A Blockchain-Based Fraud Detection and Vehicle Damage Assessment

System Using Machine Learning and Computer Vision

Wafa Ben Slama Souei

1

, N’Gouari Gana Abdou Bachir

2

and Raoudha Ben Djemaa

1

1

University of Sousse, ISITCOM, Sousse, Tunisia

2

International multidisciplinary school, EPI Digital School, Sousse, Tunisia

Keywords:

Fraud Detection, Machine Learning, Mask R-CNN, Insurance Claims, Computer Vision, Vehicle Damage

Assessment.

Abstract:

Car insurance is a cornerstone of modern society, offering crucial financial protection in the event of accidents

and vehicle-related damage. However, this intricate system is now grappling with a significant challenge:

fraud manifesting in various forms, including staged accidents, fraudulent claims, and collusion between indi-

viduals, and it poses a serious threat to the integrity and long-term viability of car insurance. In this paper, we

will propose an innovative approach to fraud detection in car insurance and reimbursement estimation. The

proposed approach makes significant contributions to the field by introducing a new dataset of 5,483 images

with corresponding labels. Fraud detection is performed using the XGBoost Classifier, which is known for its

robustness in handling complex classification tasks. Damage detection is carried out using the Mask R-CNN

model, enabling precise identification and segmentation of vehicle damages. The system integrates structured

data fraud detection with image-based damage assessment, where Mask R-CNN results serve as an additional

validation factor. This end-to-end approach enhances fraud detection accuracy by combining data-driven in-

sights with visual evidence for more reliable claim verification. These advancements contribute to improving

the accuracy and efficiency of automated fraud detection and reimbursement estimation systems.

1 INTRODUCTION

Automobile insurance is a cornerstone of modern so-

ciety, providing essential financial protection in the

event of accidents and vehicle-related damages. How-

ever, this complex system is increasingly challenged

by a significant issue: fraud. Whether through staged

accidents, falsified claims, or collusion between indi-

viduals, fraud poses a serious threat to the integrity

and sustainability of the automobile insurance indus-

try.

Insurance fraud takes many forms, including stag-

ing accidents, document falsification, and exaggerat-

ing damage claims. According to the International

Association of Insurance Supervisors (IAIS), around

10% of auto insurance claims globally are fraudulent,

leading to annual financial losses of approximately

$30 billion for insurance companies in the United

States alone (PropertyCasualty360, 2009). This not

only results in direct costs for insurers but also under-

mines policyholders’ trust in the insurance system.

The consequences of insurance fraud are far-

reaching. It not only inflicts substantial financial

losses on insurance companies but also drives up pre-

miums for honest policyholders. A study by the

Coalition Against Insurance Fraud found that fraud

costs American families an extra $400 to $700 an-

nually in increased premiums, imposed to cover the

financial burden of fraudulent activities (of Investiga-

tion, 2023). This creates an unfair situation for hon-

est customers and places additional financial strain on

households, which can, in turn, erode customer satis-

faction and loyalty towards insurance providers.

Beyond financial costs, automobile insurance

fraud also has broader societal impacts. It contributes

to rising healthcare and emergency service expenses,

as well as increased road congestion. For exam-

ple, an analysis by the National Insurance Crime Bu-

reau (NICB) found that staged accidents and fraudu-

lent claims increase the demand for medical care and

emergency services, which imposes additional costs

on public infrastructure (National Insurance Crime

Bureau, 2024). Moreover, such fraudulent activities

can compromise road safety by encouraging reck-

less driving behaviors aimed at fabricating accidents.

This, in turn, creates serious challenges for public

Souei, W. B. S., Bachir, N. G. A. and Ben Djemaa, R.

A Blockchain-Based Fraud Detection and Vehicle Damage Assessment System Using Machine Learning and Computer Vision.

DOI: 10.5220/0013500800003929

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 27th International Conference on Enterprise Information Systems (ICEIS 2025) - Volume 1, pages 1123-1130

ISBN: 978-989-758-749-8; ISSN: 2184-4992

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

1123

infrastructure management and healthcare services,

which must respond to the growing demand for re-

sources.

