1%, 5%, and 10% confidence levels, respectively.

Source: Authors' calculation.

route caused by the US-Houthi conflict. Furthermore,

the majority of sectors, including consumer

discretionary, consumer staples, energy, healthcare,

industrials, information technology, materials, real

estate, and utilities, experience negative

impacts.Additionally, we expand the analysis by

using different windows compared to the previous

analysis (Table 7). We find that the post-event

reaction remains consistently negative across most

sectors, such as communication services, consumer

discretionary, consumer staples, energy, financials,

healthcare, industrials, materials, real estate, and

utilities. This consistency indicates that investor

behavior, reflecting market reactions to the Middle

East conflict, has contributed to global economic

instability. One key factor is the disruption of trade

routes through the Suez Canal, which leads investors

to anticipate declines in corporate performance due to

strong geopolitical pressures. Consequently, many

investors choose to withdraw their funds, driving

stock prices down and suppressing buying prices

(Basnet et al., 2022).

4 CONCLUSIONS

This study examines the market reaction to the US-

Houthi conflict, with a particular focus on the Chinese

market. The sample includes 2,114 companies

operating in China. Utilizing an event study approach

and measuring cumulative abnormal returns (CAR),

we find that the US-Houthi conflict has a significant

negative impact on the Chinese stock market,

especially following the event, which triggers a

pronounced negative market reaction. Specifically,

three sectors—Communication Services, Consumer

Discretionary, and Utilities—experience the most

severe negative effects from the conflict, both pra and

post the event, although almost all sectors show

negative impacts post the event. Furthermore, the

analysis reveals that the US-Houthi geopolitical risk

particularly affects small and medium-sized

companies, as well as those with medium to high

growth rates.

The findings of this study underscore the

significant sensitivity of the Chinese market to

geopolitical risks, particularly those involving critical

trade routes such as the Suez Canal. Policymakers

should consider enhancing strategies to mitigate the

economic impact of such conflicts by promoting

market diversification and strengthening the

resilience of trade routes. Furthermore, regulators

may need to implement more robust risk assessment

frameworks for small and medium-sized companies

that are vulnerable to such external shocks. For

managers and investors, the study highlights the

importance of incorporating geopolitical risk factors

into strategic planning and investment decisions to

better navigate the volatility caused by such conflicts.

REFERENCES

Basistha A, and Kurov A (2008), Macroeconomic cycles

and the stock market’s reaction to monetary policy.

Journal of Banking & Finance 32(12), 2606 – 2616.

http://dx.doi.org/10.1111/sjoe.12436

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

124

Basnet, A., Blomkvist, M., Galariotis, E. (2022). The role

of ESG in the decision to stay or leave the market of an

invading country: The case of Russia. Economics

Letters, 216, 110636.

https://doi.org/10.1016/j.econlet.2022.110636

Boubaker, S., Goodell, J.W., Pandey, D.K., and Kumari, V.

(2022), “Heterogeneous impacts of wars on global

equity markets: evidence from the invasion of

Ukraine”, Finance Research Letters, 48, 102934.

https://doi.org/10.1016/j.frl.2022.102934

Boubaker, S., Nguyen, N., Trinh, V. Q., Vu, T. (2023).

Market reaction to the Russian Ukrainian war: a global

analysis of the banking industry. Review of Accounting

and Finance, 22(1), 123-153.

https://doi.org/10.1108/RAF-10-2022-0294

Essallamy, M., Bari, A. A., & Kotb, M. (2020). Spectral

fatigue analyses comparison study: Suez Canal vs.

Cape of Good Hope Arab Academy for Science,

Technologies and Maritime Transport (AASTMT).

Journal of Marine Engineering & Technology, 19(4),

257-265.

https://doi.org/10.1080/20464177.2019.1572703

Fama, E., Fisher, L., Jensen, M., Roll, R. (1969). The

adjustment of stock prices to new information.

International Economic Review. 10(1), 1-21.

https://doi.org/10.2307/2525569

Gonen, E. (2023). China and the Suez Canal—Politics,

Economy, and Logistics. In: Lutmar, C., Rubinovitz, Z.

(eds) The Suez Canal: Past Lessons and Future

Challenges. Palgrave Studies in Maritime Politics and

Security. Palgrave Macmillan, Cham.

https://doi.org/10.1007/978-3-031-15670-0_2

Haralambides, H. (2024). The Red Sea crisis and

chokepoints to trade and international shipping.

Maritime Economics & Logistics, 26, 367–390.

https://doi.org/10.1057/s41278-024-00296-y

He, P., Sun, Y., Zhang, Y., and Li, T. (2019). COVID–19’s

Impact on Stock Prices Across Different Sectors—An

Event Study Based on the Chinese Stock Market.

