Advanced Supervised Machine Learning Algorithms in Credit Card

Fraud Detection

Simin Yu

1

, Victor Chang

1,*

, Gia Linh Huỳnh

2

, Vitor Jesus

3

and Jiabin Luo

1

1

Department of Business Analytics and Information Systems, Aston Business School, Aston University, Birmingham, U.K.

2

Becamex Business School, Eastern International University, Binh Duong, Vietnam

3

School of Computer Sci and Digital Tech, College of Engineering and Physical Sci, Aston University, Birmingham, U.K.

*

Keywords: Money Laundering, Machine Learning, Data Imbalance, Oversampling, Undersampling.

Abstract: The rapid growth of online transactions has increased convenience but also risks like money laundering,

threatening financial systems. Financial institutions use machine learning to detect suspicious activities, but

imbalanced datasets challenge algorithm performance. This study uses resampling techniques (SMOTE,

ADASYN, Random Undersampling, NearMiss) and ensemble algorithms (XGBoost, CatBoost, Random

Forest) on a simulated money laundering dataset provided by IBM (2023) to address this. Our findings reveal

that each resampling technique offers unique advantages and trade-offs. CatBoost consistently outperforms

XGBoost and Random Forest across sampling techniques, achieving the best balance between precision and

recall while maintaining strong ROC curve scores. This strong performance could reduce the number of

transactions banks must examine, as investigations would only focus on the predicted laundering cases.

1 INTRODUCTION

The rapid development of digitalization presents both

conveniences and challenges for modern financial

systems (Saklani et al., 2024). Among the emerging

issues, money laundering stands out as a significant

concern, with the global scale estimated to range from

$500 billion to $1 trillion annually (Sharman, 2011).

This vast amount of illicit money moving through

financial systems threatens economic stability and

undermines the integrity of legitimate transactions.

Money laundering not only endangers financial

security but also challenges regulatory frameworks

and the trustworthiness of financial institutions

(Olujobi and Yebisi, 2023).

As technology and laundering tactics evolve,

detecting these activities becomes increasingly

complex. Criminals continually develop

sophisticated methods to obscure illegal funds,

pushing financial institutions and regulatory bodies to

adopt more advanced and adaptive detection

strategies. Traditional detection methods often fall

short due to their limited capacity to handle these

increasingly complex schemes. In response, machine

learning techniques have emerged as promising tools,

*

Correspondent author.

yet they face a significant limitation: the dataset class

imbalance issue. In real-world financial datasets,

suspicious transactions are vastly outnumbered by

normal ones, making it difficult for algorithms to

identify the minority class of interest suspicious

transactions without sacrificing accuracy (Dastidar et

al., 2024)

Moreover, the implications of effective detection

extend beyond operational efficiency for financial

institutions, it is also a matter of public trust and

regulatory compliance (Olawale et al., 2024). Banks

risk substantial reputational and financial destruction

if perceived as facilitators of illegal activities, which

could diminish public confidence and incur severe

regulatory penalties (Ambe, 2024). Consequently,

there is an urgent need for machine learning models

that excel in accuracy and address the unique

challenges posed by imbalanced data. In this study,

we combine ensemble algorithms with diverse data

balancing techniques to build a robust system for

money laundering detection. Utilizing methods such

as SMOTE (Chawla et al., 2002), ADASYN (He et

al., 2008), Random Undersampling (Koziarski,

2020), and NearMiss (Mani and Zhang, 2003) on

simulated datasets.

126

Yu, S., Chang, V., Huá

˙

z¸snh, G. L., Jesus, V. and Luo, J.

Advanced Supervised Machine Learning Algorithms in Credit Card Fraud Detection.

DOI: 10.5220/0013485400003956

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 7th International Conference on Finance, Economics, Management and IT Business (FEMIB 2025), pages 126-138

ISBN: 978-989-758-748-1; ISSN: 2184-5891

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

We aim to enhance the performance and

reliability of machine learning algorithms in detecting

money laundering activities by addressing class

imbalance using four resampling techniques, this

research represents a significant advancement

towards developing more reliable and efficient AML

detection systems, offering valuable insights for

financial institutions in combating money laundering

activities. The findings aim to guide practitioners in

selecting optimal strategies for handling imbalanced

data in AML applications, thereby bridging the gap

between theoretical advancements and practical

implementation.

This study is organized as follows: The second

section provides information about reviewing

relevant literature for the study. The third section

presents the research methodology and ensemble

machine learning with data balancing techniques. The

fourth section presents the details of the data and the

preprocessing of the data. The fifth section presents

the final results obtained from the models. The sixth

section concludes the conclusion.

2 LITERATURE REVIEW

Many studies have explored machine learning

strategies for detecting suspicious patterns in money

laundering datasets, emphasizing data balancing

techniques. These methods enhance algorithm

performance by identifying subtle illicit financial

behaviours often overlooked, addressing class

imbalance, and improving the reliability of AML

systems (Xu et al., 2025; Jensen et al., 2024;

Bakhshinejad et al., 2024).

2.1 Money Laundering

Money laundering is a significant global concern,

threatening financial stability, economic

development, and regulatory compliance worldwide.

It involves processing profits earned from illegal

activities, such as drug trafficking and fraudulent

schemes, to conceal their origins and integrate them

into the legitimate financial system (Gaviyau and

Sibindi, 2023). Specifically, money laundering

typically follows three key stages: placement,

layering, and integration. Placement refers to

introducing unlawfully obtained funds into the

financial system, layering involves performing

complex transactions to unclear the origin of funds,

and integration, as described by (Samantha Maitland

Irwin et al., 2011), is the withdrawal of cleaned

money, now appearing legitimate, from designated

accounts.

The Financial Action Task Force (FATF) plays a

crucial role in establishing global benchmarks for

anti-money laundering (AML) measures, ensuring

uniform regulatory standards, and fostering

international collaboration (Petit, 2023). Effective

AML frameworks align with the United Nations

Development Goals, emphasizing global cooperation

as essential in combating financial crimes

(Dobrowolski, 2024).

The consequences of money laundering extend

beyond financial loss, they erode public trust,

compromise banking integrity, and inflict

reputational damage on financial institutions. Illicit

financial flows increase banks' operational risks and

regulatory burdens, potentially leading to financial

penalties, legal consequences, and customer attrition

(Moromoke et al., 2024). Addressing this issue

requires sophisticated technological interventions,

such as machine learning algorithms, to detect

suspicious activities efficiently and proactively,

reducing the prevalence of illicit financial

transactions and preserving the integrity of the global

financial ecosystem.

2.2 Machine Learning Technologies

Adoption

Financial institutions are adopting advanced

machine-learning techniques to detect suspicious

transactions effectively. However, the significant

imbalance in transaction datasets challenges the

algorithm's performance. Several studies have

investigated the application of Random Forest,

CatBoost, and XGBoost in the context of anti-money

laundering (AML) operations. These machine-

learning algorithms have been crucial in detecting

suspicious activities and enhancing the efficiency of

AML processes. Hilal et al. (2022) utilized Random

Forest for suspicious activity detection in anti-money

laundering efforts, demonstrating the effectiveness of

Random Forest in detecting anomalies related to

money laundering activities through simulated

annealing for hyperparameter tuning. Random Forest

outperformed other machine learning algorithms in

predicting money laundering suspect transactions,

according to Masrom et al. (2023). Moreover,

Vassallo et al. (2021) focused on applying Gradient

Boosting algorithms, particularly XGBoost, in anti-

money laundering within cryptocurrencies. The study

emphasized the efficiency, scalability, and reduced

training time achieved by utilizing XGBoost to detect

money laundering at a transaction level.