Addressing insurance fraud is a complex issue that

demands a multifaceted approach. Insurance compa-

nies must not only detect fraud but also evaluate its

severity and implement appropriate measures to com-

bat it. Enhancing detection and assessment processes

is critical to preserving the integrity and effectiveness

of the insurance system. Artificial Intelligence (AI)

has shown immense potential in transforming and en-

hancing computer systems across a wide range of in-

dustries. AI enables the automation of processes, the

analysis of vast amounts of data with unparalleled ac-

curacy, and the extraction of valuable insights to sup-

port decision-making.

In the automobile insurance sector, AI is par-

ticularly effective at detecting fraudulent activities

(Benedek et al., 2022). With advanced machine learn-

ing algorithms and predictive analytics, AI systems

can identify patterns and anomalies in claims data that

would typically escape traditional detection methods

(Benedek and Nagy, 2023). This not only helps miti-

gate financial losses from fraud but also boosts opera-

tional efficiency and improves the overall experience

for honest policyholders.

Given the growing challenge of fraud, innovative

solutions for detecting and preventing it in automobile

insurance are more critical than ever. Our project aims

to address this need by developing an advanced AI

model capable of identifying suspicious claims, as-

sessing the level of fraud involved in each case, and

determining the appropriate reimbursement percent-

age based on the findings.

The integration of blockchain and AI signifi-

cantly enhances the performance and security of in-

surance and transport systems (Souki et al., 2024).

Blockchain provides transparency (Souei et al.,

2024), immutability, and decentralized validation

(Souei et al., 2023), ensuring data integrity and re-

ducing the risk of fraud in claims processing. AI, on

the other hand, enables the system to analyze large

datasets, such as vehicle damage reports, in real-time,

ensuring accurate and efficient decision-making. To-

gether, these technologies streamline the claims pro-

cess, improve automation, and offer higher levels of

trust, security, and reliability in the insurance sector.

The main objective of our study is to design, develop,

and evaluate an Artificial Intelligence (AI) model ca-

pable of effectively detecting fraud in automobile in-

surance claims. Specifically, our model aims to:

• Detect suspicious claims by analyzing data related

to the accident, damages, and the policyholder’s

history.

• Assess the degree of fraud in each claim by evalu-

ating the consistency of the information provided

by the policyholder and cross-referencing it with

known patterns of fraudulent behavior.

• Deploy the proposed solution using the

blockchain technology to maintain a high

level of security and accessibility.

Our model strives to be both accurate and fair, min-

imizing false positives (i.e., avoiding the wrongful

classification of legitimate claims as fraudulent) while

efficiently identifying proven cases of fraud.

2 RELATED WORK

Fraud detection in automobile insurance has been the

focus of numerous recent studies, aiming to enhance

the accuracy and efficiency of detection systems.

2.1 Fraude Detection

Quan (Quan, 2024) conducted an in-depth study on

this subject by analyzing the landscape of automo-

bile insurance fraud. His approach integrates machine

learning models, such as logistic regression, decision

trees, and discriminant analysis, to develop predictive

models for fraud detection. The results showed that

the logistic regression model provided the highest ac-

curacy among the three models.

An innovative approach was presented by Yang

et al. (Yang et al., 2023), who developed a multi-

modal learning framework for automobile insurance

(AIML). This framework combines natural language

processing and computer vision techniques with a

knowledge-based algorithm to detect fraudulent be-

havior. AIML also incorporates a semi-automatic fea-

ture generation algorithm (SAFE) for processing au-

tomobile insurance data and a framework for handling

visual data. The results demonstrated a significant

improvement in the model’s performance in detect-

ing fraudulent behavior compared to models that used

only structural data.

Kouach, el Attar, and El Hachloufi (Kouach et al.,

2022) developed a novel automobile insurance fraud

detection system using unsupervised learning. Their

system employs Isolation Forest and Local Outlier

Factor algorithms to identify fraudulent behavior by

detecting anomalies. Isolation Forest isolates abnor-

mal data efficiently, while Local Outlier Factor iden-

tifies data points that deviate from their neighbors.

