Bank Risks, and Bank Stability: The Moderating Role of State

Ownership in the MENA Region

Ahmed Rashed

1,2 a

and Dexiang Wu

1

1

School of Economics and Management, Beihang University, Beijing, China

2

Faculty of Commerce, Cairo University, Cairo, Egypt

Keywords: Credit Risk, State Ownership, Liquidity Risk, Financial Stability, MENA Region.

Abstract: This paper empirically examines the impact of state ownership on the relationship between bank risks and

financial stability for a sample of 110 banks within the period 2007-2021 with 1650 bank observations listed

in the Middle East and North Africa regions. The findings show that there is no simultaneous link between

credit risk and liquidity risk. Liquidity and credit risks can be managed jointly to affect banking stability. State

banks are more stable, less likely to engage in risky behavior, and more concerned with social welfare. State

banks eliminate the impact of banks' risks on banking stability. Results enhance good governance, economic

development, and employment opportunities, maintain financial safety, and ultimately enhance growth. Our

results are consistent with the present regulatory framework, particularly Basel III, which confirms the

importance of joint management of liquidity and credit risk.

1 INTRODUCTION

The banking sector constitutes a fundamental

component of the financial system, serving as the

foundational financial infrastructure for the economy

of any country, and therefore it is necessary to

contribute to conducting research on financial

stability analysis even in light of a stable

macroeconomic environment. The most significant

financial risks that directly affect what banks do and

why they fail are credit and liquidity risks (Abdelaziz

et al., 2022). Liquidity risk is an opportunity for

depositors to withdraw their deposits suddenly

(Ghenimi et al., 2021; Thakor & Yu, 2024). Credit

risk means the inability of borrowers to repay on time

and constantly changing interest rates (Naili &

Lahrichi, 2022).

This study differs from other previous studies on

the MENA region in four aspects. First, this paper

investigates the effect of bank risks on bank stability

in the MENA region via different statistical methods

like OLS to check the static model, 2SLS to address

the possible endogeneity problem, and GMM to

explore the dynamic results. Second, this study is the

first to provide evidence that state ownership

moderates the relationship between bank risks and

bank stability in large conventional banks in the

a

https://orcid.org/0000-0002-3782-1895

MENA region over the long period of 2007–2021.

Third, we use Merton’s distance to default (DD) and

Z-score as financial stability measures, which Z-score

uses in most literature based on accounting measures,

while Merton’s distance to default (DD) is one of the

most important measures taken into consideration by

investors’ expectations regarding equity. Fourth, we

use a large sample of the MENA region, where these

countries are characterized by common economic,

political, and social features in addition to the same

accounting standards.

Our paper is organized as follows. Section 2

presents the relevant literature review, while Section

3 describes the data and methods. The findings and

robust checks are outlined in Section 4, and the

summary and conclusion are outlined in Section 5.

2 LITERATURE REVIEW

2.1 Credit Risk and Liquidity Risk

According to the traditional theory of financial

intermediation, scholars assert that credit risk and

liquidity risk are positively correlated. For instance,

Cai and Zhang (2017) found a positive association

between credit risk and liquidity risk in Ukrainian

Rashed, A. and Wu, D.

Bank Risks, and Bank Stability: The Moderating Role of State Ownership in the MENA Region.

DOI: 10.5220/0013479300003956

In Proceedings of the 7th International Conference on Finance, Economics, Management and IT Business (FEMIB 2025), pages 279-286

ISBN: 978-989-758-748-1; ISSN: 2184-5891

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

279

banks. Some studies emphasize how there is a

negative correlation between credit risks and liquidity

risks (Louati et al., 2015; Hassan et al., 2019; Le &

Pham, 2021). In contrast, some studies show there is

no economically significant reciprocal relationship

between the two risks (Imbierowicz & Rauch, 2014;

Ghenimi et al., 2017). Most research on the reciprocal

relationship is linear, with two studies examining a

nonlinear relationship (Pop et al., 2018; Boussaada et

al., 2022). According to the various points of view

and empirical studies mentioned above, we propose

the following hypothesis:

H

1

: There is an interdependency between credit

risks and liquidity risks.

2.2 Credit, Liquidity Risks and

Stability

Bank stability is necessary to ensure the smooth

functioning of financial activities in emerging

economies. Banks are subject to several risks, like

liquidity risk and credit risk. Imbierowicz and Rauch

(2014) show that both credit and liquidity risks jointly

influence the possibility of bank failure. Ghenimi et

al. (2017) found that the existence of an individual

and joint influence for both liquidity and credit risks

on banking stability. Hassan et al. (2019) concluded

that both liquidity risks and credit risks adversely

affect financial stability. Lachaab (2023) concluded

that credit and liquidity hurt bank stability in Islamic

banks. Some of the literature argues that credit risk is

the most important part of determining bank stability,

while generally liquidity risk is ignored (Lachaab,

2023; Ben Lahouel et al., 2024).

On the other hand, some of the literature

concludes that the interaction between liquidity and

credit risk leads to higher bank failure risk through a

decrease in market liquidity due to an increase in risk

premium (He & Xiong, 2012). Some studies indicated

that non-traditional banking activities increase risks,

whereas adequate funding liquidity positively affects

stability, reinforcing the need for effective risk

management (Habib et al., 2022).