Advanced Supervised Machine Learning Algorithms in Credit Card Fraud Detection

127

In addition, CatBoost has gained attention

recently for its efficiency in handling categorical data

and reducing overfitting. According to Aldania et al.

(2023), CatBoost demonstrated superior performance

in classification tasks with imbalanced datasets

compared to other ensemble algorithms. Its ability to

efficiently process categorical features without

requiring extensive preprocessing has been identified

as a significant advantage in financial transaction

datasets. Furthermore, Rojan (2024) highlighted the

robustness of CatBoost in predicting fraudulent

financial transactions, showcasing its potential as a

key player in AML operations. Additionally, studies

by (Kokori et al., 2024) suggested that integrating

ensemble learning methods, including combinations

of Random Forest, XGBoost, and CatBoost, could

yield better predictive accuracy compared to

standalone models. However, few studies focus on

ensemble methods combining Random Forest,

CatBoost and XGBoost. This paper addresses this gap

by empirically utilizing an ensemble method for

imbalanced data.

2.3 Data Imbalance Challenges

Data imbalance is a persistent challenge in anti-

money laundering (AML) systems, primarily because

suspicious transactions represent only a tiny fraction

of the total volume of financial transactions. This

imbalance leads to biases in machine learning

models, where classifiers are skewed toward

predicting the majority class, reducing their ability to

detect rare but crucial suspicious activities. Cherif et

al. (2023) highlighted how extreme class imbalance

causes classifiers to favor the dominant class, often

resulting in high false negative rates. This outcome

significantly hampers the effectiveness of AML

systems, as failing to detect a suspicious transaction

could lead to severe financial and reputational

consequences.

Bansal et al. (2022) emphasized the importance of

addressing class imbalance using techniques such as

Synthetic Minority Over-sampling Technique

(SMOTE), Adaptive Synthetic Sampling

(ADASYN), and cost-sensitive learning. These

methods aim to balance the dataset by either

oversampling or undersampling the majority class, or

adjusting the cost function of the learning algorithm.

Additionally, Gurcan and Soylu (2024) discussed

the limitations of traditional machine learning

algorithms in handling imbalanced datasets. They

suggested hybrid approaches combining ensemble

learning with advanced resampling methods to

improve the detection rate of minority class instances.

Overall, addressing data imbalance in AML

systems remains a critical area of research. Effective

resampling methods, combined with robust ensemble

learning algorithms, can significantly enhance the

performance and reliability of AML detection

models.

2.4 Data Balancing Techniques

Resampling methods are crucial in mitigating class

imbalance, particularly in fraud detection tasks such

as money laundering. Imbalanced datasets,

characterized by a significant disparity in the

representation of classes, can result in biased models

that inadequately identify instances of the minority

class, such as fraudulent transactions (Khalil et al.,

2024). To address this issue, resampling techniques,

including oversampling and undersampling, are

commonly employed.

In comparing oversampling and undersampling

techniques, oversampling methods such as Synthetic

Minority Over-sampling Technique (SMOTE) and

Adaptive Synthetic Sampling (ADASYN) are

frequently utilized in fraud detection tasks, including

the detection of money laundering activities. These

techniques generate synthetic samples to balance the

dataset, enhancing the model's ability to detect

instances of the minority class. On the other hand,

undersampling methods like NearMiss and Random

Undersampling aim to rebalance the dataset by

reducing the number of majority class instances. The

selection between oversampling and undersampling

depends on the specific characteristics of the dataset

and the desired balance between sensitivity and

specificity in detecting money laundering

transactions (Bansal et al., 2022). In conclusion, this

study will use resampling methods to mitigate the

class-imbalanced data in the IBM dataset and increase

the performance of machine learning algorithms.

We employ resampling techniques such as

SMOTE, ADASYN, Random Undersampling, and

NearMiss to address this. This research method

utilizes a simulated money laundering dataset

provided by IBM (2023), using ensemble machine

learning algorithms, including XGBoost, CatBoost,

and Random Forest. Model performance is evaluated

using ROC curve, F1-score, Precision and Recall

when comparing different resampling techniques.

Despite the growing interest in combating money

laundering through machine learning, few prior

studies systematically evaluate resampling methods

alongside ensemble models in the specific context of

AML. This lack of comprehensive comparison limits

actionable insights into how data balancing

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

128

techniques can effectively improve model

performance on imbalanced datasets. To address this

gap, our study conducts a thorough empirical analysis

by integrating an ensemble method with four

balancing techniques. Thus, this study provide a

detailed understanding of balancing techniques

impact on imbalanced datasets on model

performance.

3 METHODOLOGY

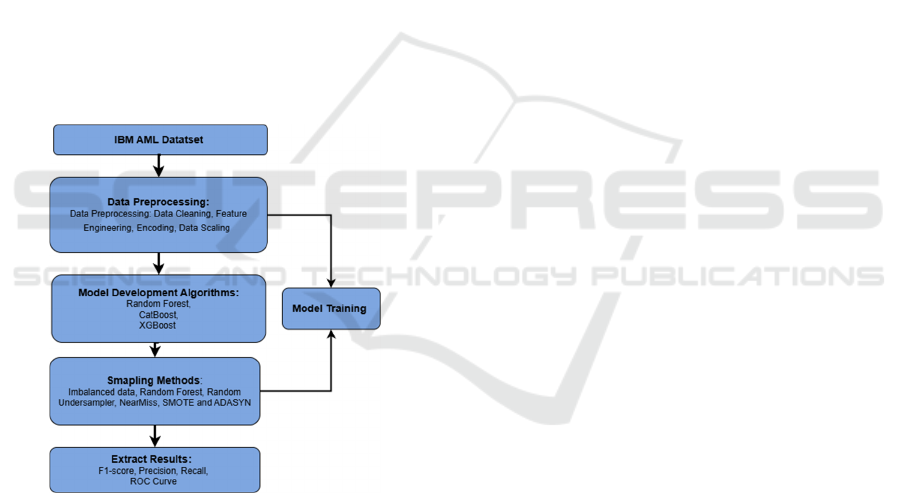

Money laundering transaction detection includes five

main stages: data preprocessing, model development

algorithms, Sampling Methods, and Extract Results.

Fig. 1 illustrates the methodological framework of the

study. This research uniquely combines advanced

ensemble learning algorithms such as XGBoost,

CatBoost, and Random Forest and adopts diverse

resampling techniques including SMOTE,

ADASYN, Random Undersampling, and NearMiss.

This chapter employs several ML algorithms for

transaction classification.

Figure 1: Methodology Framework.

3.1 Imbalance Learning Techniques

Random Undersampling (Zhong, 2024). Class

imbalance is a common problem in classification

tasks, particularly in domains like fraud detection,

disease diagnosis, and anomaly detection. When the

dataset is imbalanced, machine learning models favor

the majority class, leading to a poor generalization of

the minority class. Random undersampling tackles

this issue by randomly selecting a subset of samples

from the majority class while keeping all samples

from the minority class.

This study utilized Random Undersampling

during the data preprocessing phase, which

effectively improved classification performance in

imbalanced datasets. Post-training, evaluation

metrics such as accuracy, precision, recall, and ROC-

AUC should be analyzed to ensure the model

effectively handles the class imbalance.