The integration of these algorithms allows their sys-

tem to effectively detect fraudulent activities, offering

a promising approach to reduce insurance companies’

financial losses.

BEST 2025 - Special Session on Blockchain and Enhanced Security for a New Era of Trust

1124

Table 1: Comparison of existing solutions based on various criteria.

Solution Data Type Models Used Accuracy Practical Imple-

mentation

Quan (2024) Structured Logistic Regres-

sion, Decision

Tree, Discrimi-

nant Analysis

High for Logistic

Regression

Limited

Yang et al. (2023) Multimodal NLP, Com-

puter Vision,

Knowledge-based

Algorithms

Significant Im-

provement with

AIML

Complex

Kouach et al. (2023) Structured Isolation Forest,

Local Outlier

Factor

Good but with

False Positives

Calibration Re-

quired

Aziz et al. (2023) Textual Na

¨

ıve Bayes Good for Textual

Data

Simple but Lim-

ited

Todevski (2024) Structured Logistic Regres-

sion, Gradient

Boosting, Ran-

dom Forest

High for Customer

Retention

Customer Reten-

tion Specific

Zhang et al. (2020) Images Mask R-CNN,

ResNet, FPN

Very High with

Enhanced Preci-

sion

Complex but Ef-

fective

Widjojo et al. (2022) Images Mask R-CNN,

EfficientNet, Mo-

bileNetV2

Very High with

91% F1 Score

Complex

Jayaseeli et al.

(2021)

Images Mask R-CNN Very High with

Improved Damage

Detection

Complex

Our Solution Structured and

Unstructured

Logistic Regres-

sion, Random

Forest, Gradient

Boosting

Very High with

Multimodal Com-

bination

Adaptable and

Scalable

Aziz, Fareedullah, & Mahmood (Aziz et al., 2022)

proposed an automobile insurance fraud detection

model using advanced machine learning techniques.

Their approach primarily relies on the Na

¨

ıve Bayes

classifier, a simple yet powerful probabilistic classifi-

cation algorithm. Na

¨

ıve Bayes is known for its sim-

plicity and effectiveness in data classification, espe-

cially with textual data. In the context of automobile

insurance fraud detection, the model was adapted to

identify potential fraud patterns by analyzing claim

characteristics and comparing them to normal behav-

ior patterns.

The study’s results demonstrated that the Na

¨

ıve

Bayes model achieved significant accuracy in fraud

detection, making it an effective tool for insurance

companies to combat fraud and reduce financial

losses.

And finally, another example is Todevski (Tode-

vski et al., 2021), who developed an artificial in-

telligence model aimed at increasing the customer

base for insurance companies. Their approach utilizes

three AI models: logistic regression, gradient boost-

ing, and random forest. These models were used to

predict whether a potential customer would remain

with the company, with a prediction probability of

81%.

2.2 Car Damage Detection

These works significantly contribute to automobile in-

surance claims management by providing an auto-

mated and accurate method for vehicle damage as-

sessment.

Zhang et al. (Zhang et al., 2020) developed an en-

hanced Mask R-CNN algorithm for vehicle damage

detection. They improved detection accuracy by us-

ing an optimized ResNet with Feature Pyramid Net-

work (FPN) and fine-tuned the Region Proposal Net-

work (RPN) for better region proposals. The model,

trained with COCO dataset weights, achieved sig-

nificant performance gains, providing more accurate

damage identification and reducing manual evaluation

costs.

A Blockchain-Based Fraud Detection and Vehicle Damage Assessment System Using Machine Learning and Computer Vision

1125

Widjojo et al. (Widjojo et al., 2022) developed

a deep learning system for vehicle damage detection

and classification using transfer learning. Their ap-

proach includes damage segmentation with Mask R-

CNN, damage detection with EfficientNet, and dam-

age classification with MobileNetV2. The system

combines segmentation outputs with feature extrac-

tion for improved classification accuracy, achieving

an F1 score of 91%. Their integrated model offers

better accuracy and resource management compared

to other CNN models, enhancing damage assessment

and insurance claims processing.