Chai et al. (2022) found that bank-specific risks,

including credit and liquidity, negatively impact bank

stability in Pakistan. According to theoretical and

empirical research, liquidity and credit risks can

affect bank stability, and interacting between both

credit and liquidity risks may reduce the likelihood of

bank failure and thus improve banking stability.

Based on the aforementioned discussion, we propose

that:

H

2

: Liquidity risk and credit risk jointly support

banking stability.

2.3 State Ownership and Stability

Theoretical perspectives support government

ownership as a tool to secure capital to fund projects

with high social and political returns but might have

high risk and low financial returns (Boulanouar et al.,

2021).State ownership is viewed from two

perspectives. According to the first perspective,

ownership structures foster good governance,

economic development, financial safety, and growth

by attracting employment opportunities through

various financing methods, even without private

financing (Lassoued et al., 2016; Boulanouar et al.,

2021). State-owned banks are less likely to engage in

risky behavior and are more concerned with social

welfare. The second perspective is associated with the

conflict between the agent (managers) and principal

(owners), hence raising agency problems in state

ownership compared to private bank. Managers may

achieve their own goals regardless of the interests of

the ultimate owners due to bureaucracy and the

inefficiency of capital market. State ownership enjoys

governmental protection, which may push more risky

decisions because losses and excess costs are

constantly being paid by the government. The lending

practices of state banks may prioritize social goals

over financial ones through their unprofitable projects

to achieve their social objectives. Politicians

essentially control state-owned banks by achieving

their own goals instead of their social ones and by

having the ability to transfer resources to their

backers. Soft budget constraints in state banks are

related to excessive risk-taking behavior and resource

allocation. Empirical results support two perspectives

related to state ownership and bank stability. The first

perspective argued that state ownership is associated

with increased efficiency and lower risk-taking

(Boubakri et al., 2020).On the other hand, the second

preservative supports the role of state ownership in

raising risk-taking and insolvency risk and decreasing

financial stability. State ownership plays a positive

role in the face of cyclical fluctuations, preventing

private banks from generating credit bubbles.

Restricting loan granting during boom periods is

crucial for banking stability. Boulanouar et al. (2021)

found that state-owned banks are more stable than

privately owned banks within 14 years for 76 GCC

markets. Mateev et al. (2023) argued that ownership

structure has a significant impact on shaping risk

behavior in the MENA region. Hunjra et al. (2020)

found that state banks have more risk-taking behavior

compared to foreign banks in emerging markets.

Based on the theoretical and empirical arguments, we

formulate the third hypothesis as follows:

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

280

H

3

: State ownership is positively related to bank

stability in the MENA region.

2.4 Moderating Role of State

Ownership

Some of the literature argues that government

ownership increases risk-taking (Shleifer & Vishny,

1997; Laeven & Levine, 2009; Haque & Shahid,

2016), while other studies suggest decreased risk-

taking (Iannotta et al., 2007; Haddad et al., 2020;

Alshammari, 2022).

Shleifer and Vishny (1997) believe that

government ownership leads to inefficiency because

of conflicts between political and social goals,

bureaucracy and corruption, and politics among

interest groups. Haddad et al. (2020) concluded that

ownership structure had a significant positive impact

on conventional banks' performance but not on

Islamic banks.

The authors argue that state ownership moderates

the relationship between bank risks and bank stability

from two perspectives: Firstly, state ownership

creates governmental protection caused by increased

risk-taking behavior and thus decreases bank

stability. In countries with inadequate legal and

regulatory frameworks, agency disputes related to

state control are more prevalent and thus increase

risk-taking. Secondly, state ownership is related to

good governance and economic development, which

maintains financial safety and ultimately enhances

bank stability. The government seeks to achieve its

different social and political goals through its

participation in banks. State-owned banks are less

likely to engage in risky behavior and are more

concerned with social welfare compared to non-state

banks. Based on the above explanation, the authors

suggest that state ownership may moderate the

relationship between bank risks and stability in the

MENA region, and thus we formulate both the fourth

and fifth hypotheses as follows:

H

4

: State ownership inversely impacts the

relationship between credit risk and bank stability in

the MENA region.

H

5

: State ownership inversely impacts the

relationship between liquidity risk and bank stability

in the MENA region.

Consequently, this paper addresses the

subsequent research questions. First, Is there a causal

relationship between liquidity risk and credit risk?

Second, how do the joint of credit risks and liquidity

risks affect the banking stability? Finally, does state

ownership moderate the relationship between bank

risks and banking stability?