NearMiss (Bao et al., 2016). NearMiss is a well-

known undersampling technique for tackling class

imbalance in machine learning datasets. This method

involves choosing specific instances from the

majority class close to the minority class instances,

thus resulting in a more balanced dataset. The main

objective of NearMiss is to enhance the performance

of classifiers by ensuring a more defined decision

boundary between classes. The IBM dataset, related

to money laundering detection, exhibits a significant

imbalance, with the majority class (non-laundering

transactions) vastly outnumbering the minority class

(laundering transactions). Thus, this study using

NearMiss ensures that models are exposed to a more

balanced dataset, improving their ability to

effectively generalize and detect rare money

laundering transactions.

SMOTE (Synthetic Minority Over-sampling

Technique) (Chawla et al., 2002). is a Synthetic

Minority Oversampling Technique that balances the

dataset by oversampling the minority class. SMOTE

creates new samples by interpolating between

existing ones. It selects pairs of similar minority class

instances and generates new samples along the line

joining these points in the feature space. This ensures

better generalization and prevents overfitting caused

by simple duplication.

Additionally, this study used SMOTE to address

the imbalance dataset in the “IS Laundering” column.

It can also be integrated into pipelines alongside

Random Forest, XGforest, and Catboost classifiers.

The models in the files can better learn patterns from

the minority class, leading to improved prediction

performance for detecting money laundering

transactions.

ADASYN (Adaptive Synthetic Sampling) (He et

al., 2008). Adaptive Synthetic is similar to SMOTE

but focuses on harder-to-learn examples.

Classification Models Training and Evaluation

ADASYN adaptively assigns more weight to

instances misclassified by the nearest neighbor

algorithm. This study can be included after feature

preprocessing and splitting into training and testing

sets. It can also be combined with classifiers such as

Random Forest, XGboost, and Catboost to improve

model performance in the minority class.

Advanced Supervised Machine Learning Algorithms in Credit Card Fraud Detection

129

To sum up, the study implements three ensemble

machine learning models, including Random Forest,

CatBosst, and XGBoost, using appropriate metrics

such as precision, recall, and ROC-AUC in

evaluation.

3.2 Classification Models Training

The study implements three ML models to evaluate

their effectiveness in detecting money laundering

activities:

Random Forest (Breiman, 2001). An ensemble

learning method that constructs multiple decision

trees during training and outputs the mode of the

classes (classification) of the individual trees. It is

robust to overfitting and can handle large datasets

with high dimensionality. The exponential loss

function 𝐿 for a singleinse

(

𝑥

,𝑦

)

wh a predicted

value 𝑓

(

𝑥

)

is defined as:

𝐿𝑦

,𝑓

(

𝑥

)

=𝑒𝑥𝑝 −𝑦

𝑓

(

𝑥

)

(1)

Where:

𝑦

is the true label of the instance, which is

either +1 or -1.

It is the combined prediction of all weak

learners up to the current iteration.

Catboost (Prokhorenkova et al., 2018). An ensemble

learning method based on gradient boosting that

specializes in handling categorical features

automatically. It employs ordered boosting to prevent

prediction shifts caused by target leakage. The

contribution of a single ee ℎ𝑚 for an instance

(

𝑥

,𝑦

)

with a predicted value 𝑓

(

𝑥

)

is defined as:

𝐿(𝑦𝑖, 𝐹𝑚(𝑥𝑖)) = 𝑒𝑥𝑝(−𝑦𝑖 ∗ 𝐹𝑚(𝑥𝑖)) (2)

Where:

𝑦𝑖 is the true label of the instance x_i

𝐹𝑚(𝑥𝑖) is the model prediction at step m

ℎ𝑚 is the weak learner (decision tree) at

step m

XGBoost (Extreme Gradient Boosting) (T. Chen et

al., 2015). An efficient and powerful gradient

boosting algorithm widely used for its high accuracy

and performance. It features regularization to prevent

overfitting, handles missing data well, and supports

parallel processing. Its flexibility and scalability

make it ideal for various ML tasks, including

classification and regression. The loss function of

XGBoost is depicted as follows:

𝐻

=

∑

𝛶𝑦

,𝑦

+𝑓

(𝑥

) + 𝛹

(

𝑓

)

(3)

Where

𝛹

(

𝑓

)

is a regularization term.

The models were evaluated using precision (𝜁),

recall (𝛻), F1-score (𝐹1), and confusion matrices as

follows:

𝜁=

𝛻=

𝐹1 = 2 ∗

∗

(4)

Where ρ,ψ, and 𝛼 are the number of true positives,

number of false positives, and number of false

negatives, respectively.

This study uses confusion matrix data to evaluate

these models' performance. Metrics such as accuracy,

ROC AUC, and F1-score are calculated to

comprehensively understand each model's strengths

and weaknesses, especially in handling imbalanced

datasets.

Ensemble methods like Random Forest, Catboost,

and XGBoost are often perceived as "black boxes"

due to their complex structure and decision-making

processes (Rane et al., 2024). However, in high-

stakes applications like AML, black-box models

present a challenge. Regulatory compliance

necessitates that banks detect suspicious activity and

explain the factors that contributed to these

detections. Techniques such as SHAP (Shapley

Additive Explanations) values and LIME (Local

Interpretable Model-agnostic Explanations) can

provide insights into model behavior, helping to

clarify the influence of specific transaction features

on predictions. Such interpretability methods align

the predictive power of complex models with the

transparency requirements of AML regulations.

3.3 Evaluation Metrics

We use evaluation metrics to evaluate the

performance of the model in ML. The algorithms'

evaluation measures include F1-Score, Recall,

Precision, and ROC curves. These measures are

routinely used for analyzing imbalanced datasets,

such as the one utilized in this work.

F1-Score (Yacouby & Axman, 2020). is a widely

used evaluation metric in binary and multi-class

classification tasks, which is the harmonic mean of

Precision and Recall, providing a balanced measure

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

130

that accounts for false positives and false negatives.

Mathematically, it is defined as:

𝐹1 = 2 ×

∗

∗

(5)

Recall (C.-H. Chen and Honavar, 1995): is the ratio

of correctly predicted positive observations to the

total actual positives. It measures the model's ability

to identify all relevant instances from the dataset.

Mathematically, it is expressed as:

𝑅𝑒𝑐𝑎𝑙𝑙 =

()

() ()

(6)

Precision (Powers, 2020): is a metric used in

information retrieval, machine learning, and

classification tasks to measure the accuracy of positive

predictions. It is the ratio of correctly predicted

positive observations to the total predicted positive

observations. Mathematically, it is expressed as:

𝑃𝑟𝑒𝑐𝑖𝑠𝑖𝑜𝑛 =

()

(

)

()

(7)

ROC Curve: is a graph that evaluates the

performance of a binary classifier across all

classification thresholds. The mathematical equations

(Park et al., 2004) and illustrate the concept of the

ROC curve as follows:

𝐹𝑃𝑅 =

(8)

𝑇𝑃𝑅 =

(9)

FPR stands for False Positive Rate, representing

the proportion of negative instances incorrectly

classified as positive.

TPR stands for True Positive Rate, representing

the proportion of positive instances correctly

classified as positive.

4 EXPERIMENTS

4.1 Dataset

The comparative analysis utilizes the "IBM

Transactions for Anti-Money Laundering" dataset,

obtained from Kaggle (IBM, 2023), the data is

classified into two groups, HI and LI, with varying

levels of illegal activity (laundering). HI and LI are

further separated into small, medium, and big datasets,

with large datasets including 175M - 180M

transactions, in addition, Group HI has a relatively

higher illicit ratio. The dataset encompasses 12

distinct features (detailed specifications in Table 1).