Jayaseeli et al. (Jayaseeli et al., 2021) utilized

Mask R-CNN for vehicle damage detection and cost

assessment. Their model, trained with COCO dataset

weights and fine-tuned on damaged vehicle images,

uses precise annotation and a ”color splash” visu-

alization technique to highlight damage. This ap-

proach improves detection accuracy and cost assess-

ment transparency, reducing insurance claims pro-

cessing costs and fraud risks while enhancing repair

estimate precision and claims evaluation efficiency.

2.3 Synthesis

After a thorough analysis of Table 1, it appears that

the previously presented work has certain shortcom-

ings. Firstly, many studies primarily focus on the de-

velopment and validation of fraud detection models

in a laboratory setting. However, there is a gap in re-

search concerning the implementation of these mod-

els in an operational environment within insurance

companies. The challenges related to integrating ex-

isting systems, managing organizational change, and

user acceptance are often underestimated. A thorough

understanding of the practical obstacles to adopting

these technologies and strategies to overcome them is

crucial to ensure a successful transition from theoret-

ical models to practical applications.

Secondly, most current research focuses on lever-

aging structured data, such as tabular data from in-

surance company databases. Nevertheless, a consid-

erable amount of relevant information is contained in

unstructured data, such as images of damaged vehi-

cles, accident videos, and text from claims reports.

Integrating this unstructured data into fraud detection

models could enhance their accuracy and robustness.

Advanced techniques such as natural language pro-

cessing (NLP) and image recognition need to be ex-

plored to leverage these diverse data sources.

Finally, there is a notable lack of research on the

actual impact of fraud detection models on reduc-

ing fraud and improving the profitability of insurance

companies. Current studies often focus on model per-

formance metrics such as precision, recall, and F1-

score, without examining their effectiveness in a real-

world context. Longitudinal studies are essential to

assess the long-term impact of these models on fraud

prevention, customer satisfaction, and financial gains.

This also includes analyzing the costs associated with

the implementation and maintenance of these sys-

tems.

3 PROPOSED SOLUTION

This research work focused on the development and

evaluation of artificial intelligence models for fraud

detection in car insurance and reimbursement estima-

tion. The proposed approach illustrated in Figure 1

Figure 1: Architecture of the Proposed Solution.

makes significant contributions to the field of fraud

detection in car insurance and reimbursement estima-

tion;

• Creating a new data set of 5,483 images and la-

bels.

• The detection of fraud is performed based on the

XGBoost Classifier.

• The detection of damage is performed based on

the Mask R-CNN model.

4 RESEARCH METHODOLOGY

AND STEPS

Previous research has underscored that existing deep

learning-based vehicle damage recognition tech-

niques often overlook the damage volume necessary

for auto insurance claims. In addition, accurately

identifying various types of vehicle damage and as-

sessing their severity is critical for practical applica-

tions. To address these shortcomings, this paper in-

troduces a prototype system called CES (Cost Esti-

mation System), designed to detect damaged vehicle

parts, evaluate the extent of the damage, and estimate

the total claim cost. The CRISP-DM methodology

BEST 2025 - Special Session on Blockchain and Enhanced Security for a New Era of Trust

1126

was employed to guide the development of this proto-

type, ensuring its accuracy and alignment with busi-

ness objectives (Chapman et al., 1999).

4.1 DataSet

The data collection for this project was carried out

using two main sources: Kaggle and data.gov. The

data from Kaggle includes rich and well-documented

datasets on car insurance claims, while data.gov pro-

vides additional details on accidents, such as speed,

engine temperature, and fuel consumption. These re-

liable sources allowed for the creation of a solid foun-

dation for analysis, with comprehensive information

on drivers, insured vehicles, and claims.