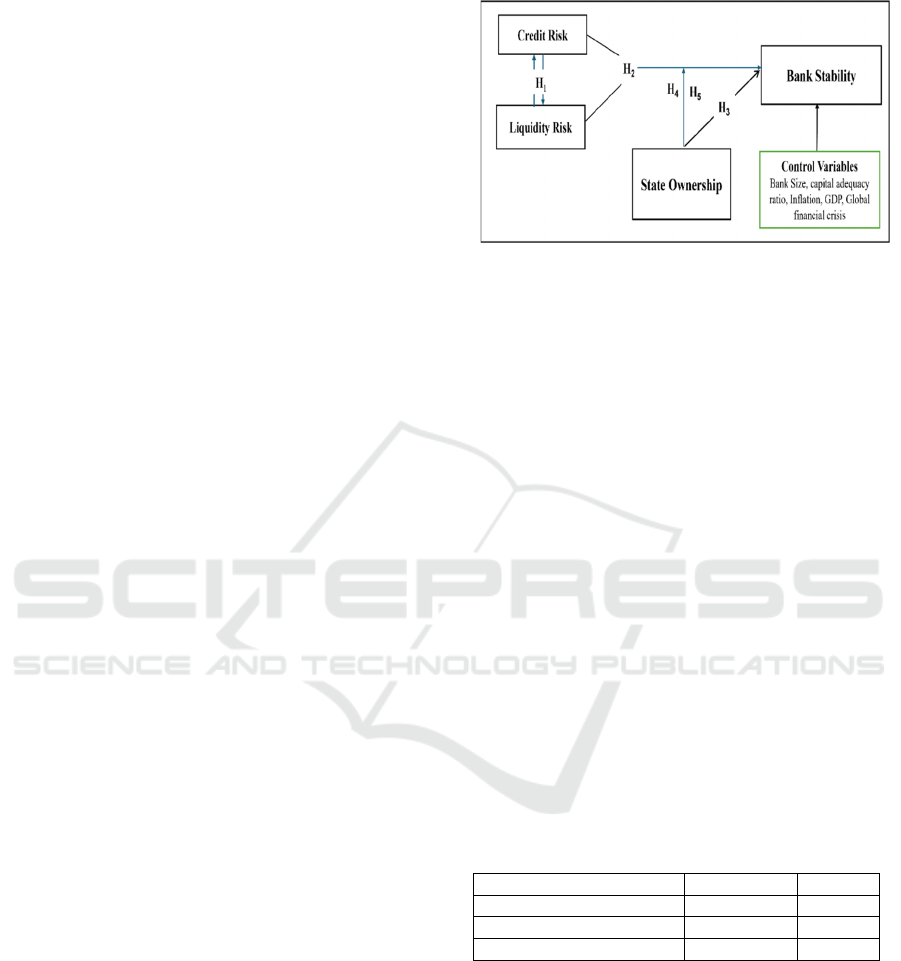

The proposed model is illustrated in Figure (1).

Figure 1: The proposed research model.

3 RESEARCH DESIGN

3.1 Sample and Data

Our sample consists of 110 commercial banks from

16 MENA countries from 2007 to 2021, excluding

unstable countries and Islamic banks. The final

sample included 1650 bank-year observations. The

sample excluded Islamic banks due to potential

differences in bank risks. The study examines the

long-term impact of bank risks on bank stability from

2007 to 2021, encompassing economic uncertainty

events like the global financial crisis in 2008, Arab

Spring in 2010, and US presidential election in 2020,

and the prolonged uncertainty around Brexit, and

other events, the research period encompassed the

majority of economic uncertainty occurrences. Data

is gathered from Bankscope while macroeconomic

variables are obtained from the World Bank. Table

(1) reveals that state ownership accounted for 66% of

banks, while non-state ownership was 34%.

Table 1: Sample distribution.

Ownership structure Freq %

State

b

anks 1089 66

Non-State

b

anks 561 34

Total 1650 100

3.2 Empirical Models

This study explores the causal link between credit and

liquidity risk in the MENA region using two-stage

least squares (2SLS) and panel vector autoregressive

(PVAR). Also, we explore the impact of state

ownership on the relationship between bank risks and

bank stability. According to the simultaneous

equation (2SLS), the formula is as follows:

Bank Risks, and Bank Stability: The Moderating Role of State Ownership in the MENA Region

281

𝐶𝑅

,

=𝛼

+𝛽

𝐶𝑅

,

+𝛽

𝐿𝑅

,

+𝛽

𝐵𝑎𝑛𝑘

,

+𝛽

𝑀𝑎𝑐𝑟𝑜

,

+𝜂

,

(1)

𝐿𝑅

,

=𝛼

+𝛽

𝐿𝑅

,

+𝛽

𝐶𝑅

,

+𝛽

𝐵𝑎𝑛𝑘

,

+𝛽

𝑀𝑎𝑐𝑟𝑜

,

+𝜂

,

(2)

CR

k,t

refers to credit risk. LR

k,t

expresses liquidity

risk. Bank

k, t,

and Bank

g

k.t

refer to bank-specific

variables: BS, CAR, and GFC. Macro

m

k, t,

and Macro

n

k, t

refer to the INF and GDP.

Panel vector autoregressive (PVAR) explores the

causal relationship between credit and liquidity risk.

By introducing fixed effects (π

k, t

), PVAR accounts

for individual bank specificity at the level of the

variables as follows:

𝑌

,

=𝜋

,

+µ (𝐿)𝑌

,

+𝜂

,

(3)

Where Y

k,t

is a vector of variables and µ (L)

denotes the lag operator.