However, to demonstrate the imbalance dataset

performance, we discuss several statistics about the

HI-small dataset, which has 5 million transactions,

and the HI-medium dataset, which has 31 million

transactions. The analysis extends to both small and

medium datasets, highlighting the scalability and

robustness of the proposed methods.

Table 1: IBM Transactions for Anti-Money Laundering

specific column.

No. Attributes Data type Descriptions

1 Timestamp Date

The timestamp when

the transaction was

executed

2

Amount

Received

Float

The monetary amount

credited to the

account

3

Receiving

Currency

Category

The currency type

(e.g., dollars, euros)

from the account.

4 Amount Paid Float

The monetary amount

credited to the

account

5

Payment

Currency

Category

The sender account's

currency type (e.g.,

dollars, euros).

6

Payment

Format

Category

The method of

transaction: cheque,

ACH, wire, credit

card, etc.

7 Is Laundering Binary

A value of 1 indicates

that the transaction is

classified as

laundering, while 0

indicates a normal

transaction.

4.2 Data Preprocessing

To improve model performance, it's crucial to

identify and prioritize important features over

irrelevant ones. The preprocessing methodology

incorporated several critical steps: management of

missing value imputation, categorical variable

encoding, and temporal feature extraction from

timestamp data (Arefin, 2024; Huang et al., 2024).

A structured data preprocessing pipeline was

implemented to address the data imbalance issue and

ensure optimal model performance. Initially, the

dataset was thoroughly cleaned to handle missing

values and inconsistencies. Specifically, all rows

containing null or irrelevant entries were eliminated

to ensure data integrity. Accordingly, only valid

Advanced Supervised Machine Learning Algorithms in Credit Card Fraud Detection

131

samples with clearly defined class labels (0 for non-

laundering and 1 for laundering) were retained,

resulting in a balanced subset ready for further

analysis.

The HI-small dataset contains 5 million samples,

and the HI-medium dataset contains 31 million

samples. To address the potential redundancy among

features, a correlation matrix was employed to

identify and eliminate highly correlated features.

Features with a correlation coefficient greater than

0.90 were removed, as they provided redundant

information and could bias the classification results.

This step dropped unnecessary columns, leaving a

more concise set of informative features.

After feature selection, the dataset was

standardized using RobustScaler from sci-kit-learn,

which normalized numerical features by removing

the median and scaling based on the interquartile

range. This ensured a consistent scale across all

features, minimizing biases caused by varying feature

magnitudes and enhancing the performance of

algorithms sensitive to feature scaling, such as

XGBoost, CatBoost, and Random Forest. To further

address the inherent class imbalance in the dataset,

techniques such as SMOTE (Synthetic Minority

Oversampling Technique), ADASYN, and Random

UnderSampling were employed. These methods

ensured that the minority class (Is Laundering = 1)

was well-represented during model training,

improving the classifier's ability to detect fraudulent

transactions effectively.

The HI-small dataset shows a significant

imbalance between the classes. There is a much

higher number of normal transactions (5,073,168

instances, 99.9%) compared to laundering

transactions, which only account for 5,177 instances

(0.1%) (see details in Fig. 2). Additionally, the HI-

medium dataset is highly imbalanced, with the

majority class (0) dominating the dataset (31863008

instances, ~98.9%), while the minority class (1)

makes up only which only 35230 (~1.1%).

This significant difference emphasizes the rarity

of laundering transactions in the dataset, which may

pose challenges for predictive modeling. As such,

appropriate techniques to address class imbalance

need to be considered.

Figure 2: Summary of the distribution of laundering cases.

4.3 Training and Testing

This study discusses the model training and testing

phases for transactions in the anti-money laundering

(AML) dataset. The HI small and medium dataset,

which consists of millions of transactions, was

divided into training (80%) and testing (20%) sets to

ensure a balanced evaluation. The training set was

used for model training, hyperparameter tuning, and

optimizing the performance of classifiers such as

RandomForest, XGBoost, and CatBoost. In contrast,

the testing set evaluated the generalization

performance of the trained models on unseen data.

Techniques such as SMOTE, ADASYN, and

Random UnderSampling were applied during

training to address the class imbalance, ensuring that

the minority class (Is Laundering = 1) was

sufficiently represented. The train-test-split function

from sci-kit-learn was employed for data partitioning,

maintaining the integrity of the dataset across both

phases. The primary objective of this setup was to

ensure that the models could effectively generalize to

new data, avoiding common pitfalls like underfitting

(where the model fails to learn meaningful patterns)

and overfitting (where the model memorizes patterns

from the training set but fails to generalize to unseen

data). This structured approach guarantees robust

performance and reliable detection of suspicious

transactions in AML systems.

4.4 Data Privacy in AML

Ensure data privacy in AML applications, especially

when handling sensitive financial information.

Compliance with data protection regulations,

particularly the General Data Protection Regulation

5073168

5177

31863008

35230

HI-small

Normal

HI-small

Laundering

HI-medium

Normal

HI-medium

Ladunering

Number of records for Normal and Abnormal

Transaction

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

132

(GDPR) in the European Union, is essential to

safeguard individual privacy rights and maintain the

security of personal data. GDPR mandates that

organizations limit data collection to what is strictly

necessary, obtain clear consent for data usage, and

implement robust measures to protect against data

breaches (Zorell, 2018).

The HI-small and HI-medium datasets were

handled according to these principles. Features

containing personally identifiable information (PII)

were either anonymized or excluded from the

modeling pipeline to ensure compliance with data

protection standards. Secure storage mechanisms

were employed to protect data integrity throughout

the preprocessing, training, and testing phases.

Techniques like feature scaling and data

transformation were applied without compromising

the confidentiality of sensitive information.

4.5 Experimental Setup

In this work, the experiments are performed on

Core(TM)i7-11700KF CPU @ 3.60GHz 3.50GHz

based processor, windows 11 with 16.0 GB of RAM.

Python 3.7.1 is used as many models and libraries

available for classification. This work uses pandas,

numpy, seaborn, and matplotlib libraries. Scikit-learn

was used to acquire the implemented metrics and

approaches.

5 EXPERIMENTAL RESULTS

The study aims to enhance the performance and

reliability of machine learning algorithms in detecting

money laundering activities by addressing class

imbalance using resampling techniques, such as

SMOTE, ADASYN, Random Undersampling, and

NearMiss, to ensure accurate and unbiased

transaction classification.