Additionally, a dataset of 1,400 annotated images,

including segmentation masks and bounding boxes,

was used to train a Mask R-CNN model. It con-

sists of multiple images of vehicles categorized into

three levels of damage as illustrated in Figure 2: soft,

medium, and hard. These images were divided into

three groups: 900 for training, 300 for validation, and

200 for testing, all accompanied by JSON files con-

taining detailed metadata. The images were prepro-

cessed to ensure quality, resized, normalized, and en-

hanced using augmentation techniques such as rota-

tion and exposure adjustments. The total dataset in-

cludes 5,483 images and an equal number of labels,

ensuring a robust foundation for training and evaluat-

ing the Mask R-CNN model. Data preprocessing in-

volved resizing, augmenting, and splitting the dataset

to optimize model performance while maintaining a

balance between subsets. This preparation ensures the

model’s robustness and its ability to generalize effec-

tively in detecting and classifying vehicle damage.

Figure 2: Car Damage Types.

4.2 Evaluation Metrics

In our work, we evaluated the performance of the de-

veloped models using various metrics (Naidu et al.,

2023): precision and recall to measure the accuracy

of positive predictions and the proportion of actual

positives detected, respectively. We also used the loss

function to quantify the model’s prediction errors dur-

ing training and the F1-score to balance precision and

recall, especially for imbalanced datasets. Finally, the

mean Average Precision (mAP) was employed to as-

sess overall detection accuracy across all classes in

object detection tasks. These metrics are essential

to ensure the robustness and reliability of our recom-

mendation system.

4.3 Models Training and Testing

In this stage, the focus is on selecting the appropriate

model for the task at hand. Different modeling tech-

niques are considered based on the nature of the data

and the problem being solved. The goal is to choose a

model that aligns with the desired outcomes and can

effectively learn from the data to make accurate pre-

dictions.