The research model to explore the impact of

ownership structure on the relationship between risk

and bank stability Whereby the formula is as follows:

ZSC

it

= α

+ β

CR

+ β

LR

+ β

CR

∗

LR

+ β

OWN

+ β

OWN

∗CR

+ β

OWN

∗LR

+β

BS

+ β

CAR

+ β

INF

+

β

GDP

+ β

GFC

+ ϵ

(4)

We measured bank stability through the Z-score

(Ghenimi et al., 2017; Naili & Lahrichi, 2022), which

considers profitability, leverage, and return volatility.

It measures return on assets (ROA) and return on

equity (ROE). A higher Z-score indicates increased

stability and a decrease in bankruptcy probability.

The log of the Z-score is used due to its asymmetry

and high skewness (Ahamed & Mallick, 2017). In the

robustness check, we employ DD as an alternate

metric of stability. We measure credit risk based on

non-performing loans divided by total loans (Natsir et

al., 2019; Naili & Lahrichi, 2022). The higher value

of credit risk means higher loan losses, and the bank

should change its credit policy to be able to manage

its loans. Liquidity risk is measured by the sum of

liquid assets to total assets (Ghenimi et al., 2017;

Hassan et al., 2019). Liquid assets are the sum of

demand deposits, transaction deposits, and contingent

liabilities within a fiscal year. A positive score

indicates insufficient liquid assets for short-term

obligations, necessitating funding from other sources,

while a negative score indicates more liquid assets

than short-term liabilities.We measure ownership

structure with a dummy variable equal to 1 if the bank

is a state and 0 otherwise (Boulanouar et al., 2021).

We account for several bank-specific variables that

are frequently associated with bank stability, such as

bank size, which is determined by the natural

logarithm of total assets. We also take into

consideration other bank-specific variables, such as

the capital adequacy ratio (CAR), which measures the

equity-to-asset ratio. Financial crisis period measured

by the dummy variable 1 if the year is 2007, 2008,

2009, and 0 otherwise. It is necessary to use both

country and year-fixed effects as control variables.

This study also considers the yearly growth rate of the

gross domestic product (GDP), as well as inflation,

which is measured by the inflation rate (Hassan et al.,

2019).

4 RESULTS

4.1 Descriptive Statistics

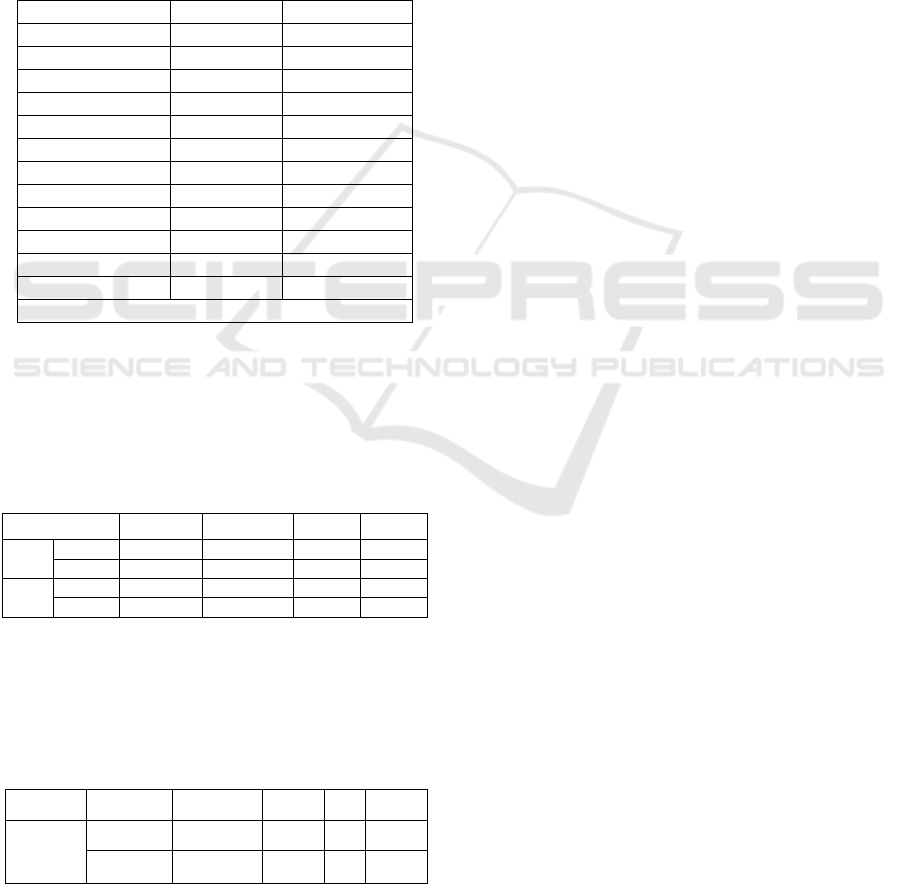

Table 2 presents the mean of both credit and liquidity

risks is about 0.635 and 0.294, respectively, which

implies high credit and liquidity risks, while the

average BS and CAR are about 6.842 and 17.599,

respectively, which denotes a high bank size and

capital adequacy ratio. Indeed, the averages of both

INF and GDP are about 3.548 and 3.442,

respectively, which indicates high inflation and gross

domestic product. According to financial stability, the

averages of Z

ROA

, Z

ROE

, and DD are about 3.855,

3.323, and 3.703, respectively, which denotes high

financial stability in the MENA region.