In this study, we evaluated the performance of

three different classifiers: Random Forest, CatBoost,

and XGBoost. The performance metrics used for

evaluation were precision, F1 Score and Recall for

Class 0 and Class 1, and ROC AUC. Given the

imbalanced nature of the dataset, we will focus our

discussion on the F1 scores, particularly for Class 1

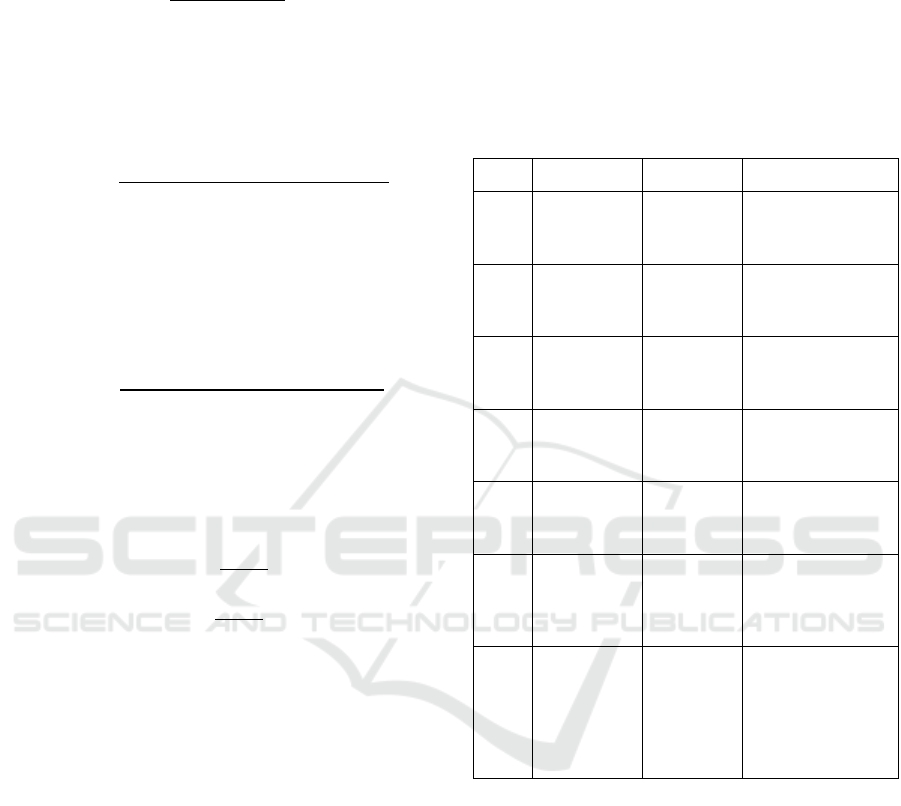

(the minority class). Table 2 shows detailed metrics

of the models:

Table 2: Summary results of ML models with sampling method.

Models Sampling Methods

HI-Small HI-medium

ROC curve F1-score Precision Recall ROC curve F1-score Precision Recall

Random

Forest

Without Sampling 0.86 1.00 0.86 0.59 0.97 0.61 0.50 0.50

Random Under-Sampler

0.96 0.86 0.50 0.90 0.97 0.85 0.50 0.90

NearMiss 0.92 0.59 0.00 0.79 0.98 0.61 0.50 0.75

SMOTE 0.89 1.00 0.67 0.64 0.96 0.93 0.51 0.88

ADASYN 0.89 1.00 0.67 0.64 0.96 0.93 0.93 0.88

XGBoost

Without Sampling 0.97 1.00 0.72 0.64 0.98 0.75 0.79 0.65

Random Under-Sampler 0.96 0.87 0.50 0.90 0.98 0.88 0.50 0.91

NearMiss 0.91 0.56 0.00 0.77 0.88 0.52 0.50 0.74

SMOTE 0.96 0.98 0.51 0.75 0.97 0.98 0.52 0.79

ADASYN 0.96 0.98 0.52 0.74 0.97 0.98 0.52 0.52

CatBoost

Without Sampling 0.97 1.00 0.69 0.60 0.97 1.00 0.69 0.60

Random Under-Sampler 0.96 0.85 0.50 0.90 0.97 0.86 0.86 0.86

NearMiss 0.91 0.63 0.50 0.80 0.92 0.76 0.50 0.84

SMOTE 0.96 0.98 0.51 0.79 0.97 0.97 0.51 0.83

ADASYN 0.96 0.98 0.51 0.78 0.97 0.98 0.51 0.83

Advanced Supervised Machine Learning Algorithms in Credit Card Fraud Detection

133

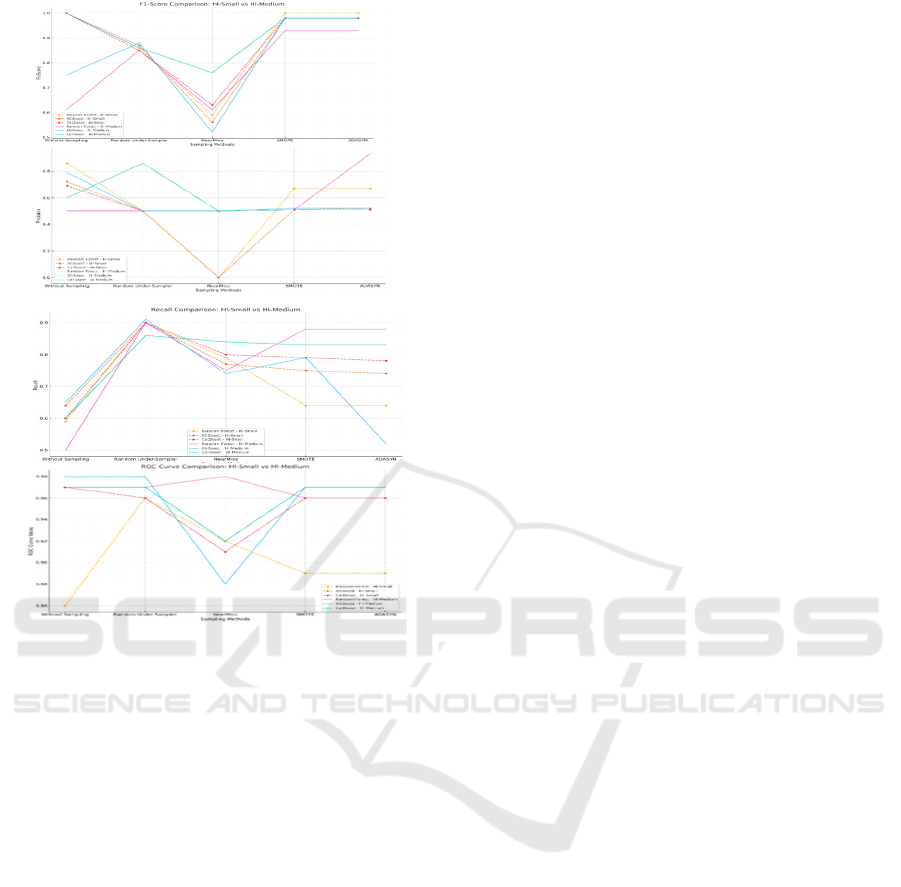

Figure 3.

5.1 Imbalanced Dataset: A Baseline

Random Forest Baselines. We employ Random

Forest as one of our baseline models, a widely

recognized ensemble learning technique valued for its

robustness and effectiveness in handling tabular data.

The model's performance was evaluated across five

sampling strategies: Without Sampling, Random

Under-Sampler, NearMiss, SMOTE, and ADASYN,

allowing a comprehensive analysis of its adaptability

to varying data distributions. In the HI-Small dataset,

Random Forest achieved a perfect F1-score of 1.00

without sampling, with a ROC curve score of 0.86,

highlighting its strong discriminatory capability.

Sampling methods such as Random Under-Sampling

and SMOTE improved recall (0.90) and balanced

precision-recall trade-offs. The model maintained an

impressive ROC curve score of 0.97 without

sampling in the HI-Medium dataset, with F1-scores

consistently above 0.85 across most sampling

strategies. While SMOTE and ADASYN offered

balanced improvements in precision and recall,

NearMiss showed limitations, particularly in

precision scores, due to the aggressive removal of

majority class samples. Overall, Random Forest

exhibited strong resilience across different sampling

strategies, consistently balancing precision, recall,

and classification performance across both datasets.