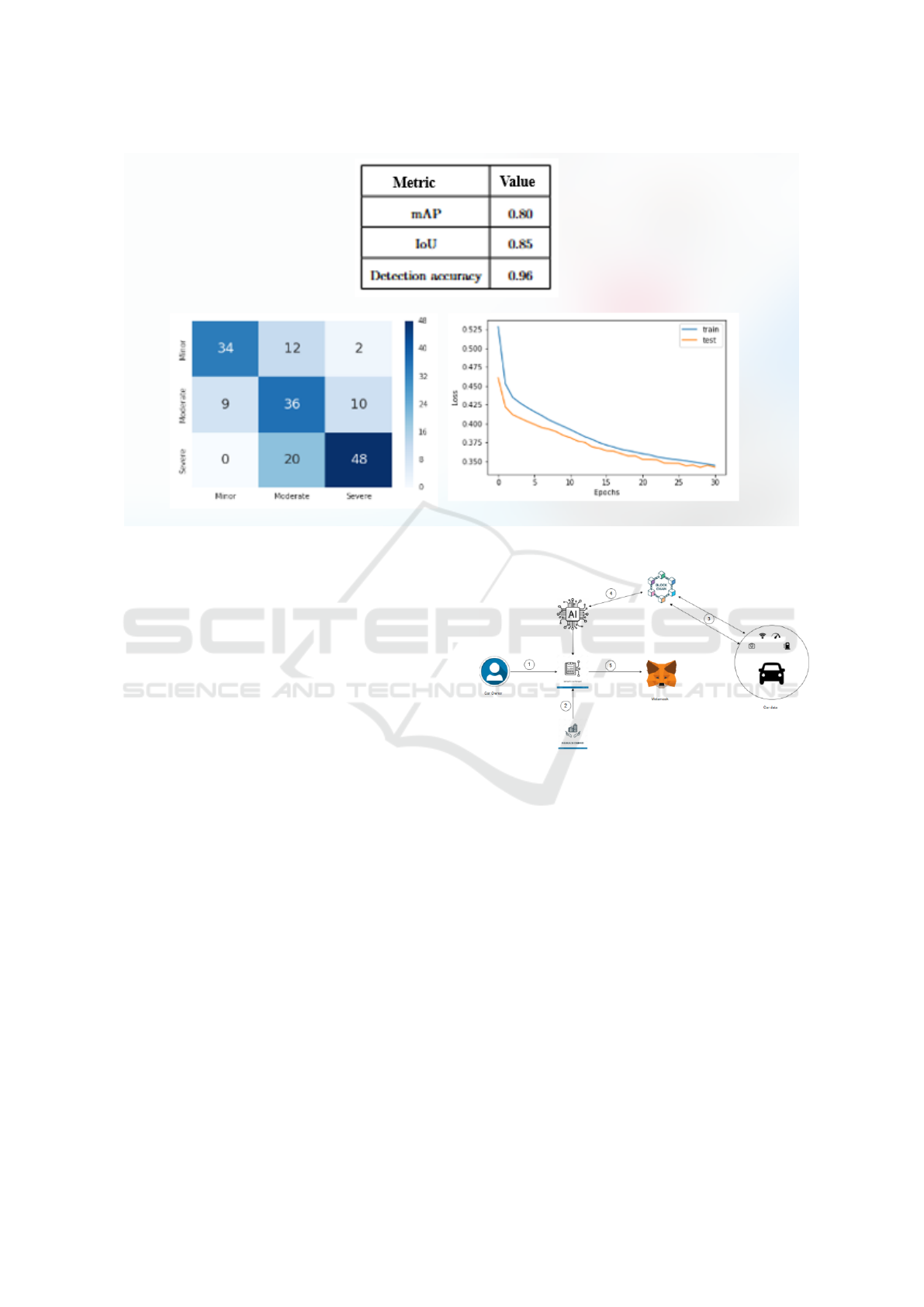

4.3.1 Damage Detection

The detection of vehicle damage is performed us-

ing the Mask R-CNN model, a state-of-the-art deep

learning framework for instance segmentation. This

model was trained on a dataset of annotated vehicle

images, where damages were categorized into minor,

moderate, and severe levels. Each image was labeled

with segmentation masks and bounding boxes to en-

able precise localization of damaged areas. Prepro-

cessing techniques such as image resizing, normal-

ization, and data augmentation (rotation, brightness

adjustments, and noise reduction) were applied to en-

hance the model’s robustness. The performance of the

Mask R-CNN model was evaluated using key met-

rics such as Intersection over Union (IoU), mean Av-

erage Precision (mAP), and detection accuracy. The

results showed in Figure 3 that the model achieved an

IoU score of 0.85 and an mAP of 0.80, demonstrat-

ing its ability to accurately segment and classify vehi-

cle damages. The precision-recall analysis indicated

a high confidence level in detecting damaged regions

while minimizing false positives. These findings con-

firm that the Mask R-CNN model is highly effective

in automating vehicle damage assessment, providing

insurers with a reliable tool for faster and more objec-

tive claim evaluations.

4.3.2 Fraude Detection

The detection of fraud in automobile insurance claims

is carried out using the XGBoost Classifier, a pow-

erful gradient boosting algorithm known for its effi-

ciency and high predictive accuracy. The model was

trained on a dataset containing key features related

to claims, including policyholder information, claim

history, and vehicle attributes. Preprocessing steps

such as feature selection, categorical encoding, and

A Blockchain-Based Fraud Detection and Vehicle Damage Assessment System Using Machine Learning and Computer Vision

1127

Figure 3: Damage detection results.

handling missing values were applied to enhance data

quality.

The model’s performance was evaluated using key

metrics such as accuracy, precision, recall, and F1-

score. The results showed that XGBoost achieved an

accuracy of 92%, with an F1-score of 0.87, demon-

strating its strong ability to distinguish between fraud-

ulent and legitimate claims. The precision-recall

curve indicated that the model effectively minimized

false positives, reducing the risk of denying legitimate

claims. Furthermore, feature importance analysis re-

vealed that factors such as claim amount, previous

fraudulent claims, and inconsistencies in reported ac-

cident details were the most influential in fraud de-

tection. These findings highlight the effectiveness of

XGBoost in improving fraud detection processes and

reducing financial losses for insurance companies.