Table 2: Descriptive Statistics.

Var N Mean SDV Min Max

Z

ROA

1650 3.855 0.267 3.483 4.162

Z

ROE

1650 3.323 0.452 2.637 4.286

DD 1650 3.703 0.348 3.105 4.265

CR 1650 .635 0.414 0.2 1.4

LR 1650 .294 .023 .256 .329

BS 1650 6.842 0.735 5.7 8

CAR 1650 17.599 4.712 9.16 24.67

INF 1650 3.548 2.699 0.693 9.42

GDP 1650 3.442 1.482 1.1 6.4

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

282

4.2 Causality Test

Table 3 shows the causality between credit risk and

liquidity risk using 2SLS. The null hypothesis of the

Durbin-Wu-Hausman test is rejected, and the Hansen

test confirms the over-identifying restriction null

hypothesis. We find no meaningful reciprocal

relationship between credit and liquidity concerns,

consistent with the literature (Imbierowicz & Rauch,

2014; Ghenimi et al., 2017). This result shows that

there is a unidirectional causal relationship between

credit and liquidity risks.

Table 3: Credit and liquidity risks using 2SLS.

Var CR LR

CR -0.484***

LR -.393

BS .006*** .0062**

CAR .061*** 0.030

INF .001*** .001***

GDP 0.001 -.0022**

GFC -.005* 0.000

_cons 1.753*** 1.075

AR (1) 0.000 0.000

AR (2) 0.232 0.193

Hansen J –test 0.343 0.435

DWH test 0.000 0.000

Note: ***p < 0.01; **p < 0.05; *p < 0.1.

Robustness check using panel vector

autoregression (PVAR) and Granger causality in both

tables 4 and 5 show that there is no economically

significant patterns of causal links between credit and

liquidity risks.

Table 4: panel vector autoregression (PVAR).

VAR Coef. St. Err.

Ŷ

P>z

CR

CR

t

-1 0.607 0.146 4.14 0.000

LR

t

-1 2.743 1.993 1.38 0.169

LR CR

t

-1 0.033 .016 2.02 0.044

LR

t

-1 .382 .208 1.84 0.066

Results show that credit and liquidity concerns

have a unidirectional causal link using a lot of

different methods like 2SLS, PVAR, and Granger

causality. Therefore, we rejected the first hypothesis

H

1

.

Table 5: Granger causality test.

Granger Equation Excluded chi2 Df Prob

Wald

tests

CR LR 1.895 1 0.169

LR CR 4.067 1 0.044

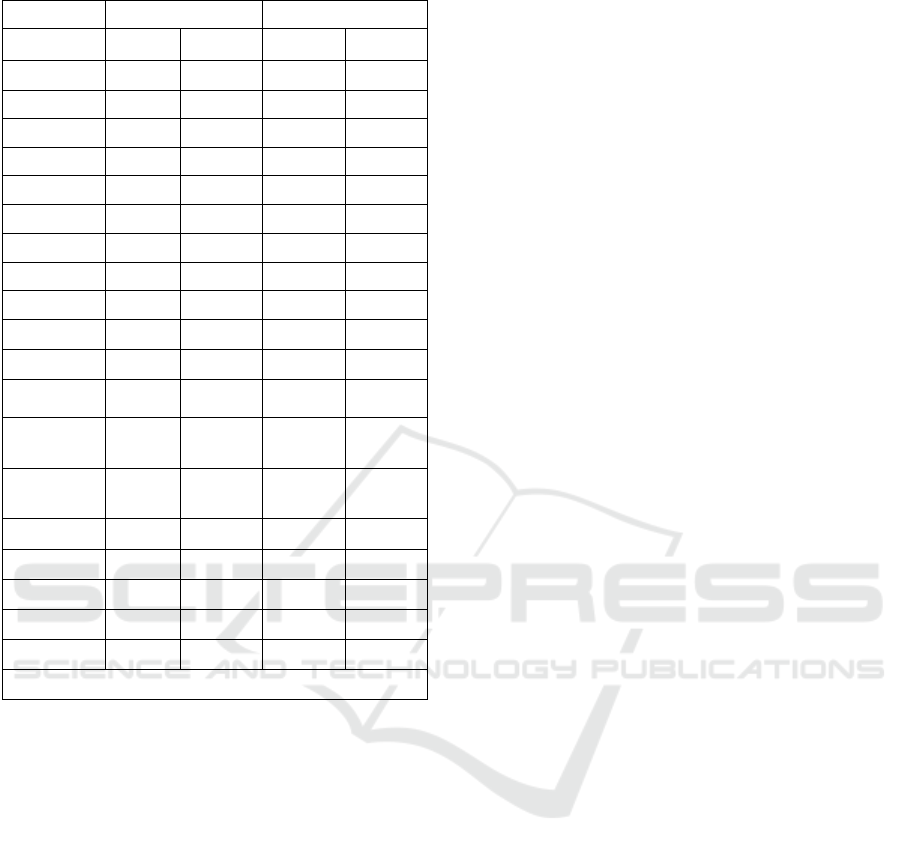

4.3 OLS &GMM Test

Table 6 presents the results from pooled OLS and

dynamic GMM. The GMM specification test AR (2)