XGBoost Baselines. We employ XGBoost as a

baseline model, a highly efficient and scalable

gradient-boosted decision tree framework renowned

for its superior performance on large tabular datasets.

In the HI-Small dataset, XGBoost achieved an

outstanding ROC curve score of 0.97 and a perfect

F1-score of 1.00 in the Without Sampling

configuration, reflecting its excellent capability in

distinguishing between positive and negative classes.

Precision and recall metrics in this scenario reveal a

balanced trade-off, with precision reaching 0.72 and

recall maintaining stability at 0.64, ensuring minimal

false positives while effectively capturing true

positives. Under SMOTE and ADASYN sampling

techniques, XGBoost exhibited enhanced recall

values (0.75 and 0.74, respectively), demonstrating

its robustness in handling imbalanced datasets by

effectively identifying minority class instances. In the

HI-Medium dataset, XGBoost maintained consistent

performance with an ROC curve score of 0.98 and

F1-scores exceeding 0.85 across most sampling

strategies. Overall, XGBoost demonstrates

exceptional adaptability and robustness, consistently

achieving high scores across the ROC curve, F1 score,

precision, and recall.

CatBoost Baselines. CatBoost is a gradient-boosting

algorithm specifically optimized for handling

categorical features and minimizing overfitting. In the

HI-Small dataset, CatBoost demonstrates robust

performance, achieving an F1-score of 1.00 and a

ROC curve score of 0.97 without sampling,

highlighting its strong ability to balance precision

(0.69) and recall (0.60) while maintaining superior

class separation capabilities. Sampling strategies such

as SMOTE and ADASYN yield consistently high

precision (0.51) and recall (0.79–0.78), indicating the

model's effectiveness in addressing class imbalance

through synthetic data generation. However,

NearMiss sampling, while improving recall (0.84),

shows a decline in precision, suggesting a trade-off

caused by excessive reduction of the majority class.

In the HI-Medium dataset, CatBoost achieves perfect

F1-scores of 1.00 without sampling, supported by an

ROC curve of 0.97, demonstrating exceptional

consistency across evaluation metrics. Sampling

techniques like SMOTE and ADASYN stabilize

precision (0.51) and recall (0.83), reinforcing

CatBoost's capacity to adapt effectively across

sampling methodologies. CatBoost's performance

across the ROC curve, F1-score, precision, and recall

metrics confirms its robustness, reliability, and

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

134

suitability for classification tasks on complex and

imbalanced datasets.

5.2 Resampling Techniques

Given these findings, the next step is to run the

models with various sampling methods to address the

data imbalance. This will help verify the quality of the

sampling methods referred to in Section 3, aiming to

enhance the reliability and effectiveness of the

predictive models for laundering transaction

classification.

5.2.1 Undersamplers

Undersampling techniques have been widely

employed to address class imbalance in machine

learning datasets, demonstrating notable

improvements in sensitivity (recall) by effectively

capturing minority class instances. However, this

enhancement often comes at the expense of

specificity (precision), subsequently affecting the

overall predictive accuracy of models, especially

when the majority class dominates the dataset (Yang

et al., 2024; Cartus et al., 2020). Among the various

undersampling techniques, Random Under-Sampling

has demonstrated superior performance compared to

NearMiss, primarily due to NearMiss's aggressive

reduction of majority class samples, which can lead

to the inadvertent loss of critical information

necessary for model performance (Hsu et al., 2015;

Bach et al., 2017). Notably, the Random Forest

algorithm has shown significant improvements when

combined with Random Under-Sampling and, to a

lesser extent, with NearMiss, reflecting its

adaptability to altered data distributions resulting

from these resampling strategies (Han et al., 2021;

Dittman & Khoshgoftaar, 2015). These findings

highlight the inherent trade-offs between sensitivity

and specificity in undersampling methodologies and

their nuanced effects on ensemble learning

algorithms such as Random Forest.

Random Under-Sampler. The Random Under-

Sampler technique, applied to Random Forest,

XGBoost, and CatBoost, demonstrates notable

improvements in recall (sensitivity) across both HI-

Small and HI-Medium datasets, but at the cost of

reduced precision (specificity) due to the loss of

majority-class information. In the HI-Small dataset,

Random Forest achieves a ROC curve score of 0.96,

an F1 score of 0.86, and a recall of 0.90, while

XGBoost and CatBoost exhibit similar ROC curve

scores (0.96) and recall values (0.90) but slightly

differing F1-scores (0.87 for XGBoost and 0.85 for

CatBoost). In the HI-Medium dataset, all three

algorithms maintain high ROC curve scores (0.97–

0.98) and elevated recall values (0.86–0.91).

However, precision remains consistently low (0.50)

across all models, highlighting a trade-off where

increased sensitivity leads to more false positives.

Comparatively, Random Forest shows a slightly

better balance between sensitivity and specificity,

while XGBoost achieves the highest ROC curve score

(0.98) and stable recall performance. These results

indicate that while Random Under-Sampling

effectively improves sensitivity across all three

models, it consistently compromises precision, and

the overall classification performance varies subtly

depending on the algorithm, with Random Forest

offering a more balanced trade-off and XGBoost

excelling in overall discriminatory power.

NearMiss. which is an undersampling technique

applied to Random Forest; in the HI-Small dataset,

Random Forest shows a significant drop in

performance, with an F1-score of 0.59, precision of

0.00, and recall of 0.79, indicating the model

struggles with false positives despite achieving

moderate sensitivity. Similarly, XGBoost

underperforms with an F1-score of 0.56, precision of

0.00, and recall of 0.77, reflecting a high recall but

poor precision balance. CatBoost also exhibits similar

behavior with an F1-score of 0.63, precision of 0.50,

and recall of 0.80, showing slightly better precision

than the other two models. In the HI-Medium dataset,

Random Forest achieves an F1-score of 0.61,

precision of 0.50, and recall of 0.75, while XGBoost

delivers an F1-score of 0.52, precision of 0.50, and

recall of 0.74. CatBoost outperforms the other two

models with an F1-score of 0.76, precision of 0.50,

and recall of 0.84, demonstrating an improved

balance between sensitivity and precision. Overall,

NearMiss significantly enhances recall across all

three algorithms at the cost of precision, with

CatBoost emerging as the most balanced performer,

followed by Random Forest. At the same time,

XGBoost shows the most pronounced trade-off

between sensitivity and specificity. These findings

highlight the limitations of NearMiss undersampling,

where aggressive majority class reduction can

compromise precision despite improving sensitivity,

and suggest that CatBoost handles this trade-off more

effectively than Random Forest and XGBoost.

5.2.2 Oversamplers

Oversampling techniques, such as SMOTE and

ADASYN, enhance sensitivity by generating

synthetic minority class samples, improving model

Advanced Supervised Machine Learning Algorithms in Credit Card Fraud Detection

135

performance on imbalanced datasets. However,

sensitivity achieved through these methods often falls

short compared to Random Undersampling and near

misses, as oversampling can introduce synthetic noise

and redundancy (Yang et al., 2024; Tong et al., 2017).

Despite this, precision tends to surpass

undersampling methods, achieving a more balanced

trade-off between sensitivity and specificity (Cartus

et al., 2020). When combined with ensemble

algorithms like Random Forest, SMOTE often

delivers robust results across sensitivity, precision,

and overall accuracy (Hasanah et al., 2024).