5 DEPLOYMENT

In the final stage, the solution is deployed for opera-

tional use in the automobile insurance context, pro-

vided it meets the evaluation criteria. During this

phase, the models are integrated into the existing in-

surance system based on the blockchain technology,

user interfaces are developed to facilitate interactions,

and real-time monitoring is implemented to assess

performance in real-world scenarios. Figure 4 illus-

trates the deployment diagram of our system that inte-

grates AI and blockchain for the management of auto

Figure 4: Architecture of the Auto Insurance Claims Man-

agement System.

insurance claims. The process can be summarized as

follows:

• Claim Submission. The vehicle owner initiates a

compensation request via a smart contract.

• Insurance Validation. The insurance company

receives and evaluates the submitted claim.

• Vehicle Data. Relevant vehicle information, in-

cluding images, sensor data, and telematics, is

collected and transmitted for processing.

• AI Analysis. Our AI model processes the data to

assess damage and verify the claim’s validity.

• Blockchain Interaction. The entire process is

recorded and validated on the blockchain, ensur-

ing transparency, traceability, and security. The

user can access their information through its

Metamask portfolio.

BEST 2025 - Special Session on Blockchain and Enhanced Security for a New Era of Trust

1128

The proposed solution is deployed on the Ethereum

blockchain, where a smart contract processes real-

time data from the insured vehicle, including sensor

readings, camera inputs, and other telematics infor-

mation. Based on this data, the smart contract au-

tonomously determines whether an accident has oc-

curred. Additionally, the severity of the damage is as-

sessed using an AI-powered damage detection model,

which analyzes the collected information to provide

an accurate evaluation. The entire process ensures

transparency, security, and automation in claims pro-

cessing, leveraging blockchain for immutability and

trust.

To conclude, Blockchain ensures data immutabil-

ity, transparency, and trust in fraud prevention by se-

curely recording real-time vehicle data and enforcing

automated claim validation through smart contracts.

Its decentralized nature prevents tampering and in-

ternal fraud, enhancing insurance claim verification.

Combined with AI, it strengthens fraud detection and

ensures fair settlements.

6 RESULTS AND DISCUSSION

This study highlights the transformative potential of

AI and ML technologies in the insurance industry.

By automating fraud detection and improving dam-

age assessment accuracy, the proposed framework ad-

dresses critical inefficiencies in traditional claim pro-

cessing systems.

The XGBoost classifier and Mask R-CNN model

both showed impressive performance in their respec-

tive tasks. XGBoost achieved an AUC of 0.89, effec-

tively minimizing false negatives through its regular-

ization techniques and weight updates, while balanc-

ing precision and recall. The confusion matrix fur-

ther confirmed its solid performance, although false

positives still remained, indicating room for improve-

ment. On the other hand, the Mask R-CNN model

excelled in damage detection, with a remarkable de-

tection accuracy of 96%, an mAP of 0.80, and an IoU

of 0.85. These results highlight the model’s strong

capability to accurately detect and segment vehicle

damages, an essential feature for streamlining insur-

ance claims. The stable loss curves throughout train-

ing and validation indicate the model’s ability to gen-

eralize well to new data. Despite some minor mis-

classifications in damage severity, the overall perfor-

mance demonstrates its practicality and potential for

automating claims processing in the insurance sector.

The findings pave the way for future research ex-

ploring advanced techniques, such as deep learning-

based anomaly detection and real-time fraud preven-

tion systems, to further enhance the robustness and

scalability of these solutions.

7 CONCLUSION

This project focuses on fraud detection in automo-

bile insurance claims and vehicle damage assessment

through machine learning and computer vision. The

XGBoost model outperformed other algorithms with

an AUC of 0.89, effectively minimizing false neg-

atives through regularization techniques and weight

updates. This highlights its strong capability in fraud

detection. Additionally, the Mask R-CNN model ex-

celled in segmenting and evaluating vehicle damage,

achieving a detection accuracy of 96%, a mean av-

erage precision (mAP) of 0.80, and an Intersection

over Union (IoU) of 0.85. These results underline

the model’s effectiveness in accurately detecting and

segmenting vehicle damages, essential for automating

the claims process in insurance. Overall, this project

demonstrates the significant potential of combining

XGBoost for fraud detection and Mask R-CNN for

damage assessment in streamlining insurance opera-

tions.