is valid for testing bank serial correlation, indicating

the empirical model's accuracy. Hansen J-statistic

tests show higher than 0.1, valid over-identifying

limits, and accurate model formulation. Positive and

significant Z

ROAt-1

and Z

ROEt-1

indicate GMM's

dynamic fit. The study reveals that credit risk

increases, and bank stability declines due to higher

loan rates. Liquidity risk significantly affects banking

stability, as stable banks are more liquid. Ineffective

handling of liquidity risk by banks and regulators can

lead to a liquidity crisis, threatening stability and

highlighting the importance of maintaining stability.

The study reveals a negative and significant

interaction between credit and liquidity risk on

banking stability at a level of 5%, with high credit risk

leading to increased liquidity risk and vice versa.

Banks with higher credit risk face reduced

liquidity risk and higher charges for stability, despite

maintaining stability with sufficient funding. Our

findings suggest that a combined rise in liquidity and

credit risk reduces stability. Our findings are

consistent with the literature supporting the combined

rise of bank risks on stability. The negative

coefficient of liquidity and credit risk reduces bank

stability during crises, leading to higher loan rates and

credit risks, resulting in bank defaults, and affecting

banks differently. This result is consistent with

(Ghenimi et al., 2017; Merton & Thakor, 2022).

These findings suggest that both liquidity and

credit issues play an important role in influencing

banking stability in the MENA region. These findings

support our hypothesis H

2

. State banks have a

statistically significant impact on the two financial

stability models. State banks have the most

substantial positive influence on bank stability with

1% and 5% significance levels in OLS and GMM,

respectively. This demonstrates how state ownership

contributes to financial stability in the MENA region.

Therefore, we accepted hypothesis H

3

. This result

highlights good governance, economic development,

and employment opportunities, maintains financial

safety, and ultimately enhances growth. Our findings

are consistent with the literature supporting the

impact of ownership structure on banking stability

(Lassoued et al., 2016; Boulanouar et al., 2021). State

ownership is less likely to be risky behavior, and

more concerned with social welfare compared to

private-owned banks, which are more likely to be

related to profit maximization and more probably

risky behavior. Bank size significantly enhances

Bank Risks, and Bank Stability: The Moderating Role of State Ownership in the MENA Region

283

banking stability in OLS and GMM models at 1%

level, as it diversifies portfolios and improves risk

management. Capital adequacy ratio (CAR) also

enhances financial stability, acting as a safety net

during crises. Financial crises, GDP growth, and

inflation rate all impact banking stability in the

MENA region, with the latter having a positive effect.

Table 6: The effect of bank risks on stability.

Va r

Z

ROA

Z

ROE

OLS GMM OLS GMM

Z

ROA t-1

.557***

Z

ROE

t

-1

.384***

CR -.043* -.0896** -.115** -.118**

LR -.629* -2.140** -1.872** -2.98**

CR*LR -.144* -.290*** -.2159* -.212**

OWN .079** .537*** .0459* .437*

BS .055*** .206*** .098*** .108***

CAR .005*** .021*** .0364*** .025***

INF .011* .029* -.007 -.006

GDP -.007 -.011* -.011 -.024*

GFC -.141* -.003* -.062 -.019

Country FE Yes Yes Yes Yes

Yea r F E Yes Ye s Yes Yes

Constant 3.175*** 2.654 2.602*** 1.961

Obs 1650 1650 1650 1650

F 16.00 *** 42.10 ***

Adjust R

2

.25 .48

Breusch T

Prob

3.44

0.063

1.12

0.290

Ramsey F

Prob

0.46

0.709

3.22

0.103

Durbin T 1.904 1.960

Levin-Lin 0.000 0.000

AR (1) (p) 0.000 0.00

AR (2) (p) 0.096 0.109

Sargan (p) 0.466 0.332

Hansen (p) 0.757 0.557

Note: ***p < 0.01; **p < 0.05; *p < 0.1.

4.4 Main Effects Test

Table 7 shows that state ownership plays an important

role in mitigating the association between credit risk

and financial stability, in addition to the association

between liquidity risk and financial stability in the

MENA region. Therefore, we accepted both

hypotheses H

4

and H

5

.

Table 7: Moderating role via OLS.