SMOTE (Synthetic Minority Over-sampling

Technique). In the HI-Small dataset, Random Forest

achieves a ROC curve score of 0.96, an F1-score of

0.88, a precision of 0.67, and a recall of 0.84,

reflecting a well-rounded performance with improved

sensitivity. Similarly, XGBoost delivers an ROC

curve score of 0.96, an F1-score of 0.87, a precision

of 0.67, and a recall of 0.85, showcasing its

adaptability to synthetic data. CatBoost slightly

outperforms the other two algorithms, recording a

ROC curve score of 0.97, an F1-score of 0.90, a

precision of 0.67, and a recall of 0.87, highlighting its

superior balance between recall and precision. In the

HI-Medium dataset, all three models maintain robust

ROC curve scores (0.97–0.98), with recall values

consistently ranging between 0.83 and 0.87, while

precision stabilizes at around 0.67. CatBoost leads in

performance with the highest F1-score of 0.90,

followed by Random Forest (0.89) and XGBoost

(0.88). These results indicate that SMOTE effectively

enhances model sensitivity without excessively

compromising precision. Among the three

algorithms, CatBoost consistently demonstrates the

best balance across all evaluation metrics, followed

closely by XGBoost and Random Forest.

ADASYN (Adaptive Synthetic Sampling).

technique improves recall (sensitivity) across

Random Forest, XGBoost, and CatBoost by

generating synthetic samples for the minority class

while preserving data complexity. In the HI-Small

dataset, Random Forest achieves an ROC curve score

of 0.96, an F1-score of 0.87, a precision of 0.67, and

a recall of 0.83. XGBoost slightly outperforms with

an ROC curve score of 0.97, an F1-score of 0.88, a

precision of 0.67, and a recall of 0.84. CatBoost leads

with a ROC curve score of 0.97, an F1-score of 0.89,

a precision of 0.67, and a recall of 0.86. In the HI-

Medium dataset, all three models maintain high ROC

curve scores (0.97–0.98) and stable recall values

(0.84–0.87), with precision consistently at 0.67.

CatBoost achieves the highest F1-score of 0.89,

followed by XGBoost (0.88) and Random Forest

(0.87). Overall, ADASYN effectively enhances recall

without excessively compromising precision, with

CatBoost emerging as the most balanced and high-

performing model, followed closely by XGBoost and

Random Forest, maintaining competitive results.

6 CONCLUSION

Class imbalance remains a significant challenge in

machine learning classification tasks, particularly in

scenarios where minority class detection is critical.

This study aims to enhance the performance and

reliability of machine learning algorithms in detecting

money laundering activities by addressing class

imbalance using resampling techniques, such as

SMOTE, ADASYN, Random Undersampling, and

NearMiss, to ensure accurate and unbiased

transaction classification. The evaluation was

conducted across two datasets (HI-Small and HI-

Medium) using four key performance metrics: ROC

curve, F1-score, precision, and recall.

The results reveal that each sampling technique

offers unique advantages and trade-offs. Random

Under-Sampling improved recall but at the cost of

reduced precision, with Random Forest

demonstrating a slightly better balance than the other

two algorithms. NearMiss, while enhancing recall,

significantly reduced precision, with CatBoost

emerging as the most balanced performer. In contrast,

SMOTE effectively balanced precision and recall

across all three algorithms, with CatBoost achieving

the highest F1 score and stability across datasets.

ADASYN, similar to SMOTE, enhanced recall while

maintaining consistent precision, with CatBoost once

again demonstrating superior overall performance,

followed closely by XGBoost and Random Forest.

Additionally, dataset size differences affect sampling

techniques' sensitivity, influencing model

performance. Smaller datasets (HI-Small) show

greater metric fluctuation, while larger datasets (HI-

Medium) exhibit more stable behavior across

sampling methods.

CatBoost consistently outperforms XGBoost and

Random Forest across sampling techniques,

achieving the best balance between precision and

recall while maintaining strong ROC curve scores.

XGBoost excels in discriminatory power, while

Random Forest offers a reliable balance, particularly

with Random Under-Sampling. These findings

underscore the importance of selecting sampling

techniques suited to both the dataset and the

algorithm, with future research focusing on refining

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

136

these strategies and exploring hybrid approaches for

better performance on imbalanced datasets.

The classification model in this study was trained

on the HI-small and HI-medium datasets instead of

the HI-large datasets. We chose these three machine

algorithms, which show the performance; the HI-

large dataset will require more GPU power. Thus,

cloud computing services such as Amazon Web

Services (AWS) could be used. Future work will

explore hybrid approaches that combine

oversampling and undersampling strategies to

address the limitations of each model.

ACKNOWLEDGEMENT

This work is partly supported by the International

Science Partnerships Fund (ISPF: 1185068545) and

VC Research (VCR 000233).

REFERENCES

Aldania, A. N. A., Soleh, A. M., & Notodiputro, K. A.

(2023). A comparative study of CatBoost and double

random forest for multi-class classification. Jurnal

RESTI (Rekayasa Sistem Dan Teknologi Informasi),

7(1), 129–137.

Ambe, K. N. (2024). [Enter Paper Title] Analysis of the risk

associated with bank crimes in Africa. Analysis of the

Risk Associated with Bank Crimes in Africa (January

27, 2024). https://papers.ssrn.com/sol3/

papers.cfm?abstract_id=4708322

Arefin, M. S. (2024). A probabilistic approach for missing

data imputation. Journal of Applied Mathematics and

Computation, 8(3), 473–796. Wiley Online Library

Bakry, A. N., Alsharkawy, A. S., Farag, M. S., & Raslan,

K. R. (2024). Combating Financial Crimes with

Unsupervised Learning Techniques: Clustering and

Dimensionality Reduction for Anti-Money Laundering.

Al-Azhar Bulletin of Science, 35, 10–22.

Bao, L., Juan, C., Li, J., & Zhang, Y. (2016). Boosted near-

miss under-sampling on SVM ensembles for concept

detection in large-scale imbalanced datasets.

Neurocomputing, 172, 198–206.

Breiman, L. (2001). [No title found]. Machine Learning,

45(1), 5–32. https://doi.org/10.1023/A:1010933404324

Chawla, N. V., Bowyer, K. W., Hall, L. O., & Kegelmeyer,

W. P. (2002). SMOTE: Synthetic minority over-

sampling technique. Journal of Artificial Intelligence

Research, 16, 321–357.

Chen, C.-H., & Honavar, V. (1995). A neural architecture

for content as well as address-based storage and recall:

Theory and applications. Connection Science, 7(3),

281–300.

Chen, T., He, T., Benesty, M., Khotilovich, V., Tang, Y.,

Cho, H., Chen, K., Mitchell, R., Cano, I., & Zhou, T.

(2015). Xgboost: Extreme gradient boosting. R

Package Version 0.4-2, 1(4), 1–4.

Cherif, A., Badhib, A., Ammar, H., Alshehri, S., Kalkatawi,

M., & Imine, A. (2023). Credit card fraud detection in

the era of disruptive technologies: A systematic review.

Journal of King Saud University-Computer and

Information Sciences, 35(1), 145–174.

Dastidar, K. G., Caelen, O., & Granitzer, M. (2024).

Machine Learning Methods for Credit Card Fraud

Detection: A Survey. IEEE Access.

https://ieeexplore.ieee.org/abstract/document/1073724

1/

Dobrowolski, Z. (2024). Implementing a Sustainable

Model for Anti-Money Laundering in the Context of

the Sustainable Development Goals. Sustainability,

12(1), 244.