REFERENCES

Aziz, T., Fareedullah, and Mahmood, M. (2022). Insurance

fraud detection model: Using machine learning tech-

niques. Journal Name, Volume(Issue):Page numbers.

Benedek, B., Ciumas, C., and Nagy, B. Z. (2022). Au-

tomobile insurance fraud detection in the age of big

data–a systematic and comprehensive literature re-

view. Journal of Financial Regulation and Compli-

ance, 30(4):503–523.

Benedek, B. and Nagy, B. Z. (2023). Traditional versus ai-

based fraud detection: Cost efficiency in the field of

automobile insurance. Financial and Economic Re-

view, 22(2):77–98.

Chapman, P., Clinton, J., Kerber, R., Khabaza, T., Reinartz,

T., Shearer, C., and Wirth, R. (1999). The crisp-dm

user guide. In 4th CRISP-DM SIG Workshop in Brus-

sels in March, volume 1999. sn.

Jayaseeli, J. D. D., Jayaraj, G. K., Kanakarajan, M., and

Malathi, D. (2021). Car damage detection and cost

evaluation using mask r-cnn. In Intelligent Comput-

ing and Innovation on Data Science, volume 248 of

Lecture Notes in Networks and Systems, pages 279–

288, Kattankulathur, India. Springer, Singapore.

Kouach, Y., el Attar, A., and El Hachloufi, M. (2022). Auto

insurance fraud detection using unsupervised learn-

ing. Journal Name, Volume(Issue):Page numbers.

Naidu, G., Zuva, T., and Sibanda, E. M. (2023). A review of

evaluation metrics in machine learning algorithms. In

A Blockchain-Based Fraud Detection and Vehicle Damage Assessment System Using Machine Learning and Computer Vision

1129

Computer Science On-line Conference, pages 15–25.

Springer.

National Insurance Crime Bureau (2024). Staged auto acci-

dent fraud. Accessed: 2025-02-01.

of Investigation, F. B. (2023). Insurance fraud. Accessed:

2025-01-30.

PropertyCasualty360 (2009). Fraud causes $30 billion in

loss annually: Iii. Accessed: 2025-01-30.

Quan, Y. (2024). Research on detecting auto insurance

fraud. Highlights in Business Economics and Man-

agement, 24:278–284.

Souei, W. B. S., Charroux, B., Sliman, L., and Ben Djemaa,

R. (2024). Towards blockchain like soa. In Interna-

tional Conference on Web Information Systems Engi-

neering, pages 301–311. Springer.

Souei, W. B. S., El Hog, C., Djemaa, R. B., Sliman, L.,

and Amor, I. A. B. (2023). Towards smart con-

tract distributed directory based on the uniform de-

scription language. Journal of Computer Languages,

77:101225.

Souki, O., Djemaa, R. B., Amous, I., and Sedes, F.

(2024). Monitoring and analyzing as a service (maaas)

through cloud edge based on intelligent transportation

applications. Cluster Computing, 27(3):3379–3395.

Todevski, D., Malik, H. S., Omkar, S. N., Monis, E. B.,

Khanna, B., and Samal, S. R. (2021). Fraud detection

in insurance with machine learning. Journal Name,

Volume(Issue):Page numbers.

Widjojo, D., Setyati, E., and Kristian, Y. (2022). Integrated

deep learning system for car damage detection and

classification using deep transfer learning. In 2022

IEEE 8th Information Technology International Semi-

nar (ITIS), Surabaya, Indonesia. IEEE.

Yang, J., Chen, K., Ding, K., and Na, C. (2023). Auto insur-

ance fraud detection with multimodal learning. Data

Intelligence, 5(2):1–25.

Zhang, Q., Chang, X., and Bian, S. (2020). Vehicle-

damage-detection segmentation algorithm based on

improved mask rcnn. IEEE Access, 8:6997–7004.

BEST 2025 - Special Session on Blockchain and Enhanced Security for a New Era of Trust

1130