Va r Z

ROA

Z

ROE

CR -.045* -.106***

LR -.946** -.967*

OWN .110*** .232** .099*** .506***

CR*OWN -.153* -.355**

LR*OWN -.523* -1.500***

BS .053*** .051*** .106*** .091***

CAR .005** .006*** .038*** .037***

INF .011* .010* -.006 -.006

GDP -.007 -.008 .009 .009

GFC .140*** .099** -.064 -.115**

Country FE Yes Yes Yes Yes

Ye ar FE Ye s Yes Ye s Yes

_cons 3.360*** 3.031*** 1.924** 2.209***

N 1650 1650 1650 1650

R

2

.266 .265 .487 .489

Adjust R

2

.250 .249 .476 .478

F-Test 16.28*** 16.19*** 42.67*** 42.98***

Breusch

Prob

1.89

(0.169)

1.94

(0.113)

0.45

(0.504)

3.06

(0.08)

Ramsey F

Prob

0.11

(0.954)

0.32

(0.807)

2.09

(0.112)

1.85

(0.09)

Durbin T 1.907 1.905 1.959 1.956

Note: ***p < 0.01; **p < 0.05; *p < 0.1.

4.5 Robustness Test

We follow two-stage robustness checks. Firstly, we

used the distance-to-default (DD) as an alternative

measure of financial stability to explore the impact of

state ownership on the relationship between bank

risks and bank stability. The default is measured by

subtracting the face value of the bank's debt from its

predicted market value and dividing the spread by the

bank's expected volatility. We used three models to

check the impact of state banks on the association

between bank risks and stability using OLS, 2SLS,

and GMM methods. Table 8 confirms the findings

that state banks positively impact financial stability in

the MENA region, while state ownership negatively

affects the association between bank risks and

stability, highlighting its crucial role in enhancing

stability.

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

284

Table 8: Robustness check.

Var OLS GMM

CR

it

-.185*** -.014**

OWN

it

.100*** .057** 5.34*** 2.029**

CR

it

*OWN -.231*** -.018*

LR

it

-3.94** -.717*

LR

i

t

*OWN -.270*** -1.52***

Control

i

t

Yes Yes Yes Yes

Country FE Yes Yes Yes Yes

Year FE Yes Yes Yes Yes

_cons 3.709*** 4.906*** 3.331** 4.672***

N 1650 1650 1650 1650

R

2

.68 0.71

F-Test 96.41*** 110.87***

Wald chi2 1842.7*** 1737.5***

Breusch Chi2

Prob

0.38

(0.53)

0.56

(0.21)

Ramsey Prob

1.35

(0.08)

1.69

(0.07)

Durbin T 2.258 2.255

AR(1) (p) .000 0.009

AR (2) (p) 0.117 0.324

Sargan (p) 0.791 0.643

Hansen (p) 0.211 0.124

Note: ***p < 0.01; **p < 0.05; *p < 0.1.

5 CONCLUSIONS

This paper investigates the impact of credit and

liquidity risk on banking stability using a panel

dataset of 110 banks listed in the MENA region from

2007 to 2021. Moreover, our analysis indicated that

credit risk and liquidity risk do not exhibit

economically significant reciprocal

contemporaneous, even though each risk category has

a major impact on financial stability. Additionally, we

found that the interaction between the two risk

categories profoundly affects financial stability.

Consequently, the findings of the estimation revealed

the pivotal role of credit and liquidity risks in shaping

banking stability in the MENA region. We found that

state-owned banks are more stable. State ownership

is less likely to risky behavior, is more concerned

with social welfare, and has increased efficiency

compared to non-state ownership, which is associated

with more likely risky behavior.

State ownership plays an important role in the

association between bank risks (credit and liquidity

risks) and financial stability. Our results have several

policy implications that are worth considering. First,

these findings offer some recommendations for bank

management and supervisors in the MENA region.

The financial crisis demonstrated that bank

failures caused by credit risk in their portfolios might

result in a liquidity market freeze. These findings

provide regulators, policymakers, and bank

management bodies with a better understanding of

bank stability and efficiency, as well as their behavior

toward credit and liquidity risk. Our findings suggest

that joint liquidity and credit risk management could

significantly affect banking stability. Finally, our

findings back up current regulatory initiatives,

particularly Basel III, which highlight the critical

importance of joint management of liquidity risk and

credit risk.

REFERENCES

Abdelaziz, H., Rim, B., & Helmi, H. J. G. B. R. (2022). The

interactional relationships between credit risk, liquidity

risk and bank profitability in MENA region. Global

Business Review, 23(3), 561-583.

Ahamed, M. M., & Mallick, S. (2017). Does regulatory

forbearance matter for bank stability? Evidence from

creditors’ perspective. Journal of Financial Stability,

28, 163-180.

Alshammari, T. (2022). State ownership and bank

performance: conventional vs Islamic banks. Journal of

Islamic Accounting and Business Research, 13(1), 141-

156.

Ben Lahouel, B., Taleb, L., Ben Zaied, Y., & Managi, S.

(2024). Financial stability, liquidity risk and income

diversification: evidence from European banks using

the CAMELS–DEA approach. Annals of Operations

Research, 334(1), 391-422.

Boubakri, N., El Ghoul, S., Guedhami, O., & Hossain, M.

(2020). Post-privatization state ownership and bank

risk-taking: Cross-country evidence. Journal of

Corporate Finance, 64, 101625.