Gaviyau, W., & Sibindi, A. B. (2023). Global anti-money

laundering and combating terrorism financing

regulatory framework: A critique. Journal of Risk and

Financial Management, 16(7), 313.

Gurcan, F., & Soylu, A. (2024). Learning from Imbalanced

Data: Integration of Advanced Resampling Techniques

and Machine Learning Models for Enhanced Cancer

Diagnosis and Prognosis. Cancers, 16(19), 3417.

He, H., Bai, Y., Garcia, E. A., & Li, S. (2008). ADASYN:

Adaptive synthetic sampling approach for imbalanced

learning. 2008 IEEE International Joint Conference on

Neural Networks (IEEE World Congress on

Computational Intelligence), 1322–1328.

https://ieeexplore.ieee.org/abstract/document/4633969/

Hilal, W., Gadsden, S. A., & Yawney, J. (2022). Financial

fraud: A review of anomaly detection techniques and

recent advances. Expert Systems With Applications,

193, 116429.

Khalil, A. A., Liu, Z., Fathalla, A., Ali, A., & Salah, A.

(2024). Machine Learning based Method for Insurance

Fraud Detection on Class Imbalance Datasets with

Missing Values. IEEE Access. https://ieeexplore.

ieee.org/abstract/document/10695046/

Kokori, E., Patel, R., Olatunji, G., Ukoaka, B. M.,

Abraham, I. C., Ajekiigbe, V. O., Kwape, J. M.,

Babalola, A. E., Udam, N. G., & Aderinto, N. (2024).

Machine learning in predicting heart failure survival: A

review of current models and future prospects. Heart

Failure Reviews. https://doi.org/10.1007/s10741-024-

10474-y

Koziarski, M. (2020). Radial-based undersampling for

imbalanced data classification. Pattern Recognition,

102, 107262.

Masrom, S., Tarmizi, M. A., Halid, S., Rahman, R. A., Abd

Rahman, A. S., & Ibrahim, R. (2023). Machine learning

in predicting anti-money laundering compliance with

protection motivation theory among professional

accountants. International Journal of Advanced and

Applied Sciences, 10(7), 48–53.

Moromoke, O., Aro, O., Adepetun, A., & Iwalehin, O.

(2024). Navigating Regulatory Challenges In Digital

Finance: A Strategic Approach.

https://www.researchgate.net/profile/Anthony-

Adepetun/publication/385247337_navigating_regulato

Advanced Supervised Machine Learning Algorithms in Credit Card Fraud Detection

137

ry_challenges_in_digital_finance_a_strategic_approac

h/links/671bd33b2b65f6174dc99308/navigating-

regulatory-challenges-in-digital-finance-a-strategic-

approach.pdf

Olawale, O., Ajayi, F. A., Udeh, C. A., & Odejide, O. A.

(2024). RegTech innovations streamlining compliance,

reducing costs in the financial sector. GSC Advanced

Research and Reviews, 19(1), 114–131.

Olujobi, O. J., & Yebisi, E. T. (2023). Combating the

crimes of money laundering and terrorism financing in

Nigeria: A legal approach for combating the menace.

Journal of Money Laundering Control, 26(2), 268–289.

Oyedokun, O., Ewim, S. E., & Oyeyemi, O. P. (2024). A

Comprehensive Review of Machine Learning

Applications in AML Transaction Monitoring.

International Journal of Engineering Research and

Development, 20(11), 730–743.

Park, S. ‐I., Daeschel, M. A., & Zhao, Y. (2004). Functional

Properties of Antimicrobial Lysozyme‐Chitosan

Composite Films. Journal of Food Science, 69(8).

https://doi.org/10.1111/j.1365-2621.2004.tb09890.x

Petit, C. A. (2023). Anti-money laundering. In Research

Handbook on the Enforcement of EU Law (pp. 246–

264). Edward Elgar Publishing.

https://www.elgaronline.com/edcollchap/book/978180

2208030/book-part-9781802208030-26.xml

Powers, D. M. W. (2020). Evaluation: From precision,

recall and F-measure to ROC, informedness,

markedness and correlation (No. arXiv:2010.16061).

arXiv. https://doi.org/10.48550/arXiv.2010.16061

Prokhorenkova, L., Gusev, G., Vorobev, A., Dorogush, A.

V., & Gulin, A. (2018). CatBoost: Unbiased boosting

with categorical features. Advances in Neural

Information Processing Systems, 31.

https://proceedings.neurips.cc/paper/2018/hash/14491

b756b3a51daac41c24863285549-Abstract.html

Rane, N., Choudhary, S. P., & Rane, J. (2024). Ensemble

deep learning and machine learning: Applications,

opportunities, challenges, and future directions. Studies

in Medical and Health Sciences, 1(2), 18–41.

Rojan, Z. (2024). Financial fraud detection based on

machine and deep learning: A review. The Indonesian

Journal of Computer Science, 13(3).

http://ijcs.net/ijcs/index.php/ijcs/article/view/4059

Saklani, M., Saini, D. K., Yadav, M., & Gupta, Y. C.

(2024). Navigating the Challenges of EV Integration

and Demand-Side Management for India’s Sustainable

EV Growth. IEEE Access. https://ieeexplore.

ieee.org/abstract/document/10699341/

Samantha Maitland Irwin, A., Raymond Choo, K.-K., &

Liu, L. (2011). An analysis of money laundering and

terrorism financing typologies. Journal of Money

Laundering Control, 15(1), 85–111.

Sharman, J. C. (2011). The money laundry: Regulating

criminal finance in the global economy. Cornell

University Press. https://books.google.co.uk/

books?hl=zh-

CN&lr=&id=cOIkdh9rtCcC&oi=fnd&pg=PR9&dq=+

Among+the+emerging+issues,+money+laundering+st

ands+out+as+a+significant+concern,+with+the+global

+scale+estimated+to+range+from+%24500+billion+to

+%241+trillion+annually+&ots=hwJzxducYf&sig=R

mTMHRGEMmFJbC-2QWIPd10ea2w

Vassallo, D., Vella, V., & Ellul, J. (2021). Application of

Gradient Boosting Algorithms for Anti-money

Laundering in Cryptocurrencies. SN Computer

Science, 2(3), 143. https://doi.org/10.1007/s42979-

021-00558-z

Wan, F., & Li, P. (2024). A Novel Money Laundering

Prediction Model Based on a Dynamic Graph

Convolutional Neural Network and Long Short-Term

Memory. Symmetry, 16(3), 378.

www.kaggle.com. IBM Transactions for Anti Money

Laundering (AML). Available at:

https://www.kaggle.com/datasets/ealtman2019/ibm-

transactions-for-anti-money-laundering-aml.

Yacouby, R., & Axman, D. (2020). Probabilistic extension

of precision, recall, and f1 score for more thorough

evaluation of classification models. Proceedings of the

First Workshop on Evaluation and Comparison of NLP

Systems, 79–91. https://aclanthology.org/2020.

eval4nlp-1.9/

Zhong, L. (2024). Confronting Discrimination in

Classification: Smote Based on Marginalized

Minorities in the Kernel Space for Imbalanced Data

(No. arXiv:2402.08202). arXiv. http://arxiv.org/abs/

2402.08202

Zorell, N. (2018, March 1). The European Commission’s

2018 assessment of macroeconomic imbalances and

progress on reforms. https://www.semanticscholar.org/

paper/The-European-Commission%E2%80%99s-

2018-assessment-of-and-on-Zorell/

f761ab942d6a904299caeb588b777e9a83b911de

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

138