Emerging Markets Finance and Trade, 56(10), 2198–

2212.

https://doi.org/10.1080/1540496X.2020.1785865

Höhler, J., Harmens, I., Lansink, A.O. (2024). The impact

of the Russia–Ukraine war on stock prices, profits and

perceptions in the food supply chain. Agribusiness.

Fourtcoming. https://doi.org/10.1002/agr.21964

Hoque, M. E., Zaidi, M. A. S. (2020). Global and country-

specific geopolitical risk uncertainty and stock return of

fragile emerging economies. Borsa Istanbul Review,

20(3), 197-213.

https://doi.org/10.1016/j.bir.2020.05.001

IMF PortWatch. (2024). Red Sea Attacks Disrupt Global

Trade. Accessed on 5 June 2024. Avaibility on

https://www.imf.org/en/Blogs/Articles/2024/03/07/Re

d-Sea-Attacks-Disrupt-Global-Trade

Kamal, R. M., Ahmed, S., Hasan, M. M. (2023). The impact

of the Russia-Ukraine crisis on the stock market:

Evidence from Australia. Pacific-Basin Finance

Journal, 79, 102036.

https://doi.org/10.1016/j.pacfin.2023.102036

Kim, M.-H. (2019). A real driver of US–China trade

conflict: The Sino–US competition for global

hegemony and its implications for the future.

International Trade, Politics and Development, 3(1):

30-40. https://doi.org/10.1108/ITPD-02-2019-003

Lesmana, D., Yudaruddin, R. (2024a). The impact of the

Russia-Ukraine invasion on market reaction across

various industries: an event study on the ASEAN

market. Afro-Asian Journal of Finance and Accounting,

14(4), 515-529.

https://doi.org/10.1504/AAJFA.2023.10057770

Lesmana, D., Yudaruddin, R. (2024b). Market Reaction to

COVID-19 and Policy Response across different

sectors: an event study on ASEAN stock market.

Finance: Theory and Practice, 28(1), 30-42.

https://doi.org/10.26794/2587-5671-2024-28-1-30-42

Nerlinger, M., & Utz, S. (2022). The impact of the Russia-

Ukraine conflict on energy firms: a capital market

perspective. Finance Research Letters, 50, 103243,

https://doi.org/10.1016/j.frl.2022.103243

Pandey, D. K., Kumari, V., Palma, A., Goodell, J. W.

(2024). Are markets in happier countries less affected

by tragic events? Evidence from market reaction to the

Israel–Hamas conflict. Finance Research Letters, 60,

104893. https://doi.org/10.1016/j.frl.2023.104893

Wu, Y., Huang, Y., Wang, H., Zhen, L. (2022). Nonlinear

programming for fleet deployment, voyage planning

and speed optimization in sustainable liner shipping.

Electronic Research Archive, 31(1), 147-168.

https://doi.org/10.3934/era.2023008

Yudaruddin, R., Fitriansyah., Lesmana, L., Bintoro, R. F.

A., Purnomo, A. H., Nugroho, B. A., Santi, E. N.

(2023). Does invasion Russia-Ukraine affect to global

financial market? evidence from consumers’ staples

sectors. Journal of Open Innovation: Technology,

Market, and Complexity, 9(3), 100086.

https://doi.org/10.1016/j.joitmc.2023.100086

Yudaruddin, R., Lesmana, D. (2024a). Banking sector

reaction during the Russian invasion of Ukraine: Who

reacted the most?. Journal of Economic Studies, 51(5),

1011-1035. https://doi.org/10.1108/JES-04-2023-0206

Yudaruddin, R., Lesmana, D. (2024b). The Market

Reaction of Real Estate Companies to the

Announcement of the Russian-Ukrainian invasion.

Journal of European Real Estate Research. 17(1), 102-

122. https://doi.org/10.1108/JERER-12-2022-0038

Yudaruddin, R., Lesmana, D., Eksi, I.H., Ginn, W. (2024).

Market reactions to the Israel-hamas conflict: A

comparative event study of the US and Chinese

markets. Borsa Istanbul Review, 24(6), 1345–1357.

https://doi.org/10.1016/j.bir.2024.10.005

Yudaruddin, R., Lesmana, D., Yudaruddin, Y.A., Yahya,

N.C., Anwar, A. (2025). Disruptions in global trade

routes: market reactions to the US–Houthi conflict in

the consumer cyclical sector. International Journal of

Development Issues, Fourtcoming.

https://doi.org/10.1108/IJDI-09-2024-0244

Market Reactions in China to the US-Houthi Conflict: An Event Study Approach

125