Boulanouar, Z., Alqahtani, F., & Hamdi, B. (2021). Bank

ownership, institutional quality and financial stability:

evidence from the GCC region. Pacific-Basin Finance

Journal, 66, 101510.

Boussaada, R., Hakimi, A., & Karmani, M. (2022). Is there

a threshold effect in the liquidity risk–non‐performing

loans relationship? A PSTR approach for MENA

banks. International Journal of Finance & Economics,

27(2), 1886-1898.

Cai, R., & Zhang, M. (2017). How does credit risk influence

liquidity risk? Evidence from Ukrainian banks. Visnyk

of the National Bank of Ukraine(241), 21-33.

Bank Risks, and Bank Stability: The Moderating Role of State Ownership in the MENA Region

285

Chai, Z., Sadiq, M. N., Ali, N., Malik, M., & Hamid, S. A.

R. (2022). Bank Specific Risks and Financial Stability

Nexus: Evidence From Pakistan. Frontiers in

Psychology, 13, 909141.

Ghenimi, A., Chaibi, H., & Omri, M. A. B. (2017). The

effects of liquidity risk and credit risk on bank stability:

Evidence from the MENA region. Borsa Istanbul

Review, 17(4), 238-248.

Ghenimi, A., Chaibi, H., & Omri, M. A. B. (2021).

Liquidity risk determinants: Islamic vs conventional

banks. International Journal of Law and Management,

63(1), 65-95..

Habib, A., Khan, M. A., & Meyer, N. (2022). The effect of

bank liquidity on bank’s stability in the presence of

managerial optimism. Journal of Asian Finance,

Economics and Business, 9(8), 0183-0196.

Haddad, A., El Ammari, A., & Bouri, A. (2020). Impacts of

ownership structure on the financial performance of

conventional and Islamic banks in the agency theory

context. Corporate Ownership and Control, 17(3), 46-

70. .

Haque, F., & Shahid, R. (2016). Ownership, risk-taking and

performance of banks in emerging economies:

Evidence from India. Journal of Financial Economic

Policy, 8(3), 282-297.

Hassan, M. K., Khan, A., & Paltrinieri, A. (2019). Liquidity

risk, credit risk and stability in Islamic and conventional

banks. Research in International Business and Finance,

48, 17-31..

He, Z., & Xiong, W. (2012). Rollover risk and credit risk.

The Journal of Finance, 67(2), 391-430.

Hunjra, A. I., Tayachi, T., & Mehmood, R. (2020). Impact

of ownership structure on risk-taking behavior of South

Asian banks. Corporate Ownership and Control, 17(3),

108-120.

Iannotta, G., Nocera, G., & Sironi, A. (2007). Ownership

structure, risk and performance in the European

banking industry. Journal of banking and finance,

31(7), 2127-2149.

Imbierowicz, B., & Rauch, C. (2014). The relationship

between liquidity risk and credit risk in banks. Journal

of banking & finance, 40, 242-256.

Lachaab, M. (2023). The Cyclical Behavior of Credit and

Liquidity Risks on Bank Stability in MENA Countries

with a Dual Banking System. International Journal of

Empirical Economics, 2(2).

Laeven, L., & Levine, R. (2009). Bank governance,

regulation and risk taking. Journal of Financial

Economics

, 93(2), 259-275.

Lassoued, N., Sassi, H., & Attia, M. B. R. (2016). The

impact of state and foreign ownership on banking risk:

Evidence from the MENA countries. Research in

International Business and Finance, 36, 167-178..

Le, T. D., & Pham, X. T. (2021). The inter-relationships

among liquidity creation, bank capital and credit risk:

evidence from emerging Asia–Pacific economies.

Managerial Finance, 47(8), 1149-1167.

Louati, S., Abida, I. G., & Boujelbene, Y. (2015). Capital

adequacy implications on Islamic and non-Islamic

bank's behavior: Does market power matter? Borsa

Istanbul Review, 15(3), 192-204.

Mateev, M., Sahyouni, A., & Tariq, M. U. (2023). Bank

regulation, ownership and risk taking behavior in the

MENA region: policy implications for banks in

emerging economies. Review of Managerial Science,

17(1), 287-338.

Merton, R. C., & Thakor, R. T. (2022). No-fault default,

chapter 11 bankruptcy, and financial institutions.

Journal of banking & finance, 140, 106066.

Naili, M., & Lahrichi, Y. (2022). The determinants of

banks' credit risk: Review of the literature and future

research agenda. International Journal of Finance &

Economics, 27(1), 334-360.

Natsir, M., Soedarmono, W., Yudhi, W. S. A., Trinugroho,

I., & Warokka, A. (2019). Foreign penetration,

competition, and credit risk in banking. Borsa Istanbul

Review, 19(3), 249-257.

Pop, I. D., Cepoi, C. O., & Anghel, D. G. (2018). Liquidity-

threshold effect in non-performing loans. Finance

research letters, 27, 124-128.

Shleifer, A., & Vishny, R. W. (1997). A survey of corporate

governance. The Journal of Finance, 52(2), 737-783.

Thakor, A., & Yu, E. (2024). Funding liquidity creation by

banks. Journal of Financial Stability, 101295.

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

286